Multicurrency Payrolls - 2024 Setup

SETUP OF A MULTIPLE CURRENCY PAYROLL - BASED ON 2024 INFORMATION

This guide will assist in converting an existing payroll to make use of two currencies to pay employees. This guide will assume that:

• Basic salary and most earnings and deductions on the payslip are denominated in foreign currency (ZiG Dollar) and one or more earnings and deductions are in the base currency (United States Dollar)

Note the base currency is the currency the tax tables are denominated in

• The effective period is the current month

• That all employees in the payroll will have paid in whole or part in United States Dollars

Before you begin, please ensure:

• A backup has been taken

• Your payroll is in the period in which the changes are to be effected.

Note: For weekly or fortnightly payrolls, ensure that the effective period is the first period of the calendar month.

TABLE OF CONTENTS

•Step 1: Setting up the Tax Table

•Step 2: Applying the tax tables to employees

•Step 3: Configuring currencies

•Step 4: Converting the payroll

•Step 6: Setting up transaction codes

•Step 7: Processing the allowance

Step 1: Setting up the Tax Table

Once an employee is being remunerated in full or part in United States Dollar, ZIMRA requires that the employees be taxed using the United States Dollar (USD) tax table.

Setting up a tax split will help to separate periods in your payroll that have one currency from those that have two and make reporting simpler.

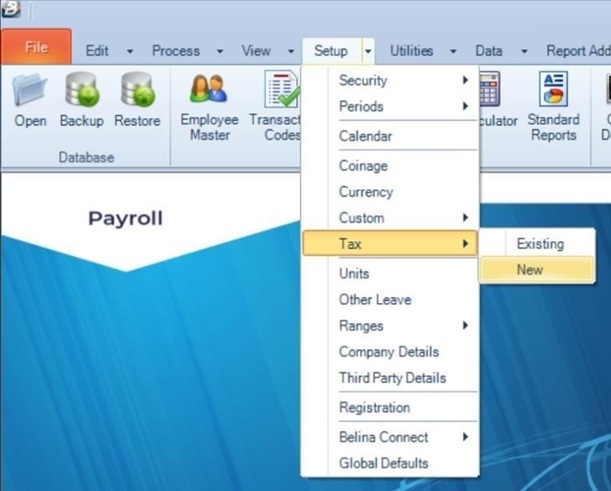

1. Go to Setup > Tax > New

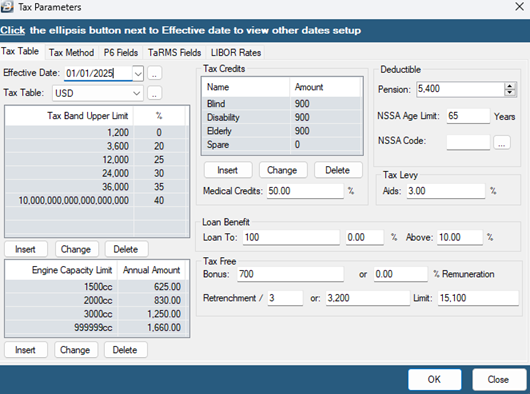

2. Enter the tax bands as shown below

NB: Effective date is the first of the month in which you are starting the setup. Pension deductible is

USD 5 400 per annum. Prorate the amount based on the number of months left in the year.

The Age Lower Limit for Elderly Credits is 55 years.

