Employee's may voluntarily pay contributions to a retirement annuity fund outside the payroll. If these amounts are processed in the payroll then the employee will benefit from the tax deduction that is allowed on this type of transaction.

As with medical expenses evidence of the payment would need to be submitted and retained for tax audit purposes.

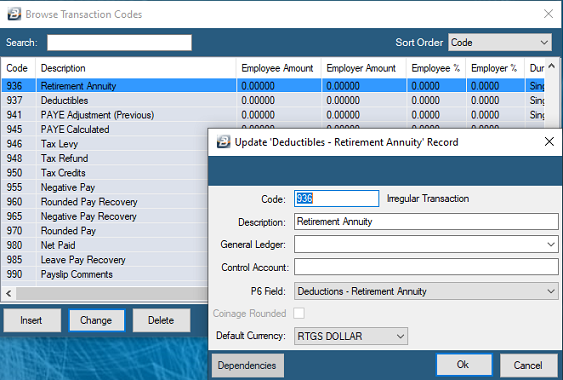

A Deductible Retirement Annuity Transaction Code (936) is automatically created by Belina PayrollHR when a new payroll is created. Use this code to process the transaction using the input method you select, example Payslip Input. The value of the retirement annuity is not included in the calculation of the Net Paid amount but is included in the tax calculation.

To Edit the Retirement Annuity Transaction Code

- Go to the 'Edit', then 'Transaction Codes' menu options

- From the table of existing Transaction Codes, browse down to 'Deductibles - Retirement Annuity'

- Press Enter or 'Change' to make changes to the Transaction Code.