Membership

Every working Zimbabwean who has attained the age of 16 years and is under the age of 65 years, who is in permanent, seasonal, contract or temporary employment is obligated in terms of Statutory Instrument 393 of 1993 to be a member of the Pension and Other Benefits Scheme. However, domestic employees and those in the informal sector are currently not covered by the scheme.

Contributions

The Pension and Other Benefits Scheme is financed from equal monthly contributions by both employers and employees. It is the employer’s obligation to ensure that contributions are deducted and paid to NSSA. The contribution rate is as follows:

• 4.5% of the insurable earnings (employee)

• 4.5% from the employer

The total of 9% to be paid to the nearest NSSA office before the 1st of each month.

No NSSA contributions should be deducted from employees that are over 65 year old or who turn 65 during the current tax year. The employer will, however, continue to pay APWCS contributions. Belina PayrollHR has been designed to stop deducting contributions in the first period of the year where the employee has already turned 65 years old.

The age limit for NSSA deductions is set up under the 'Setup' ,'Tax' then 'Existing' menu options. Enter 65 under the 'NSSA Age Limit'.

Coverage

The scheme covers:

• All employees working in a profession, trade or occupation who are above the age of 16 and who have not attained the age of 65. Once an employee attains the age of 65, deduction of contributions in respect of the employee should cease even if he/she continues to work.

• Zimbabwean citizens who are either employed in Zimbabwe, or outside Zimbabwe as a continuation of insurable employment in Zimbabwe.

• Persons who are ordinarily resident in Zimbabwe and are either employed in Zimbabwe, or outside Zimbabwe as a continuation of insurable employment in Zimbabwe.

• Civil servants.

Membership to the scheme is compulsory regardless of whether the employee is covered by a private scheme. Workers who are exempted from membership are:

1. Non Zimbabwean citizens who are not ordinarily resident in Zimbabwe

2. Diplomatic staff who are non–Zimbabwean

3. Persons employed as domestic workers

See this link for further information about NSSA setup, download the current NSSA notes on the 'Resources' section of the Belina website Resources - Belina Payroll.

The NSSA contribution rates became effective from 1 June 2021. These have remained effective for some time and are set at 4.5% up to a specified limit, for the employee and employer contributions respectively.

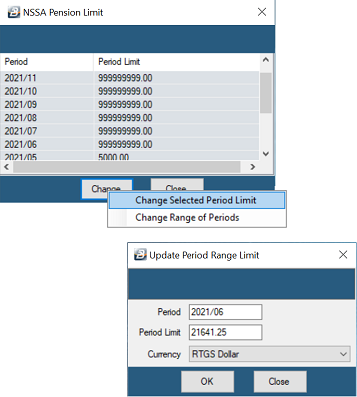

Note that these amounts are dependent on the Total Consumption Poverty Line (TCPL) for an average of five persons per household and are subject to change every period. In the event that the TCPL figure is not available or has not been published, the last published figure remains applicable. NSSA publishes the monthly insurable earnings applicable for each month on the NSSA website http://www.nssa.org.zw. The rates for the current and prior months are to be found on their home page on one of the screens that scrolls. You can also do a search using this link https://www.nssa.org.zw/?s=tcpl or on the NSSA Facebook page. Belina also publishes the figures on their Facebook page.

USD PAYROLLS USD payroll NSSA contributions need to be paid to NSSA in USD (ref Finance Act Section 8 (b) (4) of SI 169).

MULTI-CURRENCY PAYROLLS In a Multi-Currency payroll NSSA considers the basic amount being paid in each currency and will calculate the contribution amounts to be paid in each currency based on the proportion being paid in each. If allowances and benefits are higher than the combined basic amounts then these will be added to basic in the NSSA calculation.

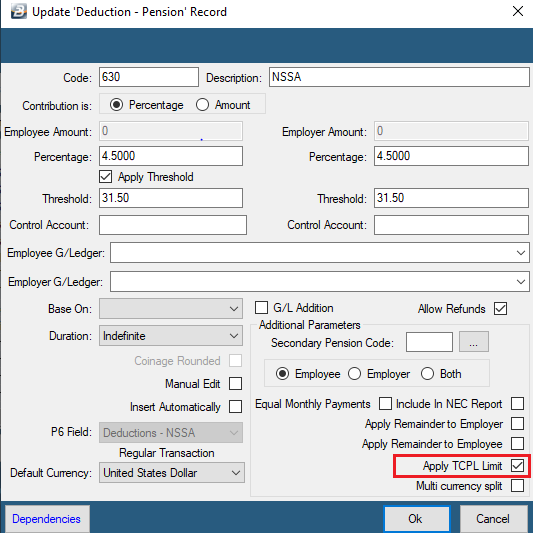

Contribution Percentage and Ceiling To change the contribution Percentage and Ceiling:

•Go to the 'Edit', then 'Transaction Codes' menu options •Select the NSSA code •Change the contribution percentages to 4.5% on Employee and 4.5% on Employer. •Place a tick against 'Apply Threshold' •Enter 'Threshold Amount' as:

•Place a tick against 'Apply TCPL Limit' •Click on 'Ok' to save

Contact your nearest NSSA Office for more information. |

NSSA should, generally, come through automatically for every period for every employee. Below are steps on how to process your NSSA. Please note that in the example below we have used the NSSA Limits effective at first of June 2024. Please use the NSSA limits effective for the period you are in. These can be found on the NSSA Portal.

