•Setting up a Multi-Currency Payroll from Scratch

Step 1: Create the Payroll with USD set as the Default Currency

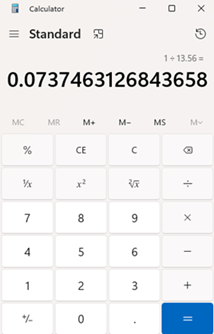

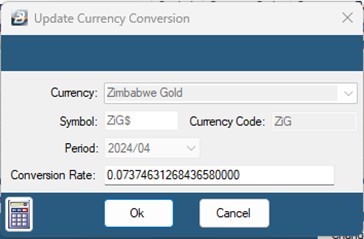

Step 2: Configuring currencies - Go to Setup > Currency - Click on Insert and choose the Zimbabwe Gold as the currency - Enter the ZiG conversion rate as 1 divided by the interbank mid rate of the day of processing your payroll, as shown by the Images below

For example, if the rate is 13.56, what you enter as the ZiG rate is 1/13.56 = 0.0737463126843658

.- click on Ok

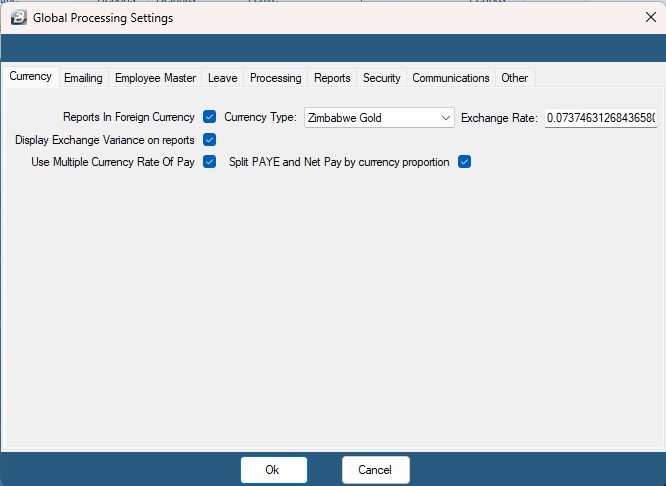

Step 3: Updating Currency Settings

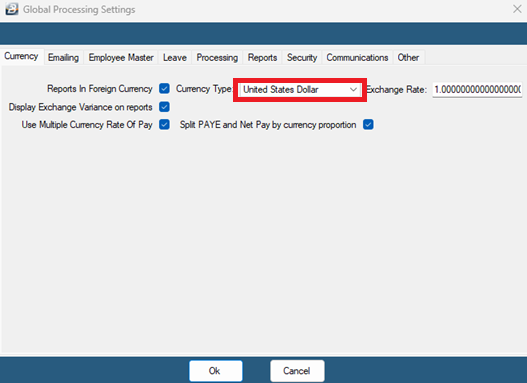

- 'Go to Setup' > 'Global Defaults' then 'Currency' menu option - Select options ‘Use Multiple Currency Rate of Pay and Split PAYE’, ‘Display Exchange Variance on reports’, and ‘Net Pay by currency proportion’ - Click on OK to save changes

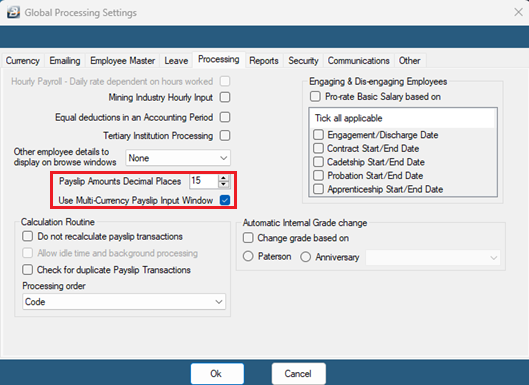

Step 4: Updating Decimal Places - Go to Setup > Global Defaults - Open the ‘Processing’ tab. - Update ‘Payslip Amounts Decimal Places’ from 2 to 15 as shown below. - Place a tick on Use 'Multi-Currency Payslip Input Window' - Click ‘Ok’ to save

