This guide will assist in converting an existing payroll from one currency to another.

Before you begin, please ensure:

•A backup has been taken

•Your payroll in is the period were the changes are to be effective

•If you have running loans in one currency and are converting payroll to another currency, ensure you have processed a loan adjustment to zero out the loan balance and process them anew.

Note: For payrolls that are weekly or fortnightly, ensure that the effective period is the first period of the calendar month.

![]() Converting Payroll from Zimbabwe Gold to USD

Converting Payroll from Zimbabwe Gold to USD

This guide will assist in converting an existing payroll from Zimbabwe Gold to United States Dollar.

Step 1: Setting up a tax split Once an employee is remunerated in full or part in United States Dollar, ZIMRA requires that employees be taxed using the United Stated Dollar (USD) tax table. Setting up a tax split will help to separate periods in your payroll that have the Zimbabwe Gold currency from those that will make use of United States Dollar currency and will make reporting simpler.

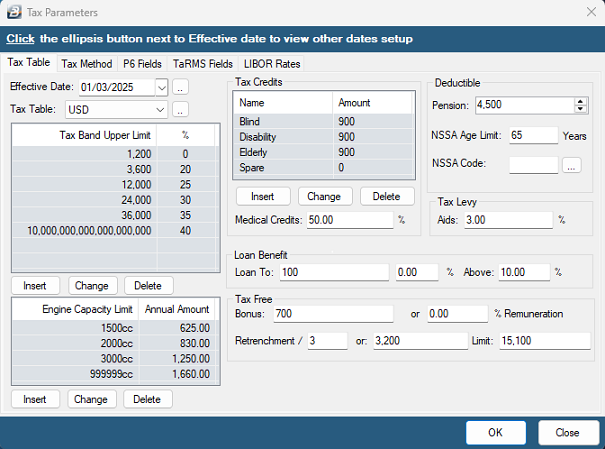

1. Go to Setup > Tax > New 2. Enter the tax bands as shown below:

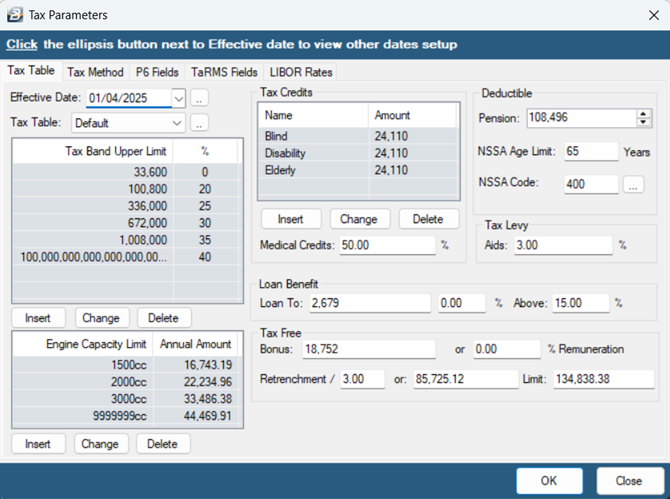

Please take note of the following: •The effective date is the first of the month in which you are starting the setup. The pension deductible is USD $5400 per annum effective 01/01/2025. Prorate the amount based on the number of months left in the year e.g. (5400/12 x remaining months). Following the tax tables below, the payroll is being converted to United states dollar starting in March, hence, the Deductible pension becomes 5400/12 x 10 = 4500. •The Elderly tax credit age lower limit is 55 years. •Select the NSSA code that you use in your Payroll, it can be any code different from 400.

