There are relatively few opportunities to be able to process a deduction against income in the calculation of PAYE.

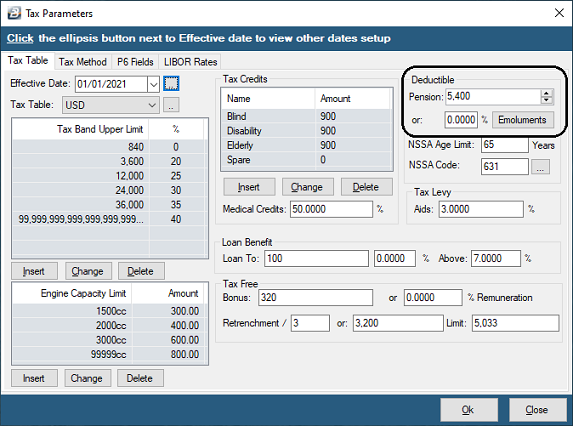

Amounts paid to a registered pension scheme are tax deductible up to a specified maximum amount that is announced each year in the Ministry of Finances' annual budget. That amount is setup under the tax parameters.

The pension deduction amount can be setup manually, but it can also be done automatically by installing the software update released after the gazetting of annual budget amounts at the end of each tax year.

To set up the deduction manually: •Go to the 'Setup' and then 'Tax' menu options •Ensure that the 'Deductible Pension' parameters have been correctly setup

|

Feature currently being introduced. |

![]() Professional Fees and Subscriptions

Professional Fees and Subscriptions

To process Professional Fees and Subscriptions incurred by the employee outside the payroll. |