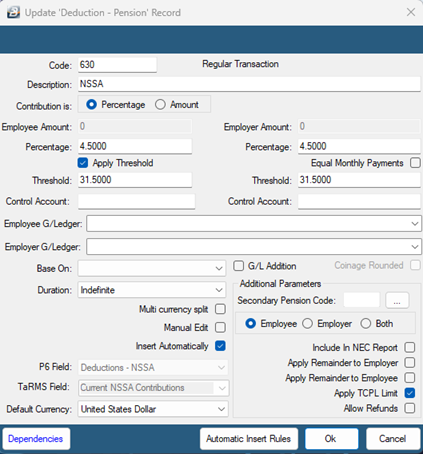

Step 5: NSSA Limits Update the NSSA limit every Pay run/Pay period. Please make sure the Apply TCPL Limit option is ticked. To do this: - Go to Edit > Transaction codes. - Select the NSSA code and click Change

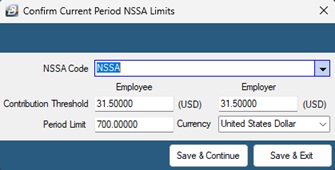

Click OK to save To make change to the NSSA values - Go to Process > Calculation routine. - Enter the Nssa Threshold for both Employee and Employer (e.g., 4.5% of the NSSA Limit i.e. 700) is 31.50 - Enter the Nssa Period limit i.e. 700

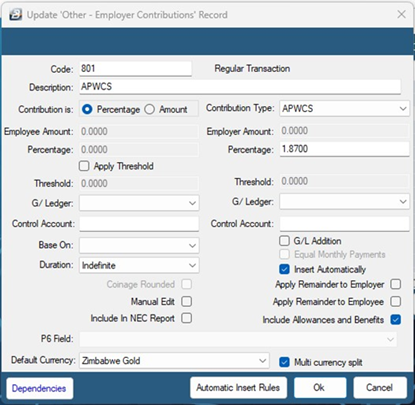

- Click Save & Continue to proceed. Step 6: Setting up transaction codes- Go to ‘Edit’, then ‘Transaction Codes’ menu options: - Make sure your WCIF/APWCS is setup correctly. - Select 'WCIF/APWCS' code and click change. - Set ‘Contribution Type’ to APWCS. - Select the blank option on ‘Base On’. - 'Tick Include Allowances & Benefits'

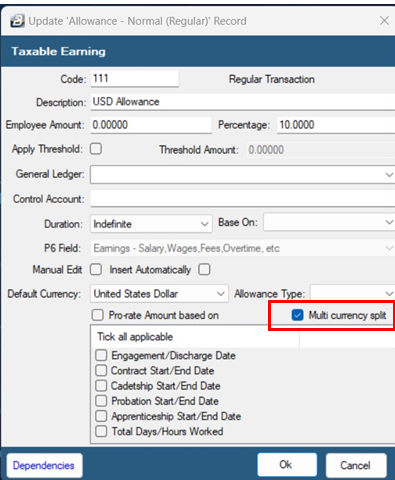

Note: Transaction codes based on the Basic Salary can be split for the system to deduct/pay in both USD and ZiG. This should be done for the ZiMDeF transaction code and can be done for Overtime, Shorttime, CILL, and Allowances that are a percentage of the Basic e.g., USD allowance that is 10% of the Basic. For example: - Select the Transaction code and click Change. - Tick ‘Multi currency split’

Click ‘Ok’ to save.

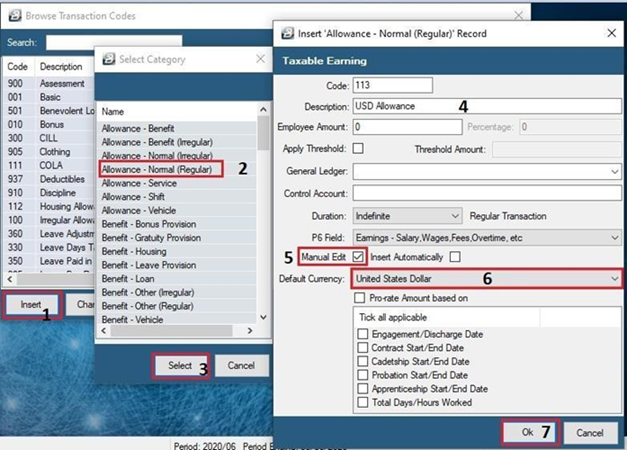

Setting up Allowance(s) if any - Whilst in the transaction codes window - Click on 'Insert' - Then highlight Allowance – Normal (Regular) or (Irregular) depending on how the transaction is supposed to work. - Click on 'Select' - Change the transaction description. - Make sure that the ‘Manual Edit’ check box is ticked. - Ensure that the ‘Default Currency’ is to United States Dollar or ZiG - Click on 'OK'

