Use the 'Deduction - Pension' Transaction Category to set up a code to process pension deductions. Pension contributions can be calculated as a percentage or as an amount for the employee and employer. The percentages apply to to the Basic set up in the Employee Master, the NEC Grade or Grade rate for the employee. This Transaction Category is used to create a NSSA Pension, or any other pension deduction code taking into account the pension tax free deduction amount.

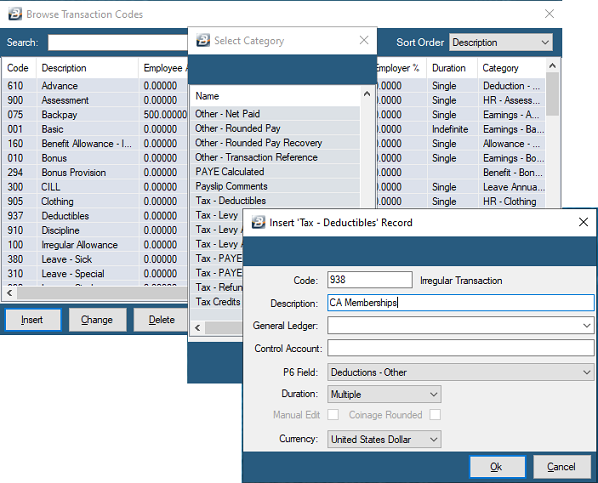

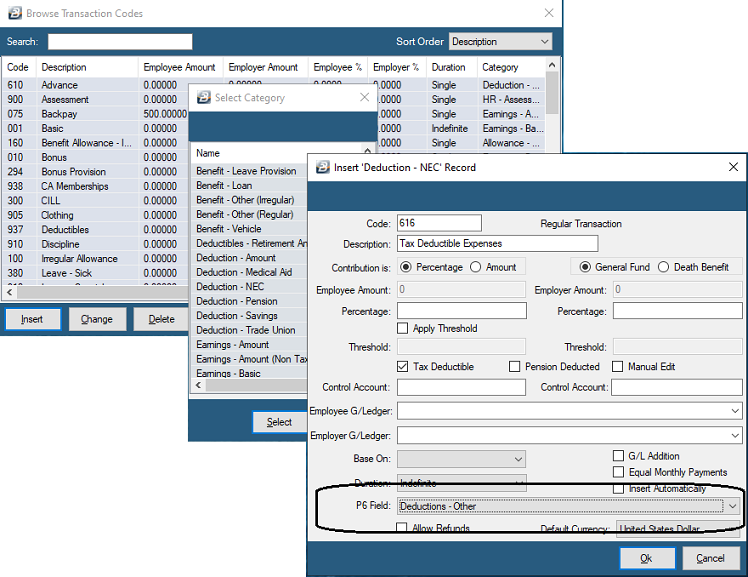

To create a 'Deduction - Pension' Transaction Code:

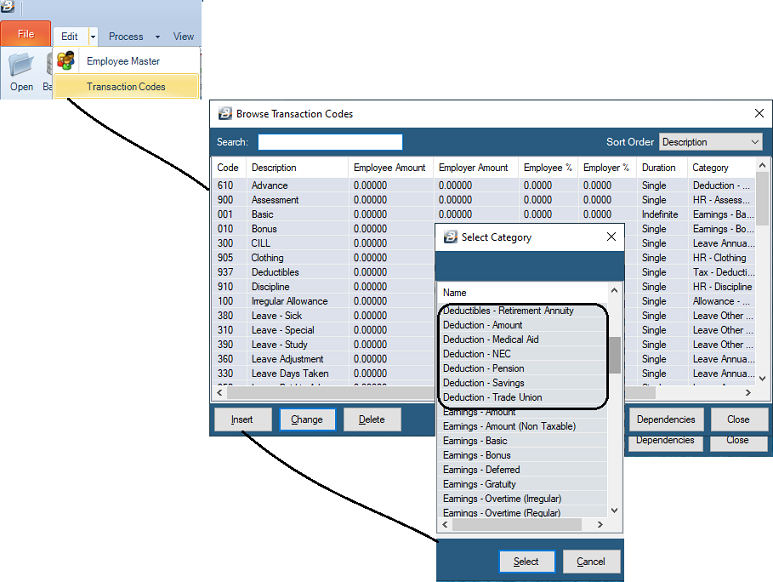

- Go to the 'Edit' , 'Transaction Codes' menu options.

- Click 'Insert' and select the Transaction Category 'Deduction - Pension' Transaction Code.

- Accept/ Change the default 'Code'. This is a unique identifier for the Transaction Code and the numbers are designed to group similar types of transaction together.

- Enter an appropriate 'Description'.

- Select whether the pension contribution will be a calculated as a percentage of basic or an amount entered.

- Enter the 'Employee Amount' if the payment is a standard amount. If the amount varies leave blank and place a tick against 'Manual Edit' which allows the entry of an amount when processing, or.

- Enter the 'Percentage' to be applied.

- Apply Threshold:

|

A threshold can be applied to limit the maximum contributions of employers and employee when setup as a percentage contribution e.g. percentage up to a specified maximum amount.

|

- Select the 'General Ledger' Code to be entered onto journal reports and exports.

- 'Base On' - If the contribution is being calculated as a percentage of basic, then select whether the amount should be based on basic entered in the Employee Master, Internal Grade Rate or Grade Rate.

- Tick 'G/L Addition' if you would like the Employee and Employer General Ledger contribution amounts to be added together to make one entry

- Set the 'Duration' - whether the transaction is to come through for a 'Single', 'Multiple' or 'Indefinite' number of periods.

