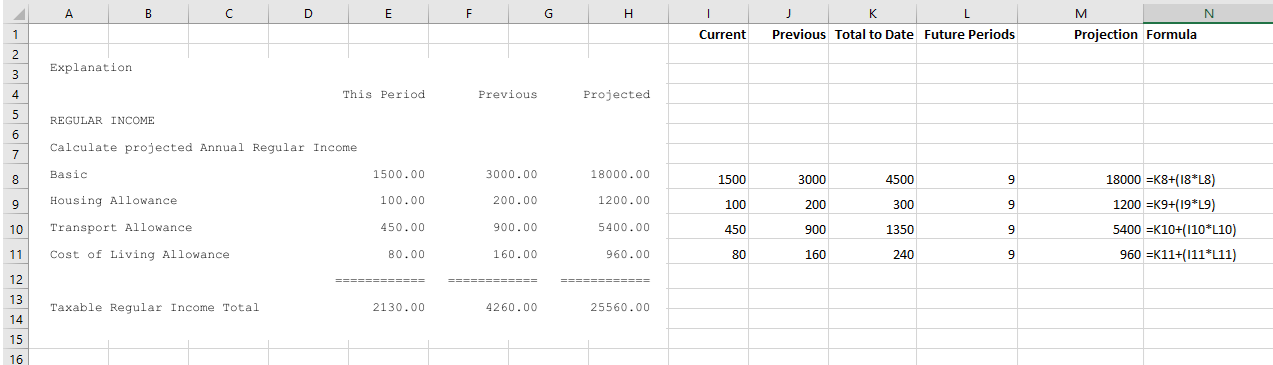

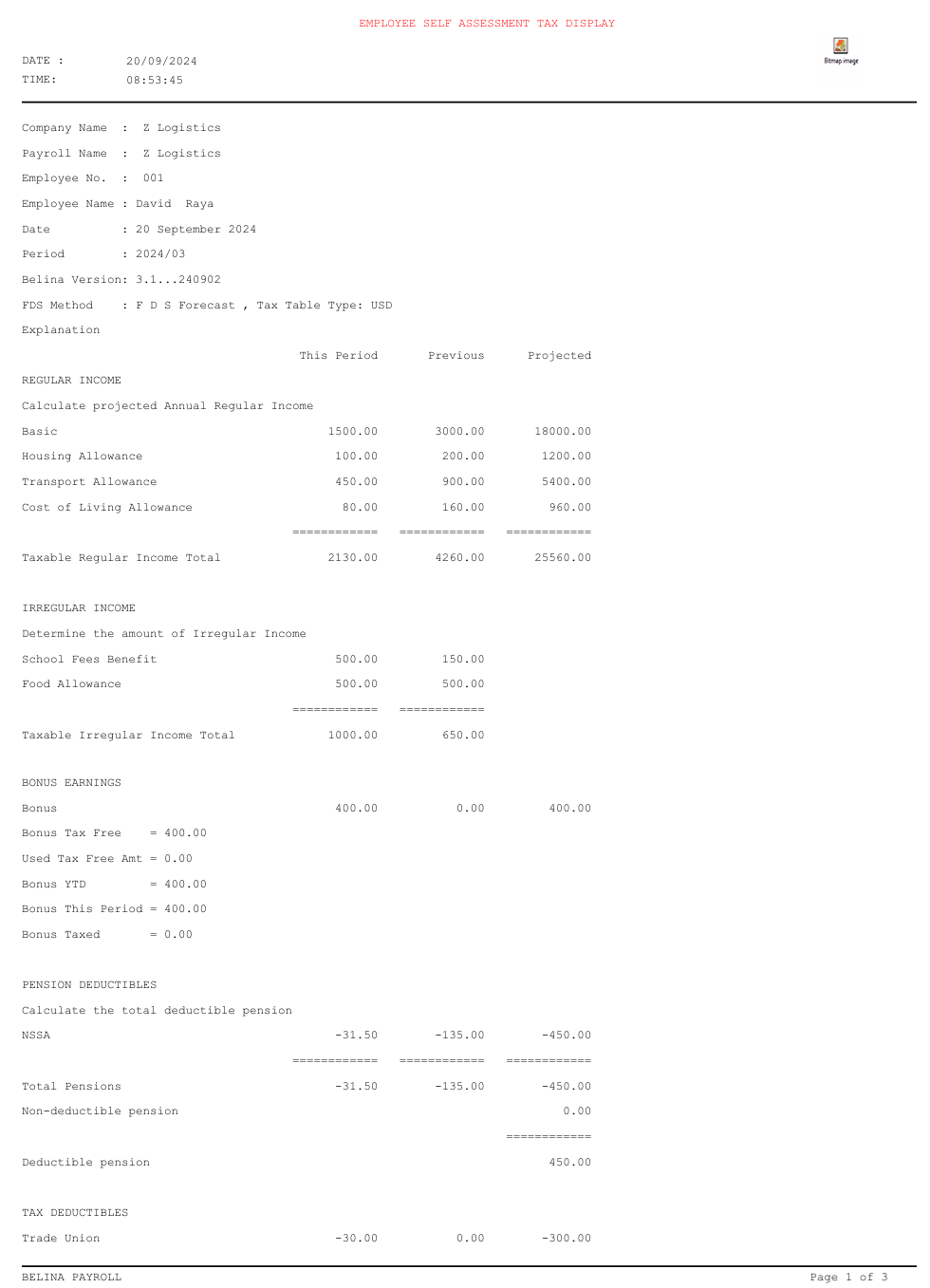

The example Tax Display, explained below, uses tax tables from 2024 and assumes that we are in period 3 of a 12 period tax year. We have given example transactions, which will differ from those of any Tax Display that you are checking. In the example 9 periods are projected. This may differ from your circumstance. If you are in a tax year beyond 2024 the principles and explanation used, can still be applied to your current circumstance.

If there is any doubt please refer to your tax consultant.