No NSSA Pop-up on Calculation Routine? For those who do not get the Pop Up on calculation routine please make sure your setup is as below:

- Go to the 'Edit', then 'Transaction Codes' menu options - Select the NSSA Transaction Code - Ensure that there is a tick on 'Apply TCPL Limit', as on the highlighted part of the image below:

Please Note: If you do not have the option in the red box on the image above please do get in touch with us. You will need an Update as it applies a new rule set by NSSA effective March 2021. You can download the update from our website under the Resources menu

Click to play

USD AND MULTICURRENCY PAYROLL

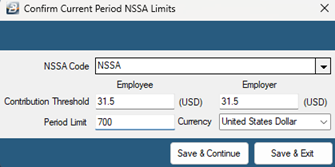

It is possible to enter the 'Contribution Threshold' and the 'Period Limit' for NSSA during the Calculation Routine.

Before running the Calculation Routine make sure that the NSSA currency type has been set to USD. To do this: - Go to the 'Edit', then 'Transaction Codes' menu options - Select the NSSA transaction code and make sure currency type selected is USD.

During the Calculation Routine a NSSA pop-up screen displays, then:

Monthly Payroll If you are running a Monthly payroll, when the pop-up screen displays: - Enter/ accept the 'Contribution Threshold' to USD$31.50 for both the employee and employer. - Enter/ accept the 'Period Limit', the ceiling amount, of USD$700. - Ensure that the 'Currency' is set to USD - Click on 'Save and Continue'.

Weekly Payroll If you are running a Weekly payroll, when the pop-up screen displays: - Enter/ accept the 'Contribution Threshold' of USD 7.875 for a 4 week month, or USD 6.3 for a 5 week month (see *Comment below) for both employee and employer. - Enter/ accept the 'Period Limit' USD 175.00 for a 4 week month, or USD 140.00 for a 5 week month (see *Comment below). - Make sure Period Limit currency is set as USD - Click 'Save and continue' Do the same process for when you enter every new month.

* Comment To check the number of weeks in the month, when the pop-up screen displays: - Go to the 'Setup', 'Periods', then 'Pay Periods' menu options - Look at how many weeks fall into the accounting period you are processing. - Make sure Period Limit currency is set as USD - Click 'Save and continue'.

Bi-Monthly Payroll If you are running a Bi-Monthly Payroll, when the pop-up screen displays: - Enter/ accept the 'Contribution Threshold' of USD 15.75 (USD 31.50/2) for both employee and employer. - Enter/ accept the 'Period Limit of USD 350.00 (USD 700/2) - Make sure Period Limit currency is set as USD - Click 'Save and continue'

Fortnightly Payroll If you are running a fortnightly Payroll, when the pop-up screen displays: - Enter/ accept the 'Contribution Threshold' of USD 15.75 if there are 2 fortnights paid in the month, or USD 10.50 if there are 3 fortnight paid in the month for both employee and employer. - Enter/ accept the 'Period Limit' of USD 350.00 if there are 2 fortnights paid in the month or USD 233.3333 if there are 3 fortnights paid in the month. - Make sure Period Limit currency is set as USD - Click 'Save and continue'

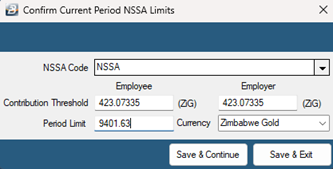

ZiG ONLY PAYROLL

Monthly ZiG Payroll If you are running a Monthly payroll, when the pop-up screen displays: - Enter/ accept the 'Contribution Threshold', the ZiG equivalent of USD$31.50, the USD amount then multiplied by the current interbank Mid-Rate, on the day of processing, for both the employee and employer. - Enter/ accept the 'Period Limit', the ceiling amount, the ZiG equivalent of USD$700, the USD amount then multiplied by the current interbank Mid-Rate, on the day of processing. - Ensure that the 'Currency' is set to USD - Click on 'Save and Continue'.

