Engagement Date

|

Enter the employee's date of engagement in the format DD/MM/YYYY. This field is printed on P6 forms and on the ITF16 form. It is also used to calculate length of service. Use the ellipse button to bring up a calendar for assistance, if necessary.

|

Retirement Date

|

Enter the employee's scheduled date of retirement in the format DD/MM/YYYY.

|

Occupation

|

Enter a valid Occupation for the employee or press the ellipse button to view, add, modify or delete the list of Occupations. The nature of employment, which may not be specific to the organization, is displayed on the P6. Use the ellipse button to create or modify an Occupation.

|

Position

|

The Position in the organizational chart. This field is used when processing Promotions in the Human Resources Module.

|

Department

|

Enter a valid Department for the employee or press the ellipse button to view, add, modify or delete the list of Departments.

|

Cost Centre

|

Enter a valid Cost Centre for the employee or press the ellipse button to view, add, modify or delete the list of Cost Centres. The Cost Centre entered will become the default Cost Centre when processing using batch or hourly input for cost accumulations.

|

Paypoint

|

Enter a valid Paypoint for the employee or press the ellipse button to view, add, modify or delete the list of Paypoints.

|

Grade

|

Enter a valid Grade for the employee or press the ellipse button to view, add, modify or delete the list of Grades.

|

NEC Grade

|

Used for organizations using NEC grading. Enter a valid NEC Grade for the employee. Press the ellipse button to view, add, modify or delete the list of NEC grades.

|

NEC No.

|

Enter the employee's NEC number. This reference number will appear on the NEC reports. The value of NEC deduction is set up under Transaction Codes.

|

NEC Leave Entitlement

|

If the employee has a leave entitlement deviating from the standard default value this could be set up under NEC, even if the employee is not contributing to NEC. The advantage of doing so would be that it is easier to identify and group those affected in reports and to change the value for the group, if that was to occur.

|

Leave entitlement

|

Enter the annual leave entitlement. Each period Belina PayrollHR will automatically accrue the number of leave days due for that period (Annual leave entitlement, set up under Global Defaults, divided by the number of payroll periods of the year. The Labour Act minimum leave entitlement is 30 days per annum.

|

Maximum Leave Allowed

|

Enter the maximum leave balance allowed by the organization. Optionally, the excess leave can be setup to be paid as CILL.

|

Other Leave Entitlement

|

Enter another leave entitlement that may apply to the individual.

|

Trade Union No.

|

Enter the employee Trade Union Number. This reference number will appear on the Trade Union Report. The value of trade union deduction is set up under Transaction Codes.

|

Group Life Assurance No.

|

Enter the Group Life Assurance number for the individual, if appropriate.

|

Time Clocking No.

|

Used by those organizations using computerized time recording systems. Enter the employee time recording reference number to facilitate import of data.

|

Industry

|

Setup up which Industry the employee works under. Grouping of employees with non-standard working hours. These could be employees working under different NEC's within the one organization e.g. security guards or simply those working with special conditions e.g. mornings only.