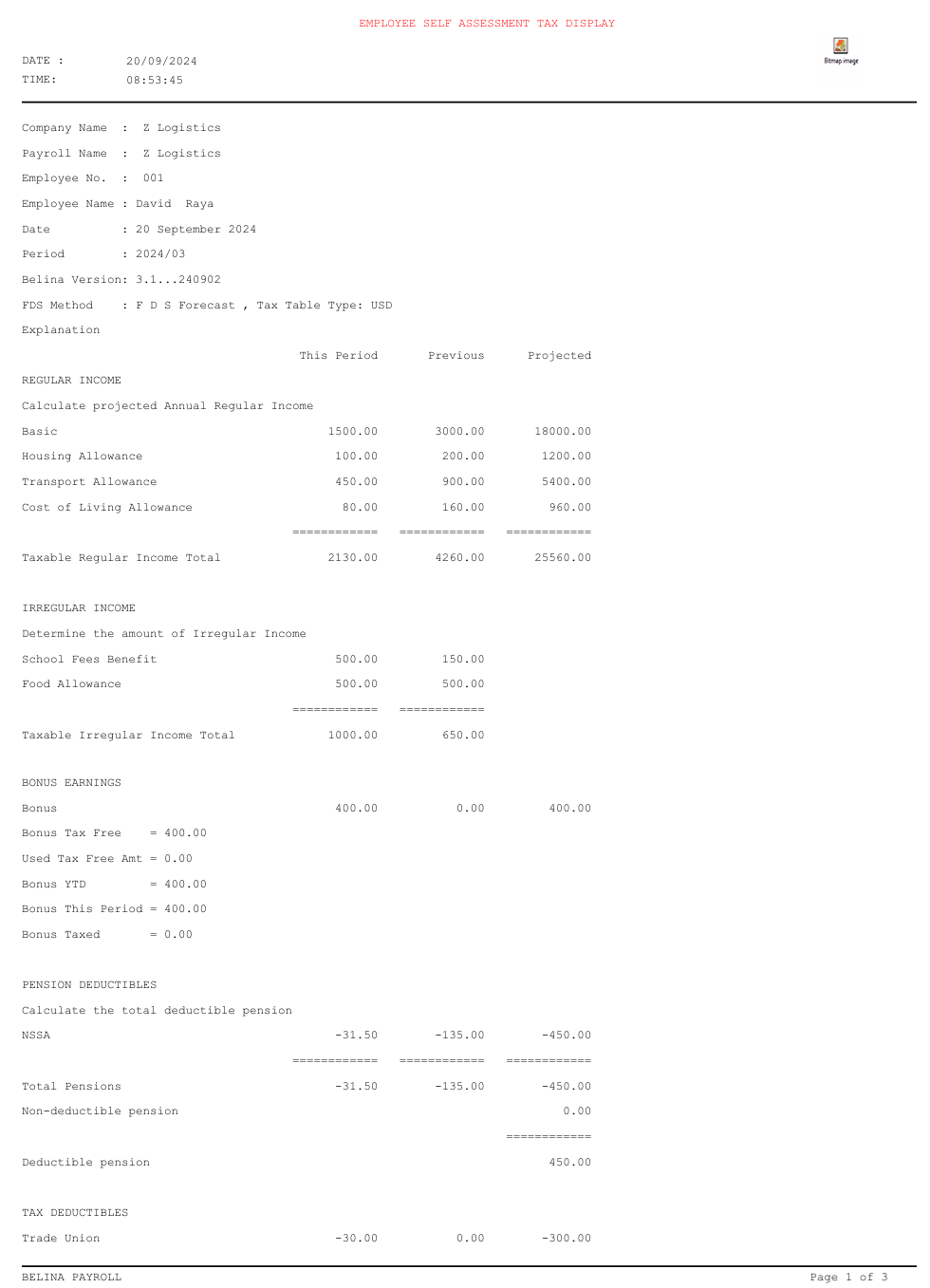

In the example we first show the full tax display for an employee. We then go through sections of the display, one section at a time, giving detailed explanations.

Explanation

The 'Tax Display' shows how the PAYE amount has been calculated for an employee using the FDS Forecast Method of calculation.

Heading

Heading

The 'Heading' section of the FDS - Forecast Method tax calculation displays:

Company Name

|

The name of the company, or organization under which the employee is engaged.

|

Payroll Name

|

The name of the particular payroll that the employee is included in. An organization may have several payrolls, one for executive salaries, another for general salaries, another for wages etc.

|

Employee No.

|

The Employee Code allocated to the individual by the organization.

|

Employee Name

|

The Employee Name of the individual

|

Date

|

Date this tax display was printed

|

Period

|

The period being examined. The tax display can be printed for current, or past periods.

|

Belina Version

|

The Belina PayrollHR version number being used to produce this report

|

FDS Method

|

The FDS tax method that has been used to calculate the PAYE amount for this individual

|

Tax Table Type

|

The tax table used in the calculations.

|

|

Projection

Projection

The projection of income includes:

•the projection of Regular income •the inclusion of Irregular income •Bonus Earnings •Pension Deductibles

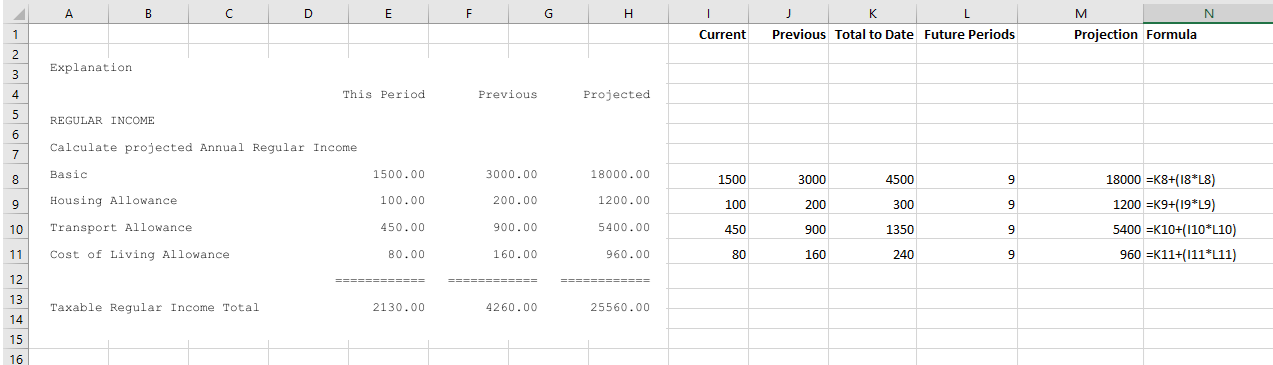

Regular Income - Projection

The projection of regular income, in the FDS - Forecast Method tax calculation, is done in the following manner for each Regular Income Transaction Code:

In this example we have 4 Regular Income Transaction Codes. We are also in period 3, so there are 3 periods where actual transaction amounts paid are known, leaving 9 periods to be estimated in the projection.

