The Labour Act stipulates that employees are entitled to 30 calendar days annual leave per annum. The spirit of the law is that employees receive the equivalent of one month's annual leave per annum. Any equivalent amount, e.g. an equivalent number of working days can also be used as long as the employee is not worse off than if calendar days were used.

Labour Act Chapter 28:01 - Section 14A - Vacation leave

(1)

|

In this section— “qualifying service”, in relation to vacation leave accrued by an employee, means any period of employment following the completion of the employee’s first year of employment with an employer.

|

(2)

|

Unless more favourable conditions have been provided for in any employment contract or in any enactment, paid vacation leave shall accrue in terms of this section to an employee at the rate of one twelfth of his qualifying service in each year of employment, subject to a maximum accrual of ninety days’ paid vacation leave: Provided that, if an employee is granted only a portion of the total vacation leave which may have accrued to him, he may be granted the remaining portion at a later date, together with any further vacation leave which may have accrued to him at that date, without forfeiting any such accrued leave.

|

(3)

|

All Saturdays, Sundays and public holidays falling within a period of vacation leave shall be counted as part of vacation leave.

|

(4)

|

An employee who becomes ill or is injured during a period of vacation leave may cancel his vacation leave and apply for sick leave.

|

(5)

|

Where an employee has no vacation leave accrued, he may be granted vacation leave without pay.

|

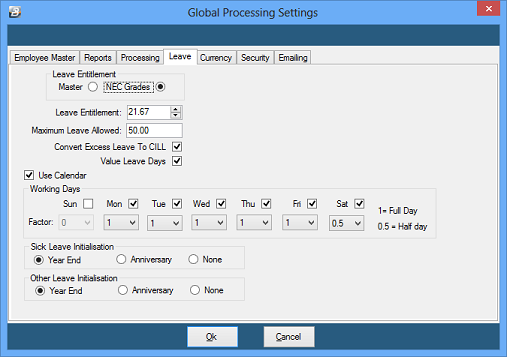

Setting Annual Leave Entitlement Setting Annual Leave Entitlement

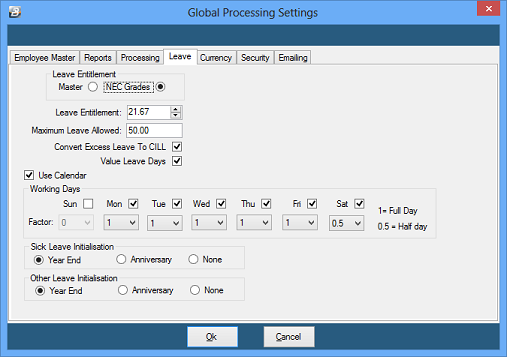

The default number of days annual leave entitlement is setup under the 'Global Defaults' facility.

•Go to the 'Setup', then 'Global Defaults' menu options •Select the 'Leave' tab, as illustrated, below:

Leave Entitlement - Master

|

The default leave entitlement for a new employee will be determined from what has been entered into the Employee Master

|

Leave Entitlement - NEC Grades

|

The default leave entitlement for a new employee will be determined from the NEC Grade leave entitlement for the Employee

|

Leave Entitlement

|

The default number of days leave to come through for new employees in the Employee Master

|

Maximum Leave Allowed

|

A limit can be set to the accumulation of leave balance.

|

Convert Excess Leave to CILL

|

Any accumulation of leave that exceeds the 'Maximum Leave Allowed' can be paid out as CILL (Cash in Lieu of Leave), if not the days are simply lost

|

Value Leave Days

|

To value leave days is to apportion the value of the Basic Pay to each type of leave taken in the period, with the balance to Basic Pay.

|

Use Calendar

|

When processing leave enter the starting date of the leave and the number of days being taken. The system will then calculate the return date. This forms a check of the entry being made and also displays on the employee payslip. In order to calculate the properly the system needs to take into account holidays set up in the Calendar as well as the value of standard Working Days information is displayed on the

|

Sick Leave Initialisation

|

The counter for Sick Leave Days can be set to initialize on the anniversary of employment for the each individual, or as a Year End Procedure is being done.

|

Other Leave Initialisation

|

The counters for Other Leave Days can be set to initialize on the anniversary of employment for the each individual, or as a Year End Procedure is being done.

