Belina PayrollHR should be set, as default, to pay in ZiG Dollars (ZWL). Where there is more than one currency then this default must be changed to USD.

2 Currencies Maximum

The multi-currency functionality in Belina PayrollHR allows the processing of transactions in a maximum of two currencies.

Default currency

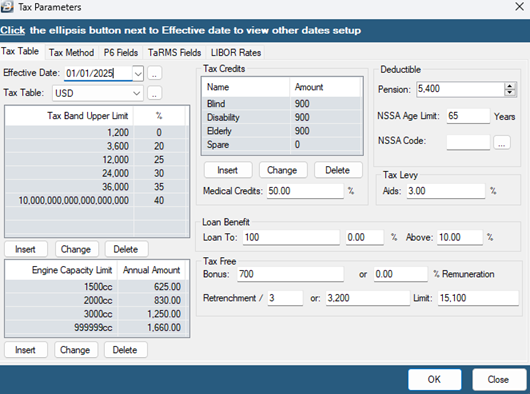

The Default currency of a multi-currency payroll should be USD. The tax tables used in the tax computations will be USD as well. All income is converted to USD for tax purposes using the exchange rates that have been entered into the system.

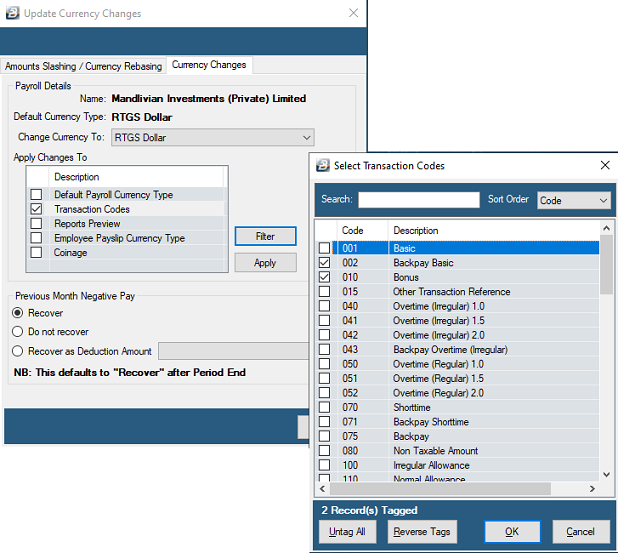

USD Transaction Codes

The following Transaction Codes in a multi-currency payroll should be in USD

•Basic

•Tax Credits (Blind, Disabled and Elderly and Medical credits are gazetted in USD and included in the tax parameters in that denomination.

•Vehicle Benefits (gazetted in USD and included in the tax parameters in that denomination).

•Vehicle Benefit Allowance, if any

•Any other amount that you would like denominated in USD

•PAYE and Tax Levy

Currency offset when Negative Pay

in a multi-currency payroll when there is a Negative Pay amount incurred in one currency in a period then the earnings from the other currency will be applied to the negative amount in the first. Any continuing shortfall will be carried forward as Negative Pay.

![]() Create Single Currency Payroll - RTGS

Create Single Currency Payroll - RTGS

Create the Payroll selecting ZiG Dollar as the Default Currency. |

![]() Create Single Currency Payroll - USD

Create Single Currency Payroll - USD

Create the Payroll selecting USD as the Default Currency.

There are a number of considerations that need to be addressed, including: •NSSA which by law has to be deducted in ZiG Dollars (ZWL) because the NSSA thresholds are set in ZiG Dollars. The amount deducted from the employee and the amount paid to NSSA can, however, be converted and paid in USD. The currency is set when creating the NSSA Transaction Code. •The currency exchange rate between USD and ZWL would be need to be set each period. |

