Once the payroll has been fully setup, and the first period has been processed, the processing routine becomes easier and more familiar every time it is run

The routine is simply:

Click on Belina Shortcut Open the payroll by clicking on the Belina Payroll icon on the Desktop.

A warning may display asking whether you would like to "allow this application from an unknown publisher to make changes to your device". Unfortunately this message displays for all software that is unknown publisher of software. Belina has previously been registered but due to financial and business sanctions that are currently in place we have been unable to renew the registration that we previously enjoyed.

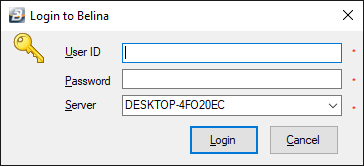

Enter the Username and Password:

Notes on how to setup Users and Passwords are available using the link shown. These can be changed from time to time.

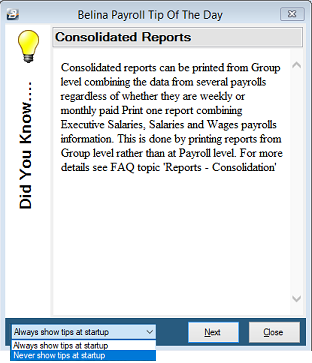

The Tip of the Day displays:

•To read the tips press 'Next' •Accept that tips should display at startup, or use the dropdown menu to stop tips from displaying •When complete press 'Close' to move onto the next step of opening the payroll.

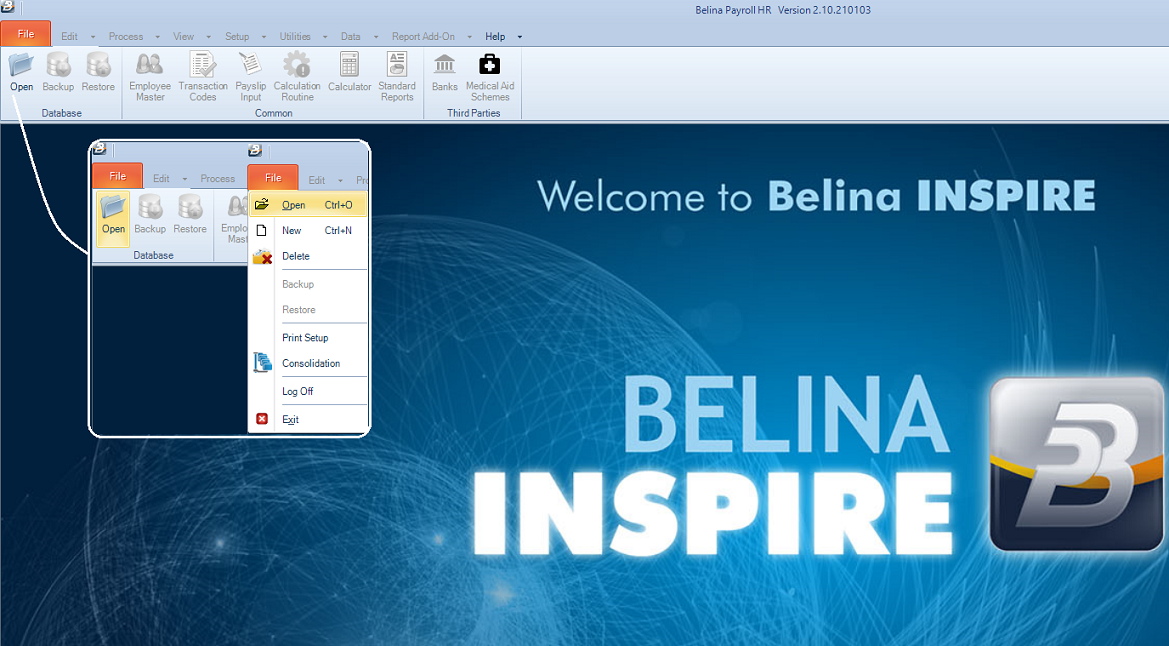

Set whether ress 'Close' to move to the next step The Belina softare loads and presents a screen where most of the options are greyed out, other than the 'File' and 'Help, menus.

Select Payroll to Open To open a payroll select the 'File', then 'Open' menu options or use the 'Open' icon.

