Tax Credits are available to elderly, blind or disabled taxpayers. Credits are also given for approved medical expenses incurred.

The credits are used to directly reduce the calculated amount of Tax Payable. In the past tax credits were only available to employees being taxed using FDS methods of calculating tax.

Now tax credits are available to all employees, including those engaged during the tax year who have their tax calculated using the PAYE method. In these instances the amount of the credit is pro rata'd from the date of engagement.

The value of the tax credit is deducted from the final Tax Payable amount, that has been calculated after having taken the Taxable Income through the tax bands.

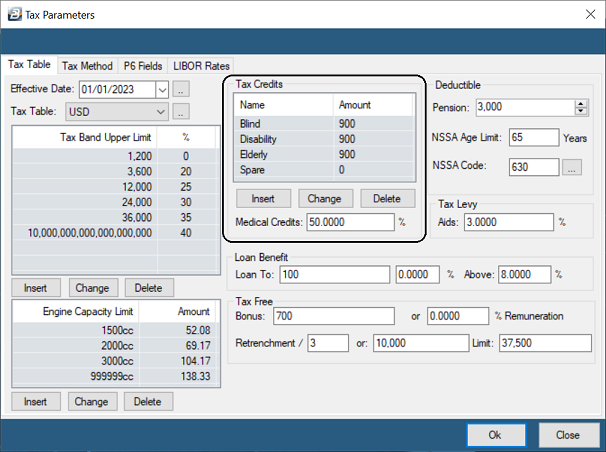

The credits available (effective 1 January 2023) are:

Blind

|

$900 per annum ($75 per month)

|

Disabled

|

$900 per annum ($75 per month)

|

Elderly

|

$900 per annum ($75 per month)

|

Medical expenses

|

50% of the expense incurred

|

Notes:

- Employees can receive either the Blind or Disabled Credit, not both

- The Elderly credit is apportioned in the year of commencement

- The Medical Expenses Credit may be claimed on payments for invalid appliances, consultation fees, drugs and medicines.

- Non-residents can claim for medical aid contributions but not other medical expenses.

- Different amounts apply for ZiG payrolls. Contact Belina support for assistance.

Blind, Disabled and Elderly Tax Credit

Blind, Disabled and Elderly Tax Credit

BLIND CREDIT

Blind credits are available to those that have obtained a tax directive from ZIMRA. The amount of the credit is determined in the annual budget. Any portion of the tax credit that is not used by the taxpayer may be transferred to the spouse, if any.

DISABLED

Disabled credits are available to those that have obtained a tax directive from ZIMRA. In order to qualify for this credit the employee should obtain a medical certificate if the disability is not visible and take it ZIMRA for them to process. A credit of the specified amount shall be deducted from the income tax from which a taxpayer is chargeable, where it is proved that the taxpayer is mentally or physically disabled to a substantial degree, but is not blind. Disabled person’s credit is not applicable to non-residents and blind taxpayers.

ELDERLY

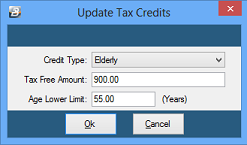

Employees that turn 55 prior to the commencement of the tax year are eligible to receive a full elderly tax credit. Those that turn 55 during the year of assessment will have the amount pro-rated. Care should be taken in entering the dates of birth of employees to ensure that only legitimate employees receive the credit. Proof of date of birth is available on the National ID card and on the birth certificate. Copies of these documents should be put on file.

LIMITATION

•Total amount of credits is limited to the total income tax chargeable to a taxpayer. •No refunds are given where credits exceed income tax chargeable.  Blind, Disabled and Elderly Tax Credit Setup Blind, Disabled and Elderly Tax Credit Setup

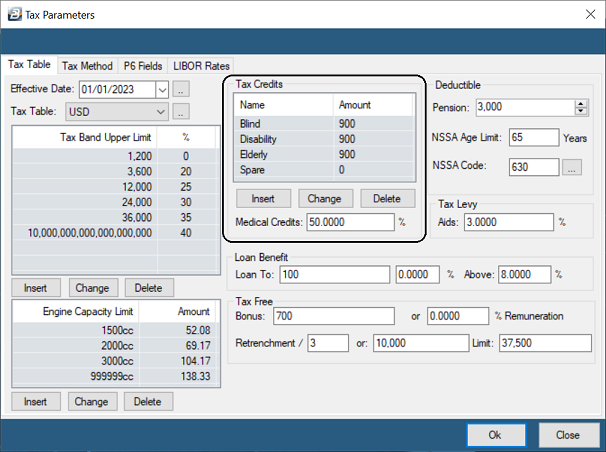

The Blind, Disabled and Elderly credits amounts can be setup manually, but are updated automatically, together, with other tax parameters, when a software update is installed after the annual budget is announced at the end of each tax year.

