To Create a Benefit Transaction Code (Example: School Fees)

Click to play

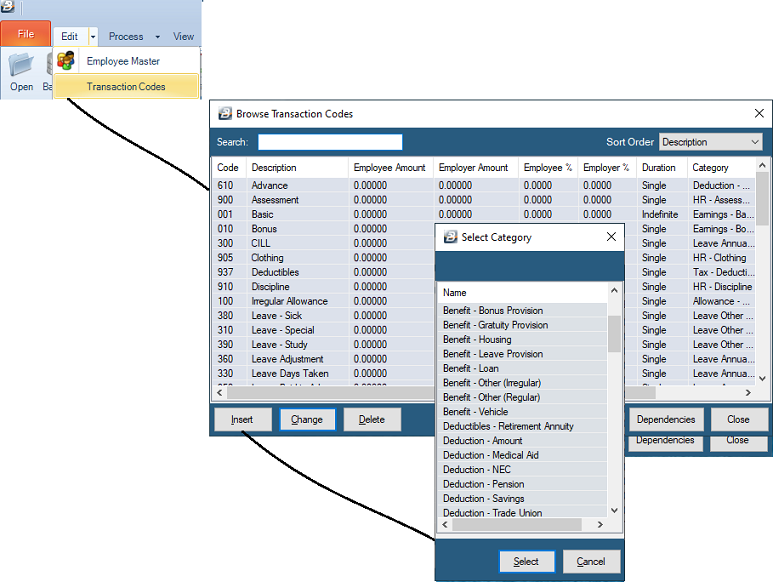

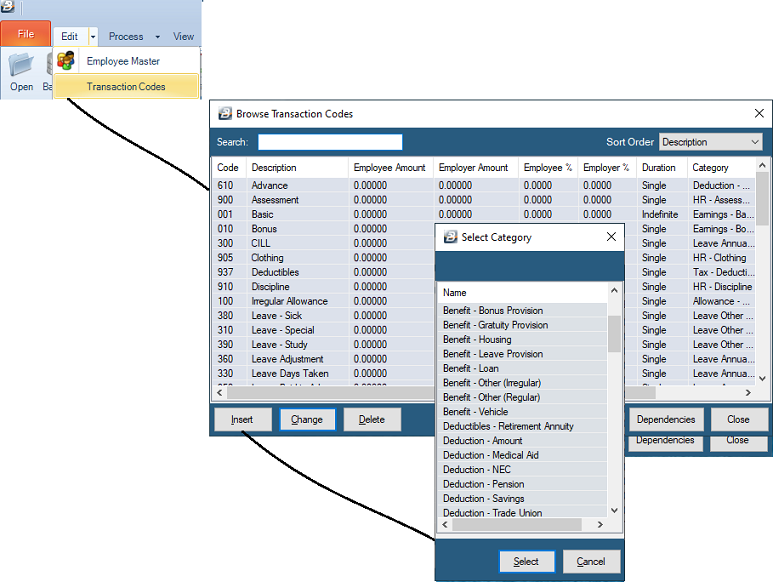

- Go to the 'Edit', then 'Transaction Codes' menu options

- From the table of existing Transaction Codes, press Insert

- A list of Transaction Categories are listed

- Notice that there are 5 different types of Benefit Transaction Categories:

'Benefits' - non cash remuneration given to an employee. Often in the form of motor vehicle useage, housing or loans. The value of the benefit is recorded on the payslip and included in the tax computation. Tax on the benefit, and not the benefit itself, is included in the calculation of Net Pay.

Benefit - Bonus Provision Benefit - Bonus Provision

Use this transaction code where there is a plan to give a bonus at the end of the year and you would like to account for the cost of the bonus on a gradual basis through the year. By creating this code the accounting transactions accrue a balance into the relevant accounts. The transaction does not affect the employee's earnings in the periods it is processed, nor does it affect the taxation calculated and the net pay.

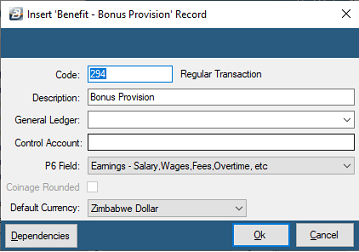

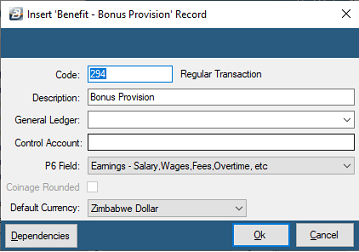

To create a 'Benefit - Bonus Provision' Transaction Code:

- Go to the 'Edit' , 'Transaction Codes' menu options.