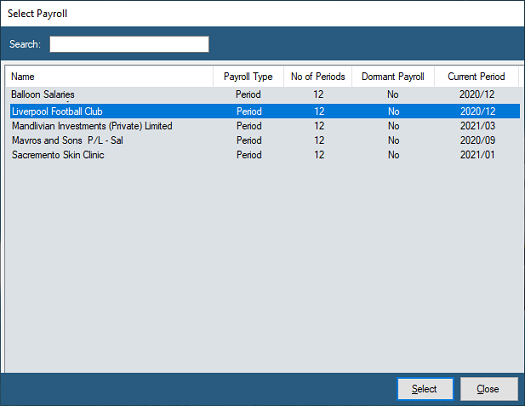

Select the payroll to be used from payrolls listed on the table. This is done by highlighting the payroll required and double-clicking, or by highlighting the payroll and pressing the 'Select' button:

Check that the correct payroll is open and which period it is in. To do this look at the foot of the screen. It displays the name of the payroll on the left hand side. The User name next to it and in the centre of the footer line the period number and the period end date:

If last period's payroll is still open and it has been paid ensure that reports have been printed, a backup have been done and then do a period end. These are described in Steps 8 onward in the notes below. |

![]() Step 2 - Update the Employee Master Records

Step 2 - Update the Employee Master Records

|

Change rates of pay, if appropriate and update any other employee information that may be required. |

Process transactions against each employee for the current period. Standing transactions come through automatically each period. These include Transaction Codes such as Basic, NSSA, NEC, standing allowances and deductions as well as transactions that have been set to run for a specified period such as loan deductions.

Some Transaction Codes e.g. Basic, Pension, NSSA, Trade Union, NEC apply across the entire payroll or group of employees . When loading these standard transactions it may be useful to use 'Bulk Input'. This will enable you to process a Transaction Code once and have it apply to the whole payroll, or group of employees. Having processed in bulk go from employee to employee using 'Payslip Input' making sure that each employee has the transactions that are required.

You can also choose from a variety of other methods of input including 'Payslip Input' where you process transactions against one employee before proceeding to the next employee. 'Spreadsheet Input' and 'Batch Input' are also useful methods of inputting data. |

![]() Step 4 - Update exchange rates

Step 4 - Update exchange rates

In a multi currency payroll update exchange rates. With hyper-inflation this may be better done as near to the completion of processing as possible. |

![]() Step 5 - Run Calculation Routine

Step 5 - Run Calculation Routine

Calculation Routine The Calculation Routine is an essential part of processing in the payroll. It must be run at least once in a period after the the last data entry. The first time the calculation routine is run it accrues leave for the current period. Running the Calculation Routine a second, or subsequent time will not adversely affect leave or any other Transaction Code.

Print Reports It is important to print reports, and keep them on file. It is a statutory obligation that payroll data (especially the payslips) be kept for seven (7) years.

Exports Once satisfied with the checks done on the payroll it is time to do bank transfer of the Net Pay amounts to employees, export the journal to accounting, do any other 3rd party exports that may be required. |

Consider locking the payroll.

Data Checks Once the Calculation Routine has been run it is now possible view the employee's Payslip Input with up-to-date computations. Do the checks that you feel necessary to gain the satisfaction that all data has been correctly captured into the system. This could include: •taking a small sample of employees to check thoroughly. •checking the tax calculation using the Tax Display audit report for Average, Forecast and PAYE methods. •doing overall reasonableness checks on the data processed.

Tax Checks Check the annual tax parameters, especially at the beginning of the tax year, to ensure that have been correctly setup. If necessary call Belina, your accountant or tax advisor to perform the checks. |

Make payments by cash or transfer

Payments can be made by: •Cash •Bank Transfer •EcoCash •Cheque (obsolete method in current economic environment) |

Once all the processes for the period have been completed it is time to do a backup and prepare for the next period's processing. |

Backup Make a good backup of your data, preferably on a reliable storage media e.g. On Cloud Storage such as Google Drive or OneDrive, Flash Drive (which should be stored off-site). |

Once everything has been printed and a backup has been taken a period end procedure can be done to ready the payroll for the next period's processing. |