'This Period'

|

Value processed in the current period

|

'Previous'

|

Total value processed in all the prior periods of the current tax year.

|

'Projected'

|

(The total value of 'Previous') + ('This Period' value x Number of remaining periods (see above))

|

'Periods'

|

The 'Periods' column in the spreadsheet side of the picture, above, shows the number of periods remaining in the current tax year, excluding the current period. The current and previous periods have actual data, it is the future periods that need projection (estimation).

|

'Projection'

|

The 'Projection' column shows the actual taxable earnings to date, 'Total To Date', plus the 'Projection' of income to the end of the current tax year.

|

'Formula'

|

The formula used to project income using the Excel cell references.

|

|

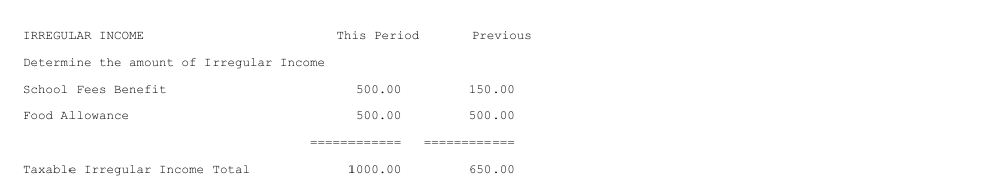

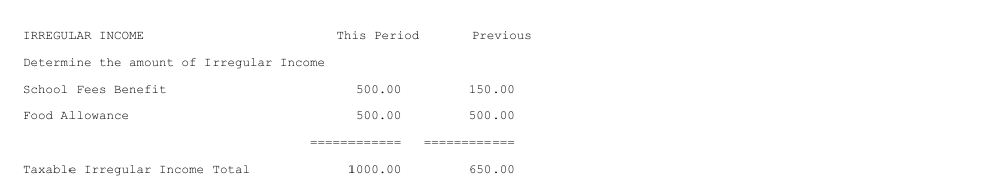

Irregular Income

Irregular Income

Irregular income is not projected. It is simply listed showing two totals. The total for 'This Period' and the total for 'Previous' period/s. These totals are used later in the calculation of PAYE. Tax on irregular income is calculated and deducted in the period in which it is earned. You will notice later that we calculate the tax related to irregular earnings in a two step process:

.

|

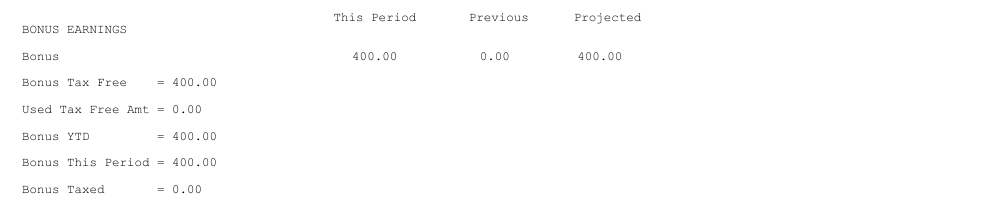

Bonus Earnings

Bonus Earnings

The Bonus section of the FDS - Forecast Method tax calculation displays:

'Bonus'

|

The amount of annual bonus, subject to a tax free element, received 'This Period' and the amount received 'Previous'. There is no projection, just a total.

|

'Bonus Tax Free'

|

The ZIMRA approved tax free element of an annual bonus setup under 'Tax Parameters'

|

'Used Tax Free Amt'

|

The amount of tax free element of an annual bonus that has been used in prior periods

|

'Bonus YTD'

|

The amount of annual bonus, subject to a tax free element, received 'Previous' plus 'This Period'.

|

'Bonus This Period'

|

The amount of annual bonus, subject to a tax free element, received 'This Period'

|

'Bonus Taxed'

|

The amount of annual bonus, that has exceeded the 'Bonus Tax Free' and is subject to taxation

|

|

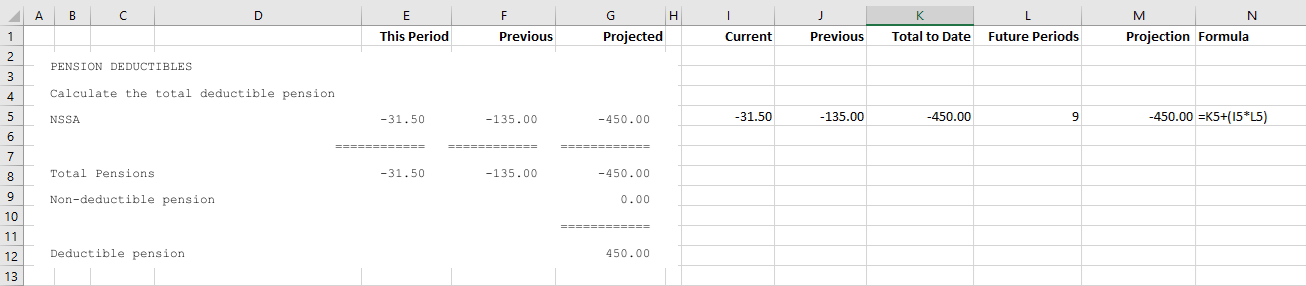

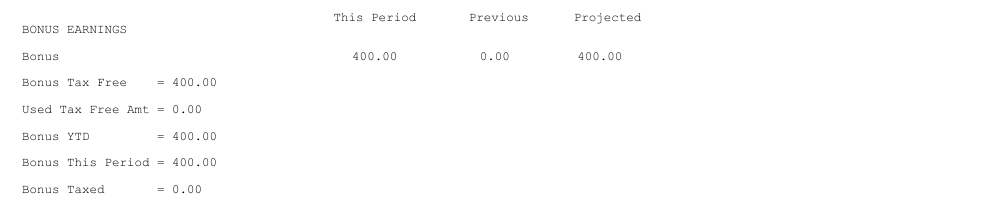

Pension Deductibles

Pension Deductibles

The Pension section of the FDS - Forecast Method tax calculation displays a listing of pension Transaction Codes that have transactions:

'This Period'

|

Value of pensions processed in the current period

|

'Previous'

|

Total value of pensions processed in all the prior periods of the current tax year.

|

'Projected'

|

(The total value of 'Previous') + ('This Period' x Number of remaining periods)

|

'Periods'

|

The 'Periods' column in the spreadsheet side of the picture, above, shows the number of periods remaining in the current tax year, excluding the current period. The current and previous periods have actual data, it is the future periods that needs projection (estimation).

