Aim

Steps to ensure that calculated Net Paid amounts are correct and ready to be paid to employees:

Before Processing:

Period |

Make sure that a backup and period end procedure was done at the conclusion of the last period. If necessary do both of these to be in the correct period for processing. |

Before or during processing:

Payroll Settings |

Update any changes to NSSA, Tax and other rates that may have changed this period. |

Employee Master |

New employees have been captured |

Terminated employees have been properly discharged and their terminal benefits included |

|

Pay rates changes have been updated |

|

Ensure that any 'Absent' or 'Suspended' Employees' are re-activated, if appropriate. |

|

If this is the first payroll run using Belina PayrollHR, or there are new employees, ensure that the bank account details have been captured correctly for all employees receiving their pay through bank transfer. |

|

Ensure that 'Tax Directives' that may have been setup on individuals Employee Master records are still valid. |

|

Processing |

Overtime and Shortime transactions have been processed |

Leave transactions have been captured |

|

New period allowances have correctly captured |

|

New loans captured |

|

Ensure that any previously suspended bank accounts are re-activated and removed from FDS calculations. |

|

Allowances and benefits have been correctly processed |

|

Calculation routine |

Ensure that the Calculation Routine has been run. In a multi-user environment that make sure that when this done no-one has the payroll open on any other terminal. |

Lock Payroll |

In a multi-user environment lock the payroll immediately after doing the Calculation Routine |

Number of Employees |

Check that the number of employees on the 'Bank Export Control Report' produced when the export is being done agrees to (or reconciled) to the number of employees on 'Earnings Summary' or the 'Payslip Summary' reports. |

Audit Checks:

• |

check that the total number of employees processed in the prayroll agrees with the physical number of employees employed (Use the 'Transaction Codes' journal report for employee totals) |

• |

check the total basic pay amount agrees to an authorized schedule of basic pay amounts (if available) (Use the 'Transaction Codes' journal report to obtain the total basic pay amount) |

• |

check that the total overtime hours agrees to total overtime hours approved (Use the 'Paysheet Summary' report to extract overtime hours) |

• |

check that the total allowances processed agrees to approval documents (if available) (Use the Period Journal 'Transaction Codes' report for employee totals) |

• |

reconcile totals from one period to another e.g. basic, overtime investigating any changes (Use the Period Journal 'Variance' Report) |

• |

reconcile the Period Journal 'Transaction Codes' report net paid amount to the total payments made to employees by cash, transfer or EcoCash. |

• |

examine of the Period Journal 'Variance' report for reasonableness. Compare totals, number of employees and percentage variances for each transaction code. |

• |

Check that the payroll does not include unwanted duplication of transactions. Use the 'Duplicate Transactions' report to identify duplications. |

• |

Check that the payroll does not include unwanted duplication of bank account details. Use the 'Duplicate Banks' report to identify duplications. |

• |

Check that the payroll does not include unwanted duplication of transactions. Use the 'Duplicate Transactions' report to identify duplications. |

Key Reports

Detailed transaction listing per employee |

(Go to the 'View', 'Payslips', 'Payroll Detail' menu options) |

|

'Transaction Codes' Journal |

Transaction totals for the period |

(Go to the 'View', 'Journals','Transaction Codes' menu options) |

Period Journal 'Variance' |

Period to period transaction total variance as an amount, percentage and number of employees |

(Go to the 'View', 'Journals','Variance' menu options) |

Payments reports |

Total amounts paid to employees by Bank Transfer, Coinage, Cheque listing |

(Go to the 'View', 'Payments', menu options) |

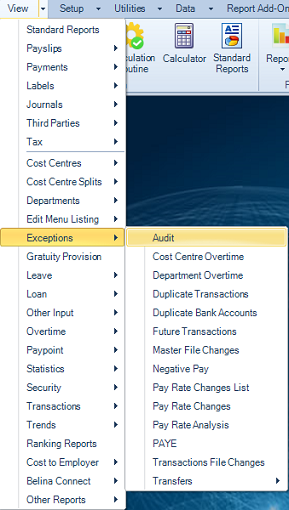

Use the 'Pay Rate Analysis' Report to check pay rates being applied in the payroll. |

(Go to the 'View', 'Exceptions', 'Pay Rate Analysis' menu options) |

|

Use the 'Future Transactions' report to check what transactions will come through automatically in the future. |

(Go to the 'View', 'Exceptions','Future Transactions' menu options) |

|

Use the 'Transaction File Changes' report to check which standing transaction codes have been changed. |

(Go to the 'View', 'Exceptions','Transaction File Changes' menu options) |

Useful Reports

It is possible to extract audit trail reports from Belina PayrollHR as follows:

An activity report showing the User, Date, Time and Activity undertaken on the system |

(Go to the 'View', ' Exceptions', 'Audit' menu options). |

|

Shows Pay Rate Changes over a selected range of periods. |

(Go to the 'View', ' Exceptions', 'Pay Rate Changes' menu options). |

|

Shows changes to the employee masterfile over the range of periods selected. |

(Go to the 'View', ' Exceptions', 'Masterfile Changes' menu options). |

|

Shows transactions that have been processed in each of the different processing methods. The report also highlights whether the transaction was added, changed or deleted. |

(Go to the 'View', ' Other Inputs', 'Batch' menu options). |

|

User Details Report |

It is useful to check security access of Users. The User Details report shows which Users that can log in. It shows the date the logins were created and the date last modified, When the login expires and the security level allocated. |

(Go to the 'View', 'Security','Audit', 'User Details' menu options) |