To reverse a prior period pension deduction:

Click to play

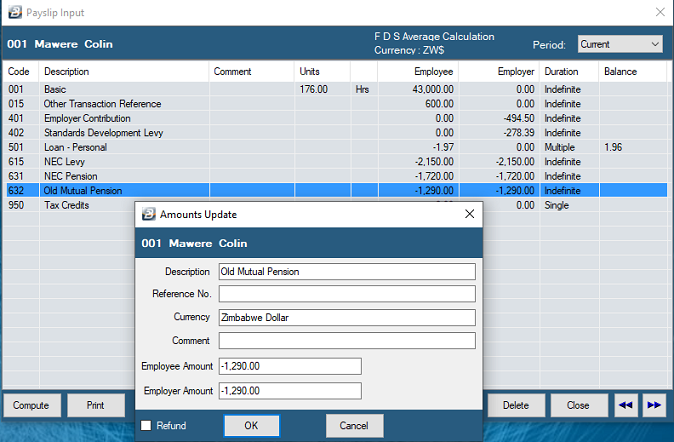

To reverse, or adjust, an over or under deduction of pension in a closed period:

- Go to Payslip Input

- Select the employee whose pension amount is to be adjusted

- Select the Transaction Code to be adjusted

- Place a tick against 'Refund'. This will reverse the sign of transaction

- If the amount to be reversed is not the full amount of the deduction then the amount may be edited as long as there has been a tick placed against 'Manual Edit' in the setup of the Transaction Code. This will enable the amount to be edited during processing.

Another method would be to create a separate pension code, if it is to be applied across a group of employees in the payroll. Process the amount using that Transaction code, but remember to delete the code in the next period since it will come through as a recurring transaction.