The ITF16 is a report designed by ZIMRA that summarizes the P6 details for all the employees in the organization and is used by them to audit the tax calculation. Every registered employer is required to submit this return of all employees detailing their salaries, wages, allowances, benefits and pension deductions.

The ITF16 summarizes payroll transactions under P6 headings. This information is reported in the ITF16 as well as the P6 form. The file that is generated has a ".f16" extension. You can save the file onto disk and send it by hand to ZIMRA. Alternatively you can email it as an attachment to them on FHarare@zimra.co.zw (alternatively fds.harare@zimra.co.zw). It is important to ensure that the file is acknowledged as having been received by ZIMRA. The file can also be hand delivered. In Harare disks can be submitted at Kurima House along Nelson Mandela Avenue between 3rd and 4th Street In other centres check with ZIMRA offices. |

![]() Checks Prior to export of ITF16 File

Checks Prior to export of ITF16 File

Checks that should be done before exporting the ITF16 file: - Print the ITF16 report - To do this go to the 'View', 'Tax', 'ITF16' menu options - Enter the organizational details into the ITF16 Report header form.

- Once printed, check that the ITF16 has the correct number of employees. - Check the P6 field setup for each of the Transaction Codes in the system. - Check the accumulated totals on the payslip summary against a printout of the ITF16 ensuring that the ITF16 groups each of the figures on the summary in the correct column |

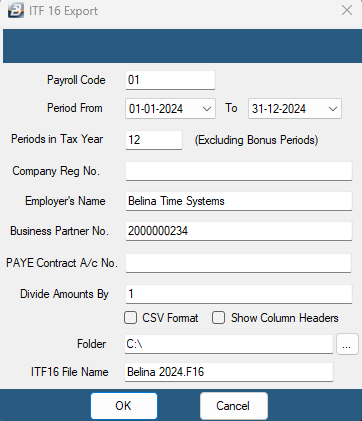

- Please note that for local currency payrolls, a tax split was implemented when the Zimbabwe Gold currency was introduced. As a result, when exporting the ITF16, you will need to generate one export for the period from January to March period and a second one for the period April to December 2024. - For payrolls originally in local currency (Zimbabwe Gold) that were switched to Multicurrency payrolls, a tax split is required when exporting the ITF16. This should be done for periods before the payroll conversion and again after the conversion. If the conversion took place after the introduction of the new Zimbabwe Gold currency, three ITF16s must be exported: one for the period from January to March, another from April until the last month processed in local currency, and the final one from the month the Multicurrency was implemented through to December. - If you converted an existing USD payroll to Multicurrency, no tax split will be required on your ITF16, as both the USD payroll and the Multicurrency payroll use USD tax bands. To export the ITF16 file: - Go to the 'Utilities', 'Exports', then 'Export ITF16' menu options - Select from the dropdown menu under 'Period From' the tax year that you want to export - The system will automatically select the correct number of periods in the tax year for you. - Fill in your organizational details - On Business Partner number please insert the company's Tin number.

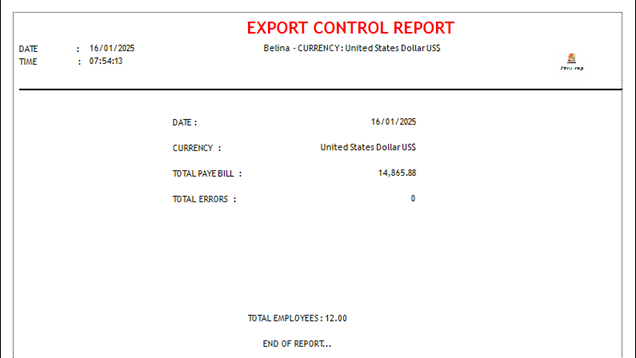

- Select the destination of your export file - Press 'OK' - Preview the Export Control report which should show the total PAYE amounts for the tax year.( This should tally with the summation of PAYE and Tax/Aids Levy for the same tax year/period)

- Follow through the prompts until the ITF16 is saved

|

Please obtain, and confirm, the email address to use for the submission of your ITF16 file from your local ZIMRA office or from your Zimra Liaison Officer . The following email addresses are given in the absence of you being able to obtain FDS Email Addresses and were current at the time of writing. |

When the ITF16 file is presented to ZIMRA they import it into their system. This produces a listing of variances. This listing variance is used to make adjustments by recovering any under-deductions from the employee, or re-reimbursing amounts, as appropriate. Prior Period To process the Adjustment into History Data: •Go to the 'Utilities', 'Data Management', 'History data', 'History File Maintenance' menu options •Select the employee for whom an adjustment is required. •Select the last period from the previous tax year (or another period if preferred) into which the adjustment is to be processed. To do this use the drop down menu in the top right-hand corner of the screen (e.g. 2012/12 or 2012/52 for 2012). •Press the 'Tab' key on your keyboard to bring up the employee's details. •Click 'Insert' and select the 'PAYE Adjustment' code. •Enter the amount of the adjustment (Use a minus sign if the employee was under taxed). •Click on 'OK'. - Close the window that's open.

Repeat these steps for each employee in the payroll that is being adjusted.

Current Period

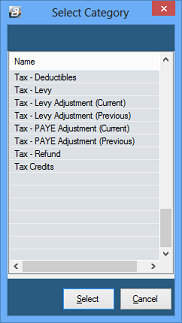

Create Transaction Codes using Tax Adjustment Transaction Categories designed for the purpose. This is important. If an adjustment is not processed using an adjustment code the amount of tax being processed will be incorrectly included in the current year tax calculation and give an incorrect result. The adjustment Transaction Categories are shown:

|

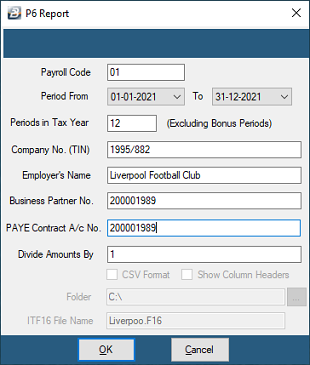

Once ZIMRA has audited the ITF16 file and any adjustments necessary have been made, then you may print your P6's as follows: •Go to 'View', 'Tax', then to 'P6' menu options •Fill in your organizational details

•Click 'OK' •Select the Range of employees to be included in the print •Press Preview, or print, as required.

Print 3 copies (One for the company, one for the employee and one for ZIMRA). |