|

|

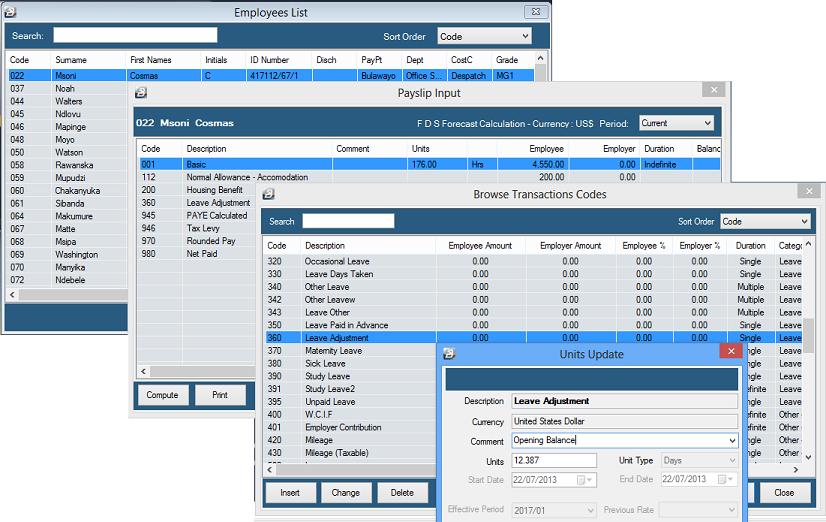

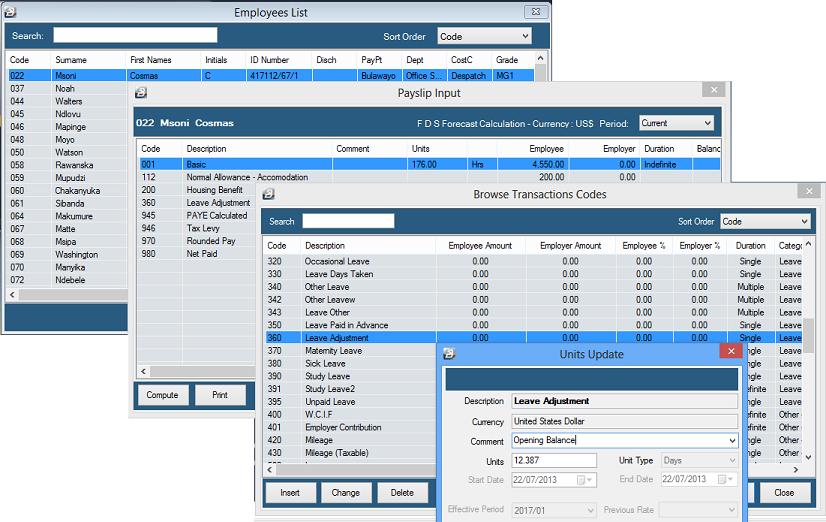

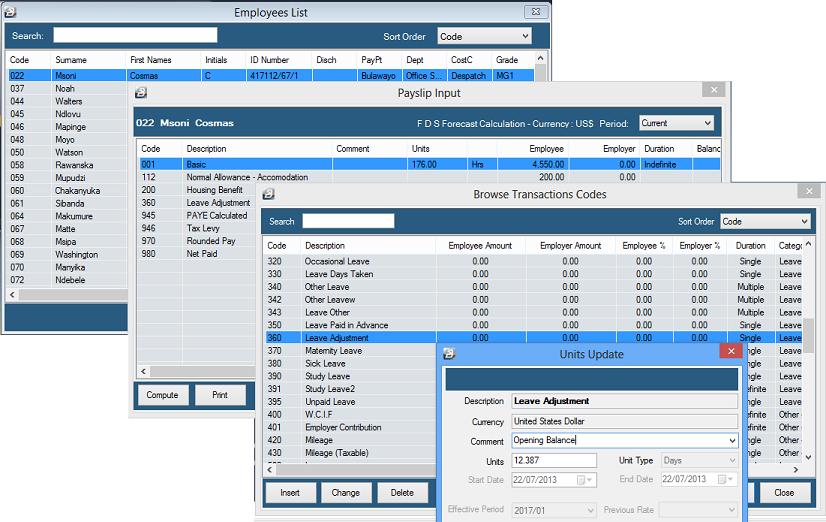

Annual Leave - Opening Balance Annual Leave - Opening Balance

Step 1

|

Determine the opening balance/s:

When entering the opening annual leave balance for an employee determine what that balance is and whether that balance includes the current period leave entitlement. If the balance includes the current period balance run the Calculation Routine before entering the balance. If not, then ensure that the Calculation Routine has not been run before entering the balance. The reason for this is that when the Calculation Routine is run for the first time in a period, it accrues leave for that period.

|

Step 2

|

Determine the adjustment required by comparing the opening leave balance required with what is currently displayed under the 'Balances Tab' in the Employee Master.

|

Step 3

|

Ensure that a 'Leave Adjustment' code exists:

When a payroll is created a 'Leave Adjustment' Transaction Code (Code: 360) is created and available for you to use. Use this code, or create an adjustment code, to make the entry of the opening balance/s.

|

Step 4

|

Process the adjustment/ Opening balance:

To do this:

•Go to the 'Process' and 'Payslip Input' menu options •Select the employee to be processed •From the list of Transaction Codes processed on the employee's payslip input press 'Insert' •Select the 'Leave Adjustment' Transaction Code •Enter the Opening Balance (the amount that the leave balance needs to be adjusted by)

•Press 'OK' to accept the entry |

Step 5

|

After the adjustment/s have been processed check that the new Opening Leave balance/s are correct on the Balances Tab for each employee, or run a Leave - Summary

|

|

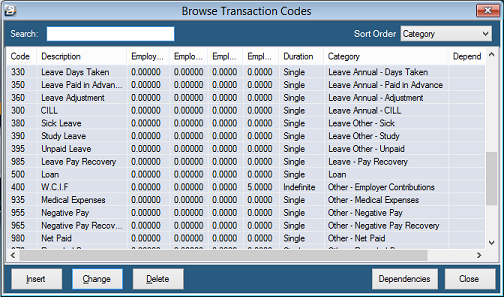

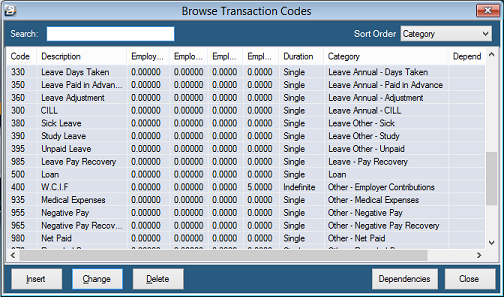

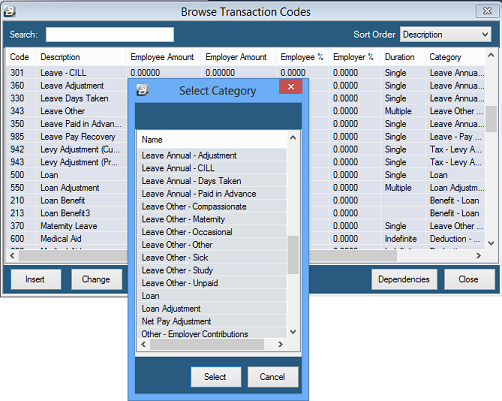

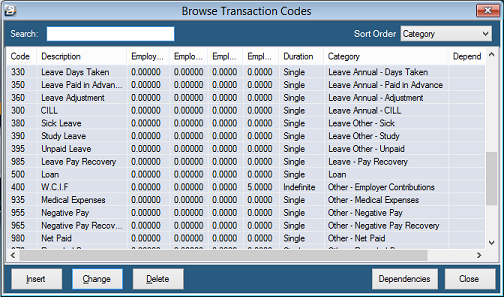

Leave Annual - Transaction Codes Leave Annual - Transaction Codes

Annual leave days taken/ used can be processed using:

•Leave Annual - Days Taken •Leave Annual - Paid in Advance, and •Leave Annual - CILL

