Apportionment of overhead expenses

Cost Centre Splits is a method of apportioning payroll overhead costs of labour either using a set percentage per individual or as a time apportioned method. In this way non-time based transaction costs can be applied to different cost centres in an accepted proportion.

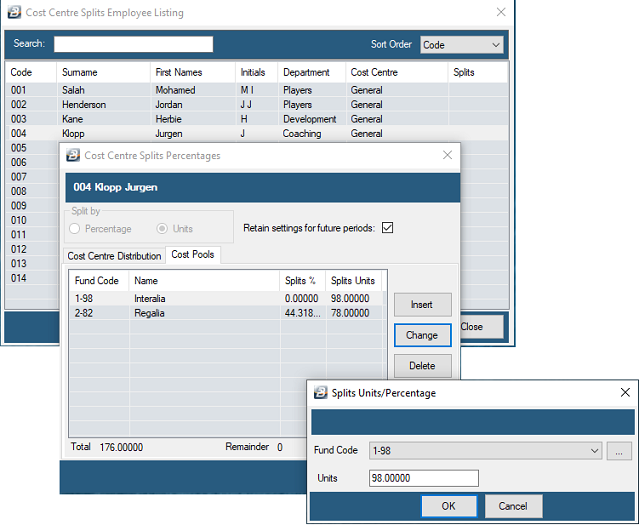

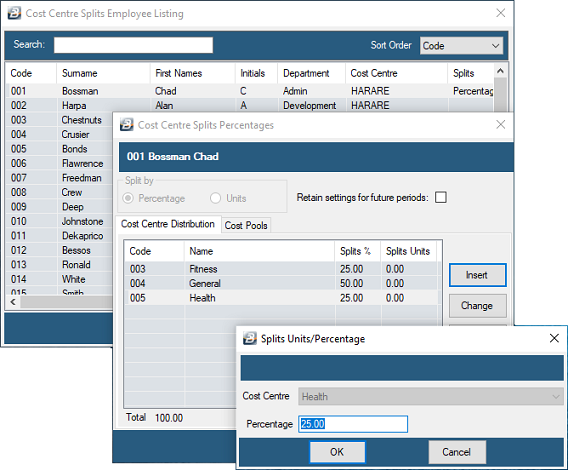

To process cost centre splits for Individuals as percentages of the whole 100% or as Units, the number of hours of the full period hours:

- Go to the 'Process' then 'Cost Centre Splits' menu options

- Select the employee to process by highlighting the employee and double-clicking, or by pressing the 'Update' button.

- Use the radio button to select whether to split by 'Percentage' or 'Units' (hours)

- Click 'Insert'

- Select the cost centre and enter the percentage for that cost centre.

Note: If percentages are used they should add up to 100% and if 'Units' used the hours should add up to the total period hours.

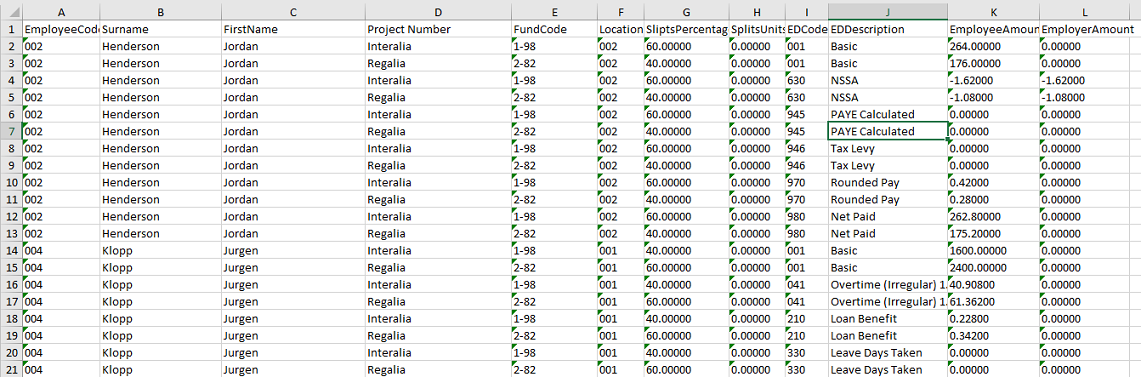

This works in conjunction with Cost Centre Splits Exports where data can be extracted to spreadsheet and further manipulated. The exports can be accessed through:

•Go to the 'Utilities', 'Exports', 'Cost Centre Splits' menu options

This feature is designed for Non Governmental Organizations where donors cover the cost of employment of specific employees in an organization. As with the case with Cost Centre Splits it is possible to split the cost of employment of an individual based on either a percentage or on a proportional time basis.

