Apply Threshold

When setting up a Transaction Code the deduction, or Employer Contribution can be set to be calculated as a percentage. If this option is selected the amount deducted can be limited to a specific maximum amount, a 'Threshold'. Tick the 'Apply Threshold' check-box to enable the 'Threshold' fields in which the maximum deduction or contribution is entered.

Automatic

Tick to have this Transaction Code come through automatically onto the payslip of a new employee.

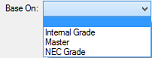

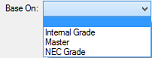

Base On

Some Transaction Codes are based on the Basic pay for the employee. This amount could be entered into each employee's masterfile or it could be the amount being paid for that grade as determined by an Internal grading system or NEC grade.

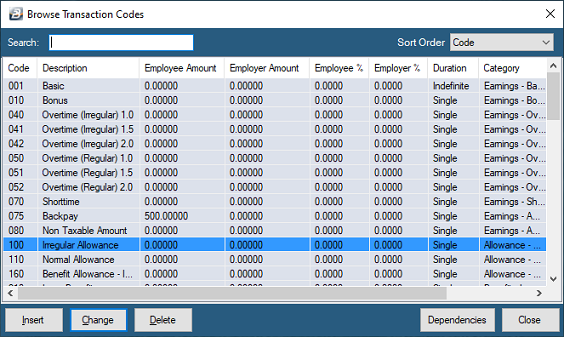

Clear Value

This check-box is used in the setup of Loan Transaction Codes to indicate that the next repayment amount will be entered manually in the next period. The system will automatically readjust the repayment amount and recompute the interest charged. The number periods of the loan is not adjusted.

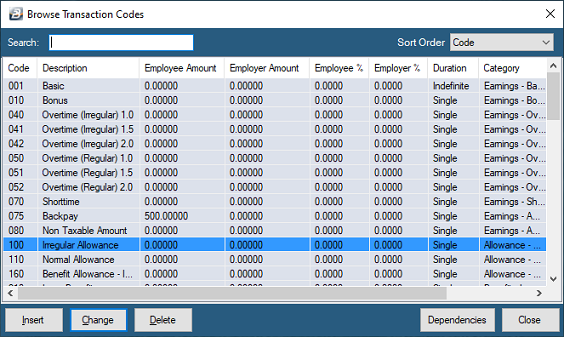

Code

When a new Transaction Code is Created Belina PayrollHR allocates a default Transaction Code, grouping the Transaction Codes in an order suited for payslip printing. Transaction Codes are presented on the payslip in Transaction Code order. Employees are generally more interested to see their earnings, so the Earnings Transaction Codes are put at the top of the list followed by Allowances, then Deductions. The Transaction Code sequence 900 onwards are mostly reserved for standard Belina PayrollHR Reserved Transaction Codes.

Coinage Rounded

Have the amount calculated for the Transaction Code rounded to the lowest denomination that has been setup in the Coinage Table.

Description

The 'Description' of the Transaction Code comes up on the payslips and is used in reports. It is important that the description is therefore clear for all users of payroll information to understand.

Default Currency

The Default Currency is usually set-up when the payroll is initially created. Belina PayrollHR has been designed to accommodate multiple currencies. This is particularly useful for international organizations that pay their local staff in one currency and their other staff in another. Select the default currency to be applied. In Zimbabwe it would be the US Dollar.

Dependencies

It is possible to have one Transaction Code depend on the value of one or more other Transaction Codes, these are set up as 'Dependencies'.

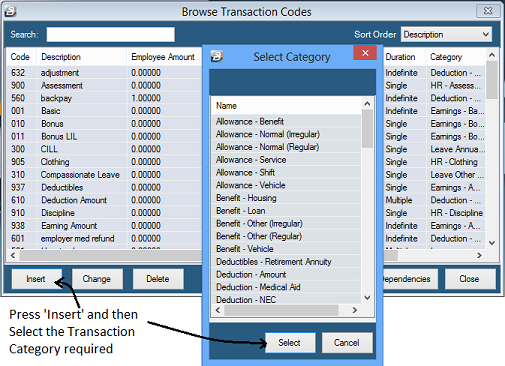

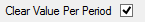

To set up Dependencies:

Step 1

|

Create the first Transaction Code (if it has not already been created)

|

Step 2

|

Create the Transaction Codes on which the the first Transaction Code is dependent (if they have not already been created)

|

Step 3

|

Edit the first Transaction Code. Notice that there is a 'Dependencies' button at the bottom of the form which was not present when the Code was first created. Press this button

|

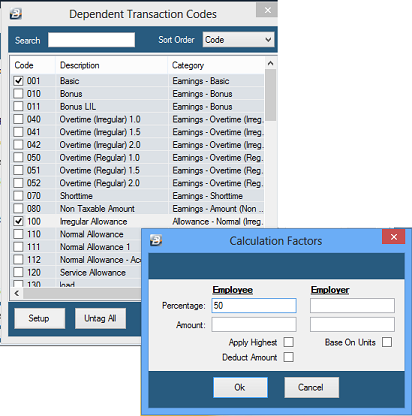

Step 4

|

Tick the dependent Transaction Codes. In the example, below, only one Transaction Code has been ticked.

|

Percentage

|

takes a percentage of the value of that Transaction Code

|

Amount

|

takes the specified amount into account in the transaction

|

Apply Highest

|

takes whichever amount is higher, that amount calculated under 'Percentage' or the 'Amount' entered.

|

Reverse Sign

|

If the dependent Transaction Code is a deduction it has a negative sign. To add the value to the list of dependent Transaction Codes you may need to reverse the sign.

|

Base on Units

|

You may wish to pick up the units rather than the value of a Transaction Code e.g. you may pay a danger allowance dependent on the number of hours worked on that Transaction Code.

|

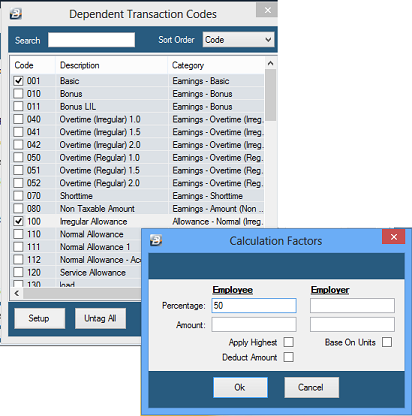

One way of determining whether a Transaction Code has been set up with dependent Transaction Codes is to click on the Transaction Code and observe the colour of the word 'Dependencies'. If the word is in blue there are dependent Transaction Codes, if the word is in black there are none, as illustrated below:

Another way of determining whether there are dependent earning codes entered against Transaction Codes is to simply move up or down the Transaction Code table highlighting each of the rows. At the bottom of the screen you will see the word 'Dependencies' being displayed in one of three ways, as follows:

Blue

|

there are dependent Transactions Codes set up against this Transaction Code

|

Black

|

there are no dependent Transaction Codes set up against this Transaction Code

|

Dependencies can be set up on the following Transaction Types:

•

|

Allowance - Normal (Irregular)

|

•

|

Allowance - Normal (Regular)

|

•

|

Earnings - Overtime (Regular)

|

•

|

Earnings - Overtime (Irregular)

|

•

|

Deduction - Trade Union

|

Another way to access the 'Dependencies' button is from the Transactions Codes Table. Simply highlight the Transaction Code and select the 'Dependencies' button in the bottom right hand corner of the table. This button is only active for selected Transaction Codes, discussed above.

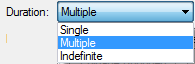

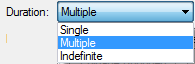

Duration

Many of the Transaction Codes can be set-up to come through onto the Payslip Input once, or once every period for a range of periods.

Single

|

select 'Single' to have the transaction processed once in the current period only

|

Multiple

|

select 'Multiple' for the transaction to come through once in each of the periods selected in the range of periods

|

Indefinite

|

select 'Indefinite' for the transaction to come through automatically each period until further notice

|

Equal Monthly Payments

Monthly contributions on a weekly payroll can be handled in two ways:

Average

|

Manually compute an average amount to be contributed every week (Monthly contribution multiplied by 12, to get the annual contribution, divided by 52 weeks to get the average weekly contribution. This will mean that employees will pay the same amount per week but the monthly contribution may vary depending of whether there are 4 or 5 weeks in the month. NSSA accept this method of deduction since by the end of the year the contributions balance out.

