To Adjust - History Data:

Click to play

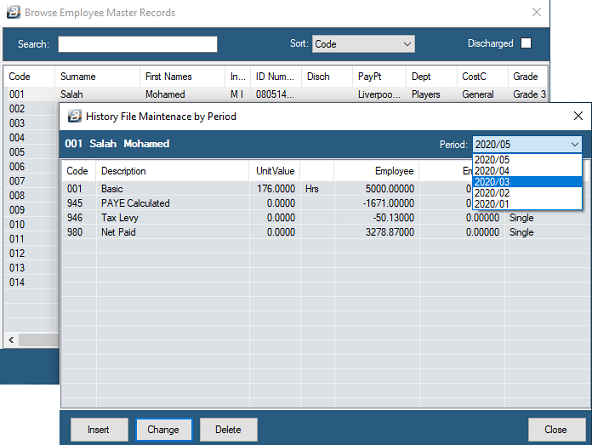

The payroll Administrator may need to made adjustments to History Data when: •Implementing a New Payroll to capture prior period transactions and balances, and •Adjustments in prior periods.

In order to access this feature the Administrator will need to enter their administrator Username and Password.

Implementing a New Payroll Use the adjustment feature to capture history information for a new employee. Transactions, or cumulative totals, from prior periods are captured to enable the correct computation of FDS tax. This is necessary because FDS uses year to date earnings values to correctly project earnings and the tax payable.

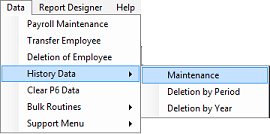

Steps necessary to Adjust, Insert or Delete Transactions in Previous Periods.

Prior Period Adjustments There may be occasion to go into the history records of an employee and make adjustments. Adjustments of this nature are uncommon. An example of where an adjustment may be required is where remuneration was made outside the payroll which needs to be processed in history of the payroll for FDS tax audit purposes thus ensuring that the overall record of remuneration received is correct.

This is a sensitive area and strict security measures are available to ensure that only authorized personnel have the ability to make the changes that are required. See the Security section of this manual. |