To process Cost Pools for Individuals: - Go to the 'Process' then 'Cost Centre Splits' menu options - Select the employee to process by highlighting the employee and double-clicking, or by pressing the 'Update' button. - Select the 'Cost Pools' tab - Click 'Insert' - Select, or create, the Cost Pool - Enter the percentage or Hours. - Click 'OK' - Press 'Insert' and continue adding Cost Pools and entering percentages, or Units, until 100% is reached or the total number of period hours has been entered.

|

This Cost Centre export feature shows a breakdown of Payroll transaction costs broken down by Cost Pool (Fund Code). To access this export to Excel: •Go to the 'Utilities', 'Exports', 'Cost Centre Splits', then 'Cost Pool Allocations' menu options •Enter the range criteria, •Press 'OK' •In the new screen that displays use the elipsis button to lookup the 'Destination Folder' and enter the 'Filename'. •A message displays that the file has been successfully exported. •It is now possible to open and view the exported file.

|

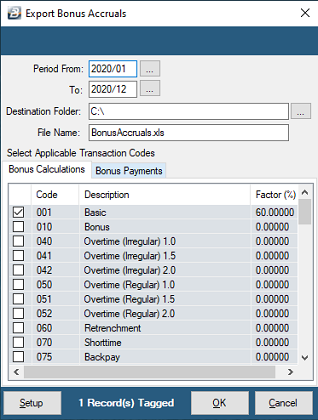

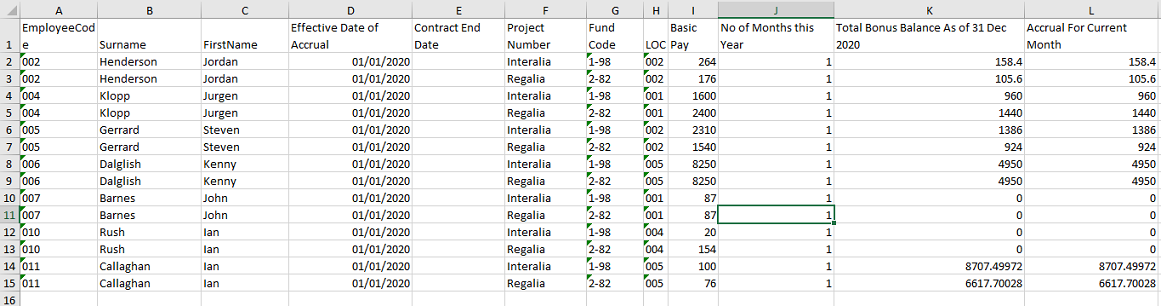

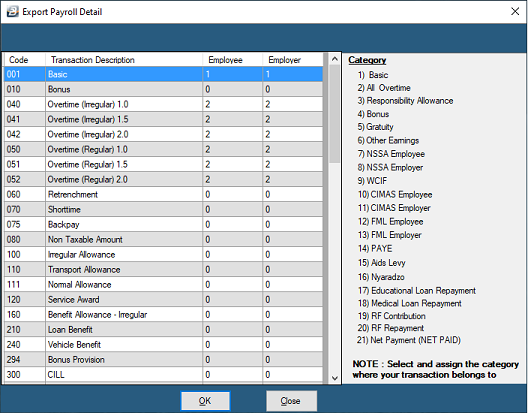

This Cost Centre export feature shows a breakdown of an accrual for Bonus amounts based on a percentage of selected transactions split between Cost Pools (Fund Codes). To access this export to Excel: •Go to the 'Utilities', 'Exports', 'Cost Centre Splits', then 'Bonus Accruals' menu options •Select the Transaction Codes and enter the factor to be applied to each in the export

•Press 'OK' •Enter the range criteria, •Press 'OK' •In the new screen that displays use the elipsis button to lookup the 'Destination Folder' and enter the 'Filename'. •A message displays that the file has been successfully exported. •It is now possible to open and view the exported file.

