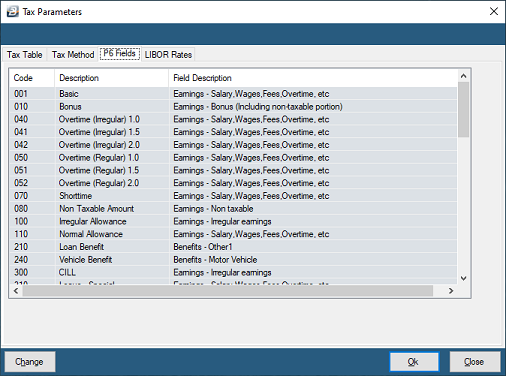

First Tab - Tax Table

Belina PayrollHR comes with the current tax parameters already setup for you. Thereafter, as revised tax bands are gazetted, Belina make available a downloadable program update at http://zw.belinapayroll.com/resources. This update will have the latest tax parameters already setup for you to use.

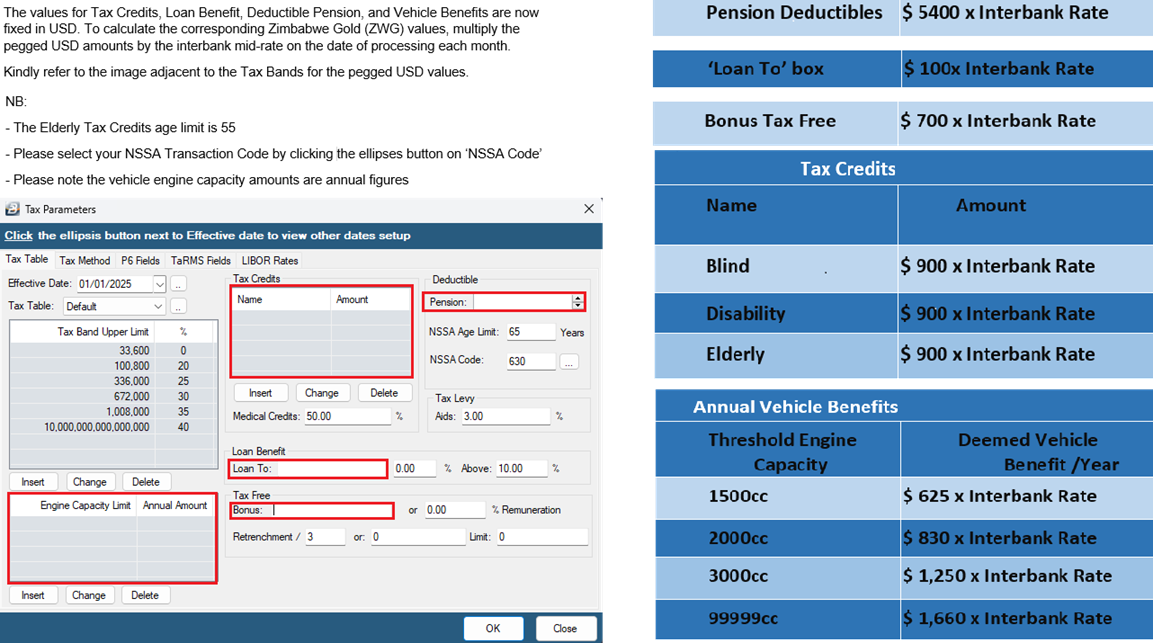

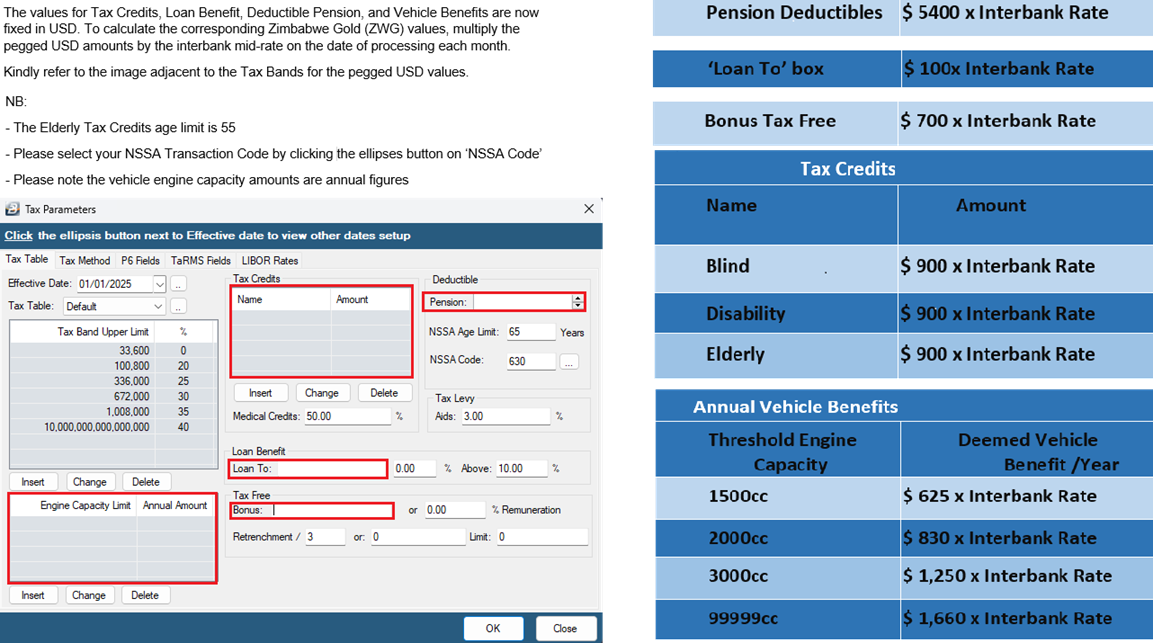

Example of Tax Tables set up in ZiG currency:

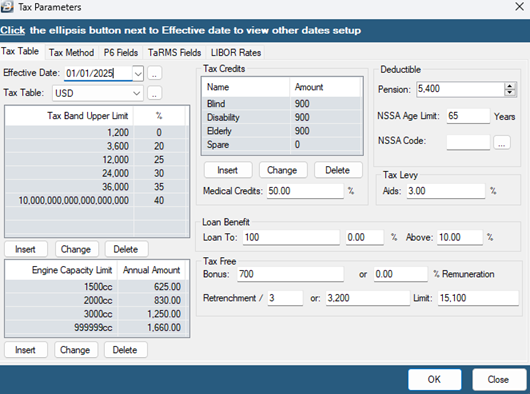

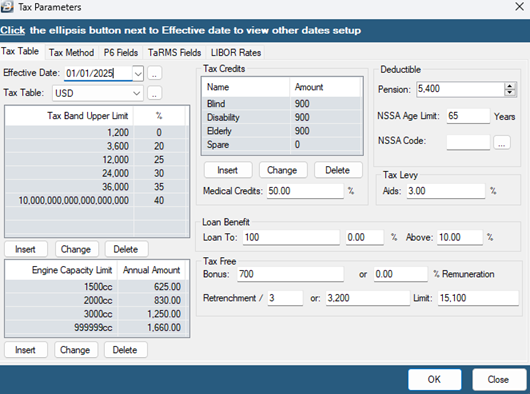

Example of Tax Tables set up in USD currency:

Check the Tax Parameters detailed with your tax consultant, legislation, or from ZIMRA.

Effective Date

|

The date that tax parameters become effective (normally the first day of the year). Use the dropdown menu to 'Auto Create Tax Tables'. This is usually done at the after the budget has been released towards the end of the tax year and you have upgraded your software with a version containing the updated tables.

|

Tax Band Upper Limit

|

Use the 'Insert' and 'Change' buttons (see keyboard conventions) to enter, or update, the upper limit for each tax band and the percentage tax rate that applies to that band. The upper limit of one band is automatically taken as the lower limit for the next.

|

Engine Capacity Limit

|

Use the 'Insert' and 'Change' buttons (see keyboard conventions) to enter, or update, the range of engine capacities and the deemed ZIMRA vehicle benefit.

|

Tax Credits

|

Use the 'Insert' and 'Change' buttons (see keyboard conventions) to enter, or update, the types of credits and credit amounts that apply.

|

Medical Credit %

|

Enter the Tax Credit percentage that will be applied to medical expenses processed through the payroll.

|

Tax Free Bonus

|

Enter the tax free annual bonus amount for the tax year (announced towards the end of the tax year by the Minister of Finance in the annual budget statement).

