An annual bonus is a bonus that is paid to employees at the end of the tax year. The calculation of tax on the bonus takes into account the tax free bonus amount. This is generally announced at the end of the tax year as part of the Minister of Finance's budget speech and gazetted some time after that.

The bonus amount is not projected in the FDS tax calculation but is merely added to the total in calculating Taxable Income. The tax on the bonus amount is calculated at the top marginal tax rate, being the percentage applied to the last dollar of income before the tax on the bonus is calculated.

Incentive, production and other bonuses that are paid to employees during the course of the year should not be processed as 'Annual' bonuses. This income is taxed like any other earning as either a Regular or Irregular income.

Any PAYE amount payable on the bonus is included in the employee's total PAYE amount for the period. This can be checked by examining the 'Tax Display' for the employee.

A Bonus Period is a period that has been created specifically to process a bonus amount. This is done before period end. You cannot convert the current period into a bonus period. The bonus period must exist before doing a period end into the bonus period. Also note that the period numbers will change for example if you have 12 periods for the year and you process bonus after Nov the Bonus period becomes period 12 and Dec Period becomes period 13. This will not change or affect your tax calculation for the period as the bonus period is only for a separate bonus payslip only.

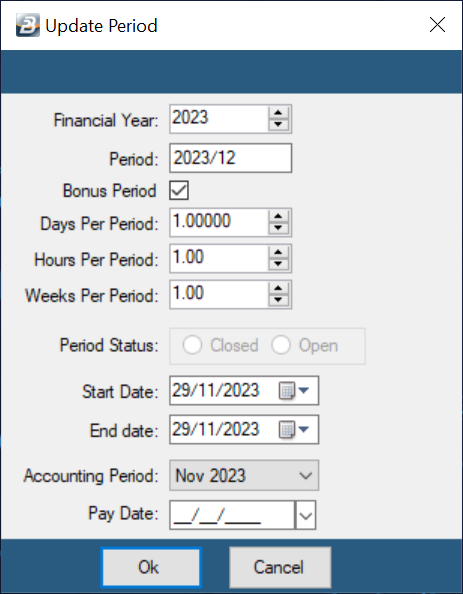

First insert a new period into the Period Table (List of Periods). This must be done in a prior period to the bonus period. To do this: •Go to the 'Setup', 'Periods' and 'Pay periods' menu options •Highlight on the period before which you would like to pay the bonus •Click 'Insert', •Tick 'Bonus Period' •Enter your start and end dates. For a bonus period we suggest that you enter a specific date which will be the same for the Start and End dates within the month that you processing the bonus period. e.g. Christmas Bonus being paid in Period 12 (Before Dec. Start Date 29/11/2022 and End Date 29/11/2022. •Now go to to 'Accounting periods', click the down arrow and select the accounting period in which the bonus is being paid •Click 'Ok'

You are now ready to do a period end into your bonus period (the system will inform you that the next period you are entering into is a bonus period when you do Period End) |

Create a Bonus transaction code for processing |

To process the Bonus Transaction using Payslip Input: •Go to the 'Process' menu •Select the employee from the table of listed employees •Press 'Insert' •Look up and select the Bonus Transaction Code. •Enter the amount of the Bonus •Press OK. The Bonus will then be automatically added to the Earnings and Deductions for the employee.

Note: - Leave days are not accumulated in a bonus period. - Amounts processed are not projected in the FDS system. - Care should, therefore, be taken if recurring amounts are being processed. - All recurring transactions from your previous normal period will not come through in the bonus period but will come through in the next normal period. - Using a separate bonus period ensures that the payslip only shows the Bonus and related tax. |

Annual Bonuses qualify for tax exemption up to the amount specified by the Minister of Finance each year. Annual bonuses that are subject to tax relief should be setup using the 'Earnings - Bonus' Transaction Code Category.

SETUP The tax free element is setup in the tax parameters. The value of any bonus amount/s paid to employees will be tax-free up to the value of the tax free amount entered. Excess amounts will be taxed.

TAX - OTHER BONUSES Incentive and other bonuses should be setup using either the 'Allowance - Normal (Regular)' or 'Allowance - Normal (Irregular)' Transaction codes depending on the regularity of the payment. This will ensure the correct projection of income for FDS tax.

TAX - THRESHOLD If there is an adjustment to the Bonus Tax free threshold within a tax year the FDS tax system will automatically adjust the current tax deduction to take into account the adjusted threshold.

Any bonus amounts taxed in previous periods which should not have been taxed taking into account the new threshold will get tax relief in the current period.

If the bonus amounts paid to date did not exceed the threshold amounts then there would be no adjustment to the taxation amount. The tax deducted on the bonus is explained in the Tax Display reports. You will notice that the bonus tax free amount, not already utilized, will have been deducted from the bonus amount and then the balance taxed at normal rates. |