|

'Projection'

|

The 'Projection' column shows the actual deductible pension to date, 'Total To Date', plus the 'Projection' of pension to the end of the current tax year.

|

'Total Pensions'

|

In our example there is just one pension. If there were more then they would be listed and the projected contributions would be totaled here.

|

'Non-deductible pension'

|

The total in the example does not exceed the maximum deductible amount (The 2024 maximum pension deductible amount is USD5400). Any projected pension contributions exceeding this amount will not be allowed.

|

'Deductible pension'

|

The allowable amount of projected pension contributions.

|

'Formula'

|

The formula used to project income using the Excel cell references.

|

|

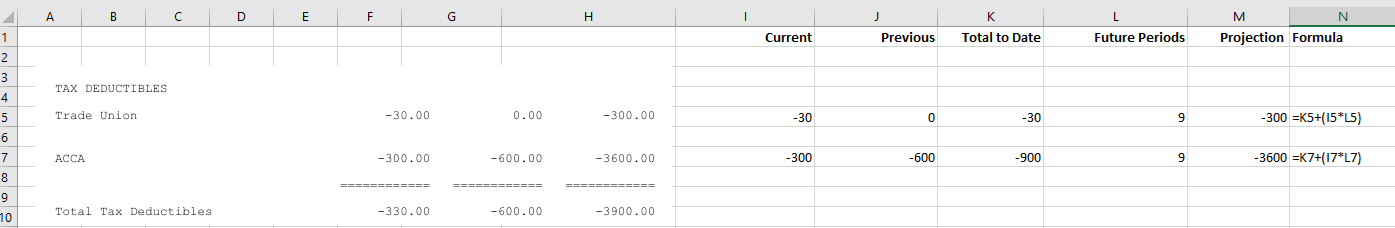

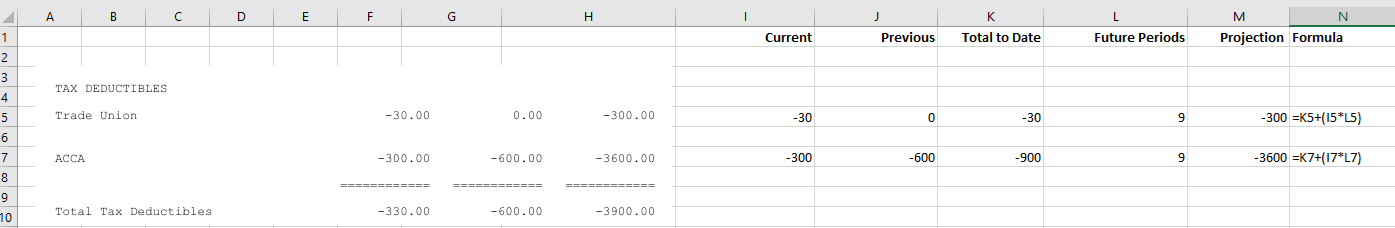

Tax Deductibles

Tax Deductibles

'This Period'

|

Value of tax deductible transactions processed in the current period

|

'Previous'

|

Total value of tax deductible transactions processed in all the prior periods of the current tax year. In this example we are in period 3, so there are 2 prior periods.

|

'Projected'

|

(The total value of 'Previous') + ('This Period' x Number of remaining periods)

|

'Periods'

|

The 'Periods' column in the spreadsheet side of the picture, above, shows the number of periods remaining in the current tax year, excluding the current period. The current and previous periods have actual data, it is the future periods that needs projection (estimation).

|

'Projection'

|

The 'Projection' column shows the actual tax deductibles to date, 'Total To Date', plus the 'Projection' of deductibles to the end of the current tax year.

|

'Total Tax Deductibles'

|

In our example there is just one tax deductible transaction. If there were more then they would be listed and the projected contributions would be totaled here.