|

Loan Benefit

|

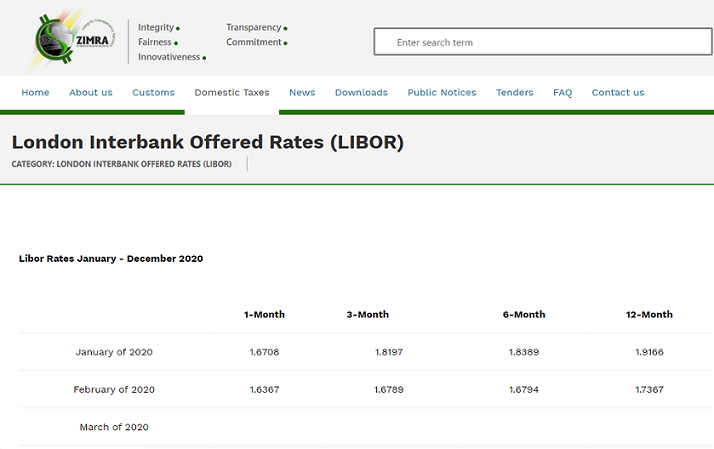

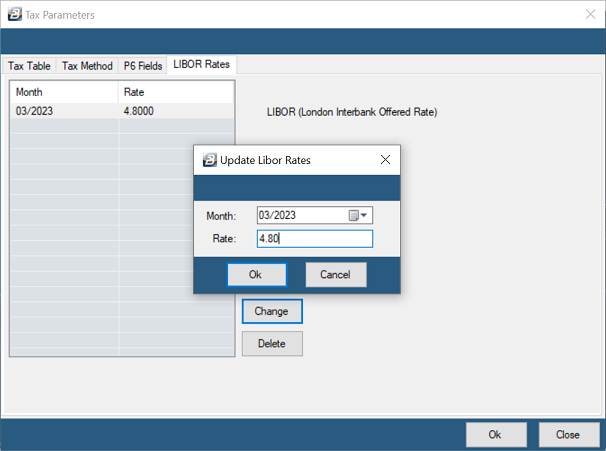

A loan benefit arises where a loan, or credit, exceeding the specified loan amount (currently $100) is given to an employee. The benefit, if any, is deemed to be the difference in the amount of interest charged and the amount that would have been charged if the LIBOR rate plus 5% was charged. A benefit also arises if any amount of the loan is written off. See comment 'LIBOR Rates' below.

|

Retrenchment

|

There are tax concessions for those employees that are retrenched. Part of the retrenchment package is tax free. A stated amount is tax free or a percentage of the first $x is tax free which ever is the higher amount.

|

Deductible Pension

|

The Finance Act allows pension contributions as a tax deduction. The Pension Deduction is the lower of a specified amount or a percentage of emoluments, which-ever is lower. Enter the amount and percentage.

|

NSSA Age Limit

|

Enter 65, the age at which NSSA deductions cease to be made. No NSSA contributions are made from employees that are over 65 year old or who turn 65 during the current tax year.

|

NSSA Code

|

Enter, or use the Ellipsis button to look-up, the NSSA Transaction Code

|

Tax Levy - Aids

|

Enter the Aids Levy percentage to be applied to the PAYE amount.

|

To set up bands for the next year

You can set up bands for future tax periods. Simply insert the new 'Effective Date' and enter the new tax bands and other parameters.

To add, change or delete a tax band follow the normal keyboard conventions.

Tax credits

In the past tax credits were only available to employees being taxed using FDS methods of calculating tax. Now tax credits are available to all employees being taxed, pro rata'd from the date of engagement. Setup the credit amounts for Blind, Disabled, and Elderly and the medical credit percentage.

Retrenchment

According to the ZIMRA website :'Section 14 of the Income Tax At (Chapter 23:06) as read with paragraph 4 (p) of the Third Schedule to the same Act exempts the greater of US$5,000 or one third of up to US$45,000 of the amount of any severance pay, gratuity or similar benefit received on cessation of employment due to retrenchment, under a scheme approved by the Minister responsible for labour. The amount determined as legislated will thus not be liable to tax or in other words, will be excluded from the taxable income.'

Explanation (effective for the 2024 tax year only):

Any retrenchment amount up to $9 600 has the first third, ie. the first $3 200 tax free.

Any retrenchment amount from $9 600 to $15 100 has the first third tax free

Any retrenchment amount above $15 100 has the first third of $9 600 tax free only

The tax concession for retrenchment is gazetted each year and is only available to employees that have been retrenched as part of a formal retrenchment exercise approved by the Ministry of Labour.

Important: Before applying any of the above parameters please check the current rates from your tax consultant, legislation, or from ZIMRA

|