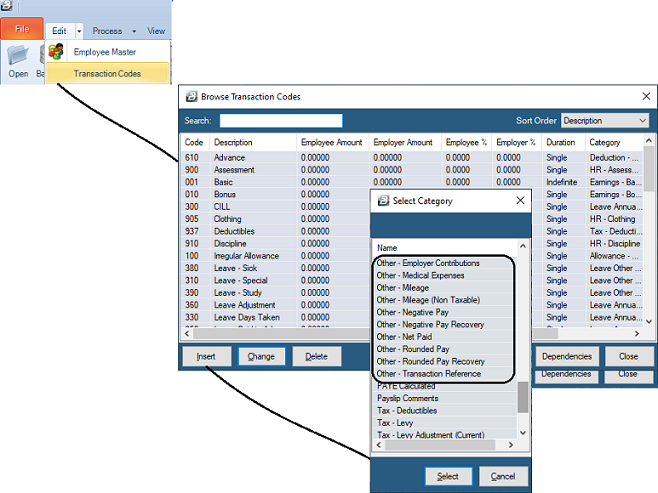

To Create an Earnings Transaction Code

- Go to the 'Edit', then 'Transaction Codes' menu options

- From the table of existing Transaction Codes, press Insert

- A list of Transaction Categories are listed

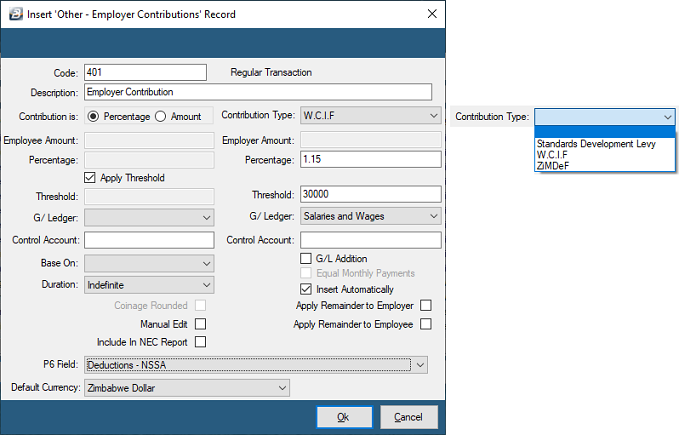

Other - Employer Contributions (Zimdef, WCIF, Standards Development Levy) Other - Employer Contributions (Zimdef, WCIF, Standards Development Levy)

Use this transaction type to process amounts paid by the employer on behalf of an employee e.g. WCIF contributions. The amounts processed are reflected on the payslip but do not affect the net pay.

To create a Zimdef Transaction Code

|

To create a Standards Development Levy Transaction Code

|

To create a WCIF Transaction Code

|

|

|

|

Click to play

|

Click to play

|

Click to play

|

To create an 'Other - Employer Contributions' Transaction Code:

- Go to the 'Edit' , 'Transaction Codes' menu options.

- Click 'Insert' and select the Transaction Category 'Other - Employer Contributions'.

- Accept/ Change the default 'Code'.

- Enter an appropriate 'Description'.

- Use the radio button to select whether the amount will be calculated as a percentage of Basic Pay, or an amount

- Select 'Contribution Type' from the drop-down menu, leave blank if it is not one of the three listed.

- If the calculation is based on a percentage now select whether a threshold applies. If the 'Apply Threshold' check-box has a tick then the Employer 'Threshold' field is activated ready for the entry of the maximum amount to be applied to the employer.

- Enter the 'Employer Amount' if the payment is a standard amount. If the amount varies leave blank and place a tick against 'Manual Edit' which allows the entry of an amount when processing.

- Select the 'General Ledger' Code to be entered onto journal reports and exports.

- If the Contribution is based on the Employee's Basic pay select whether that Basic amount is the Employer Master, NEC or Internal Grade basic amount.

- Select whether the Transaction Code should be inserted automatically onto every payslip on the payroll.

- Set the 'Duration' - whether the transaction is to come through for a 'Single', 'Multiple' or 'Indefinite' number of periods.

- Set the 'P6 Field' for year end ITF16 export.

- Set 'Manual Edit' if you would like to be able to enter, or change, the amount of the Allowance when processing.

- Click 'Ok' to save the new Transaction Code.

