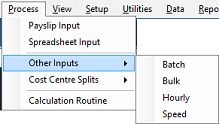

Belina PayrollHR has a number of different methods of processing data all designed to make it easier for you to process transactions efficiently. Most organizations use 'Payslip Input' with a combination of other methods:

Payslip Input

Process earnings and deductions for each employee in turn. Standing earnings and deductions come through automatically each period. Add, remove or change any transaction then continue to the next employee. The User can see all the transactions being processed against an employee including the PAYE, Aids Levy and Net Paid.

Spreadsheet Input

Process transactions using a spreadsheet interface.

Batch Input

Batch input is designed to process transactions in batches with optional batch control controls.

Bulk Input

Bulk Input allows the processing, or deletion, of one transaction code to, or from, a selected range of employees.

Hourly Input

Hourly input has been designed to process batches of time sheets and clock cards. It can also be used to process units for any Transaction Code that has been set up using the Mileage allowance.

Speed Input

Process transactions in an automated loop. Tag the transactions codes to be included in the loop and have the routine process each of these against a selected range of employees. The routine goes through each transaction code, one at a time, and then goes automatically to the next employee.

Transactions Import

Process transactions in spreadsheet and then import the results into Belina PayrollHR. Complex calculations can be performed on the data and have only the results imported into the payroll. The notes in the link describe the import of history data, but can be adapted to importing current transaction data by simply selecting the 'Current Data' instead of 'History Data' drop-down menu, when prompted.

Medical Expenses

Process shortfall claims and medical expenses for particular employees. for the system to recognize the medical credits when calculating tax on the FDS tax system.

Subscriptions

Process subscriptions to professional bodies that are accepted by the ZIMRA being paid directly by an employee, outside the payroll,for the system to recognize the tax.

Retirement Annuity

Process other pensions or retirement schemes that employees pay outside of the payroll.

Negative Pay

If an employee's deductions exceed income for a period/s then the employee effectively owes the organization money, called 'Negative Pay'. In the period that this first happens Belina Payroll will make an advance to make net pay zero. It remembers the advance and deducts the amount in the subsequent period. If in the next period the deductions exceed income Belina Payroll will again advance an amount and try recover it in the next period. In this way Belina Payroll will go from period to period until the full amount of the negative pay is recovered.

|