3. Click OK when done to save changes.

Applying the tax tables to employees

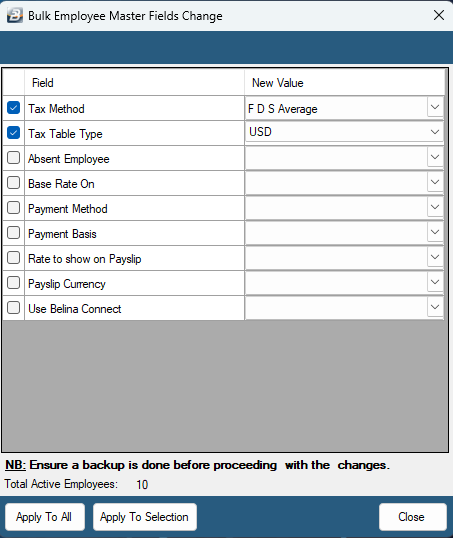

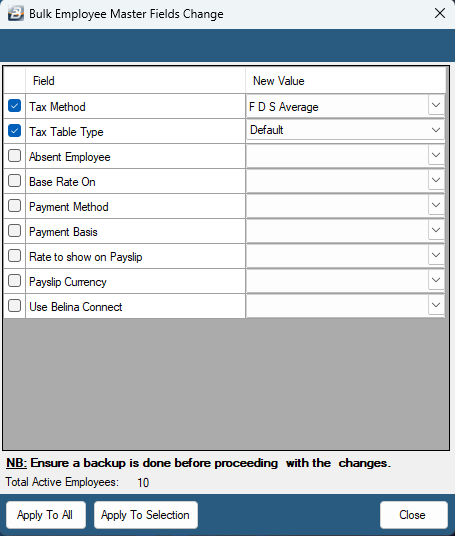

To apply the new tax settings

1. Click on Data > Bulk Routines > Employee Master File Changes 2. Tick the box on 'Tax Method' and select 'FDS Average'. 3. Tick the box on 'Tax Table Type' and select 'USD'

3. Click ‘Apply to all’

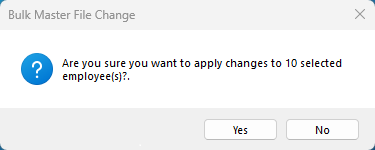

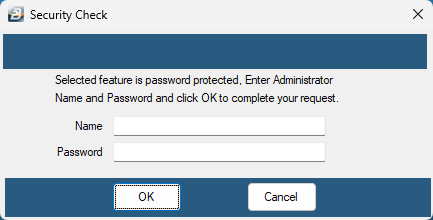

4. Click ‘Yes’ 5. Enter your Administrator's username and password in order to proceed. (Please note that it is case sensitive).

6. Click OK to close

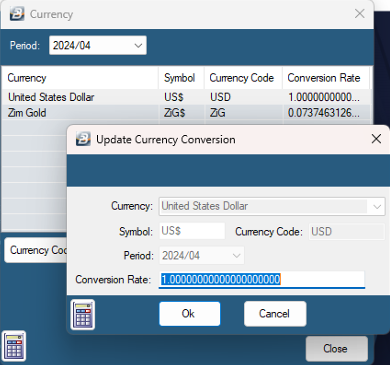

Step 2: Configuring currencies

1. Go to Setup > Currency

2. Click 'Insert' and choose 'United States Dollar' as the currency 3. Enter 1 as the Conversion Rate. 4. Click ‘OK’ then ‘Close’

Step 3: Converting the payroll

The following steps will guide you to bulk change the payroll currency settings from Zimbabwe Gold to United States Dollar. If you would like to apply a conversion rate during your currency conversions follow these Currency Switch steps instead.

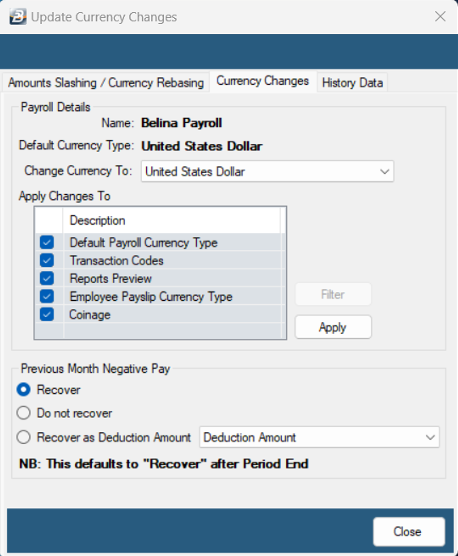

1. Go to Data > Support Menu > Currency Changes 2. Click on the Currency Changes tab 3. Select United States Dollar on 'Change Currency To'