- Click 'Insert' and select the Transaction Category 'Benefit - Bonus Provision'.

- Accept/ Change the default 'Code'. This is a unique identifier for the Transaction Code and the numbers are designed to group similar types of transaction together.

- Enter an appropriate 'Description'.

- Select the 'General Ledger' Code to be entered onto journal reports and exports.

- Set the 'P6 Field' for year end ITF16 export.

- Set the 'Default Currency' that this transaction code will be paid in.

- Click 'Ok' to save the new Transaction Code.

Dependencies: This Transaction Code can be based on a percentage, amount or the number of units stated in one or more dependent Transaction Codes.

More:

|

Benefit - Gratuity Provision Benefit - Gratuity Provision

If there is a plan to accrue the cost of gratuities paid for employees that will eventually terminate employment then it is possible to account for the cost of the gratuity bonus on a gradual basis through the year. By creating this code the accounting transactions accrue a balance into the relevant accounts. The transaction does not affect the employee's earnings in the periods it is processed, nor does it affect the taxation calculated and the net pay. Gratuity payments are particularly relevant where contracts are being worked and a gratuity is paid at the termination of the contract.

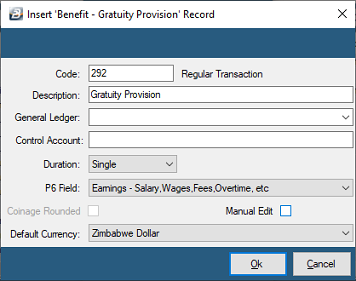

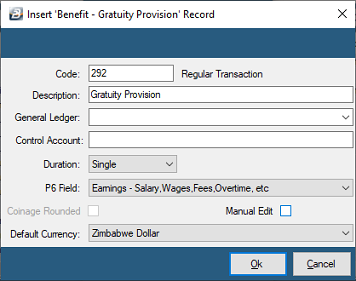

To create a 'Benefit - Gratuity Provision' Transaction Code:

- Go to the 'Edit' , 'Transaction Codes' menu options.

- Click 'Insert' and select the Transaction Category 'Benefit - Gratuity Provision'.

- Accept/ Change the default 'Code'. This is a unique identifier for the Transaction Code and the numbers are designed to group similar types of transaction together.

- Enter an appropriate 'Description'.

- Select the 'General Ledger' Code to be entered onto journal reports and exports.

- Set the 'P6 Field' for year end ITF16 export.

- Set the 'Default Currency' that this transaction code will be paid in.

- Click 'Ok' to save the new Transaction Code.

Dependencies: This Transaction Code can be based on a percentage, amount or the number of units stated in one or more dependent Transaction Codes.

More:

|

Benefit - Housing Benefit - Housing

Enter the value of a housing benefit, or allow 'Manual Edit' to enter the amount during processing.

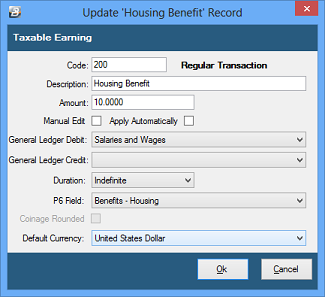

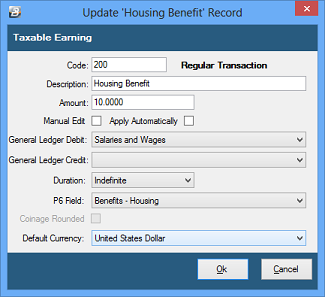

To create a 'Benefit - Housing' Transaction Code:

- Go to the 'Edit' , 'Transaction Codes' menu options.

- Click 'Insert' and select the Transaction Category 'Benefit - Housing'.

- Accept/ Change the default 'Code'. This is a unique identifier for the Transaction Code and the numbers are designed to group similar types of transaction together.

- Enter an appropriate 'Description'.

- Enter the 'Amount' of the value of the benefit. If the amount varies leave blank and place a tick against 'Manual Edit' which allows the entry of an amount when processing.

- Set 'Manual Edit' if you would like to be able to enter, or change, the amount of the Benefit when processing.

- Check 'Insert Automatically' if you would like the Transaction Code to be put on every persons payslip each period.

- Select the 'General Ledger' Code to be entered onto journal reports and exports.

- Set the 'Duration' - whether the transaction is to come through for a 'Single', 'Multiple' or 'Indefinite' number of periods.

- Set the 'P6 Field' for year end ITF16 export.

- Set the 'Default Currency' that this transaction code will be paid in.

- Click 'Ok' to save the new Transaction Code.

