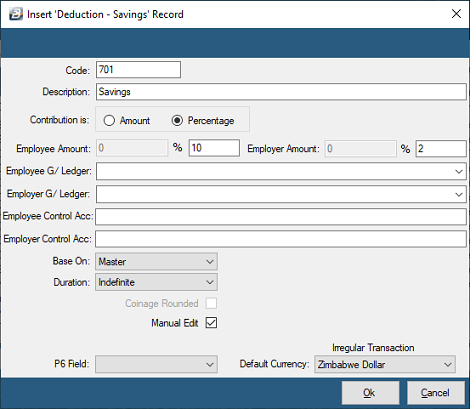

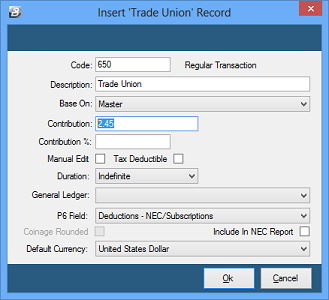

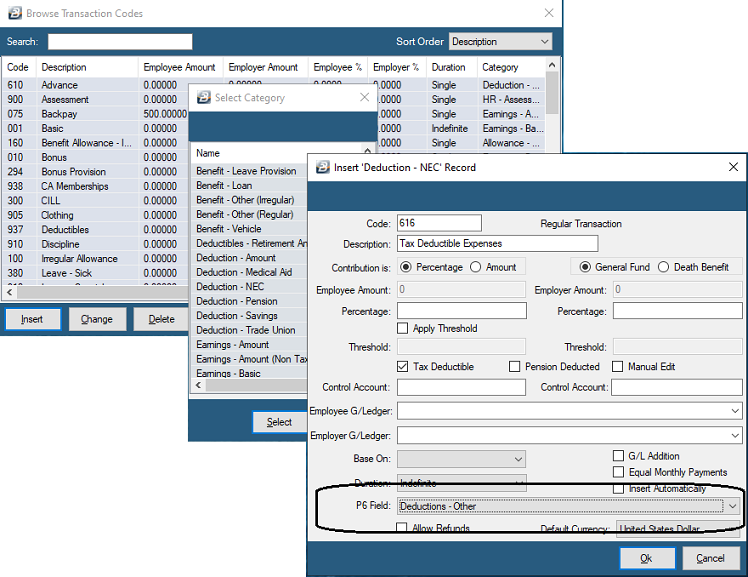

Use the 'Deduction - Pension' Transaction Category to set up a code to process pension deductions. Pension contributions can be calculated as a percentage or as an amount for the employee and employer. The percentages apply to to the Basic set up in the Employee Master, the NEC Grade or Grade rate for the employee. This Transaction Category is used to create a NSSA Pension, or any other pension deduction code taking into account the pension tax free deduction amount.

To create a 'Deduction - Pension' Transaction Code:

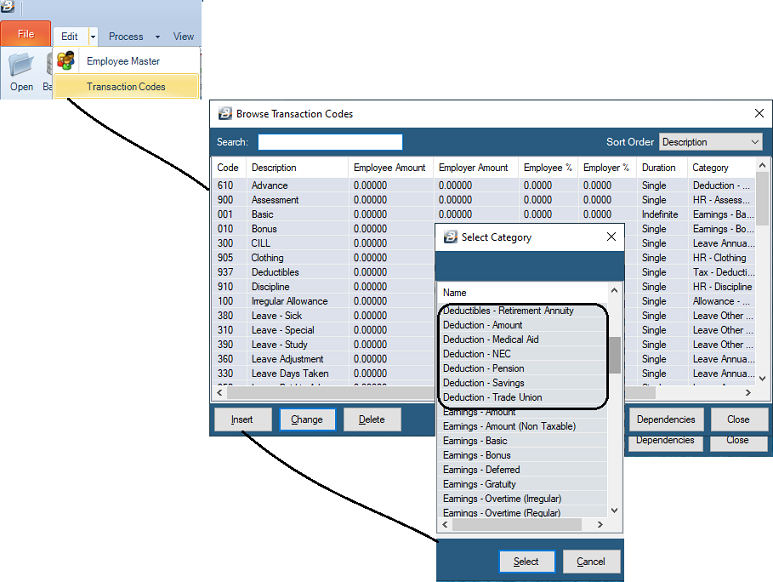

- Go to the 'Edit' , 'Transaction Codes' menu options.

- Click 'Insert' and select the Transaction Category 'Deduction - Pension' Transaction Code.

- Accept/ Change the default 'Code'. This is a unique identifier for the Transaction Code and the numbers are designed to group similar types of transaction together.

- Enter an appropriate 'Description'.