|

|

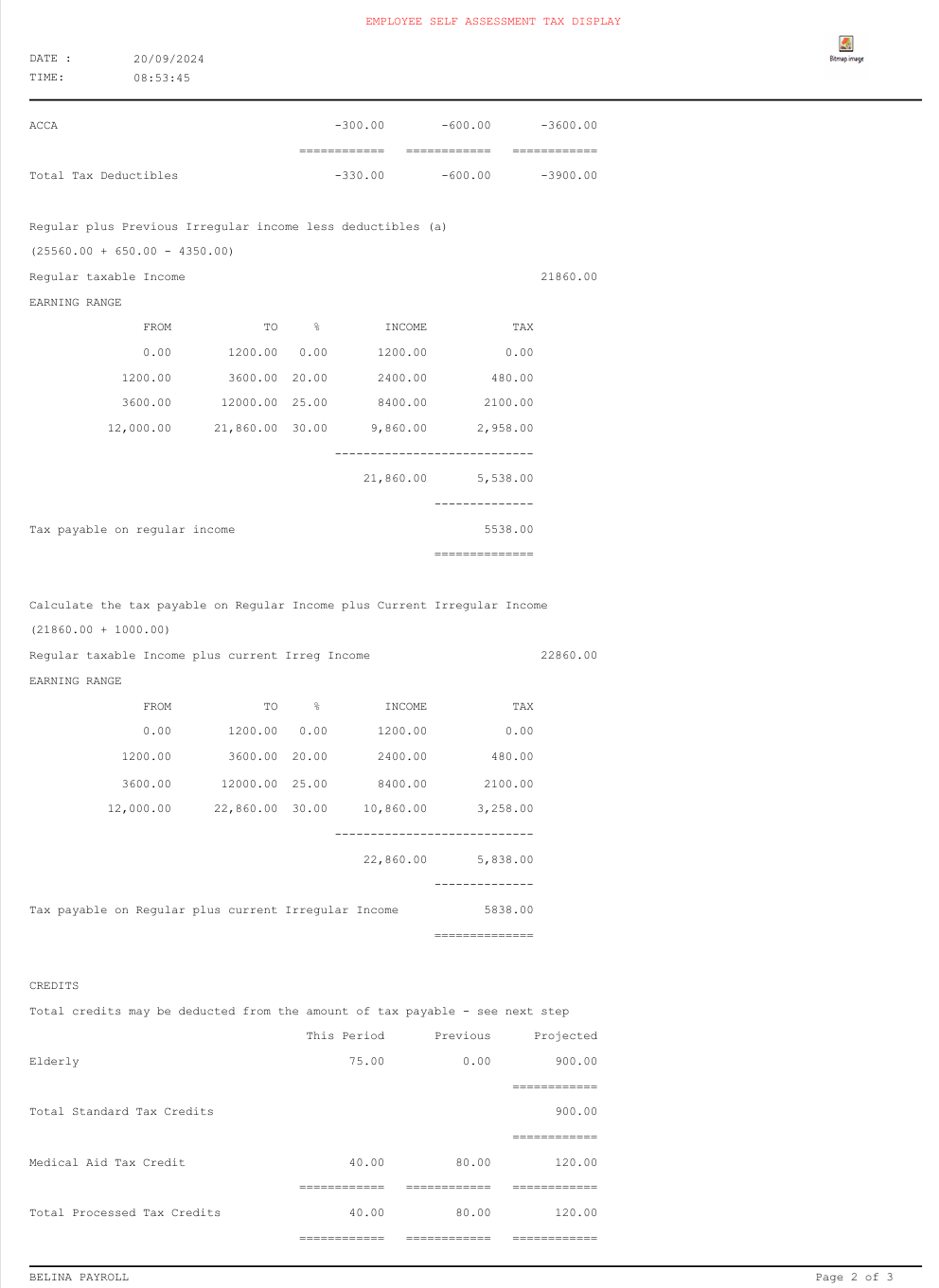

Tax Payable on Projected Income

Tax Payable on Projected Income

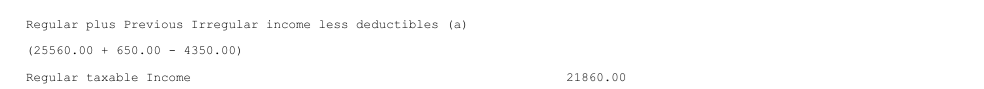

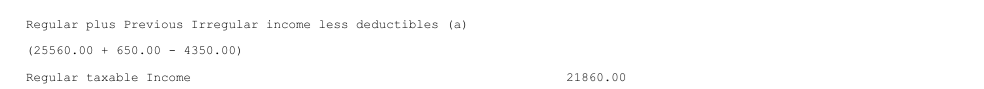

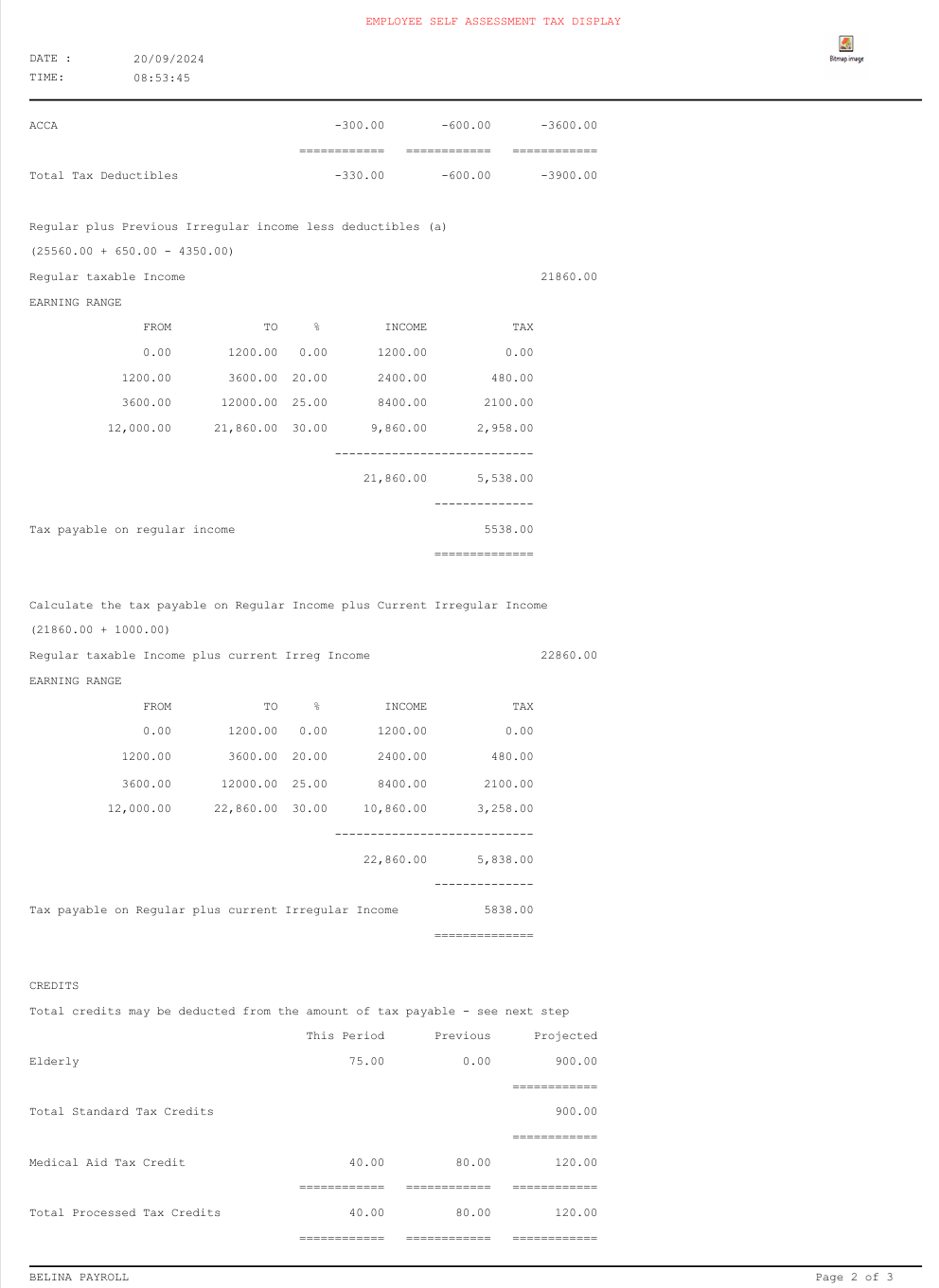

Step 1 - Calculate Net Projected Regular Income (including known irregular income up to but excluding the current period)