The benefit is based on the value to the employee, which is usually the market value of the accommodation. The value could, however, be less where the employee is forced by work circumstances to stay in a house above his/her standard. As a guideline you could use 12.5% of the basic or 7.5% of the market value of the house.

Professional advice from a Human Resources consultant or advice direct from ZIMRA is recommended.

More:

|

Benefit - Loan Benefit - Loan

Use 'Loan - Benefit' to setup a Transaction Code to have the value of a loan benefit calculated automatically for employees receiving loans at low interest rates. The value of a loan benefit is computed Automatically by Belina PayrollHR if the amount of interest charged on a loan is lower than ZIMRA rate setup in under the loan tax parameters.

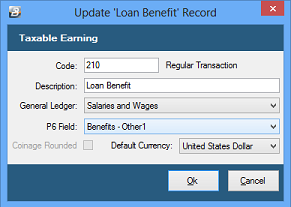

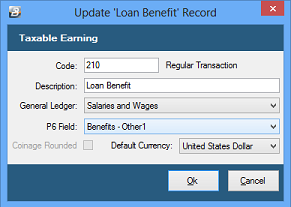

To create an 'Loan - Benefit' Transaction Code:

- Go to the 'Edit' , 'Transaction Codes' menu options.

- Click 'Insert' and select the Transaction Category 'Loan - Benefit'.

- Accept/ Change the default 'Code'. This is a unique identifier for the Transaction Code and the numbers are designed to group similar types of transaction together.

- Enter an appropriate 'Description'.

- Select the 'General Ledger' Code to be entered onto journal reports and exports.

- Set the 'P6 Field' for year end ITF16 export.

- Set the 'Default Currency' that this transaction code will be paid in.

- Click 'Ok' to save the new Transaction Code.

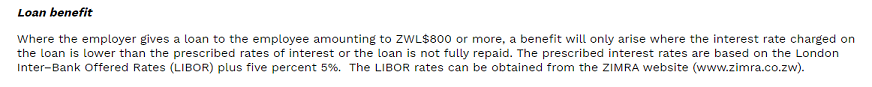

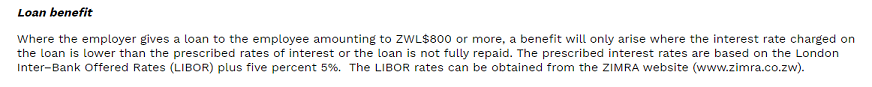

When a loan is given to an employee there is deemed to be a tax benefit if the interest charged on the loan is lower than the rates stipulated by ZIMRA for the size of the loans involved.

INTEREST

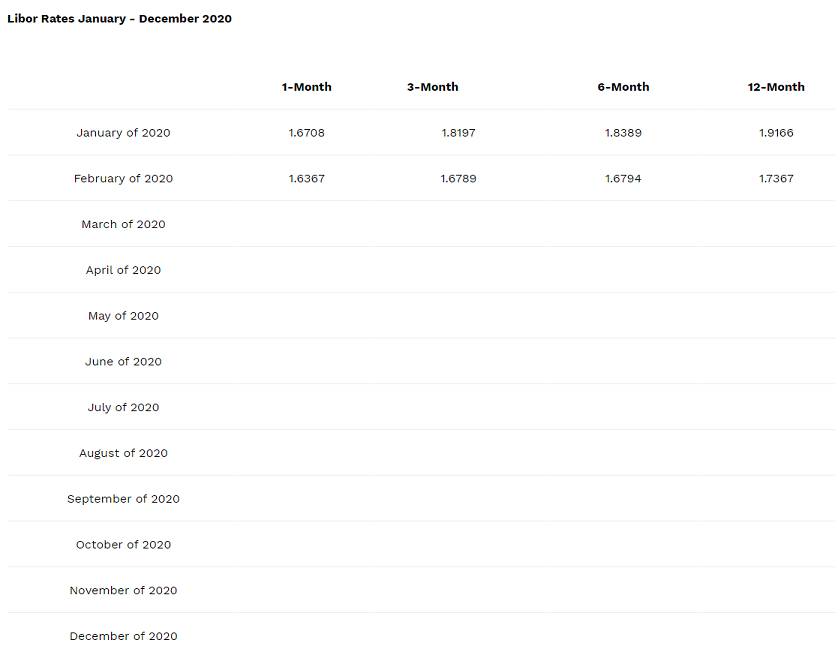

The rate of interest stipulated by ZIMRA is based on the LIBOR rate plus 5%.