4. Click on ‘Apply’

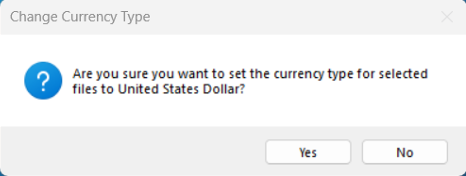

5. Click ‘Yes’ to proceed

6. Click ‘OK’ to close. Step 4: Setting up transaction codes NSSA NSSA will be setup in line with new regulations effective 1 April 2022 For the current NSSA setup instructions see: NSSA in Payroll- Further topics section. |

![]() Converting Payroll from USD/Multicurrency to Zimbabwe Gold

Converting Payroll from USD/Multicurrency to Zimbabwe Gold

This guide will assist in converting an existing payroll from United States Dollar/ Multicurrency to Zimbabwe Gold.

Step 1: Setting up Zimbabwe Gold Tax Table

When an employee is being remunerated solely in Zimbabwe Gold, ZIMRA requires that the employee be taxed using the Zimbabwe Gold (ZiG) tax table. Setting up a tax split will help to separate periods in your payroll that have the United States Dollar currency from those that will make use of Zimbabwe Gold currency and will make reporting simpler.

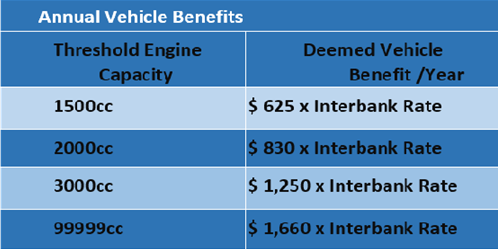

Please take note of the following: 1.Select the NSSA code that you use in your Payroll, it can be any code different from 400. 2.Figures for Vehicle benefit, Tax Credits, Deductible pension, Bonus tax free are denoted in the USD stated values and must be converted each month using the rate of the day you are processing the payroll. The values below have been converted to ZiG using the rate of 26.7891.

The USD values are as follows: •Elderly, Disability and Blind tax credits are $900 each. The elderly credit has an 'Age Lower Limit' of 55 years. •The pension deductible is USD $5400 per annum effective 01/01/2025. The effective date is the first of the month in which you are starting the setup. Prorate the amount based on the number of months left in the year e.g. (5400/12 x remaining months). Following the tax tables below, the payroll is being converted to Zimbabwe Gold starting in April, hence, the Deductible pension becomes 5400/12 x 9 = 4050. •‘Loan to’ box - $100; ‘above’ 15%. •The Tax-Free portion of bonus is $700. •The USD figures for the engine capacity are displayed in the following table. Kindly note these are annual figures and are to be multiplied as they are by the rate as at the day you are processing.

1. Go to Setup > Tax > New 2. Enter the tax bands as shown below:

3. Click on OK when done to save changes.

Step 2: Applying the tax tables to employees

To apply the new tax settings

1.Go to Data > Bulk Routines > Employee Master File Changes 2.Tick the box next to Tax Method and select 'FDS Average'. 3.Tick the box next to 'Tax Table Type' and select 'Default'

3. Click ‘Apply to all’

4. Click ‘Yes’ to continue 5. Enter your Administrator's username and password in order to proceed. (Please note that it is case sensitive).

6. Click OK

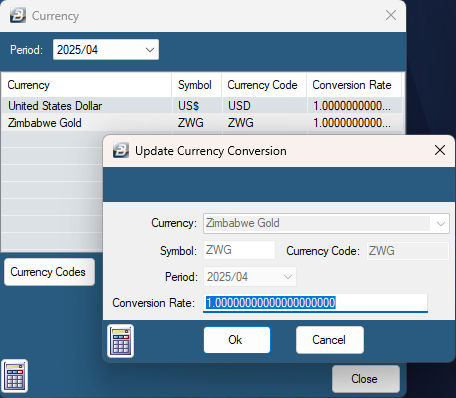

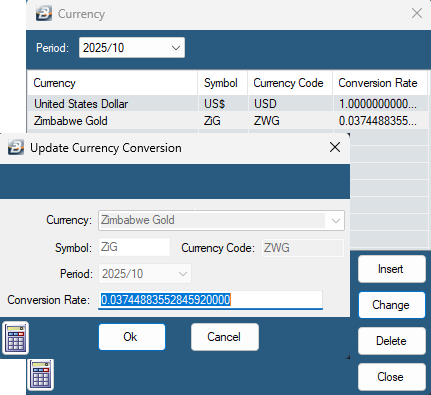

Step 3: Adding Zimbabwe Gold to the system

1.Go to Setup > Currency 2.Click 'Insert' and choose Zimbabwe Gold as the currency 3.Enter 1 as the Conversion Rate.

