Use 'Tax - Deductibles' Transaction Code to process expenses incurred by the employee, outside the payroll, that are tax deductible. Examples include payment of trade and professional subscriptions, purchases of tools and other expenses incurred in order to earn the income that is now being subjected to PAYE.

To create an 'Tax - Deductibles' Transaction Code:

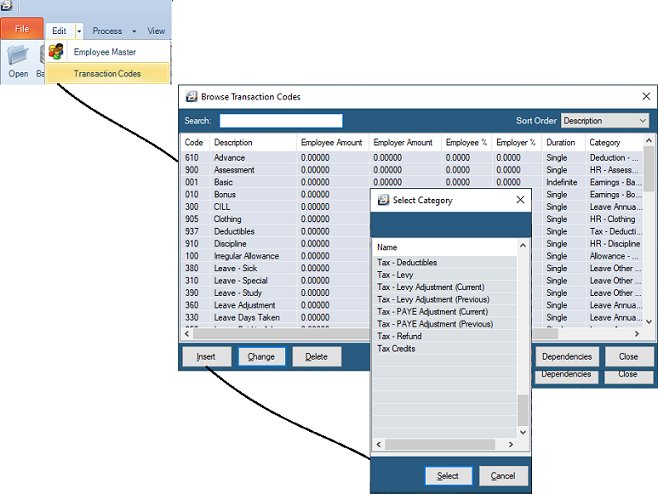

- Go to the 'Edit' , 'Transaction Codes' menu options.

- Click 'Insert' and select the Transaction Category 'Tax - Deductibles'.

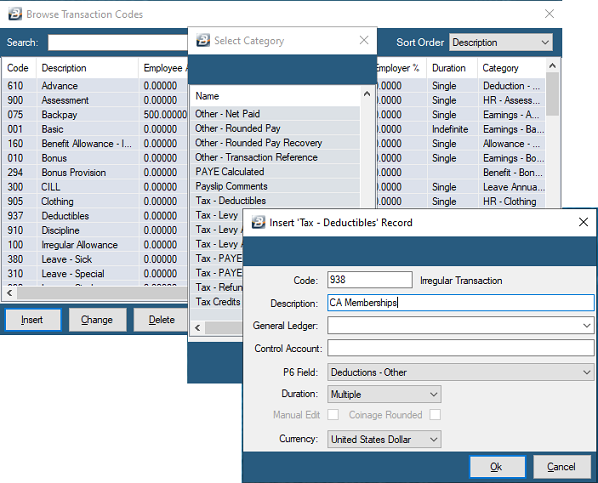

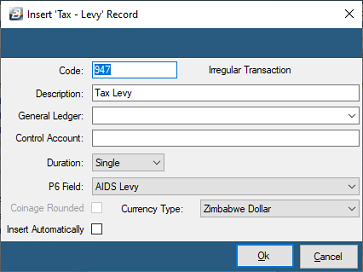

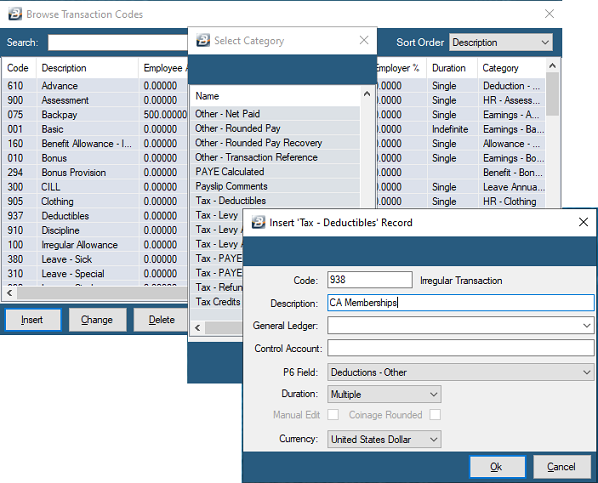

- Accept/ Change the default 'Code'.

- Enter an appropriate 'Description'.

- Select the 'General Ledger' Codes to be entered onto journal reports and exports for the Employee and Employer.

- Set the 'P6 Field' for year end ITF16 export.

- Set the 'Duration' - whether the transaction is to come through for a 'Single', 'Multiple' or 'Indefinite' number of periods.

- Click Ok to save the new Transaction Code.

More:

Tax Deductible - Donations and Contributions Tax Deductible - Donations and Contributions

The following Donations and Contributions are tax Deductible

|

Description

|

Section

|

Limit Per Annum

|

|

Donations to National Scholarship Fund, National Bursary Fund and charitable trusts

|

15(2)(r)

|

None

|

|

Contribution for equipment, construction, extension, maintenance of hospitals and procurement of drugs and equipment.

|

15(2)(r1)

|

US$100 000

|

|

Contributions to a research institution

|

15(2)(r2)

|

US$100 000

|

|

Contribution for equipment, construction/ extension, and maintenance of schools and procurement of books

|

15(2)(r3)

|

US$100 000

|

|

Donations to the Public Private Partnership Fund

|

15(2)(r4)

|

US$50,000

|

|

Donations to the Destitute Homeless Persons Rehabilitation Fund

|

15(2)(r5)

|

US$50,000

|

|

Expenditure on attending Convention or Trade Mission

|

15(2)w(i)

|

Amount incurred for attending not more than one convention or trade mission in any one year of assessment limited to US$2 500

|

|

Contribution to the maintenance of buildings, roads, bridges, sanitation works, water works, public parks, or any other utility amenity or item of infrastructure approved by the Min responsible for local government

|

Sect 15(2)(kk)

|

US$50,000

|

|

|