When a loan is given to an employee there is deemed to be a tax benefit if the interest charged on the loan is lower than the rates stipulated by ZIMRA for all loans above the prescribed amount set for the tax year. Obtain the amount from ZIMRA, Belina support, or your labour consultant. This is a quotation from the Zimra website in October 2020:

LIBOR (London Inter Bank Offered Rate)

Rates are quoted on the ZIMRA website. In October 2020 these were found at:

https://www.zimra.co.zw/domestic-taxes/london-interbank-offered-rates-libor

More:

|

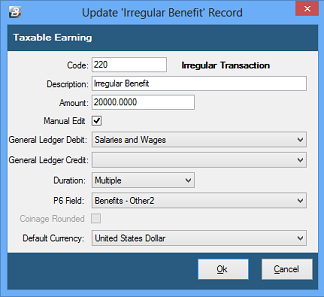

Benefit - Other (Irregular) Benefit - Other (Irregular)

An irregular benefit is one that is, or is anticipated, to be be paid occasionally during year and is added but not projected in the calculation of income for the tax purposes.

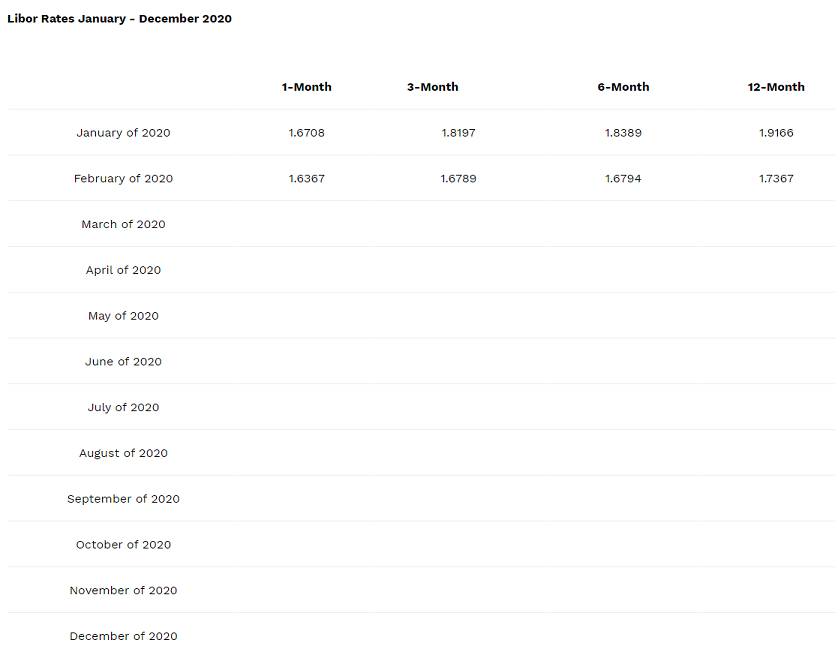

To create an 'Benefit - Other (Irregular)' Transaction Code:

- Go to the 'Edit' , 'Transaction Codes' menu options.

- Click 'Insert' and select the Transaction Category 'Benefit - Other (Irregular)'.

- Accept/ Change the default 'Code'. This is a unique identifier for the Transaction Code and the numbers are designed to group similar types of transaction together.

- Enter an appropriate 'Description'.

- Enter the 'Amount', or value, of the benefit. If the amount varies leave blank and place a tick against 'Manual Edit' which allows the entry of an amount when processing.

- Set 'Manual Edit' if you would like to be able to enter, or change, the amount of the Allowance when processing.

- Select the 'General Ledger' Code to be entered onto journal reports and exports.

- Set the 'Duration' - whether the transaction is to come through for a 'Single', 'Multiple' or 'Indefinite' number of periods.

- Set the 'P6 Field' for year end ITF16 export.

- Set the 'Default Currency' that this transaction code will be paid in.

- Click 'Ok' to save the new Transaction Code.

More:

|

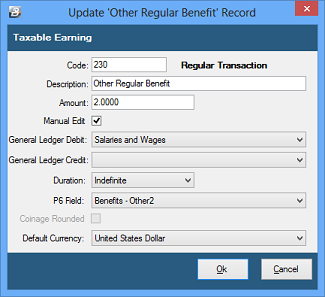

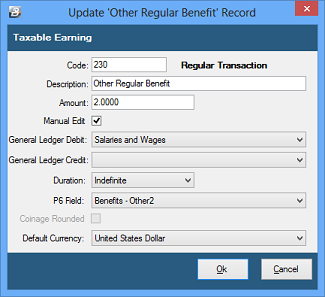

Benefit - Other (Regular) Benefit - Other (Regular)

A regular benefit is one that is, or is anticipated, to be be paid regularly through the year and included in the projection of income for the tax purposes.