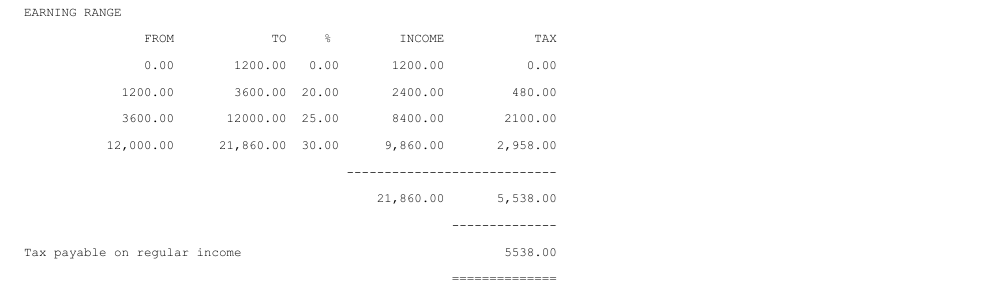

Step 2 Calculate the Tax Payable on Regular income Calculated in Step 1

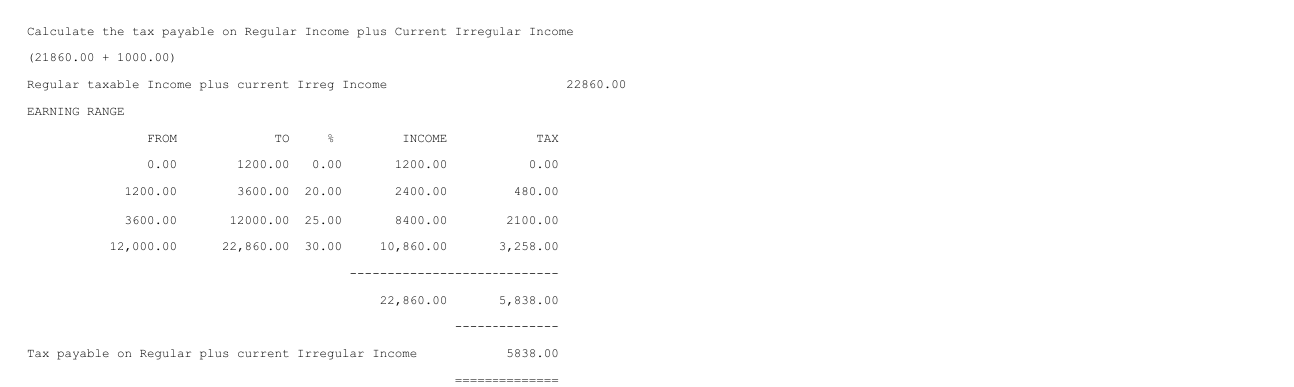

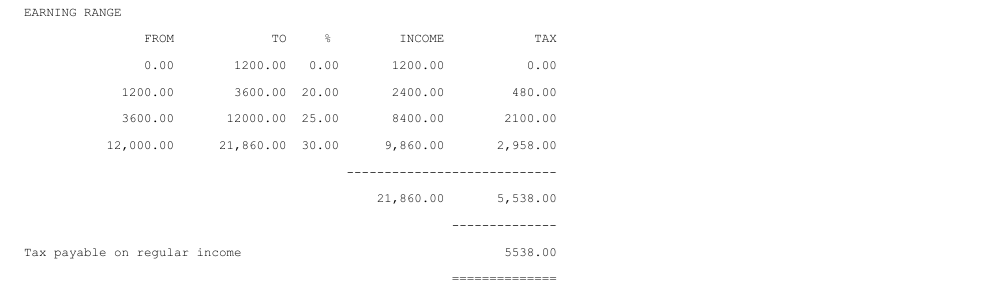

Step 3 - Calculate the Tax Payable on Regular income plus current period Irregular Income