|

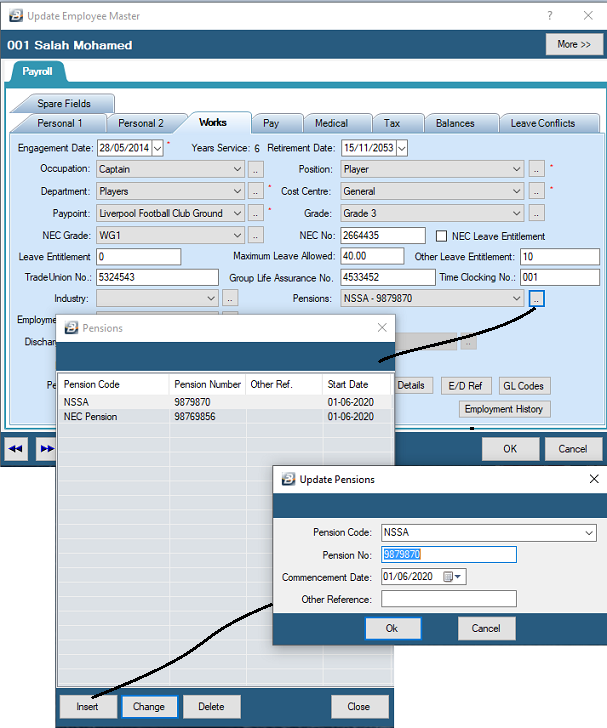

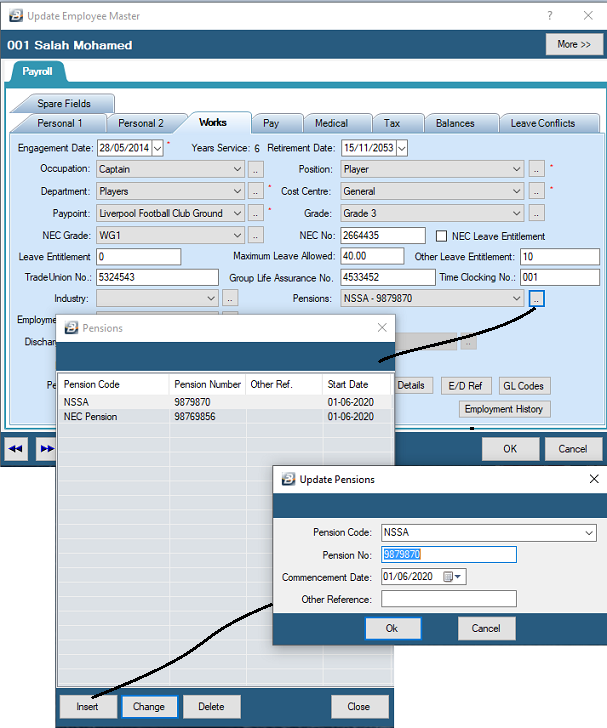

Pensions

|

It is possible that an employee is contributing to more than one pension scheme. Set up any number of schemes, that the employee is contributing to, detailing the name of the scheme, date joined and the pension number.

|

Employment Type

|

This is largely used by the ZIMSTAT Quarterly Employment Inquiry and other reports to separate 'Full-time','Contract','Part-time','Casual','Seasonal' and 'Cadetship' employment categories.

|

Discharge Date

|

Date of Discharge or suspension. Entering any date activates the field telling the system that the individual is not to be considered for processing after the specified date. You will notice on the employee master screen:

'f' - the employee is being discharged in a future period

'd' - this is the last period that transactions are to be processed for the employee

'D' - the employee has left and no transactions are to be processed against this person.

|

Reason

|

Enter Reason for Discharge for future reference. Press the ellipse Key to see the list of Reasons set up for the organization under the Edit Menu and select the appropriate.

|

Immediate

|

Tick to indicate that the discharge is immediate and all transactions for the individual for the current period should be removed.

|

Director

|

Indicate whether the employee is a company director. This is required for the ITF16 where, in the past, it was necessary to print company directors separately.

|

Pensioner

|

Indicate whether the employee is a pensioner. This is required for the ITF16 where, in the past, it was necessary to print pensioners separately.

|

Absent Employee

|

If an employee is marked 'Absent' then the pay for that individual is suspended. The transactions in the Payslip Input are removed and no payment will be made to that employee at period end. Should the employee be re-activated by the removal of the tick against 'Absent' then the system will automatically re-insert the transactions that were in the Payslip Input.

Note: Any employee that is suspended and does not receive a payment in a period should be removed from the FDS method of calculating tax and put on the PAYE method.