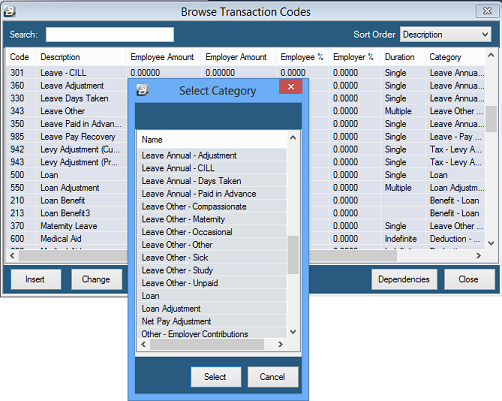

Each of these Transaction Codes are automatically inserted, and ready to be used for processing, when a new payroll is created. They can also be inserted manually by:

•Going to the 'Edit', then 'Transaction Codes' menu options, •If the Transaction Codes does not exist press 'Insert' •Go to the Transaction Categories starting with the word 'Leave Annual'

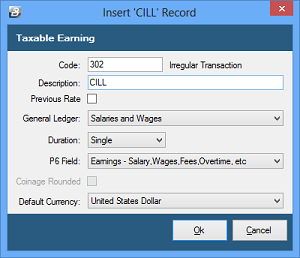

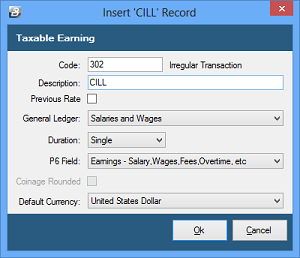

Leave Annual - Cash in Lieu (CILL) Transaction Code Leave Annual - Cash in Lieu (CILL) Transaction Code

Use this Transaction Code to process Annual Leave Days cashed-in by an employee, rather than taken, during the course of the year. To create the Transaction Code:

•Go to the 'Edit', then 'Transaction Codes' menu options, •Press 'Insert' to obtain a list of Transaction Code Categories, •Select Transaction Category 'Leave Annual - CILL' •Accept, or change, the default Transaction Code number, Description and General Ledger Code

Previous Rate

|

Leave can be paid at the last rate of pay applied to the individual.

|

|

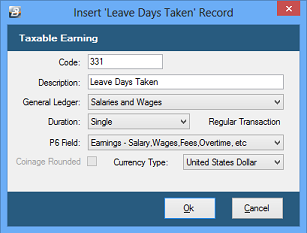

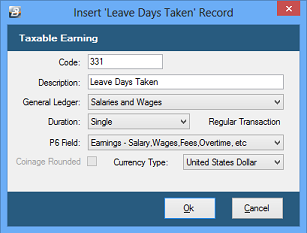

Leave Annual - Days Taken Transaction Code Leave Annual - Days Taken Transaction Code

Use this Transaction Code to process Annual Leave Days taken during the course of the year. To create the Transaction Code:

•Go to the 'Edit', then 'Transaction Codes' menu options, •Press 'Insert' to obtain a list of Transaction Code Categories, •Select Transaction Category 'Leave Annual - Days Taken' •Accept, or change, the default Transaction Code number, Description and General Ledger Code

|

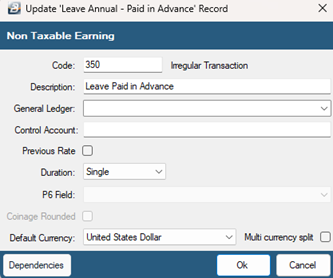

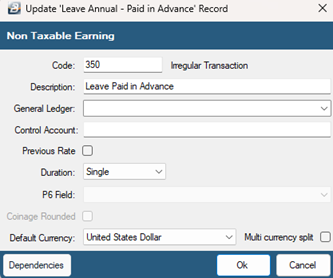

Leave Annual - Paid in Advance Transaction Code Leave Annual - Paid in Advance Transaction Code

Create the Leave Paid in Advance Transaction Code manually, by:

•Going to the 'Edit', and 'Transaction Codes' menu options •Press 'Insert' to obtain a list of Transaction Code Categories, •Select the 'Leave Annual - Paid in Advance' Transaction Category •Accept, or change, the default Transaction Code number, Description and General Ledger Code

|

|

Annual Leave Processing Annual Leave Processing

In the examples, below, we have selected to use the 'Payslip Input' processing method. Other methods of processing may also be applied.