Step 2: Applying the tax tables to employees

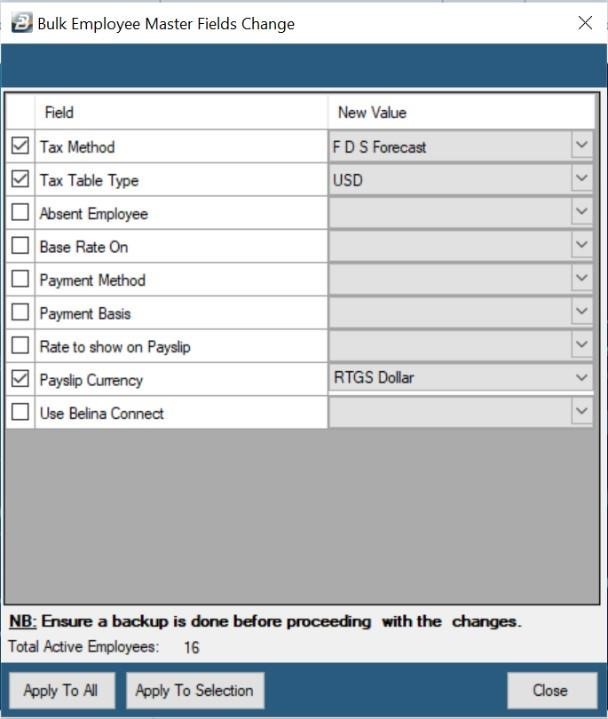

To apply the new tax settings, go to

1. Click on ‘Data’ >‘ Bulk Routines’ > ‘Employee Master File Changes’.

2. Tick on Tax Method and select ‘FDS Forecast’. Tick on Tax Table Type and select ‘USD’. Tick Payslip Currency and select ‘ZiG Dollar’

3. Click on ‘Apply to All’

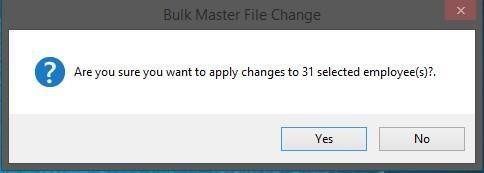

4. Click ‘Yes’

5. Enter your admin user-name and password to proceed.

6. Click ‘OK’ to close

Step 3: Configuring currencies

1. Go to Setup > Currency

2. Click on Insert and choose the United States Dollar as the currency

3. Enter 1 as the conversion rate. Click on Ok

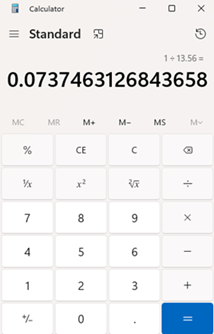

4. Select your existing Zimbabwe Gold currency and click on change. Enter the conversion rate as 1 divided by the interbank mid rate of the day of processing your payroll, as shown in the image above.

For example, if the rate is 15.56, what you enter as the ZiG rate is 1/13.56 = 0.0737463126843658

5. click on Ok

Note The United States Dollar is now the base currency, and we are expressing the 1 United States

Dollar to 1 ZiG Dollar at the RBZ Interbank Rate currently 13.56 (1/13.56). Any movement in the RBZ Interbank Rate would require an adjustment in the payroll.

Step 4: Converting the payroll

Changing Default Currency

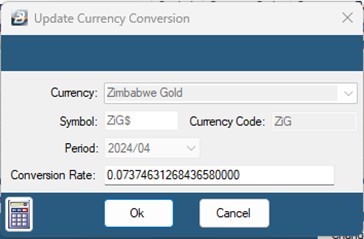

1.Proceed to click on ‘Data’, ‘Support Menu’, then ‘Currency Changes’

2. Click on the Currency Changes tab

3. Select United States Dollar on ‘Change Currency To’

4.Tick on Default Payroll Currency Type and Transaction Codes option on ‘Apply Changes to’

5.After ticking transaction codes, click on it and select ‘Filter’ then Tag the Options as shown in the picture below including Basic, Medical Expenses PAYE Calculated, Tax Levy, Tax Refund, Negative Pay, and Net Paid then click Ok

