Once a Transaction Code has been created it is ready to be used to process data onto an employee's payslip using one of the processing methods described.

Some transactions, once entered on the employee's payslip come through automatically each period. These transactions include those that have been setup to come through as 'Automatic', 'Indefinite' or 'Multiple'.

•Basic

•Pension

•Medical Aid

•NEC

•Trade Unions

•Zimdev

•Certain Allowances, deductions and benefits

•Loan repayments

Other transactions, where it is necessary to enter a value, need to be processed onto the payslip each period, these would include:

•Overtime

•Shorttime

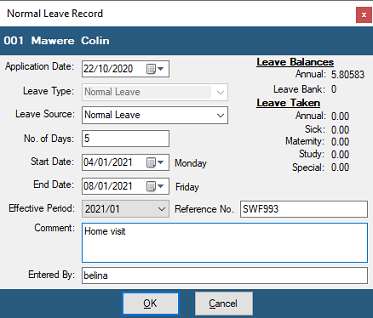

•Leave

•Loans extended

To process these transactions using Payslip Input:

There are a number of ways to process this type of transaction. The 'Payslip Input' method is described, below, which is suitable when processing one employee at a time. Other methods may be quicker, especially when the transaction is being applled to a number of employees. In those circumstances consider using 'Bulk Input', 'Speed Input', 'Spreadsheet Input', or ''Batch Input'.

To process Basic (which could be described 'Basic Pay', 'Basic Salary', 'Rate of Pay'or some other way) using 'Payslip Input': •Go to 'Process' •Select the employee from the table of listed employees •Press 'Insert' •Lookup and select 'Basic' •The Transaction Code is automatically added to the Earnings and Deductions for the employee

This will come through automatically onto the Payslip Input every period from now onwards.

To Change a Basic Transaction on Payslip Input: - This would normally be done by changing the Rate of Pay setup in the Employee Master Record of the individual. - If the rate of pay for the individual has been set to 'Hourly' or 'Daily' then the number of Units can be changed from Payslip Input. - Highlight the Basic Pay Code, - Press 'Change', or double-click, to amend the number of units

To Delete Basic Pay from Payslip Input: It would be very unusual to delete Basic. Normally a 'Shorttime' amount would be entered to offset the Basic Pay if an adjustment was being made. - From the 'Process' menu select 'Payslip Input'. - Select the employee to be processed - Highlight the 'Basic Pay' Code, - Press 'Delete' to delete the Transaction Code from the employee's Payslip Input.

We have shown how to process this transaction using Payslip Input. It is also possible to process this type of transaction using other processing methods, including Bulk Input, Spreadsheet Input, Speed Input and Batch Input. |

There are a number of ways to process this type of transaction. The 'Payslip Input' method is described, below, which is suitable when processing one employee at a time. Other methods may be quicker, especially when the transaction is being applled to a number of employees. In those circumstances consider using 'Bulk Input', 'Speed Input', 'Spreadsheet Input', or ''Batch Input'.

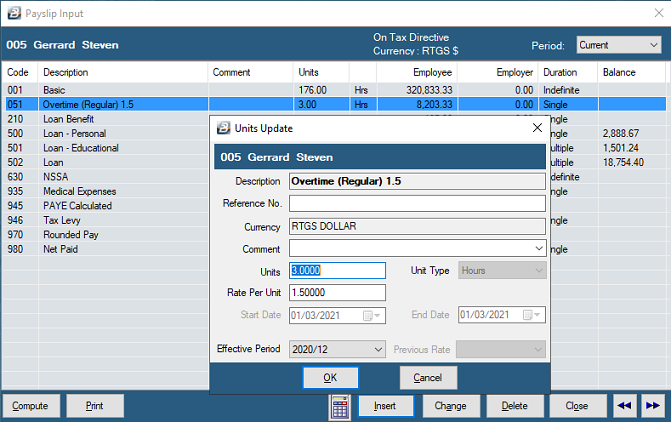

To process Overtime using 'Payslip Input': •Go to 'Process' •Select the employee from the table of listed employees •Press 'Insert' •Lookup and select the Overtime Code required. There could be several codes depending on the rate being paid and whether it is being paid as a regular or irregular amount. •Enter the number of 'Units', normally this would be the number of hours. •The Transaction Code is automatically added to the Earnings and Deductions for the employee

This transaction is a once off transaction for the period.

