Instructions on how to export your ITF16 File

Please note that for local currency payrolls, a tax split was implemented when the Zimbabwe Gold currency was introduced. As a result, when exporting the ITF16, you will need to generate one export for the period from January to March period and a second one for the period April to December 2024.

- For payrolls originally in local currency (Zimbabwe Gold) that were switched to Multicurrency payrolls, a tax split is required when exporting the ITF16. This should be done for periods before the payroll conversion and again after the conversion. If the conversion took place after the introduction of the new Zimbabwe Gold currency, three ITF16s must be exported: one for the period from January to March, another from April until the last month processed in local currency, and the final one from the month the Multicurrency was implemented through to December.

- If you converted an existing USD payroll to Multicurrency, no tax split will be required on your ITF16, as both the USD payroll and the Multicurrency payroll use USD tax bands.

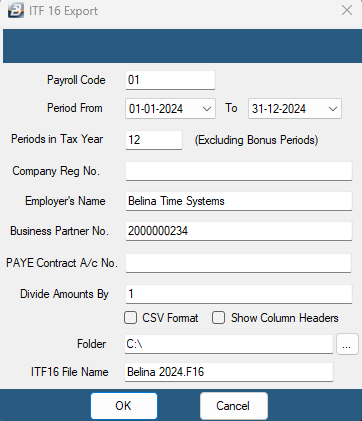

To export the ITF16 file:

- Go to the 'Utilities', 'Exports', then 'Export ITF16' menu options

- Select from the dropdown menu under 'Period From' the tax year that you want to export

- The system will automatically select the correct number of periods in the tax year for you.

- Fill in your organizational details

- On Business Partner number please insert the company's Tin number.

- Select the destination of your export file

- Press 'OK'

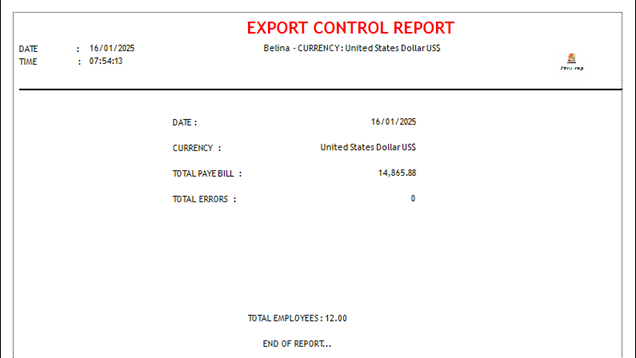

- Preview the Export Control report which should show the total PAYE amounts for the tax year.( This should tally with the summation of PAYE and Tax/Aids Levy for the same tax year/period)

- Follow through the prompts until the ITF16 is saved

- Please contact your Zimra Liaison Officer for instructions on how to submit your ITF16