6. Click on 'Apply'

7. Click on 'Yes' to proceed

8. Click on 'OK' and then Close'

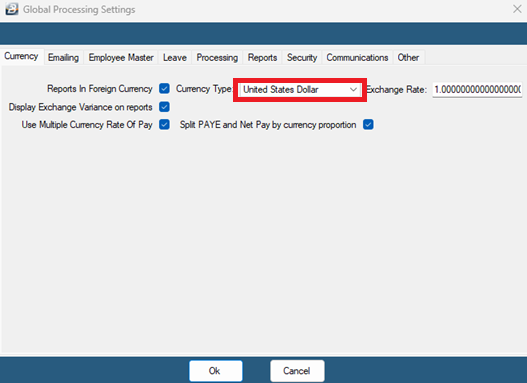

Updating Currency Settings

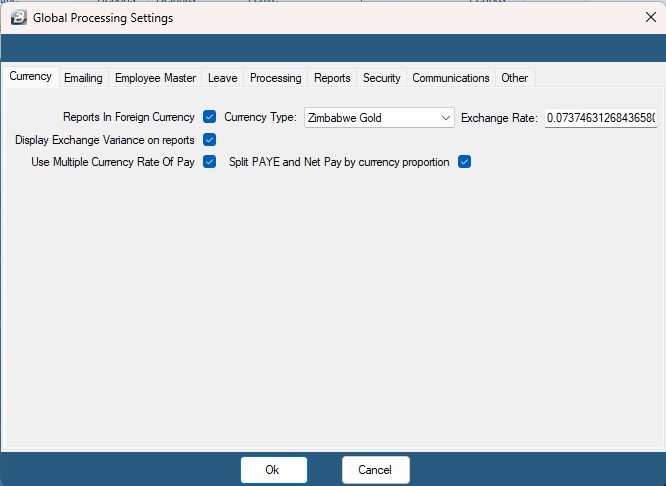

1. 'Go to Setup' > 'Global Defaults' then 'Currency' menu option

2.Select options ‘Use Multiple Currency Rate of Pay and Split PAYE’, ‘Display Exchange Variance on reports’, and ‘Net Pay by currency proportion’

3.Click on OK to save changes

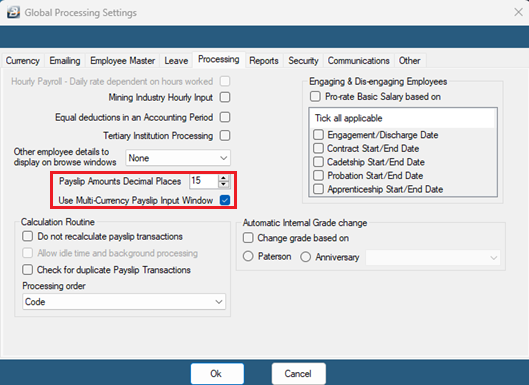

Updating Decimal Places

1.Go to Setup > Global Defaults

2. Open the ‘Processing’ tab.

3. Update ‘Payslip Amounts Decimal Places’ from 2 to 15 as shown below.

4. Place a tick on Use 'Multi-Currency Payslip Input Window'

5. Click ‘Ok’ to save

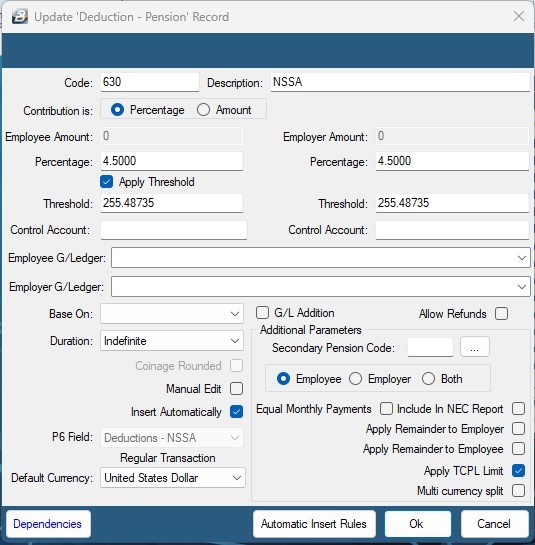

Step 5: NSSA Limits

Update the NSSA limit every Pay run/Pay period.