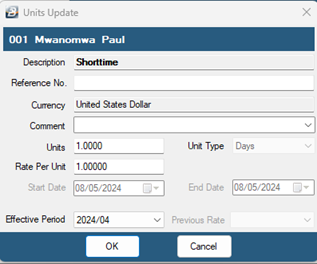

Shorttime To process Shorttime using 'Payslip Input': •Go to 'Process' •Select the employee from the table of listed employees •Press 'Insert' •Lookup and select the Shorttime Code required. •Enter the number of 'Units', normally this would be the number of hours. •The Transaction Code is automatically deducted from the Earnings and Deductions for the employee

To Change an Overtime or Shorttime Transaction on Payslip Input: - From the 'Process' menu select 'Payslip Input'. - Select the employee to be processed- Highlight the Overtime (or Shorttime) Code being changed, - Press 'Change', or double-click, to amend the number of units

To Delete Overtime or Shorttime from Payslip Input: - From the 'Process' menu select 'Payslip Input'. - Select the employee to be processed - Highlight the 'Overtime' (or Shorttime) Code being deleted, - Press 'Delete' to delete the Transaction Code from the employee's Payslip Input.

We have shown how to process this transaction using Payslip Input. It is also possible to process this type of transaction using other processing methods, including Bulk Input, Spreadsheet Input, Speed Input and Batch Input. |

There are a number of ways to process this type of transaction. The 'Payslip Input' method is described, below, which is suitable when processing one employee at a time. Other methods may be quicker, especially when the transaction is being applled to a number of employees. In those circumstances consider using 'Bulk Input', 'Speed Input', 'Spreadsheet Input', or ''Batch Input'.

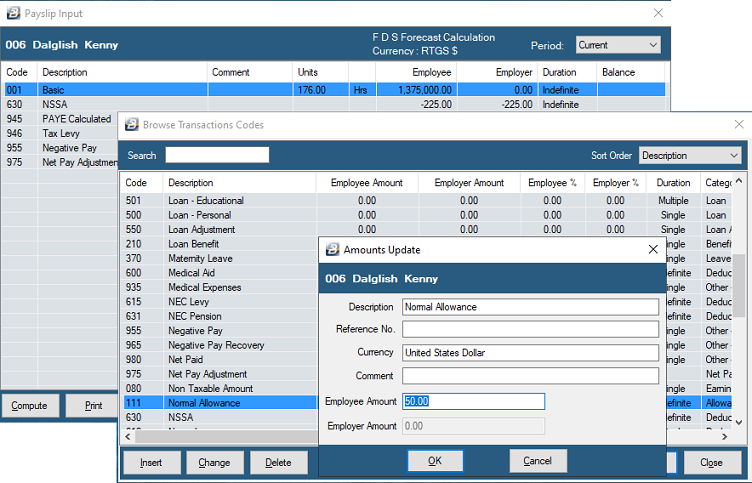

To process Allowances using Payslip Input: •Go to 'Process' •Select the employee from the table of listed employees •Press 'Insert' •Lookup and select the Allowance required. •If the Allowance has been setup with 'Manual Edit' enabled, then enter the amount. •The Transaction Code is then automatically added to the Earnings and Deductions for the employee.

This will come through automatically onto the Payslip Input every period if the transaction was setup us as 'Indefinite' or as 'Multiple' that includes future periods.

To Change an Allowance Transaction on Payslip Input: - From the 'Process' menu select 'Payslip Input'. - Select the employee to be processed - Highlight the Allowance Code being changed, - If the Allowance has been set to 'Manual Edit' then it is possible to press 'Change', or double-click, to amend the Allowance amount. - If the Allowance has not been set to 'Manual Edit' then the amount in the Transaction Code setup would need to be changed.

To Delete an Allowance from Payslip Input: - From the 'Process' menu select 'Payslip Input'. - Select the employee to be processed - Highlight the 'Allowance' Code being deleted, - Press 'Delete' to delete the Transaction Code from the employee's Payslip Input.