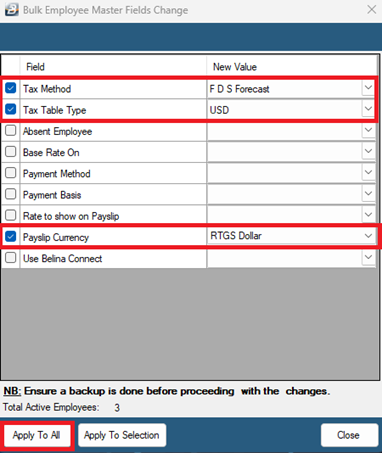

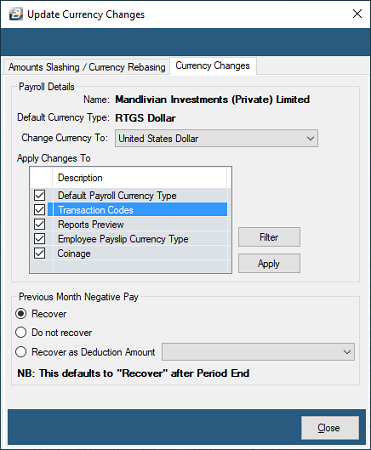

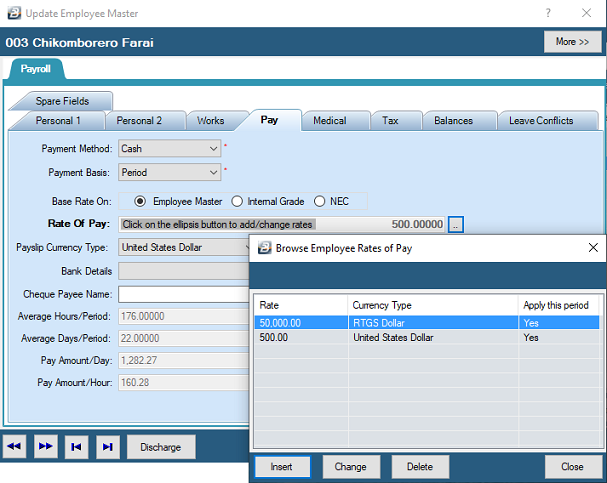

Setting up a Multi-Currency Payroll from Scratch •Create the Payroll with USD set as the Default Currency •Insert the additional Currency, selecting it from the defaults available, and set Exchange rate. •Setup the USD Tax parameters under 'Setup' and 'Tax' menu options. •Use the 'Bulk Routines' and 'Employee Masterfile Changes' menu options to change the 'Tax Table Type', assigning USD to employee masterfile records •Ensure that the Transaction Codes that need to be denominated in USD have been. This includes Basic, Vehicle Benefits and any other earning or deduction that is denominated in USD. •Setup the Multi Currency Global defaults •Setup split Basic Salary, one for each of the currencies being used.