To process leave days taken:

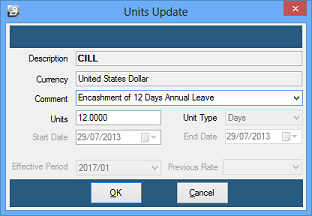

•Go to the 'Process' and 'Payslilp Input' menu options •Select the employee who is to have a leave transaction processed •Press 'Insert' and select the Leave Transaction Code required •If the person is taking a standard number of days leave use 'Leave Annual - Days Taken' •If the person is taking cash instead of taking the leave days select 'Leave Annual - CILL' •If the person is taking going on leave now and is being paid for future period/s of leave in advance, then select 'Leave Annual - Paid in Advance'  Leave Annual - Cash in Lieu (CILL) - Processing Leave Annual - Cash in Lieu (CILL) - Processing

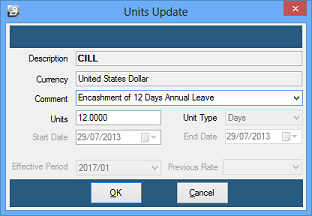

To process CILL (Cash in Lieu of Leave) days if the person is taking cash instead of taking the leave days:

•Go to the 'Process' and 'Payslilp Input' menu options •Select the employee who is to have leave encashed •Press 'Insert' and select the CILL Transaction Code

Enter a 'Comment' and the number of 'Units' (Days) leave being taken in cash.

|

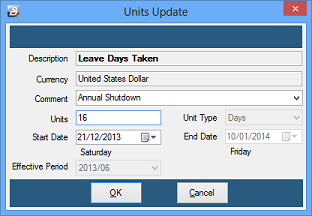

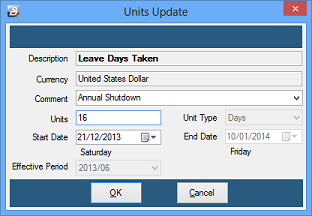

Leave Annual - Days Taken - Processing Leave Annual - Days Taken - Processing

To process leave days taken:

•Go to the 'Process' and 'Payslilp Input' menu options •Select the employee who is to have a leave transaction processed •Press 'Insert' and select the Leave Transaction Code required •If the person is taking a standard number of days leave use 'Leave Annual - Days Taken' •

•Enter a 'Comment' , •the number of 'Units' (Days) leave being taken, and •the 'Start Date' •The 'End Date' will be automatically computed taking into account whether the leave has been setup to count working, or calendar days. |

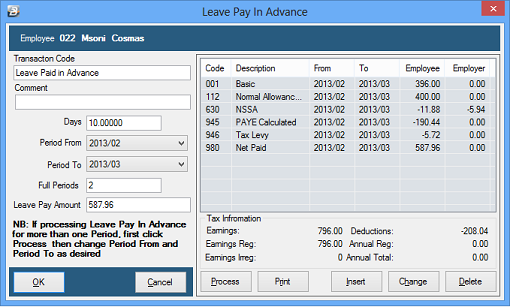

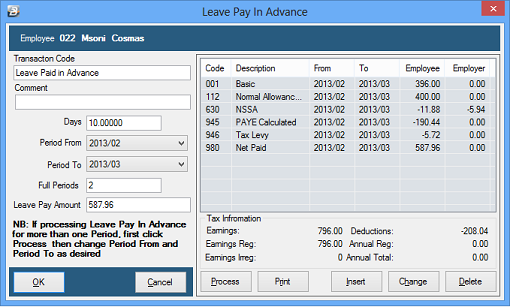

Leave Annual - Paid in Advance - Processing Leave Annual - Paid in Advance - Processing

Use the Leave Paid in Advance feature where the employee is going on leave this period and will not be at work to receive pay this period AND the next subsequent period/s.

Employee on leave this period - will be away on payday

|

Process the leave as usual using 'Leave Days Taken' Transaction Category. A special payment may be made to the employee as an advance or the full net pay can be paid and a 'Net Pay Adjustment' processed to ensure that the employee is not included in the main pay run and therefore paid twice.

|

Employee on leave this period - will be away on payday but back at work in time to receive the next period's pay.

|

Process the leave as usual using 'Leave Days Taken' Transaction Category. A special payment may be made to the employee as an advance and a 'Net Pay Adjustment' processed in the current period to ensure that the employee is not included in the main pay run for that period and therefore paid twice. If the employee is to be back in time for the next pay run then no special processing is required the employee will receive that period's pay together with the other employees.

|

Employee on leave this period - will be away on payday and will be away one or more full periods.

