Belina PayrollHR uses Payroll Periods for each period that is being paid. Once a period has been completed and paid a period end procedure is run to take the payroll into the next period ready for processing. These Payroll Periods are then allocated to Accounting Periods for accounting purposes.

Belina Payroll HR uses 'Periods' in which to store the transactions, separately, for each period. Before processing transactions in a payroll it is important to have the correct number of periods set up for the year. This period information is used by the system to calculate the daily and hourly rates of pay for overtime, shorttime and leave valuations.

How many payroll periods do you need? Before setting up payroll periods consider how many periods are actually required. The standard number of periods are:

A weekly payroll may have a varying number of periods. There may be a 51, 52 or 53 week year depending on the way in which the period end dates fall. The organization may also choose not to process the periods during an annual shutdown which may reduce the total number of periods. If the total number of periods differs from the standard number of periods, stated above, then change the number of periods under 'Payroll Maintenance '. This will ensure that the FDS tax computes properly.

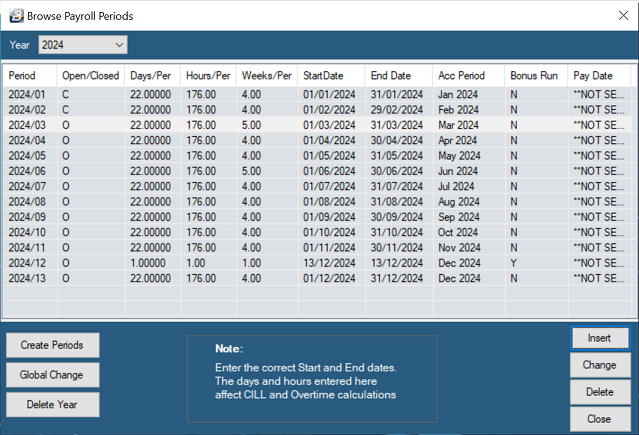

PERIOD TABLE The period table should : - be set up with the correct number of periods for the entire year - have the correct period start and end dates for each period (with no gaps) - have the correct hours and days per period

To set up the Payroll periods:

Click to play

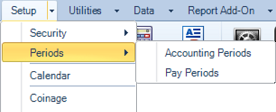

Step 1 Go to the 'Setup', 'Periods', then 'Payroll Periods' menu options Step 2 The system will have automatically created the number of payroll periods that you specified when creating the payroll.

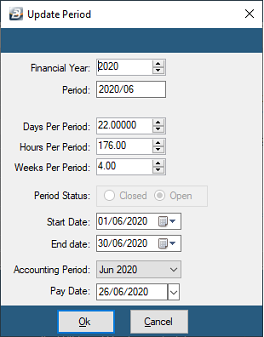

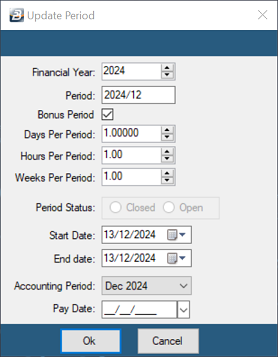

Step 3 Modify the default information, a period at a time by highlighting the entry and pressing 'Enter' or selecting 'Change'. The period information for all the periods can be done in one step by selecting 'Global Change', (see Step 4):

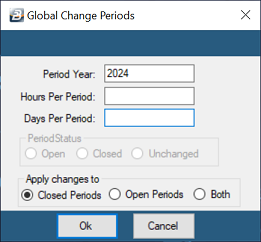

Step 4 To change the default Days and Hours for every period of a year in one step press 'Global Change'

Step 5 To create a 'Bonus Period' to process a separate Bonus Run:

Click to play

TAX YEAR 'The Tax year commences on 1 January and ends on 31 December of each year. The payroll follows the Payroll Period numbers from period 1 each year until the end of the year.. The first period of the year is January in a monthly payroll or the first working week of the year in a wages payroll.

Important : The Start and End Dates should be set up correctly. Only set up the number of periods actually required to pay staff. Period information is central to the proper functioning of the payroll. If in doubt, contact Belina or your authorized dealer.

PERIOD NUMBERS FOLLOW THE TAX YEAR 1 JANUARY TO 31 DECEMBER

IT IS IMPORTANT TO PROCESS TRANSACTIONS INTO THE CORRECT PERIOD |

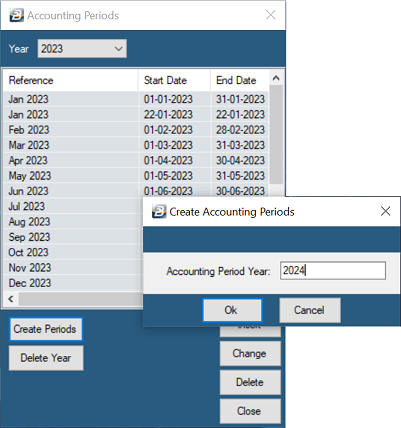

Accounting periods are used to assist in making monthly payments on a weekly payroll and also help with the consolidation of weekly and monthly payrolls. In the case of weekly and fortnightly payrolls where there are 52 and 26 periods respectively but there is usually only 12 accounting periods, one for each month of the year. Belina PayrollHR can allocate payroll periods to the respective accounting period for journal purposes.

To set up the Accounting periods:

ACCOUNTING PERIODS We are then left with having to allocate Pay Periods to the related Accounting Period. |