- Tick 'Insert Automatically' to have the Transaction Code included automatically on new employee's payslips.

- Set the 'P6 Field' for year end ITF16 export.

- Set 'Manual Edit' if you would like to be able to enter, or change, the amount of the Allowance when processing.

- Set the 'Default Currency' that this transaction code will be paid in.

- Click 'Ok' to save the new Transaction Code..

Apply Threshold

|

The Maximum pension contribution can be set for both the Employee and Employer contribution. These limits are used when setting up National Social Security Authority (NSSA). The NSSA contribution percentage has been set at 3% with the threshold changing periodically. In a weekly payroll apportion the threshold (12 / 52), likewise for fortnightly payrolls (12 / 26).

|

Pension Deduction

|

Pension contributions, up to a limit, are tax deductible. The amount is gazetted each year and is setup under Tax Parameters

|

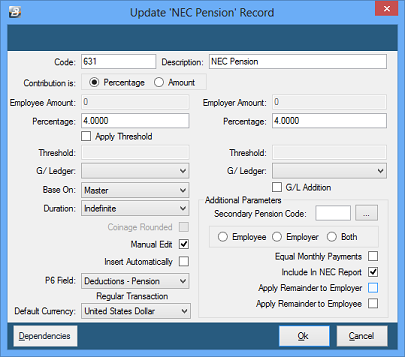

Secondary Code

|

Use the 'Secondary Pension Code' if the pension contribution is reduced by the amount of a contribution to another pension scheme such as NSSA. Use the ellipsis button to select the pension code that is being taken into account and select whether the employee, employer or both contributions are affected.

|

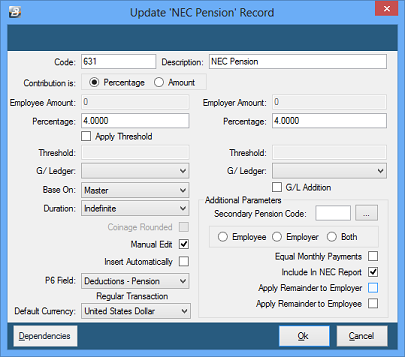

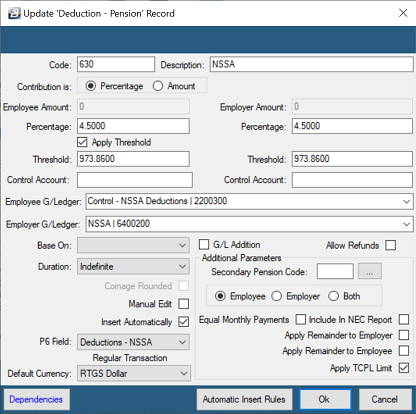

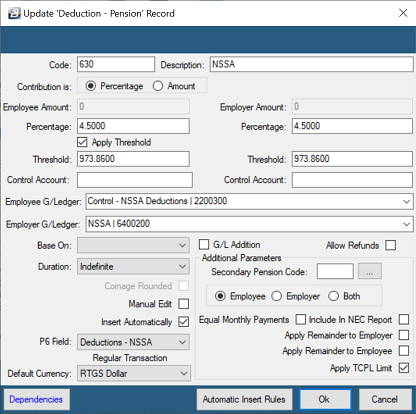

National Social Security Authority (NSSA)

NSSA contributions are set up using the pension transaction code. The percentage deduction as of 1 January 2020 is 4.5% for the employee and 4.5% for the employer giving a total contribution of 9%. The current threshold is ZW$5000 per month giving a maximum contribution of $225 per month. The following is a sample NSSA Transaction Code setup where the thresholds have been applied and Equal Monthly Payments selected.

Use the 'Automatic Insert Rules' to specifiy that the 'Insert Automatically' only applies to Permanent employees.

To Create a NSSA Transaction Code

Click to play

- Go to the 'Edit' , 'Transaction Codes' menu options.

- Click 'Insert' and select the Transaction Category 'Deduction - Pension' Transaction Code.

- Accept/ Change the default 'Code'. This is a unique identifier for the Transaction Code and the numbers are designed to group similar types of transaction together.

- Enter an appropriate 'Description'.

- Select whether the pension contribution will be a calculated as a percentage of basic or an amount entered.

- Enter the 'Employee Amount' if the payment is a standard amount. If the amount varies leave blank and place a tick against 'Manual Edit' which allows the entry of an amount when processing, or.

- Enter the 'Percentage' to be applied.

- Apply Threshold:

|

A threshold can be applied to limit the maximum contributions of employers and employee when setup as a percentage contribution e.g. percentage up to a specified maximum amount.

|

- Select the 'General Ledger' Code to be entered onto journal reports and exports.

- 'Base On' - If the contribution is being calculated as a percentage of basic, then select whether the amount should be based on basic entered in the Employee Master, Internal Grade Rate or Grade Rate.

- Tick 'G/L Addition' if you would like the Employee and Employer General Ledger contribution amounts to be added together to make one entry

- Set the 'Duration' - whether the transaction is to come through for a 'Single', 'Multiple' or 'Indefinite' number of periods.

- Tick 'Insert Automatically' to have the Transaction Code included automatically on new employee's payslips.

- Set the 'P6 Field' for year end ITF16 export.

- Set 'Manual Edit' if you would like to be able to enter, or change, the amount of the Allowance when processing.

- Set the 'Default Currency' that this transaction code will be paid in.

- Click 'Ok' to save the new Transaction Code..

More:

|