More:

|

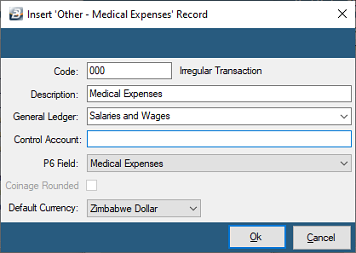

Other - Medical Expenses Other - Medical Expenses

Use the 'Other - Medical Expenses' Transaction Category to process medical expenses incurred by the employee outside the payroll. These amounts will be used in the calculation of tax credits thereby reducing the PAYE amount calculated.

To create an 'Other - Medical Expenses' Transaction Code:

- Go to the 'Edit' , 'Transaction Codes' menu options.

- Click 'Insert' and select the Transaction Category 'Other - Medical Expenses'.

- Accept/ Change the default 'Code'.

- Enter an appropriate 'Description'.

- Set the 'P6 Field' for year end ITF16 export.

- Click 'Ok' to save the new Transaction Code.

More:

|

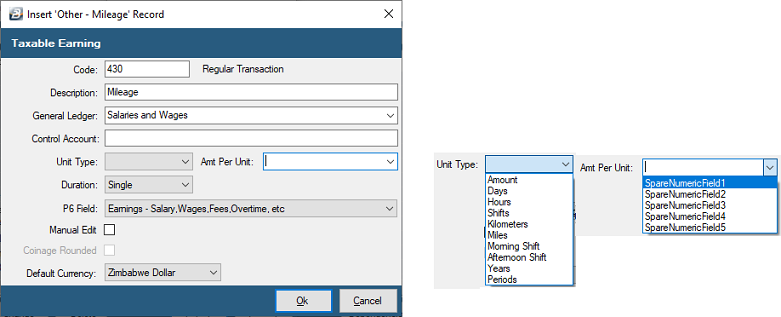

Other - Mileage Other - Mileage

Use this Transaction Type to process mileage and other taxable payments to employees, using a rate per unit. Typically mileage allowances are non-taxable. This transaction type can also be used to process taxable amounts where there is a value per unit.

To create an 'Other - Mileage' Transaction Code:

- Go to the 'Edit' , 'Transaction Codes' menu options.

- Click 'Insert' and select the Transaction Category 'Other - Mileage'.

- Accept/ Change the default 'Code'.

- Enter an appropriate 'Description'.

- Select the 'General Ledger' Code to be entered onto journal reports and exports.

- Select the 'Unit Type' to describe the transaction e.g. Kilometers, Shift, Hours, Days,Years. These unit descriptions are customizable using the 'Setup', 'Units' menu options.

- Enter the 'Amount Per Unit' to be applied in the calculation.

- Set the 'Duration' - whether the transaction is to come through for a 'Single', 'Multiple' or 'Indefinite' number of periods.

- Set the 'P6 Field' for year end ITF16 export.

- Click 'Ok' to save the new Transaction Code

Dependencies: This Transaction Code can be set-up such that the processed amount can be based on a percentage, amount or the number of units stated in one or more Transaction.

More:

|

Other - Mileage (Non Taxable) Other - Mileage (Non Taxable)

Use the 'Other - Mileage (Non Taxable)' Transaction Code to process non-taxable payments to employees, using a rate per unit. Typically, mileage allowances are non taxable. This transaction type can also be used to process non-taxable amounts where there is a value per unit.

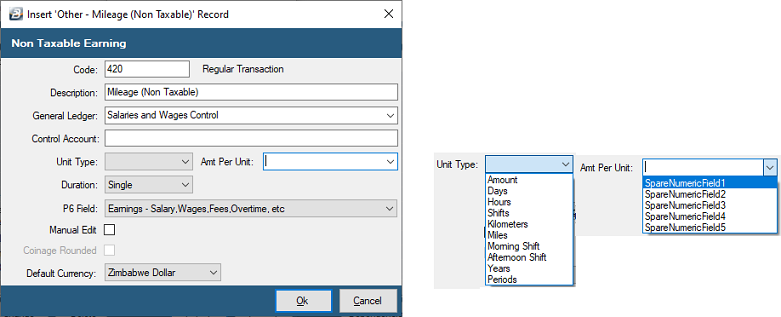

To create an 'Other - Mileage (Non Taxable)' Transaction Code:

- Go to the 'Edit' , 'Transaction Codes' menu options.

- Click 'Insert' and select the Transaction Category 'Other - Mileage (Non Taxable)'.