4.Click ‘OK’ then ‘Close’

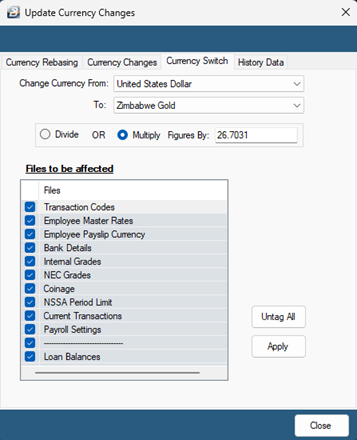

Step 4: Converting the payroll The following steps will guide you to bulk change the payroll currency settings from United States Dollar to Zimbabwe Gold. If you would like to apply a conversion rate during your currency conversions follow these Currency Switch steps instead.

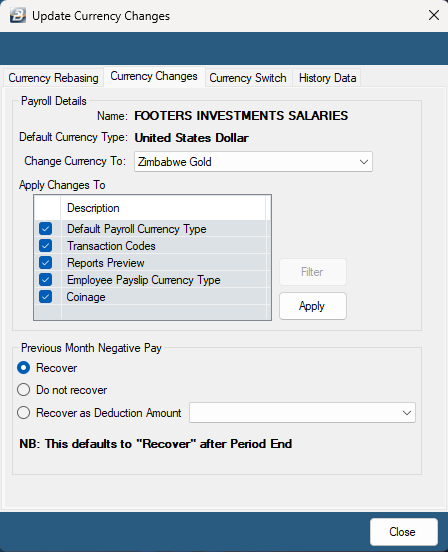

1. Go to Data > Support Menu > Currency Changes 2. Click on the 'Currency Changes' tab 3. Select Zimbabwe Gold on 'Change Currency To'