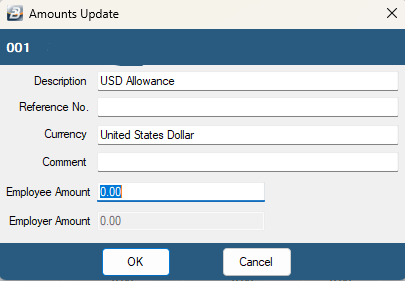

Step 7: Processing the allowanceGo to ‘Process’ > ‘Payslip Input’ - Select the employee to have the allowance. - Click on insert and the allowance created earlier

Note the input currency is required in United States Dollars as denoted by the currency field. When on the payslip the value is converted to ZiG Dollars

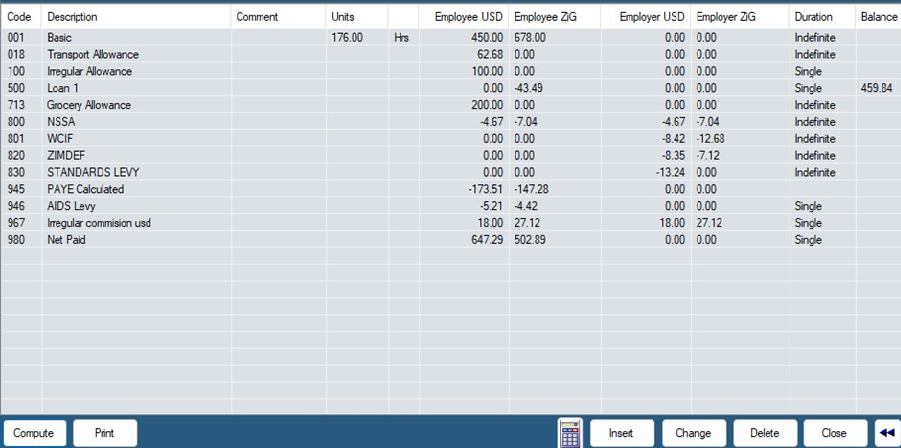

Once input of the allowances is complete run the calculation routine by clicking on ‘Process’ > ‘Calculation Routine’ Menus

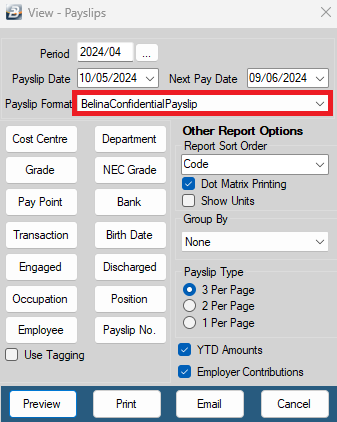

Step 8: Viewing ReportsPayslips To view payslips, go to: - ‘View’, ‘Payslips’ and then ‘Payslip Print’ menus - Select ‘BelinaConfidentialForexSplit’ as the payslip format - Change any parameters as necessary - Click on 'Preview'

Selecting the currency to view reports in - Go to 'Setup', 'Global Defaults', Currency - Tag the Reports in Foreign Currency option and select the currency you wish to view the report in - Click on 'Ok'

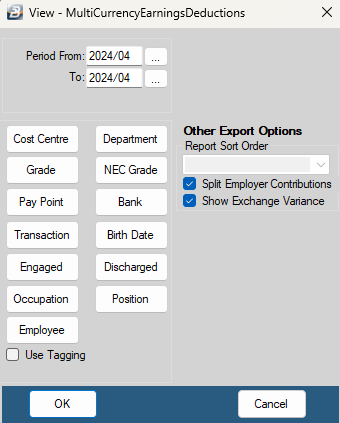

Multicurrency reports To view Multicurrency Export that show the split in currencies, go to; ‘View’ , ‘Multicurrency’

For Data export in multicurrency format Go to: 'Utilities','Exports' ,' MultiCurrency' and then Transactions

|