An employee is suspended when an employee does not work for a specified period. There is an option to have the person suspended with or without transactions being processed on their payslip during the period of the suspension.Marking an employee 'Absent' works in the same manner as if the employee is 'Suspended'.

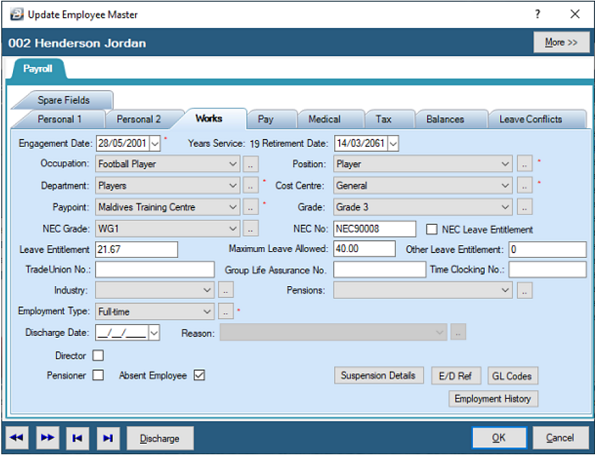

To mark an employee 'Absent' or suspended:

- Go the 'Edit', then 'Employee Master' menu options

- Select the employee from the table

- Select the 'Works' tab

- Place a tick against 'Absent Employee'.

This will remove transactions in the Payslip Input and no processing will be done for that employee. When the employee returns to work then removing the tick will put the transactions back onto the Payslip Input.

Tax Implications

If the employee misses a pay period then on the person's return they should not have their tax calculated using the FDS method and should be put on PAYE.

Pay adjustments would have to be processed in the new period to take into account amounts that may be due. Use a Earnings - Amount irregular income category

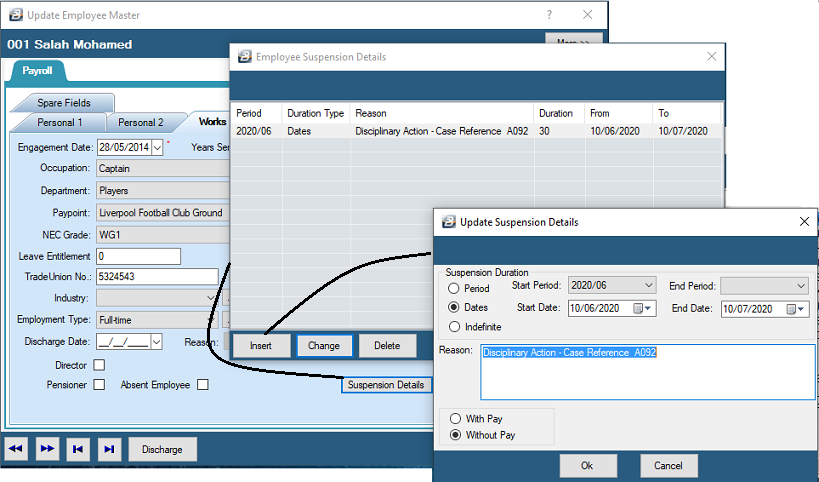

'Suspension Details' Button

Suspension details can be added, including the start and end dates or periods of the suspension, or whether the suspension is indefinite. It is also possible to enter a 'Reason' to explain the reason for the suspension.

Suspension at full pay

In the case of a suspension it may be decided to suspend the employee with full pay so that the transactions will not need to be re-captured when the suspension is lifted. The case could also be that the person is still to receive pay during the period of the suspension. If you want to process the transactions but do not want the actual payment to be made whilst the suspension is active then suspend payments to the employee's bank account.