Bonus Payments Tab Select the Transaction Code for any Bonus payments that have been made. This will have these payments reflect on the export file so that they can be taken into account when dealing with the accrual. |

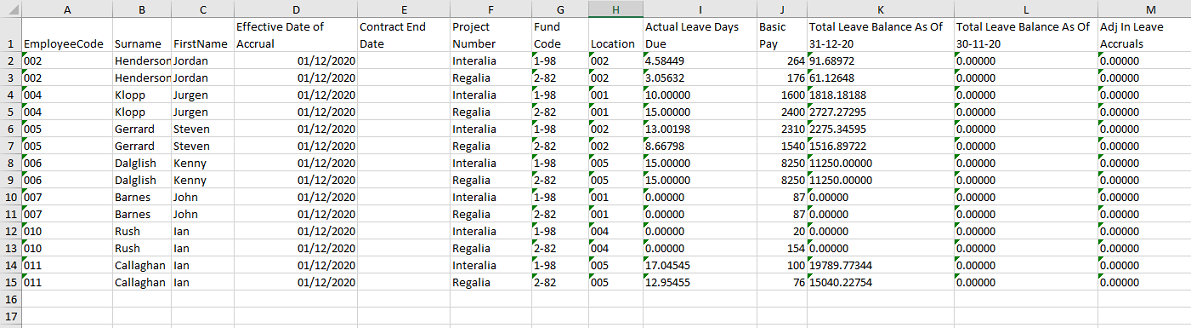

This Cost Centre export feature shows a breakdown of an accrual for the value of Leave balances split between Cost Pools (Fund Codes). To access this export to Excel: •Go to the 'Utilities', 'Exports', 'Cost Centre Splits', then 'Leave Accruals' menu options •Enter the range criteria, •Press 'OK' •In the new screen that displays use the elipsis button to lookup the 'Destination Folder' and enter the 'Filename'. •A message displays that the file has been successfully exported. •It is now possible to open and view the exported file.

|

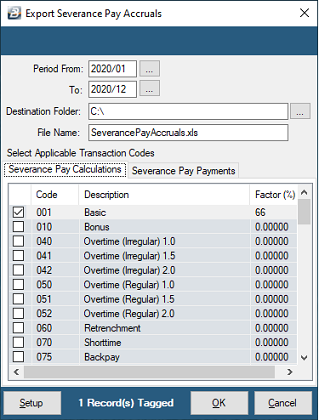

![]() Export - Severance Pay Accruals

Export - Severance Pay Accruals

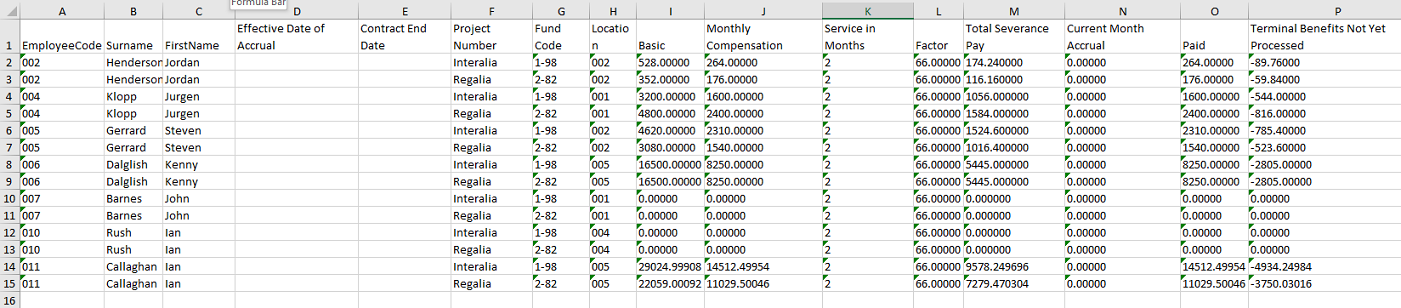

This Cost Centre export feature shows a breakdown of an accrual for severance pay based on a percentage of selected transactions split between Cost Pools (Fund Codes). To access this export to Excel: •Go to the 'Utilities', 'Exports', 'Cost Centre Splits', then 'Severance Pay Accruals' menu options •Select the Transaction Codes and enter the factor to be applied to each in the export

•Press 'OK' •Enter the range criteria, •Press 'OK' •In the new screen that displays use the elipsis button to lookup the 'Destination Folder' and enter the 'Filename'. •A message displays that the file has been successfully exported. •It is now possible to open and view the exported file.

Severance Pay Payments Tab Select the Transaction Code for any Severance payments that have been made. This will have these payments reflect on the export file so that they can be taken into account when dealing with the accrual. |