|

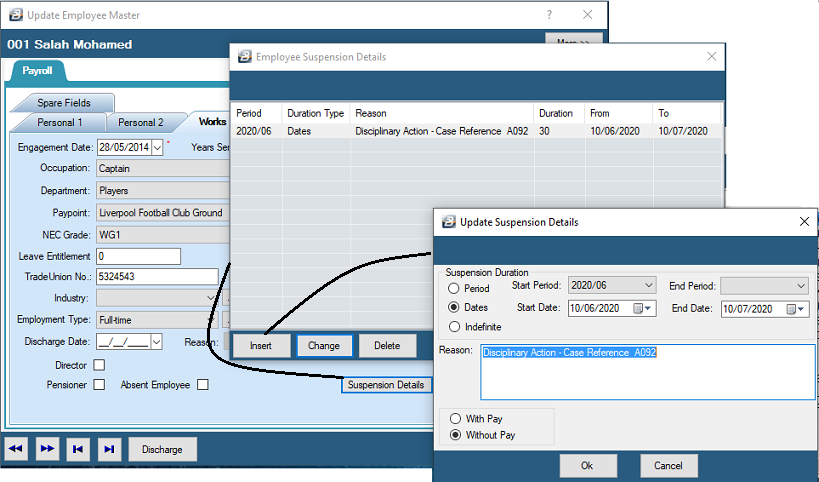

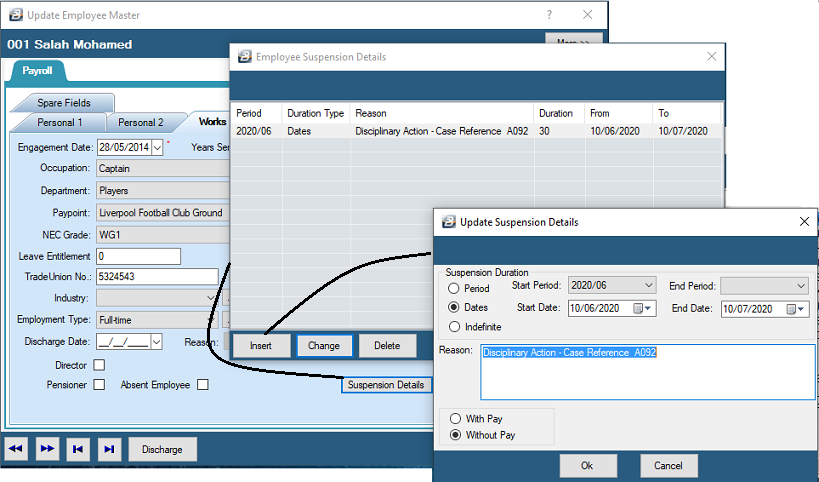

Suspension Details

|

If an employee is absent or suspended without pay. This is useful where the employee is not being discharged (see below). After selecting this option, a screen will pop up where you can type in a reason for this process. The transactions on the Payslip Input are removed but should, or when, the employee returns the transaction codes will be automatically re-inserted.

|

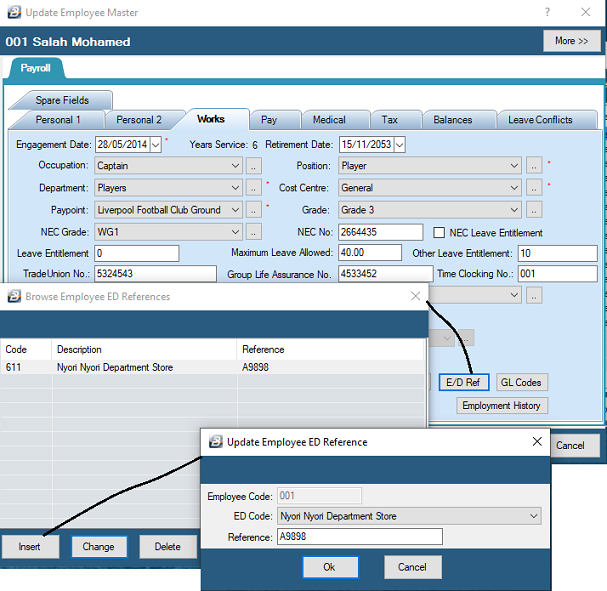

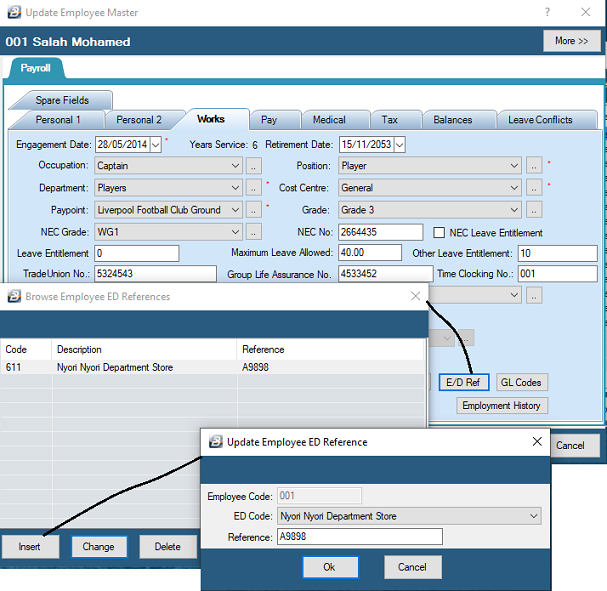

E/D Ref

|

Add the employee's account number to individual transactions made to third parties e.g. employee's Doves account. Enter the employee's Doves account number against the transaction code and extract reports.

Employees may have various credit and other accounts each of these with its own account number. Belina PayrollHR is able to record these various account numbers and include them in the 'Transactions Report'. This report summarizes the employee deductions made and can accompany the remittance made. The Transactions Report is found under the View/ Transactions/ Report menu options.

Step 1 - Press the 'E/D Ref' button on the 'Works Info' Tab in the Employee Master

Step 2 - Press Insert to select the Transaction Code applicable to the deduction being made

Step 3 - Enter the Employee's Reference number for that Transaction code

|

G/L Codes

|

Add the employee's general account number to individual internal transaction codes e.g. employee have specific account (or sub account) in the general ledger where transactions are being accumulated.

|

Employment History

|

Displays a table highlighting changes made to the employee master record as regards, grade, NEC grade, department, cost centre, paypoint, and more.

|