We have shown how to process this transaction using Payslip Input. It is also possible to process this type of transaction using other processing methods, including Bulk Input, Spreadsheet Input, Speed Input and Batch Input. |

|

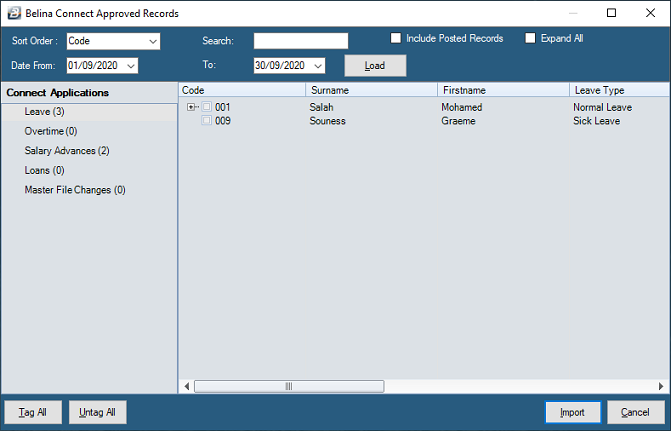

Loans can be set up in 2 Steps Processing loans for the first time:

Loan deductions resulting from the processing of the loan become a recurring entries until the loan balance is cleared.

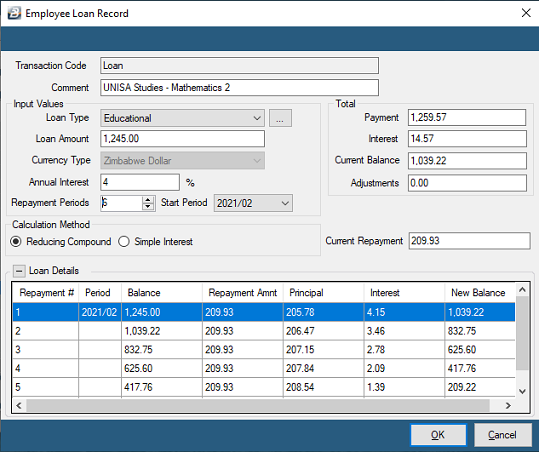

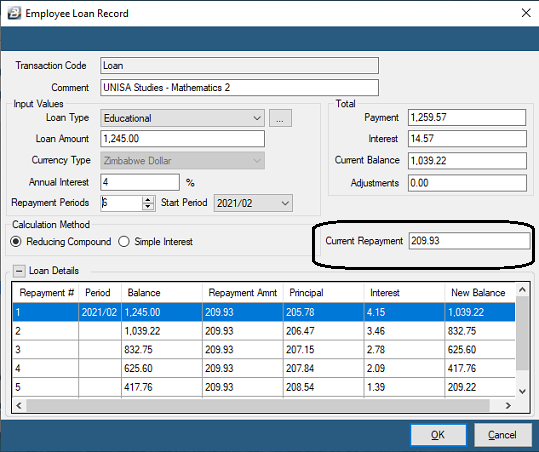

Start Period The period in which repayments are to commence.

Reducing Compound Calculates the interest on the reducing balance of the loan. The repayment is first applied to the interest payable with the balance applied to the principal amount outstanding.

Simple Interest Calculates the interest on the full balance of the loan at the outset and divides the amount equally over the periods of the loan. This results in a higher interest amount being charged than under the Reducing Balance method.

During the life of the loan it is possible to:

Freeze Loan It is possible to freeze the repayments on a loan for a number of periods. This is done by setting the 'Current Repayment' for the period to zero. If repayments are suspended for more than one period then this process would be repeated in each subsequent period. The system will automatically accrue interest whilst the loan is frozen.

Loan Benefit When a payroll is created a loan benefit code is automatically created as Code 210. This is necessary if the interest being charged on the loan is less than the ZIMRA deemed interest rate. In these cases there is a deemed loan benefit. If the loan benefit parameters have been setup for loans then the value of the loan benefit will come through using Code 210 with the value of the benefit onto the employee's payslip.

Adjustments to repayment amount There are often instances where it is necessary to adjust the repayment amount in a period. It is possible to change the repayment. The loan repayment schedule adjusts automatically to reflect the change. |

Medical aid There are 4 steps needed to process medical aid on a payroll:

Once the medical aid transaction code has been added to the employee's 'Payslip Input' the transaction will come through automatically from period to period.

To Change the amount of a Medical Aid Transaction on Payslip Input: This cannot be done through Payslip Input, it would be done by adjusting the contribution rates for the Medical Aid, and/ or the persons covered by the employee's medical aid.

To Delete a Medical Aid Transaction Code from Payslip Input: - From the 'Process' menu select 'Payslip Input'. - Select the employee to be processed - Highlight the 'Medical Aid' Code being deleted, - Press 'Delete' to delete the Transaction Code from the employee's Payslip Input.