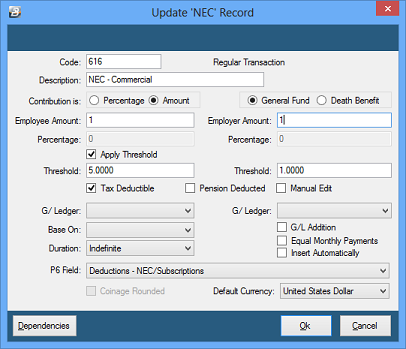

- Select whether the pension contribution will be a calculated as a percentage of basic or an amount entered.

- Enter the 'Employee Amount' if the payment is a standard amount. If the amount varies leave blank and place a tick against 'Manual Edit' which allows the entry of an amount when processing, or.

- Enter the 'Percentage' to be applied.

- Apply Threshold:

|

A threshold can be applied to limit the maximum contributions of employers and employee when setup as a percentage contribution e.g. percentage up to a specified maximum amount.

|

- Select the 'General Ledger' Code to be entered onto journal reports and exports.

- 'Base On' - If the contribution is being calculated as a percentage of basic, then select whether the amount should be based on basic entered in the Employee Master, Internal Grade Rate or Grade Rate.

- Tick 'G/L Addition' if you would like the Employee and Employer General Ledger contribution amounts to be added together to make one entry

- Set the 'Duration' - whether the transaction is to come through for a 'Single', 'Multiple' or 'Indefinite' number of periods.

- Tick 'Insert Automatically' to have the Transaction Code included automatically on new employee's payslips.

- Set the 'P6 Field' for year end ITF16 export.

- Set 'Manual Edit' if you would like to be able to enter, or change, the amount of the Allowance when processing.

- Set the 'Default Currency' that this transaction code will be paid in.

- Click 'Ok' to save the new Transaction Code..

Apply Threshold

|

The Maximum pension contribution can be set for both the Employee and Employer contribution. These limits are used when setting up National Social Security Authority (NSSA). The NSSA contribution percentage has been set at 3% with the threshold changing periodically. In a weekly payroll apportion the threshold (12 / 52), likewise for fortnightly payrolls (12 / 26).

|

Pension Deduction

|

Pension contributions, up to a limit, are tax deductible. The amount is gazetted each year and is setup under Tax Parameters

|

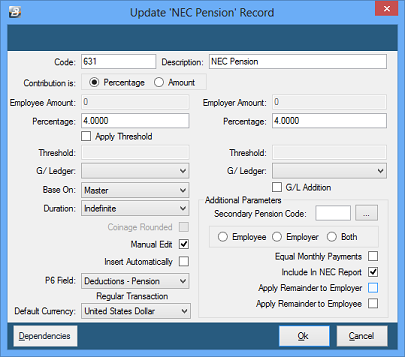

Secondary Code

|

Use the 'Secondary Pension Code' if the pension contribution is reduced by the amount of a contribution to another pension scheme such as NSSA. Use the ellipsis button to select the pension code that is being taken into account and select whether the employee, employer or both contributions are affected.

|

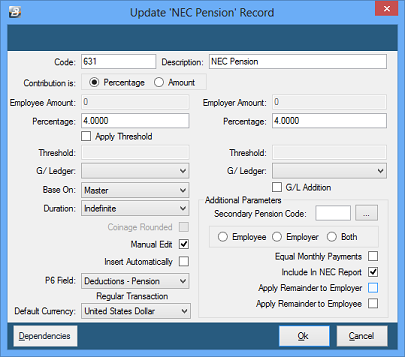

National Social Security Authority (NSSA)

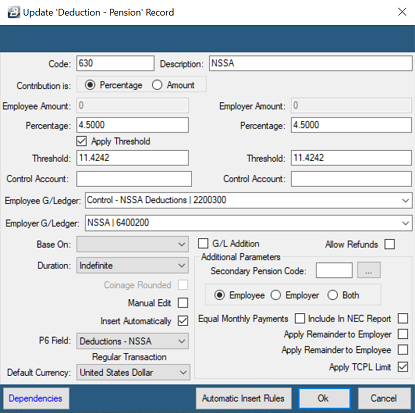

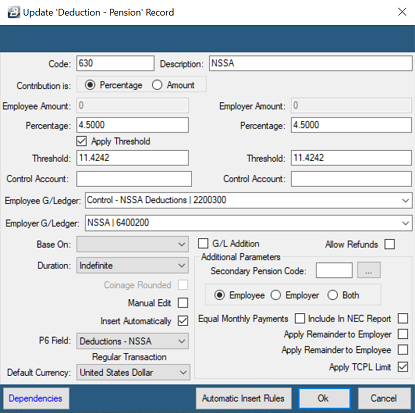

NSSA contributions are set up using the pension transaction code. The NSSA contribution rates effective from 1 June 2021 are 4.5% for both employee and employer. The Insurable Earning ceiling is currently $700 USD effective from June 2024 and the maximum contribution threshold amount is $31.50 for both the employee and the employer.

