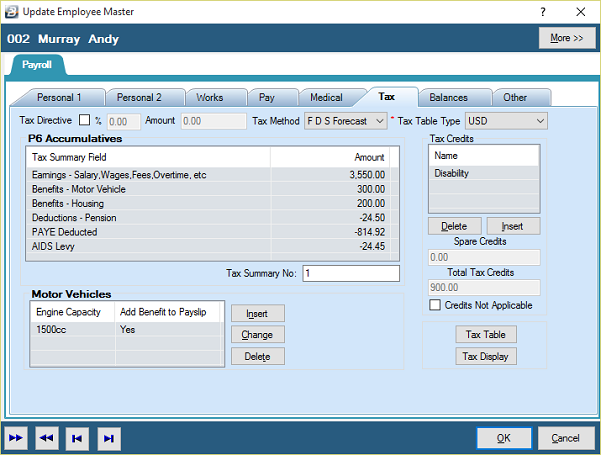

PAYE

This method is only used in circumstances where the FDS Method cannot be used. This applies to all new employees that join the organization during the course of the year or any employee that have been suspended during the year.

The 'traditional' method of computing PAYE uses payroll information from the current period, only, to estimate the total income for the year. The annual tax is calculated on this amount and divided back to give the tax payable the current period. Any irregular income, or loss of income, can easily distort the result and there is no way of balancing the amount over, or under, deducted until an assessment is made by ZIMRA and an adjustment processed.

The 'PAYE' method assumes that the income earned in the current period is the same as that earned in every period of the tax year. This generally means that employees are overtaxed during the year especially where there are irregular earnings involved e.g. overtime. This will result in over taxation which ZIMRA will refund after having made their assessment.

At the end of the year a P6 form will need to be printed for that individual. The employee should submit a tax return for assessment. When a year end procedure is done Belina PayrollHR will automatically convert the tax method for these new employees to 'FDS'.

|