Weekly ZiG Payroll If you are running a Weekly payroll, when the pop-up screen displays: - Enter/ accept the 'Contribution Threshold' the ZiG equivalent of USD 7.875 (USD 31.5/ 4 for a 4 week month) the USD amount then multiplied by the current interbank Mid-Rate, on the day of processing for both employee and employer, or USD 6.3 (USD 31.5/ 5 for a 5 week month) multiplied by the current interbank Mid-Rate, on the day of processing for both employee and employer. See *Comment below) - Enter/ accept the 'Period Limit' the ZiG equivalent of USD 175.00 (USD 700.00/ 4 for a 4 week month) the USD amount then multiplied by the current interbank Mid-Rate, on the day of processing, or USD 140.00 (USD 700.00/ 5 for a 5 week month) multiplied by the current interbank Mid-Rate, on the day of processing (see *Comment below). - Make sure Period Limit currency is set as ZiG. - Click 'Save and continue' Do the same process for when you enter every new month.

* Comment To check the number of weeks in the month, when the pop-up screen displays: - Go to the 'Setup', 'Periods', then 'Pay Periods' menu options - Look at how many weeks fall into the accounting period you are processing. - Make sure Period Limit currency is set as USD - Click 'Save and continue'.

Bi-Monthly ZiG Payroll If you are running a Bi-Monthly Payroll, when the pop-up screen displays: - Enter/ accept the 'Contribution Threshold' the ZiG equivalent of USD 15.75 (USD 31.50/2) the USD amount then multiplied by the current interbank Mid-Rate for both employee and employer. - Enter/ accept the 'Period Limit the ZiG equivalent of USD 350.00 (USD 700/2) the USD amount then multiplied by the current interbank Mid-Rate - Make sure Period Limit currency is set as ZiG - Click 'Save and continue'

Fortnightly ZiG Payroll If you are running a fortnightly Payroll, when the pop-up screen displays: - Enter/ accept the 'Contribution Threshold' the ZiG equivalentof USD 15.75 (USD 31.50/2) if there are 2 fortnights paid in the month multiplied by the current interbank Mid-Rate, or - Enter/ accept the 'Contribution Threshold' the ZiG equivalentof USD 10.50 (USD 31.50/3) if there are 3 fortnights paid in the month multiplied by the current interbank Mid-Rate for both employee and employer. - Enter/ accept the 'Period Limit' the ZiG equivalent of USD 350.00 (USD 700.00/2 ) if there are 2 fortnights paid in the month multiplied by the current interbank Mid-Rate, or - Enter/ accept the 'Period Limit' the ZiG equivalent of USD 233.3333 (USD 700.00/3) if there are 3 fortnights paid in the month multiplied by the current interbank Mid-Rate. - Make sure Period Limit currency is set as ZiG - Click 'Save and continue' |

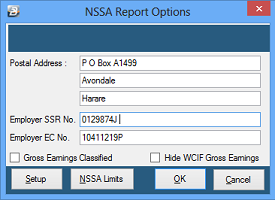

The NSSA report has to be set up in order to display the NSSA and APWCS contributions. It also has to have the total of the total insurable earnings which currently include your basic only.

NOTHING TO PREVIEW If the organization has a number of payrolls that are being consolidated then it would be possible to print the NSSA report from that consolidation payroll. |

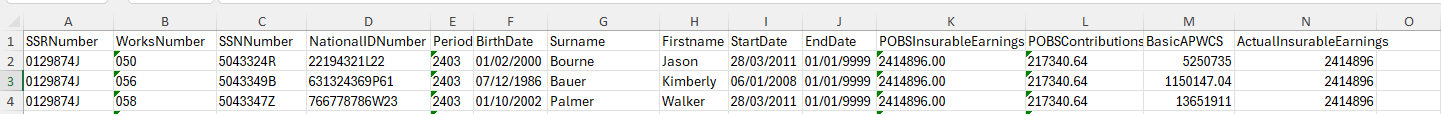

NSSA payroll details in Belina Payroll are produced in the NSSA P4 form format and uploaded to the NSSA portal. The purpose of the NSSA P4 is to ensure that there is a correct apportionment of funds between NSSA POBS contributions and the Accident Prevention and Workers’ Compensation Scheme (APWCS).

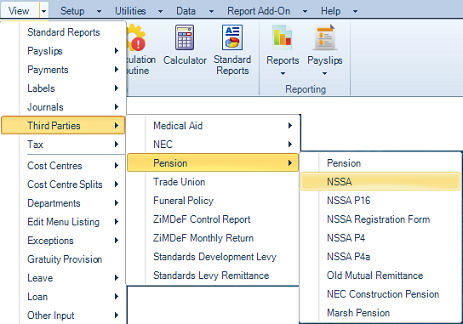

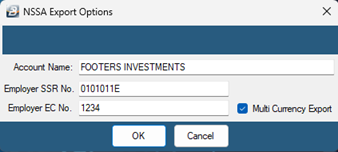

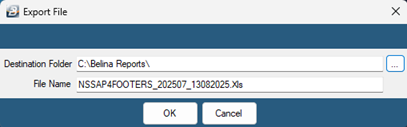

To generate the NSSA P4 form go to: 1.Go to Utilities → Exports → Pensions → NSSA P4. 2.Enter the Account Name, Employer SSR No, and Employer EC No.