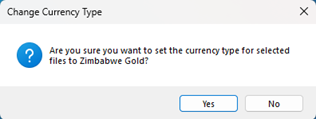

4. Click ‘Apply’

5. Click ‘Yes’ to proceed

6. Click ‘OK’ to close.

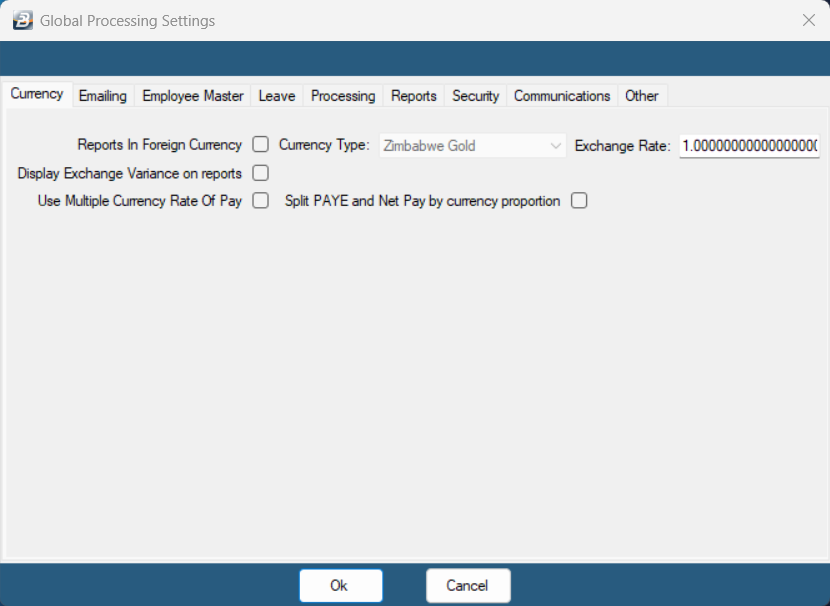

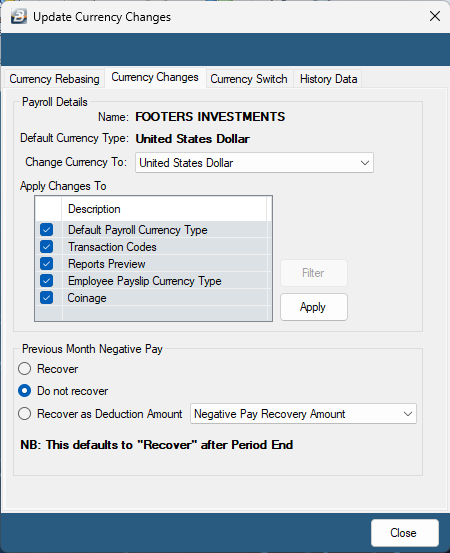

Step 5: Updating Currency Settings

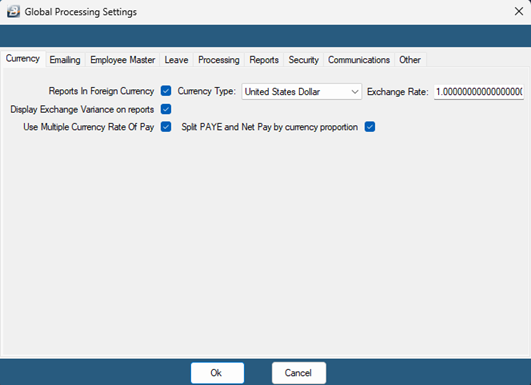

This step applies for payrolls that are converting from Multicurrency. If the payroll was fully in USD, go to the next step. 1. Go to Setup > Global Defaults then select the "Currency" tab.

2.Untag 'Multiple Currency Rate of Pay' and 'Split PAYE and Net Pay by currency proportion'. 3.Click on OK to save changes.

Step 6: Setting up transaction codes NSSA NSSA will be setup in line with new regulations effective 1 April 2022 For the current NSSA setup instructions see: NSSA in Payroll- Further topics section. |

![]() Converting Payroll from USD to Multicurrency

Converting Payroll from USD to Multicurrency

This guide will assist in converting an existing payroll from United States Dollar to Multicurrency.

Step 1: Adding Zimbabwe Gold to the system

1.Go to Setup > Currency 1.Click 'Insert' and choose Zimbabwe Gold as the currency 2.Enter the conversion rate as the figure that you get when you divide 1 by the interbank mid rate on the RBZ website (For example, 1 ÷ 26.7031 = 0.0374488355284592). 3.Click ‘OK’ then ‘Close’

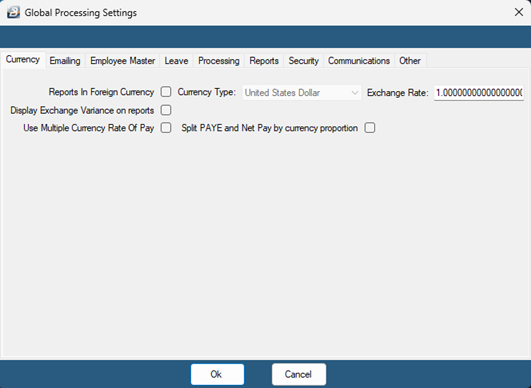

Step 2: Updating Global Currency Settings 1. Go to Setup > Global Defaults > Currency 2. Tick 'Use Multiple Currency Rate of Pay', 'Split PAYE and Net Pay by currency proportion', 'Display Exchange Variance on reports' and 'Reports in Foreign Currency'

3. Click OK to save changes

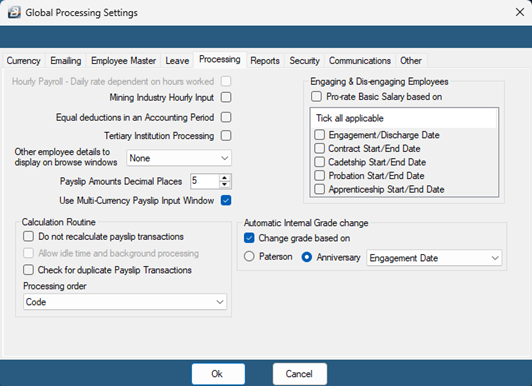

Step 5: Updating Decimal Places 1. Go to Setup > Global Defaults 2. Click the 'Processing' tab 3. Set 'Payslip Amounts Decimal Places' to 5 4. Tick 'Use Multi-currency Payslip input Window'.