Please make sure the Apply TCPL Limit option is ticked.

To do this:

1.Go to Edit > Transaction codes.

2.Select the NSSA code and click Change

Click OK to save

To make change to the NSSA values

1.Go to Process > Calculation routine.

2.Enter the Nssa Threshold for both Employee and Employer (e.g., 4.5% of the NSSA Limit i.e. 5010.83) is 225.48735

3.Enter the Nssa Period limit i.e. 5010.83

![]()

4. Click Save & Continue to proceed.

For the current NSSA setup instructions see

Step 6: Setting up transaction codes

Go to ‘Edit’, then ‘Transaction Codes’ menu options:

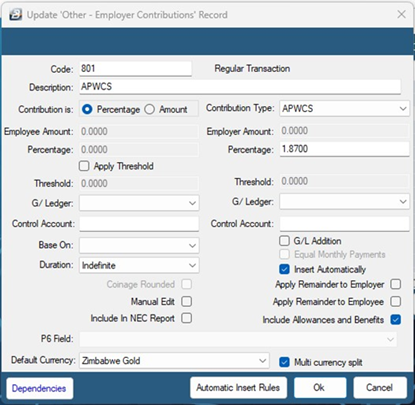

Make sure your WCIF/APWCS is setup correctly.

1.Select WCIF/APWCS code and click change.

2.Set ‘Contribution Type’ to APWCS.

3.Select the blank option on ‘Base On’.

4.Tick Include Allowances & Benefits

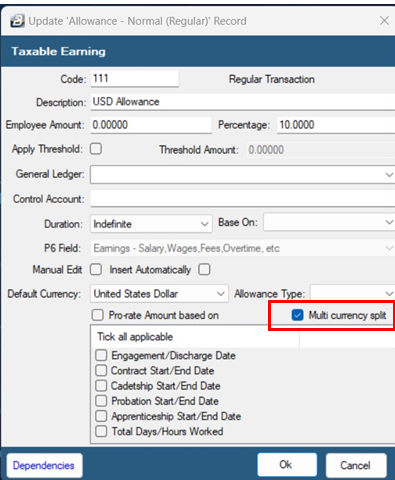

Note: Transaction codes based on the Basic Salary can be split for the system to deduct/pay in both USD and ZiG. This should be done for the ZiMDeF transaction code and can be done for Overtime, Shorttime, CILL, and Allowances that are a percentage of the Basic e.g., USD allowance that is 10% of the Basic.

For example:

1.Select the Transaction code and click Change.

2.Tick ‘Multi currency split’

3.Click ‘Ok’ to save.

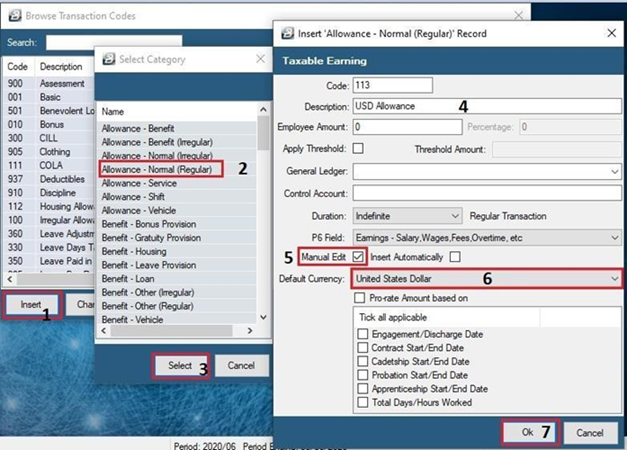

Setting up USD Allowance(s) if any

Whilst in the transaction codes window

1.Click on Insert

2.Then highlight Allowance – Normal (Regular) or (Irregular) depending on how the transaction is supposed to work.

3.Click on Select

4.Change the transaction description.

5.Make sure that the ‘Manual Edit’ check box is ticked.