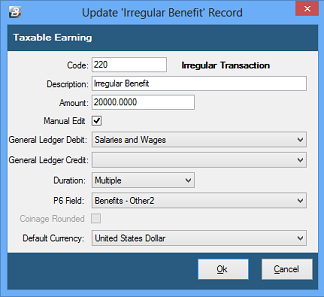

To create an 'Benefit - Other (Regular)' Transaction Code:

- Go to the 'Edit' , 'Transaction Codes' menu options.

- Click 'Insert' and select the Transaction Categoryv 'Benefit - Other (Regular)'.

- Accept/ Change the default 'Code'. This is a unique identifier for the Transaction Code and the numbers are designed to group similar types of transaction together.

- Enter an appropriate 'Description'.

- Enter the 'Amount', or value, of the benefit. If the amount varies leave blank and place a tick against 'Manual Edit' which allows the entry of an amount when processing.

- Set 'Manual Edit' if you would like to be able to enter, or change, the amount of the Allowance when processing.

- Select the 'General Ledger' Code to be entered onto journal reports and exports.

- Set the 'Duration' - whether the transaction is to come through for a 'Single', 'Multiple' or 'Indefinite' number of periods.

- Set the 'P6 Field' for year end ITF16 export.

- Set the 'Default Currency' that this transaction code will be paid in.

- Click 'Ok' to save the new Transaction Code.

More:

|

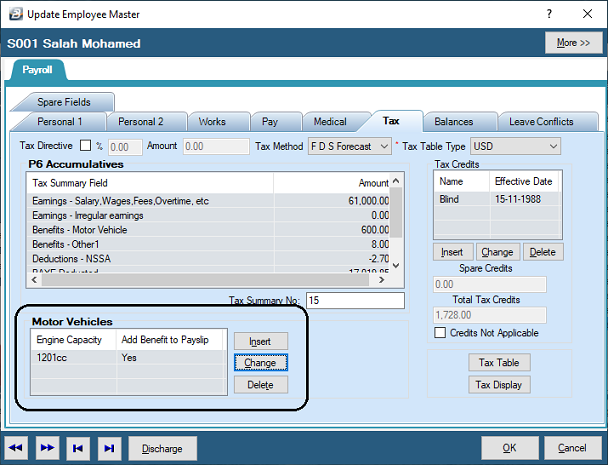

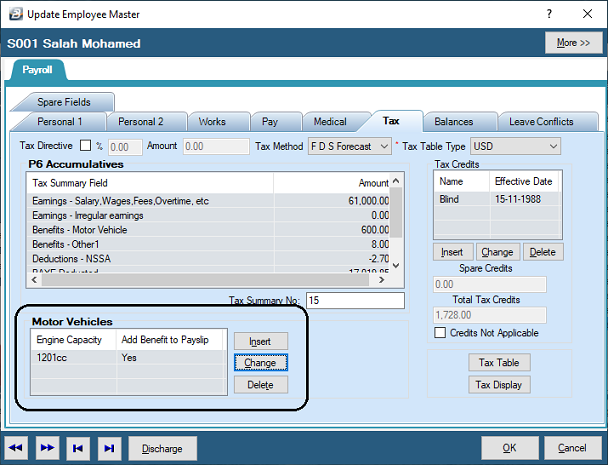

Benefit - Vehicle Benefit - Vehicle

A vehicle benefit is taken as a regular earning. The value of vehicle benefits are stipulated, by vehicle size, in the annual budget that is gazetted each year.

The vehicle benefit can be set up to work with a Vehicle Allowance where an allowance is given to the employee to cover the amount of tax that is payable on the benefit.

To create an 'Benefit - Vehicle' Transaction Code:

- Go to the 'Edit' , 'Transaction Codes' menu options.

- Click 'Insert' and select the Transaction Category 'Benefit - Vehicle'.

- Accept/ Change the default 'Code'. This is a unique identifier for the Transaction Code and the numbers are designed to group similar types of transaction together..

- Enter an appropriate 'Description'.

- Enter the 'Amount' of the vehicle benefit. If the amount varies leave blank and place a tick against 'Manual Edit' which allows the entry of an amount when processing.

- Set 'Manual Edit' if you would like to be able to enter, or change, the amount of the Allowance when processing.

- Check 'Insert Automatically' if you would like the Transaction Code to be put on every persons payslip each period.

- Select the 'General Ledger' Code to be entered onto journal reports and exports.

- Set the 'Duration' - whether the transaction is to come through for a 'Single', 'Multiple' or 'Indefinite' number of periods.

- Set the 'P6 Field' for year end ITF16 export.

- Set the 'Default Currency' that this transaction code will be paid in.

- Click 'Ok' to save the new Transaction Code.

More:

|

|