5. Click on OK to save changes

Step 6: Setting up ZWG/Multicurrency transactions NSSA will be setup in line with new regulations effective 1 April 2022. Instructions for the current NSSA setup are located under the topic NSSA. For any transaction codes that are dependent on the Basic salary that need to calculate for both USD and ZiG, you must enable the multicurrency split: Go to Edit > Transaction Codes > double click the transaction code and tick 'Multicurrency Split'. If you have any other transaction codes in ZWG for Earnings, Deductions/ Deductibles, Allowances, Benefits and Loans, you may proceed to create them.

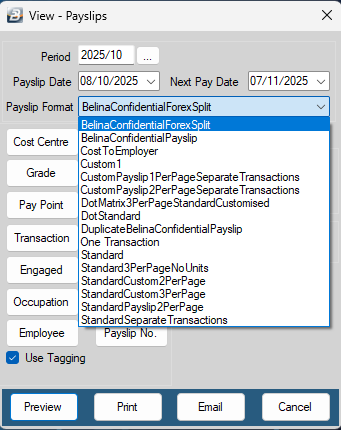

Step 7: Viewing Reports To view Multicurrency reports that show the split in currencies, go to ‘View’ > ‘Multicurrency’. To view payslips, go to: •View > Payslips > Payslip Print •Select 'BelinaConfidentialForexSplit' as the payslip format This format is required to show the multi-currency breakdown.

•Change any parameters as necessary •Click preview |

![]() Converting Payroll from Zimbabwe Gold to Multicurrency

Converting Payroll from Zimbabwe Gold to Multicurrency

This guide will assist in converting an existing payroll from Zimbabwe Gold to Multicurrency. Tax calculations will be based on the USD tax tables and split according to currency proportion. Payslips and reports may be generated in multicurrency. You will not be able to convert back to an entirely Zimbabwe Gold setup within the same tax year.

Step 1: Setting up a tax split

1. Go to Setup > Tax > New 2. Enter the tax bands as shown below:

Please take note of the following: •The effective date is the first of the month in which you are starting the setup. The pension deductible is USD $5400 per annum effective 01/01/2025. Prorate the amount based on the number of months left in the year e.g. (5400/12 x remaining months). Following the tax tables below, the payroll is being converted to Multicurrency starting in March, hence, the Deductible pension becomes 5400/12 x 10 = 4500. •The Elderly tax credit age lower limit is 55 years. •Select the NSSA code that you use in your Payroll, it can be any code different from 400.

3. Click OK when done to save changes.

Applying the tax tables to employees

To apply the new tax settings

1. Click on Data > Bulk Routines > Employee Master File Changes 2. Tick the box on Tax Method and select 'FDS Average'. 3. Tick the box on Tax Table Type and select 'USD'

3. Click ‘Apply to all’

4. Click ‘Yes’ 5. Enter your Administrator's username and password in order to proceed. (Please note that this is case sensitive).

6. Click OK to close

Step 2: Configuring currencies

1. Go to Setup > Currency

2. Click 'Insert' and choose 'United States Dollar' as the currency 3. Enter 1 as the Conversion Rate. 4. Click ‘OK’ 5. Select your existing Zimbabwe Gold currency and click on change 6. Enter the conversion rate as the figure that you get when you divide 1 by the interbank mid rate on the RBZ website (For example, 1 ÷ 26.7031 = 0.0374488355284592).

7. Click ‘OK’ then ‘Close’

Step 3: Converting the payroll

The following steps will guide you to bulk change the payroll default currency settings from Zimbabwe Gold to United States Dollar.