6.Ensure that the ‘Default Currency’ is to United States Dollar

7.Click on OK

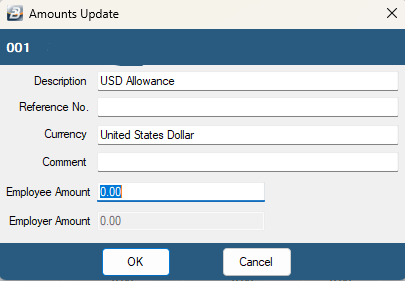

Step 7: Processing the allowance

1.Go to ‘Process’ > ‘Payslip Input’

2.Select the employee to have the allowance.

3.Click on insert and the allowance created earlier

Note the input currency is required in United States Dollars as denoted by the currency field.

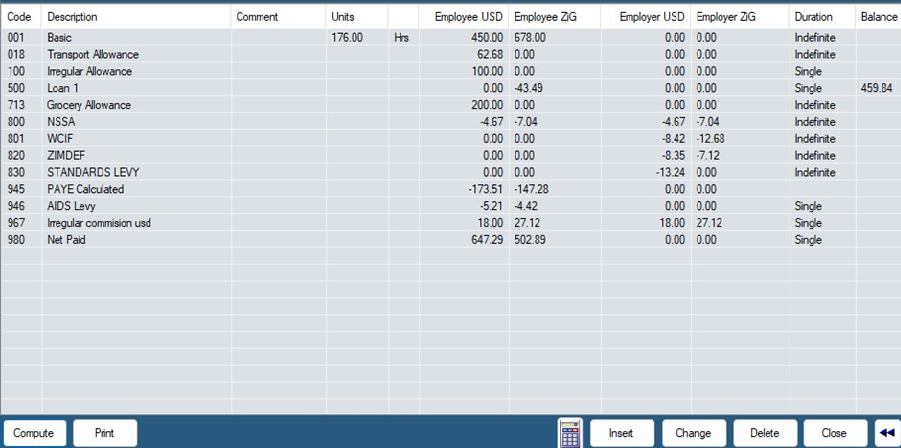

When on the payslip the value is converted to ZiG Dollars

Once input of the allowances is complete run the calculation routine by clicking on ‘Process’ > ‘Calculation Routine’ Menus

Step 8: Viewing Reports

Payslips

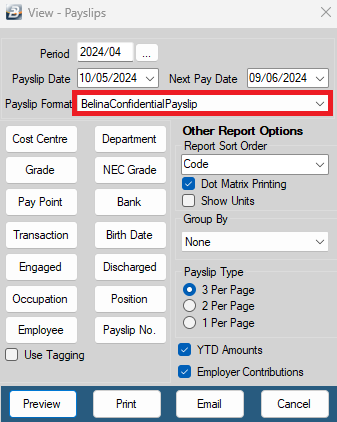

To view payslips, go to:

1.‘View’ > ‘Payslips’ > ‘Payslip Print’ menus

2.Select ‘BelinaConfidentialForexSplit’ as the payslip format

3.Change any parameters as necessary

4.Click on Preview

Selecting the currency to view reports in

1.Go to Setup > Global Defaults > Currency

2.Tag the Reports in Foreign Currency option and select the currency you wish to view the report in

3.Click on Ok

Multicurrency reports

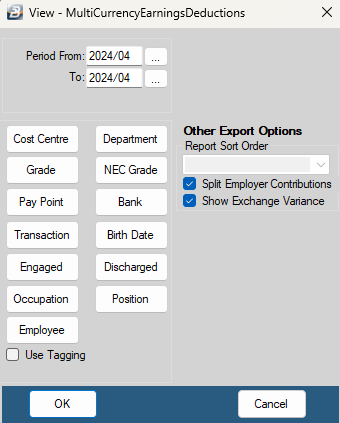

To view Multicurrency Export that show the split in currencies, go to;

‘View’ > ‘Multicurrency’

For Data export in multicurrency format Go to:

Utilities > Exports > Multi-Currency > Transactions