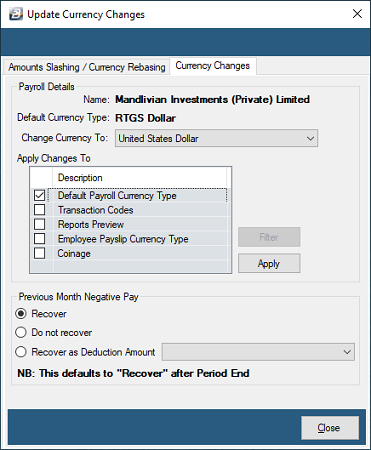

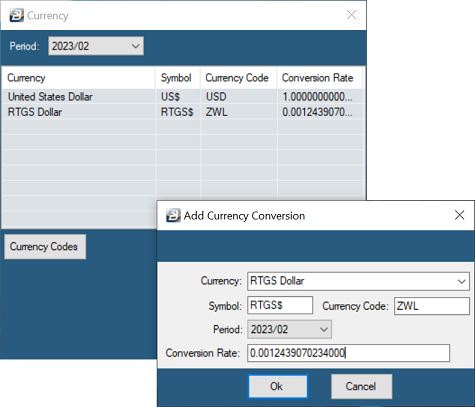

Converting a payroll from Single Currency to Multi-Currency •Insert the additional Currency, selecting it from the defaults available, and set Exchange rate. •Setup the USD Tax parameters under 'Setup' and 'Tax' menu options. •Use the 'Bulk Routines' and 'Employee Masterfile Changes' menu options to change the 'Tax Table Type', assigning USD to employee masterfile records •Ensure that the Transaction Codes that need to be denominated in USD have been. This includes Basic, Vehicle Benefits and any other earning or deduction that is denominated in USD. •Setup the Multi Currency Global defaults •Setup split Basic Salary, one for each of the currencies being used. •Go to the 'Data', 'Support Menu', then 'Currency Changes' menu options •Select the 'Currency Changes' Tab. Use the dropdown against 'Change Currency To' to select the new currency and apply it to each of the categories listed. Press Apply and accept to proceed.

Note: the 'Default Payroll Currency Type' in a multi currency payroll is always USD.

|

![]() Convert RTGS Payroll to Multi-Currency

Convert RTGS Payroll to Multi-Currency

|

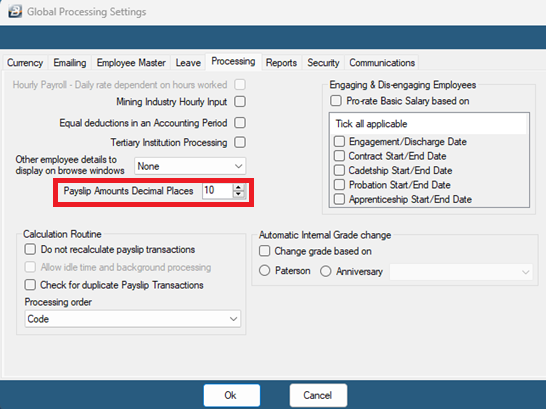

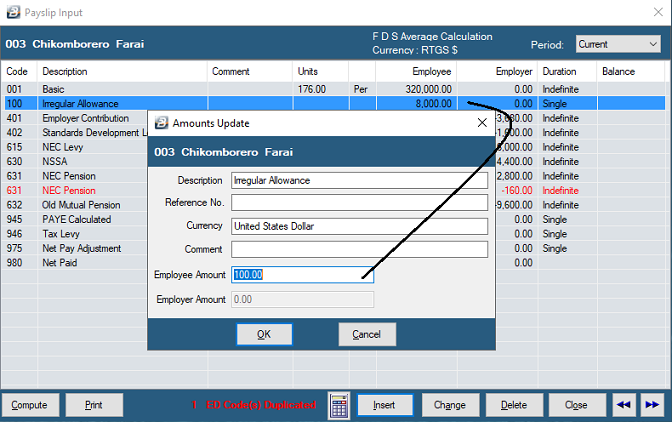

Processing Routine Processing can be done using any of the processing methods. When processing transactions in a multi currency environment a transaction processed in USD will be converted to the base currency automatically. In the example below an allowance of USD100 was processed but ZiG $8000 comes through onto the Payslip Input having been converted at the rate of 0.0125.

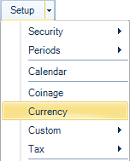

Exchange Rates Update the exchange rates at some time during the period being processed. In hyper-inflationary periods this may best be done towards the end of processing, as close as possible to the payment date of the payroll.

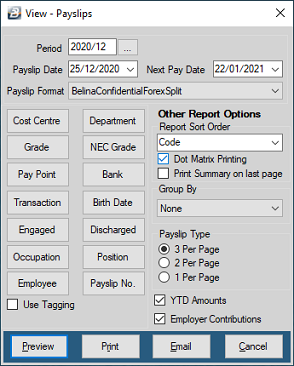

Print Reports Having done the preliminary setup it is now possible to print multi currency payslips. This is done as follows: •Go to the 'View', then 'Payslips', then 'Payslip Print' menu options •Select 'BelinaConfidentialForexSplit' as the Payslip Format on the range selection window •Preview, print or email the payslips using the buttons at the bottom of the screen.

View sample multi-currency payslip. |