Note that these amounts are dependent on the Total Consumption Poverty Line (TCPL) for an average of five persons per household and are subject too change every period. In the event that the TCPL figure is not available or has not been published, the last published figure remains applicable. The national TCPL figures are published by Zimbabwe National Statistics Agency (ZIMSTAT) and accessible on https://www.zimstat.co.zw/pdl/. NSSA will in turn publish the monthly insurable earnings applicable for each month by the 1st of each month on the NSSA website (http://www.nssa.org.zw).

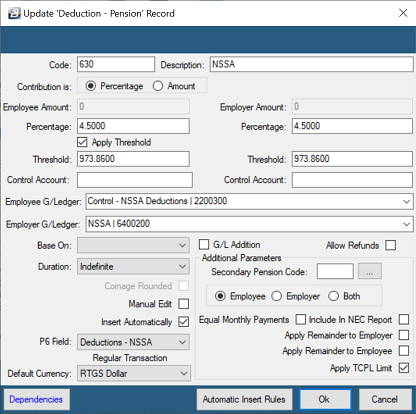

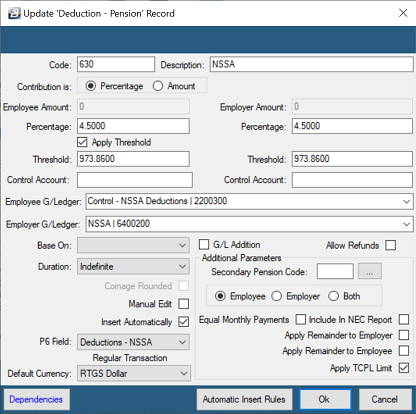

The following is a sample NSSA Transaction Code setup where the thresholds have been applied and Equal Monthly Payments selected.

For payrolls in Zimbabwe Gold, convert the NSSA ceiling to ZiG using the interbank mid-rate for the day you are processing your payroll. For example, using the rate of 26.4025 as at 12 November 2025, the NSSA ceiling becomes 18481.75 (700 x 26.4025) and the Threshold becomes 831.6788 (4.5% x 18481.75) as shown below:

For USD:

Use the 'Automatic Insert Rules' to specifiy that the 'Insert Automatically' only applies to Permanent employees.

To Create a NSSA Transaction Code

Click to play

- Go to the 'Edit' , 'Transaction Codes' menu options.

- Click 'Insert' and select the Transaction Category 'Deduction - Pension' Transaction Code.

- Accept/ Change the default 'Code'. This is a unique identifier for the Transaction Code and the numbers are designed to group similar types of transaction together.

- Enter an appropriate 'Description'.

- Select whether the pension contribution will be a calculated as a percentage of basic or an amount entered.

- Enter the 'Employee Amount' if the payment is a standard amount. If the amount varies leave blank and place a tick against 'Manual Edit' which allows the entry of an amount when processing, or.

- Enter the 'Percentage' to be applied.

- Apply Threshold:

|

A threshold can be applied to limit the maximum contributions of employers and employee when setup as a percentage contribution e.g. percentage up to a specified maximum amount.

|

- Select the 'General Ledger' Code to be entered onto journal reports and exports.

- 'Base On' - If the contribution is being calculated as a percentage of basic, then select whether the amount should be based on basic entered in the Employee Master, Internal Grade Rate or Grade Rate.

- Tick 'G/L Addition' if you would like the Employee and Employer General Ledger contribution amounts to be added together to make one entry

- Set the 'Duration' - whether the transaction is to come through for a 'Single', 'Multiple' or 'Indefinite' number of periods.

- Tick 'Insert Automatically' to have the Transaction Code included automatically on new employee's payslips.

- Set the 'P6 Field' for year end ITF16 export.

- Tick 'Apply TCPL Limit'

- Set the 'Default Currency' that this transaction code will be deducted in.

- Click 'Ok' to save the new Transaction Code..

More:

Adjust the NSSA deduction Threshold during the Calculation Routine

NSSA thresholds should be updated each time NSSA adjusts the threshold amount. These adjustments are published on their website. It is possible to change the Threshold in the 'Threshold' field for the NSSA Transaction Code, shown above. It is also possible to update the NSSA threshold when the Calculation Routine is run when this form displays:

To get the latest NSSA Contribution rates please visit our Belina Website and look for the link under the NSSA Insurable Earnings Update heading

|