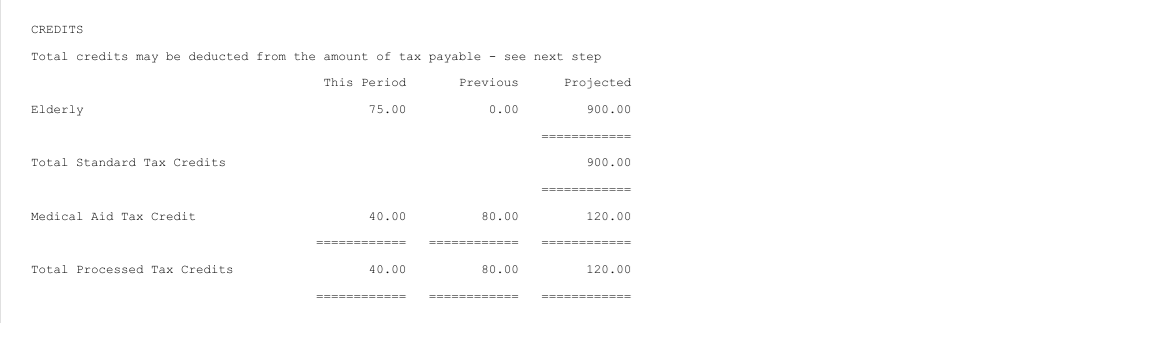

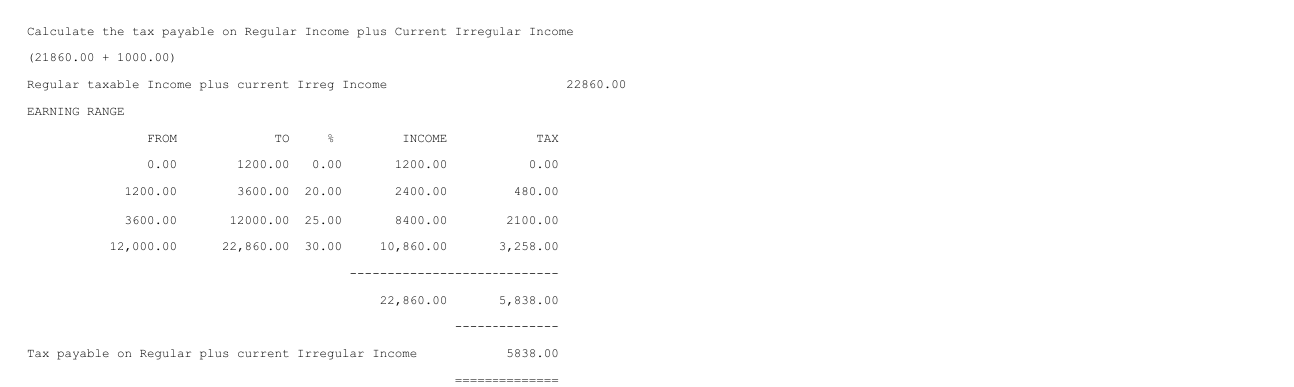

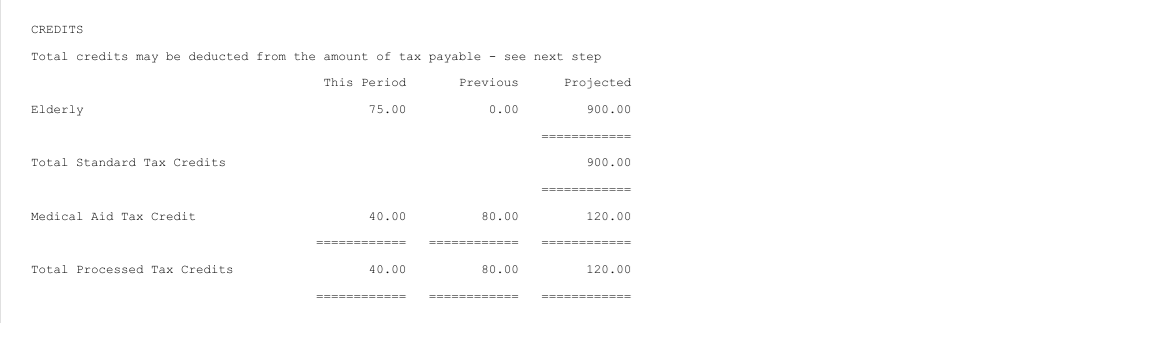

Step 4 - Credits

|

Projected (Prior Periods)

|

Projected (including current)

|

Standard Credits:

|

|

|

Projected Elderly Credit

|

0.00

|

900.00

|

Medical Credits:

|

|

|

Medical Expenses

|

80.00

|

40.00

|

Total

|

|

940.00

|

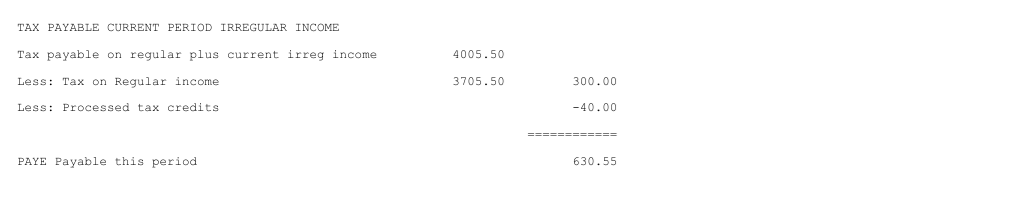

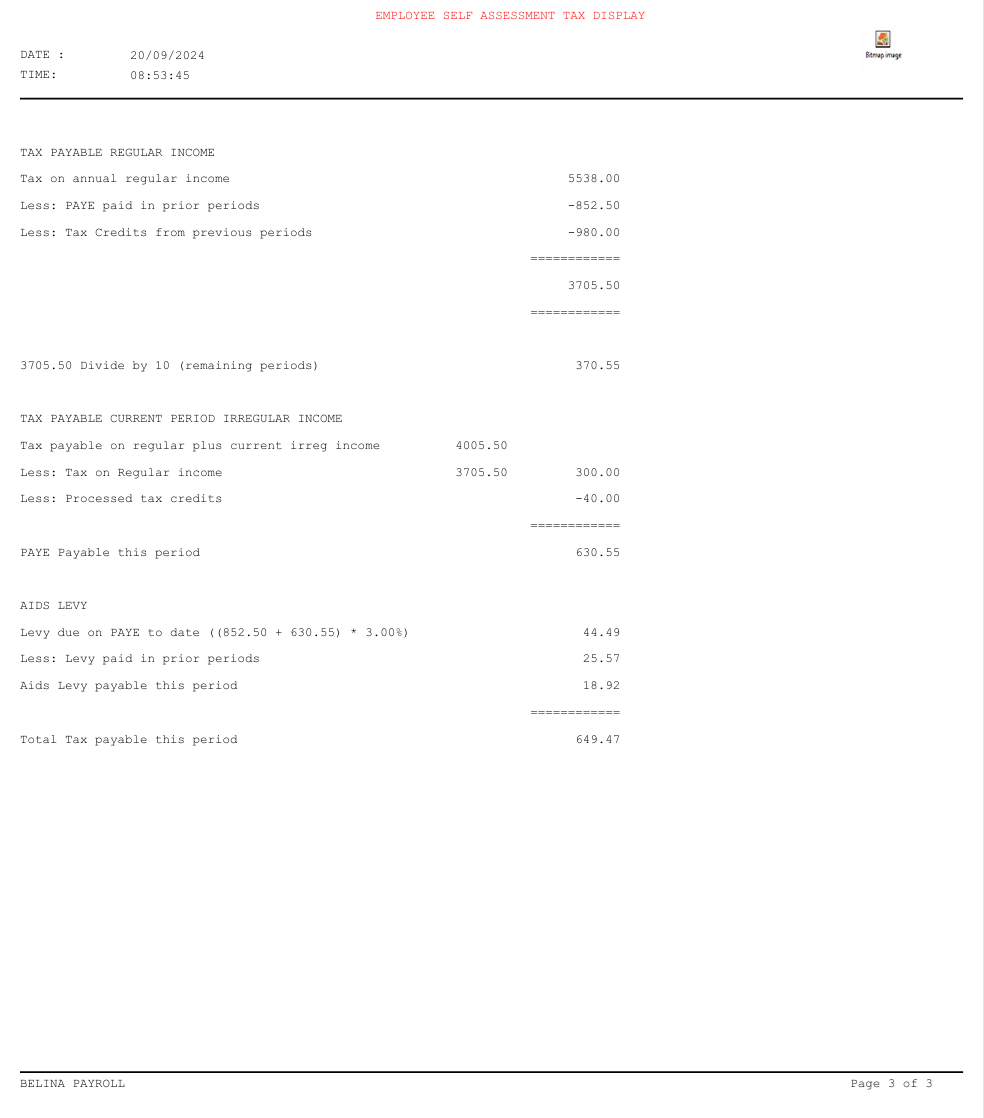

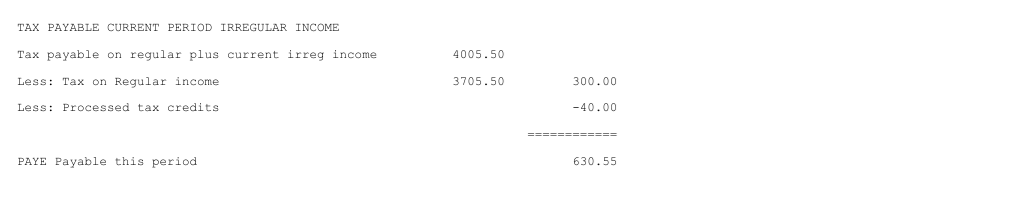

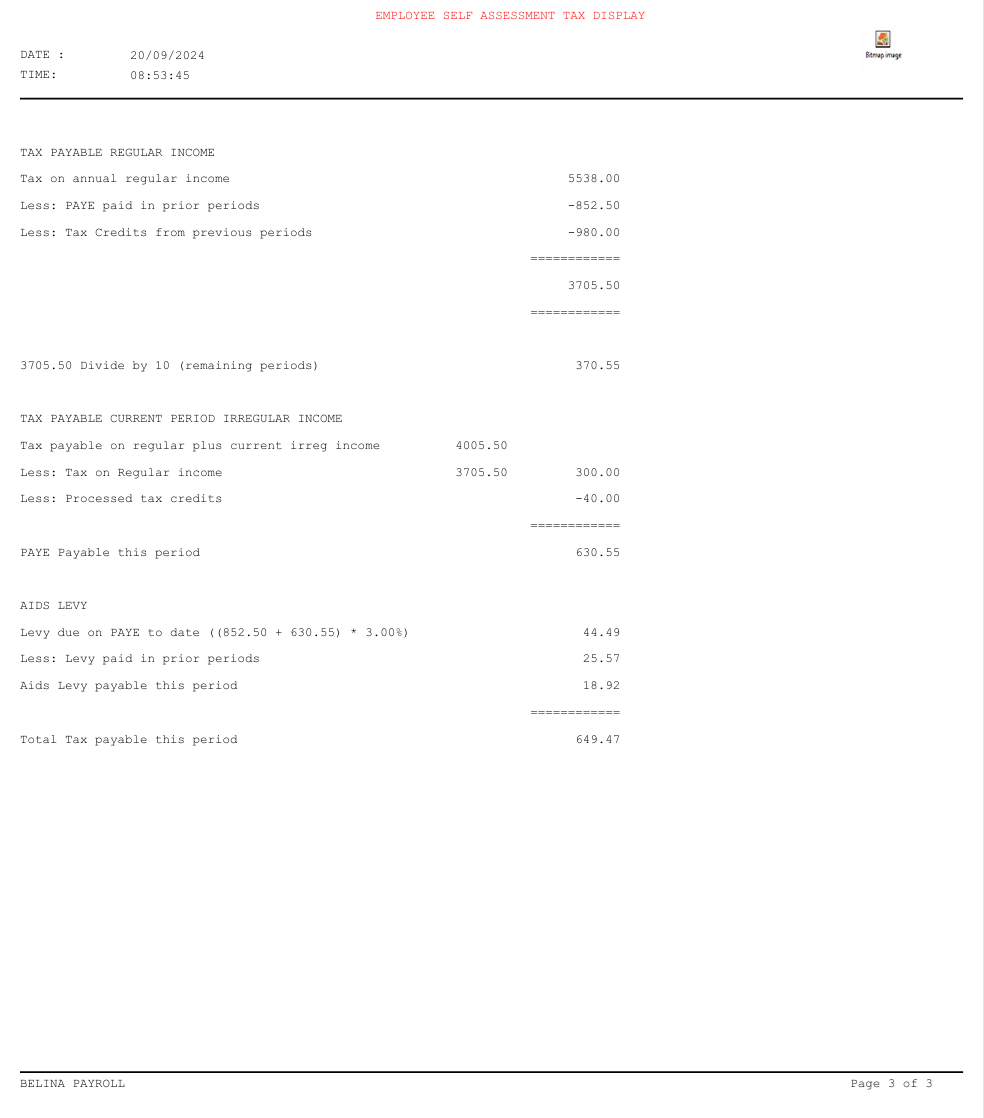

Step 5 - We now calculate the tax payable on Regular Income for the current period

Tax payable on Regular Income for the year

|

5538.00

|

Less: Tax already paid (PAYE) on Regular Income so far this year

|

-852.50

|

Less: Tax Credits from previous periods

|

-980.00

|

Net amount of tax payable on regular income in remaining periods

|

3705.50

|

Net amount of tax payable on regular income in remaining periods / remaining periods, including the current period, (as explained above)

|

370.55

|

Step 5 - Calculate the tax payable on the Irregular income earned this period

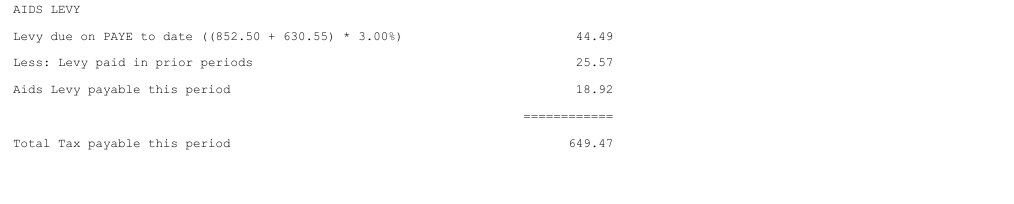

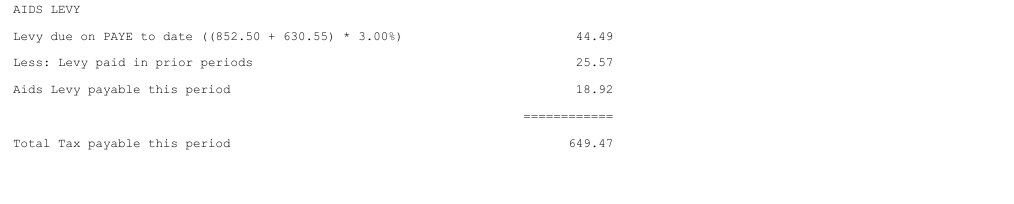

Step 6 - Aids Levy

The final step in the calculation is to deal with the Aids Levy. The calculation looks at the amount of Aids Levy that should have been paid to date on PAYE paid in prior periods and the amount of PAYE to be paid in the current period (Step 6) and subtracts what has already been paid.

This is then added to the 'PAYE Payable this period' (Step 5) to give a 'Total Tax payable this period'.

|

![]() Tax Payable on Projected Income

Tax Payable on Projected Income