This becomes a recurring entry every period.

We have shown how to process this transaction using Payslip Input. It is also possible to process this type of transaction using other processing methods, including Bulk Input, Spreadsheet Input, Speed Input and Batch Input. |

There are 2 steps needed to process NEC onto an Employee's Payslip Input:

To Change a NEC Transaction amount on Payslip Input: This cannot be done through Payslip Input, it would be done by going to the NEC Transaction Code and altering the contribution rate.

To Delete a NEC Transaction on Payslip Input: - From the 'Process' menu select 'Payslip Input'. - Select the employee to be processed - Highlight the NEC Transaction Code, then press 'Delete' to delete the Transaction Code from the employee's Payslip Input.

This becomes a recurring entry every period.

We have shown how to process this transaction using Payslip Input. It is also possible to process this type of transaction using other processing methods, including Bulk Input, Spreadsheet Input, Speed Input and Batch Input. |

To process ensure that the Deduction Transaction Code has been setup.

There are a number of ways to process this type of transaction. The 'Payslip Input' method is described, below, which is suitable when processing one employee at a time. Other methods may be quicker, especially when the transaction is being applled to a number of employees. In those circumstances consider using 'Bulk Input', 'Speed Input', 'Spreadsheet Input', or ''Batch Input'.

To process the Deduction using 'Payslip Input': •Go to 'Process' •Select the employee from the table of listed employees •Press 'Insert' •Lookup and select the Deduction required. •If the Deduction has been setup with 'Manual Edit' enabled, then enter the amount. •The Transaction Code is then automatically added to the Payslip Input for the employee.

We have shown how to process this transaction using Payslip Input. It is also possible to process this type of transaction using other processing methods, including Bulk Input, Spreadsheet Input, Speed Input and Batch Input. |

Ensure that the Pension Transaction Code has been setup.

There are a number of ways to process this type of transaction. The 'Payslip Input' method is described, below, which is suitable when processing one employee at a time. Other methods may be quicker, especially when the transaction is being applled to a number of employees. In those circumstances consider using 'Bulk Input', 'Speed Input', 'Spreadsheet Input', or ''Batch Input'.

To process the Deduction using the 'Paylip Input' method: •Go to the 'Process', then 'Paylip Input' menu options, then •Select the employee from the table of listed employees •Press 'Insert' •Lookup and select the Pension Code required. •The Transaction Code is then automatically added to the Payslip Input for the employee with the calculated Pension amount. •This becomes a recurring entry every period.

Use the 'Bulk Input' method to process Pension to a selected range of employees.

We have shown how to process this transaction using Payslip Input. It is also possible to process this type of transaction using other processing methods, including Bulk Input, Spreadsheet Input, Speed Input and Batch Input. |

Tax Deductible Expenses incurred outside the payroll (Eg. Subscriptions, Tools, Materials and Membership fees) Tax Deductible Expenses incurred by employees outside the payroll can be processed through the payroll to take advantage of the tax deductions. Use the 'Tax Deductibles' transaction code to process the transaction in Belina PayrollHR. The employee should submit supporting evidence for the cost and this should be kept on file by the organization for FDS audit purposes.

There are a number of ways to process this type of transaction. The 'Payslip Input' method is described, below, which is suitable when processing one employee at a time. Other methods may be quicker, especially when the transaction is being applled to a number of employees. In those circumstances consider using 'Bulk Input', 'Speed Input', 'Spreadsheet Input', or ''Batch Input'.

To process the tax deductible Amount using 'Payslip Input': •Ensure that a Deductibles Transaction Code has been setup •Then go to 'Process', then 'Payslip Input' •Select the employee from the table of listed employees •Press 'Insert' •Lookup and select the Deductibles Transaction Code required. •Enter the Deductible amount.