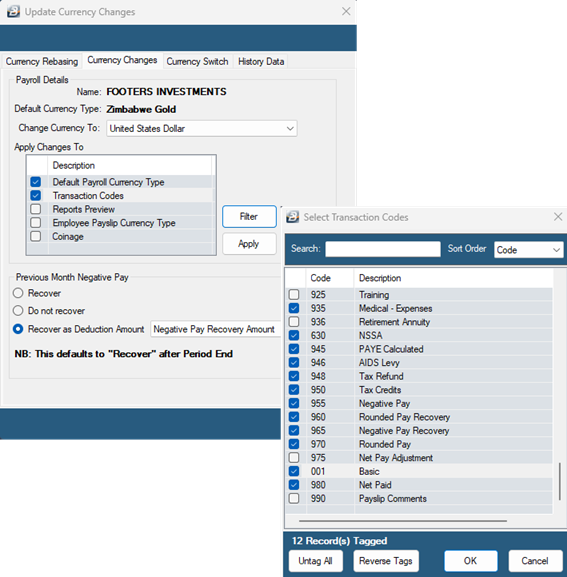

1. Go to Data > Support Menu > Currency Changes 2. Click on the Currency Changes tab 3. Select United States Dollar on 'Change Currency To' 4. On 'Apply Changes To' tag the 'Default Payroll Currency Type' and the 'Transaction codes' 5. Highlight on Transaction codes and click 'Filter' then tag the options as shown in the picture below including Basic, NSSA, PAYE Calculated, Tax Levy, Tax Refund, Negative Pay and Net Paid 6. Click 'OK'

4. Click on ‘Apply’

5. Click ‘Yes’ to proceed

6. Click ‘OK’ to close. Step 4: Updating Global Currency Settings 1. Go to Setup > Global Defaults > Currency 2. Tick 'Use Multiple Currency Rate of Pay', 'Split PAYE and Net Pay by currency proportion', 'Display Exchange Variance on reports' and 'Reports in Foreign Currency'

3. Click OK to save changes

Step 5: Updating Decimal Places 1. Go to Setup > Global Defaults 2. Click the 'Processing' tab 3. Set 'Payslip Amounts Decimal Places' to 5 4. Tick 'Use Multi-currency Payslip input Window'.

5. Click on OK to save changes

Step 6: Setting up USD/Multicurrency transactions NSSA will be setup in line with new regulations effective 1 April 2022. Instructions for the current NSSA setup are located under the topic NSSA. For any transaction codes that are dependent on the Basic salary that need to calculate for both USD and ZiG, you must enable the multicurrency split: Go to Edit > Transaction Codes > double click the transaction code and tick 'Multicurrency Split'. If you have any other transaction codes in USD for Earnings, Deductions/ Deductibles, Allowances, Benefits and Loans, you may proceed to create them.

Step 7: Viewing Reports To view Multicurrency reports that show the split in currencies, go to ‘View’ > ‘Multicurrency’. To view payslips, go to: •View > Payslips > Payslip Print •Select 'BelinaConfidentialForexSplit' as the payslip format This format is required to show the multi-currency breakdown.

•Change any parameters as necessary •Click preview |

![]() Converting Payroll from Multicurrency to USD

Converting Payroll from Multicurrency to USD

This guide will assist in converting an existing payroll from Multicurrency to United States Dollar.

Step 1: Converting the payroll

1. Go to Data > Support Menu > Currency Changes 2. Click on the Currency Changes tab 3. Select United States Dollar on 'Change Currency To'

4. Click ‘Apply’

5. Click ‘Yes’ to proceed

6. Click ‘OK’ to close. Step 2: Updating Global Currency Settings 1. Go to Setup > Global Defaults > Currency 2. Change the 'Currency Type' to United States Dollar' 2. Remove the ticks on 'Use Multiple Currency Rate of Pay', 'Split PAYE and Net Pay by currency proportion' and 'Display Exchange Variance on reports'

3. Click OK to save changes

Step 3: Updating Currency Conversion Settings

1.Go to Setup > Currency 1.Highlight 'Zimbabwe Gold' currency and click Change 2.Enter the conversion rate as 1. 3.Click ‘OK’ then ‘Close’

|