Note: For Multicurrency payrolls, tick 'Multi currency Export'. This will generate two NSSA P4 reports: one in USD and another in ZWG, split according to currency proportions. 3.Click 'Ok' to proceed' 4.On the Range Selection window, select the employee(s) you would like to generate the report for. If no employees are selected, the report will be generated for the entire payroll. 5.Click 'Ok' to proceed 6.Specify the Destination Folder where the NSSA P4 file will be saved.

7.Click 'Ok' to proceed and Belina will export the file. 8.Go onto the NSSA portal, browse for the NSSA P4 form generated above and upload it into the NSSA system.

|

Generating a NSSA P4 for Internal Use Sometimes, you may need a P4 report for reference (internal purposes or for NSSA review without formal submission). To generate this NSSA P4: 1.Go to View → Third Parties → Pensions → NSSA P4. 2.Enter the organization’s NSSA details. 3.Generate the report — this version is not for upload but for information purposes only. |

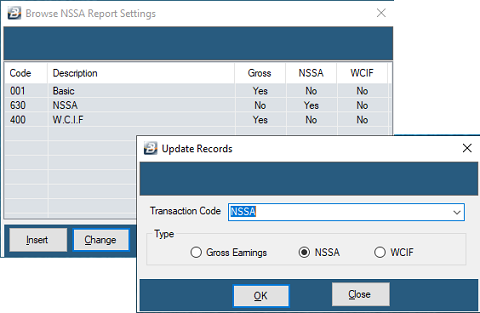

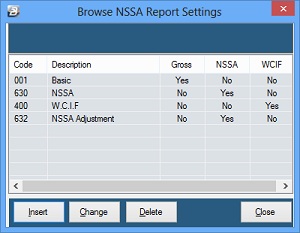

If you have made adjustments to NSSA using a separate NSSA adjustment code then this code may be included on the report. If you setup your NSSA adjustment Transaction Code under the category ‘Deduction - Pension’ then it is a simple matter of setting up that report to take into account the Transaction Code.

Step-by-Step Setup 1.Open the NSSA Report. Go to View → Third Parties → Pension → NSSA. 2.Click the Setup button. 3.Click Insert. 4.From the drop-down list under 'Transaction Code', select the NSSA adjustment transaction code you want to add. 5.Move the radio button to select NSSA as the 'Type'. 6.Click OK to confirm. The setup screen should now list your adjustment code along with other NSSA-related transaction codes.

- Now proceed to print the report which now includes the value of the adjustment |

![]() NSSA in a Multi Currency Environment

NSSA in a Multi Currency Environment

|

Click to play

Note: The NSSA parameters used in this Video Tutorial were those that applied in 2020.

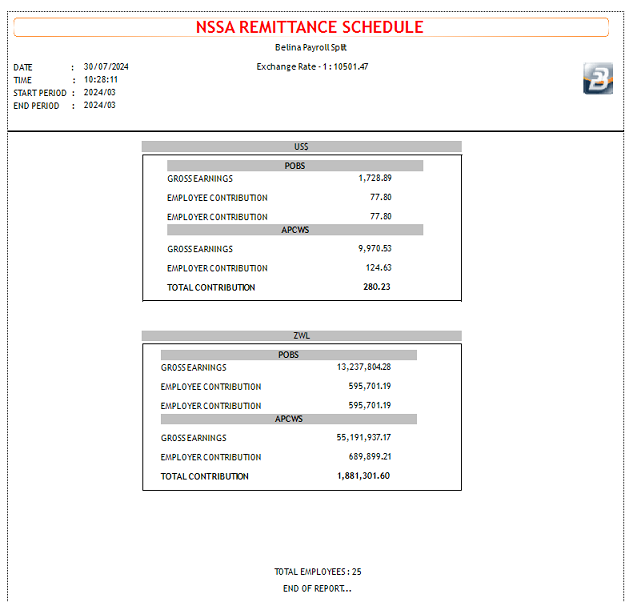

NSSA REMITTANCE SCHEDULE

If you are running a Multicurrency payroll, you are also required to submit your proof of payments with a NSSA Remittance Schedule report. This report is useful for NSSA because it will have a breakdown of the contributions in both currencies and the interbank rate used at the day of processing.

To generate the Remittance Schedule: 1.Go to View → Multicurrency 2.Select Third Parties → NSSA Remittance Schedule 3.Click Preview to generate the report. The report will be created for submission alongside your proof of payments.

|