.

|

Process the leave using the 'Leave - Paid in Advance' Transaction Category. The system calculates the net pay amount that would have been payable for each of the full period/s that the employee will be away. The total is computed and paid to the employee in the current period. Each time a 'Period End' is processed the standard Transaction Codes come through automatically together with a deduction for the unrecovered portion of the total net value of Leave Paid in Advance for each of the full period/s that the employee has been away.

The Leave Paid in Advance only includes full periods that the employee is away. Therefore, the employee can expect to receive a full period's pay in the first period back at work. No advance payment is made for any leave days in a period where the employee is back at work.

|

To process 'Leave Paid in Advance':

•Select the 'Leave Paid in Advance' Transaction Code from Payslip Input •Press 'Process' •Enter a 'Comment' and the 'Period From' and the 'Period To' •The system will automatically calculate the number of 'Days' •Any balance of days not being Paid in Advance needs to be processed separately as 'Leave Annual - Days Taken'.

|

|

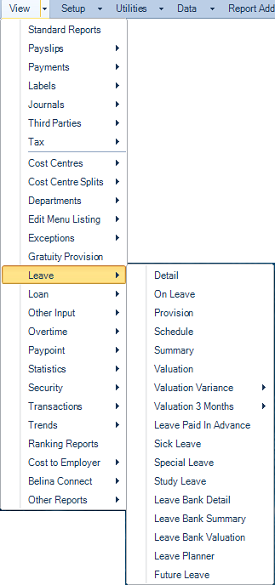

Annual Leave Balance Annual Leave Balance

To see the Annual Leave Balance for an individual:

•Go to the 'Edit', then 'Employee Master' menu options •Select the employee whose leave balance you would like to see •Select the 'Balances' Tab •Note the number against 'Annual Leave' - the annual leave balance.

It is also possible to see the leave balance for one, or more, individuals by running a report. This is done by:

•Going to the 'View', 'Leave' menu options •Select a report that displays leave balances e.g. Leave Detail and Leave Summary Reports |

Annual Leave Adjustment Annual Leave Adjustment

Step 1

|

When determining the amount of a leave adjustment it is necessary to look at the current leave balance by going to the Balances Tab in the Employee Master and determining the required new balance. It is important to determine whether the balance reflected in the Employee Master includes the current period leave accrual, or not. If the Calculation Routine has been run then the balance includes the current period leave accrual, if not then the balance excludes the leave accrual.

|

Step 2

|

Calculate the number of days leave adjustment required.

|

Step 3

|

Ensure that a 'Leave Adjustment' code exists:

When a payroll is created a 'Leave Adjustment' Transaction Code (Code: 360) is created and available for you to use. Use this code, or create an adjustment code, to make the entry of the opening balance/s.

|

Step 4

|

Process the adjustment:

To do this:

•Go to the 'Process' and 'Payslip Input' menu options •Select the employee to be processed •From the list of Transaction Codes processed on the employee's payslip input press 'Insert' •Select the 'Leave Adjustment' Transaction Code •Enter the amount that the leave balance needs to be adjusted by

•Press 'OK' to accept the entry |

Step 5

|

After the adjustment/s have been processed check that the new Opening Leave balance/s are correct on the Balances Tab for each employee, or run a Leave - Summary

|

|

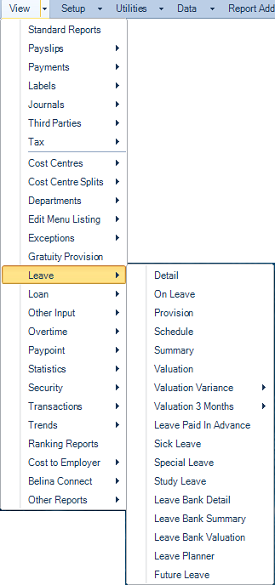

Annual Leave Reports Annual Leave Reports

There are a variety of Leave reports that are available with selected information available on each. To access the reports:

•Go to the 'View' and then 'Leave' menu options

•Select the report that best suits your information requirements.

To best determine which report suits your requirements view the Leave sample reports.

|

|