|

Equal monthly

|

Tick 'Equal Monthly Payments' on the set up of Medical Aid and Pension Transactions Types. This will divide the monthly Payments contribution by the number of weeks in the period. Employees will, therefore, have the same amount being deducted for each week of the month but this may vary from month to month depending on if there are 4 or 5 weeks in the month. The advantage is that at the end of the month the total deducted from the employee will exactly correspond with the amount that should have been deducted for the month.

|

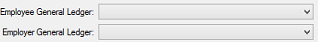

General Ledger

When setting up Transaction Codes use the drop down look-up to select the General Ledger Code to be applied. This will then come through on Journal reports and exports. In some instances it is necessary to set up the General Ledger Code for both the employee deduction and the employer contribution e.g. NSSA and Medical Aid.

GL Addition

Tick this Check Box on the setup of a Transaction code where the employee and employer contributions should be added together to export the combined amount in the accounting journal.

Insert Automatically

Warning:

Transactions that have been set to 'Insert Automatically' will come through onto the new employees Payslip Input automatically. If you do not want this to happen turn off the 'Insert Automatically'. It is not sufficient to delete the transaction on the Payslip Input because when a Calculation Routine is run it will come back again. To prevent this go to to the Edit menu and remove the 'Insert Automatically' tick until processing for that period is complete. It can then be re-inserted before engaging new employees in the next period.

There some transaction codes where the rules applying to 'Insert Automatically can be refined, these are for:

- Basic Note: 'Insert Automatically' rules can be refined for Basic. In this case you can specify that the 'Insert Automatically' only applies to Permanent employees.

- NSSA Note: 'Insert Automatically' rules can be refined for NSSA. In this case you can specify that the 'Insert Automatically' only applies to Permanent employees

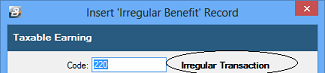

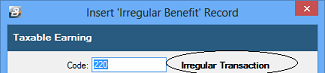

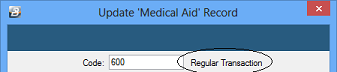

Transaction Code

Irregular Transaction

An Irregular Transaction is one that is unlikely to be processed regularly on an employee's payslip and should, therefore, not be included in the projection of income for FDS tax calculations.

Manual Edit

To be able to change amounts that have have come through on a Transaction Code tick against 'Manual Edit'.

P6 Field

When a Transaction Code is created a default P6 field is allocated by Belina PayrollHR. If necessary change this default to the correct P6 field to be applied.

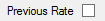

Previous Rate

Belina PayrollHR allows the processing of overtime and shorttime at the last rate of pay that previously applied before the entry of the latest rate of pay in the Employee Masterfile.

Rate

Enter the rate at which the deduction of shorttime is to be effected e.g. at normal time (x1) or overtime (x1.5 or x2.0)

When processing leave, overtime and shorttime Belina PayrollHR gives the option of processing amounts in either hours or days:

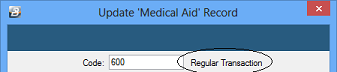

Regular Transaction

A Regular Transaction is one that is likely to be processed regularly on an employee's payslip and should, therefore, be included in the projection of income for FDS tax calculations.

Reserved Transaction Codes

As Belina PayrollHR does the Calculation Routine it automatically generates Transaction Codes that are required to present certain standard transaction amounts, these include:

945

|

PAYE Calculated

|

946

|

Tax Levy

|

950

|

Tax Credits

|

955

|

Negative Pay

|

965

|

Negative Pay Recovery

|

975

|

Rounded Pay Recovery

|

970

|

Rounded Pay

|

980

|

Net Paid

|

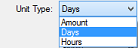

Unit Type:

A choice is given in the way in which Overtime and Shorttime is processed. It may be processed in:

Days

|

Enter the number of days of overtime/ shorttime. Belina PayrollHR will calculate the value of the number of days with reference to the Rate entered and the Rate of Pay of the individual.

|

Hours

|

Enter the number of hours of overtime/ shorttime. Belina PayrollHR will calculate the value of the number of hours with reference to the Rate entered and the Rate of Pay of the individual.

|

Amount

|

Enter the value of the overtime/ shorttime taken.

|

|