- Accept/ Change the default 'Code'.

- Enter an appropriate 'Description'.

- Select the 'General Ledger' Code to be entered onto journal reports and exports.

- Select the 'Unit Type' to describe the transaction e.g. Kilometers, Shift, Hours, Days, Years

- Enter the 'Amount Per Unit' to be applied in the calculation.

- Set the 'Duration' - whether the transaction is to come through for a 'Single', 'Multiple' or 'Indefinite' number of periods.

- Set the 'P6 Field' for year end ITF16 export.

- Click 'Ok' to save the new Transaction Code.

Dependencies: This Transaction Code can be set-up such that the processed amount can be based on a percentage, amount or the number of units stated in one or more Transaction.

More:

|

Other - Negative Pay Other - Negative Pay

This Transaction Code is a system generated Transaction. No User setup is required - it is automatically generated and entered, when necessary, on an Employee's payslip if deductions exceed income in a period. Belina HR advances sufficient to cover the deficit to leave a NIL Net Pay Amount.

The amount advanced is recovered automatically in subsequent period/s through a ‘Negative Pay – Recovery’.

|

Other - Negative Pay Recovery Other - Negative Pay Recovery

This Transaction Code is a system generated Transaction. No User setup is required - it is automatically generated and entered, when necessary, in a prior period, an Employee's deductions exceeded income. Belina PayrollHR then advanced sufficient to cover the deficit leaving a NIL Net Pay Amount.

The amount so advanced is now recovered in the Negative Pay Recovery Transaction Code.

|

Other - Net Paid Other - Net Paid

This Transaction Code is a system generated Transaction. No User setup is required - it is automatically generated and entered, when, the Calculation Routine is run. The excess of income over deductions is the balance due to the employee and is paid using the 'Net Paid' Transaction Code.

|

Other - Rounded Pay Other - Rounded Pay

This Transaction Code is a system generated Transaction. No User setup is required - it is automatically generated and entered, when necessary, the Calculation Routine is run. It arises where there has been rounding of Transaction amounts and rounding of the Net Paid amount in line with what has been setup in the transaction codes and the Coinage Table. The lowest denomination in the Coinage Table effectively is the amount to which the Net Paid amount is rounded. Belina PayrollHR rounds up to the nearest denomination, which means that the rounded amount is added to the Calculated Net Paid. This additional amount can, optionally, be recovered in the subsequent period.

|

Other - Rounded Pay Recovery Other - Rounded Pay Recovery

This Transaction Code is a system generated Transaction. No User setup is required - it is automatically generated and entered, when necessary when the Calculation Routine is run. It arises where there has been rounding of Transaction amounts and rounding of the Net Paid in a prior period and the system has been set to recover the amount advanced.

|

Other - Transaction Reference Other - Transaction Reference

Use 'Transaction Reference' to record a value that is used in a calculation elsewhere. It is not included in earnings or deductions or in the calculation of Net Paid or PAYE. Other Transaction Code/s refer to the Transaction Reference value and calculate an amount that is included on the payslip. In some instances clients would prefer that the Transaction Reference were not to be reported on payslips. This can only be done by Belina Support staff using their Belina Support Menu.

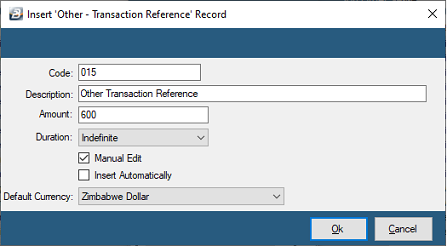

To create an 'Other - Transaction Reference' Transaction Code:

- Go to the 'Edit' , 'Transaction Codes' menu options.

- Click 'Insert' and select the Transaction Category 'Other - Mileage (Taxable)'.

- Accept/ Change the default 'Code'.

- Enter an appropriate 'Description'.

- Enter a default 'Amount', if appropriate. If the amount varies from one employee to another tick 'Manual Edit' to allow the entry of a specific amount for the employee as the transaction is processed.

- Set the 'Duration' - whether the transaction is to come through for a 'Single', 'Multiple' or 'Indefinite' number of periods.

- Tick 'Insert Automatically' to have the Transaction Code included automatically on new employee's payslips.

- Set the 'Default Currency' that this Transaction Code is recorded in.

- Click 'Ok' to save the new Transaction Code.

More:

|

|