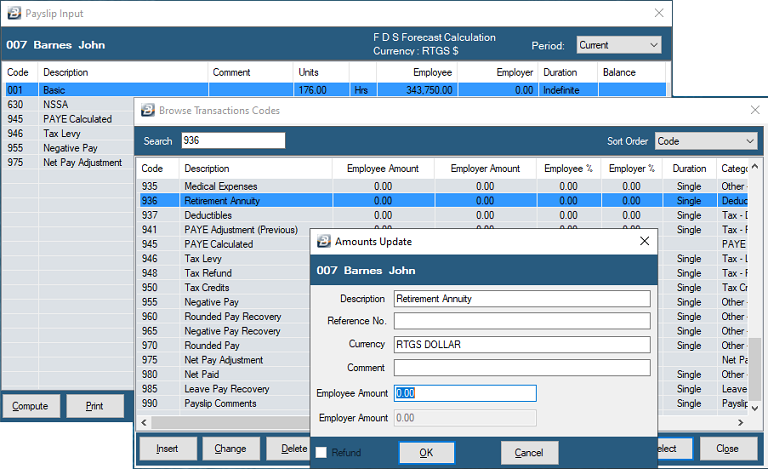

Retirement Annuities Employees might subscribe to a personal pension or a retirement scheme outside the payroll. These amounts should also, therefore, be considered as part of the deductible pension amount used in the tax computation. Use the 'Deductibles - Retirement Annuity' transaction code to process this type of transaction in Belina PayrollHR.

To process a Retirement Annuity Tax Deductible Amount: •Ensure that the Retirement Annuity Transaction Code has been setup •Then go to 'Process', then 'Payslip Input' •Select the employee from the table of listed employees •Press 'Insert' •Lookup and select the Retirement Annuity Code required. •Enter the Retirement Annuity amount.

Retirement Annuity amounts would need to be entered when they occur. They do not come through automatically from one period to another.

We have shown how to process this transaction using Payslip Input. It is also possible to process this type of transaction using other processing methods, including Bulk Input, Spreadsheet Input, Speed Input and Batch Input. |

Ensure that the Trade Union Transaction Code has been setup.

There are a number of ways to process this type of transaction. The 'Payslip Input' method is described, below, which is suitable when processing one employee at a time. Other methods may be quicker, especially when the transaction is being applled to a number of employees. In those circumstances consider using 'Bulk Input', 'Speed Input', 'Spreadsheet Input', or ''Batch Input'.

To process the Trade Union deduction using 'Payslip Input': •Go to 'Process' •Select the employee from the table of listed employees •Press 'Insert' •Lookup and select the Trade Union Code required. •The Transaction Code is then automatically added to the Payslip Input for the employee with the calculated Trade Union amount.

This becomes a recurring entry every period.

We have shown how to process this transaction using Payslip Input. It is also possible to process this type of transaction using other processing methods, including Bulk Input, Spreadsheet Input, Speed Input and Batch Input. |

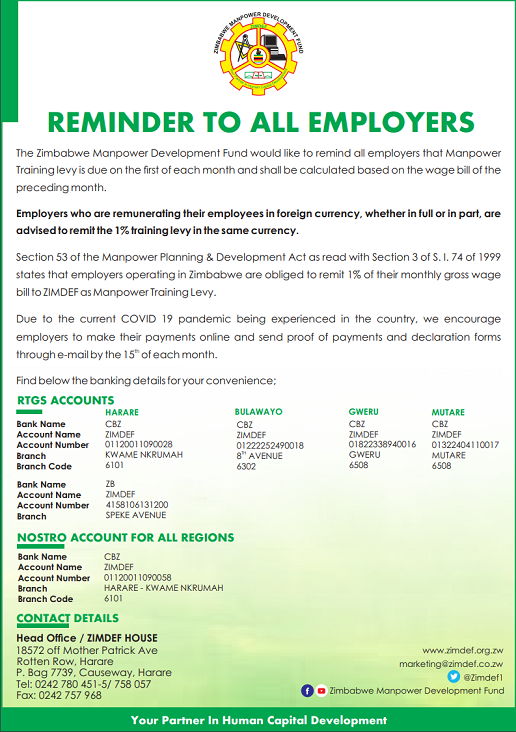

![]() Zimdev and Standards Development

Zimdev and Standards Development

Contributions to the Zimbabwe Manpower Development Fund (Zimdev) and Standards Development Levy may be:

To process these transactions against each employee: Step 1 Create a Transaction Code using the Transaction Type 'Other - Employer Contributions', Step 2 Set up the percentage contribution. In 2021 the Standards Development Levy was 0.5% and Zimdev 1%. Step 3 Notice that the 'Dependent' Transaction Codes are automatically setup for each of these transaction codes.

The advantage of setting up the contribution for each employee is that the value of the employee contribution can be included in the payslip showing the employee the total cost of their employment.

We have shown how to process this transaction using Payslip Input. It is also possible to process this type of transaction using other processing methods, including Bulk Input, Spreadsheet Input, Speed Input and Batch Input. |