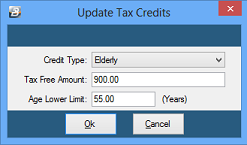

To set up the Blind, Disabled and Elderly credits manually:

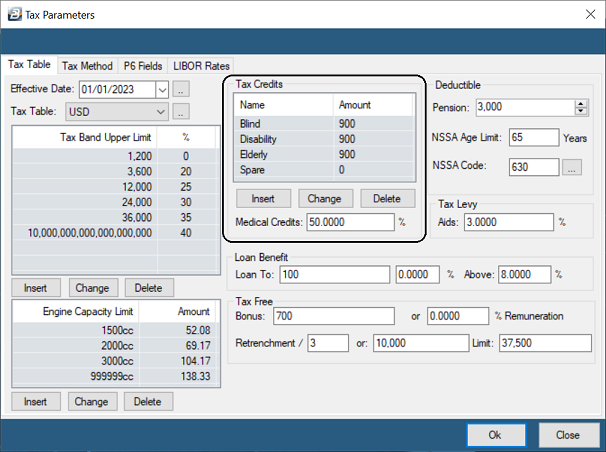

•Go to the 'Setup', then 'Tax' menu options •Under the 'Tax Table' tab go to the section 'Tax Credits'

•Highlight 'Blind' and click on 'Change' then enter the current credit amount •Highlight 'Disabled' and click on 'Change' then enter the current credit amount •Highlight 'Elderly' and click on 'Change' then enter the current credit amount . Also set the 'Age Lower Limit' for this credit to apply (55 years - in the 2023 tax year)

|

Blind, Disabled and Elderly - Employee Setup Blind, Disabled and Elderly - Employee Setup

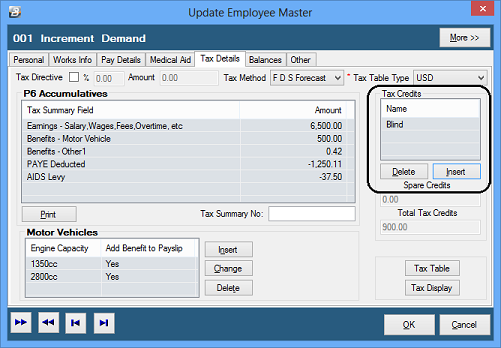

In order for credits to come through for employees that are eligible for Elderly, Blind and Disabled credits the employee master records need to be setup.

To do this:

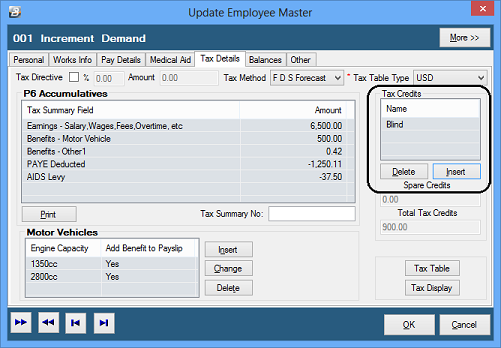

•Go to the 'Edit', then 'Employee Master' menu options •Select the employee affected •Ensure that the 'Date of Birth' has been correctly setup. •This will ensure that the Elderly credit will come through automatically, if applicable.

To continue and enter a Blind or Disability credit, if applicable

•Go to the 'Tax Details' Tab

•Press 'Insert' in the 'Tax Credits' section •Select 'Blind' and/ or 'Disability'

To check that the credits are coming through properly check the Tax Display for the individual.

|

Blind, Disabled and Elderly Processing Blind, Disabled and Elderly Processing

Elderly, Blind and Disabled credits come through automatically. There is no specific processing required. Once these credits have been correctly setup for the employee they will continue to do so indefinitely.

To check that the credits are coming through properly check the Tax Display for the individual.

|

|

Medical Credits

Medical Credits

An employee is entitled to a 50% credit for the value of Medical expenses and/or Medical Aid Contributions paid. This includes payments for immediate family (first spouse and minor children).

When processing insert the full amount of the expense. Belina will compute the 50% credit if it has been setup correctly under the 'Setup', then 'Tax' menu options.

VOUCHERS

Medical expenses must be supported by valid invoices and/ or receipts from: - Registered Clinics - Hospitals - Pharmacies for prescription drugs. The employee should submit the supporting voucher which should then be kept on file for ZIMRA audit.

Medical expenses credit on payment for invalid appliances, consultation fees, drugs and medicines are not available to non-residents. However, medical aid contributions are allowable to non-residents.

The Medical credit applies to payments by a taxpayer covering the taxpayer, the spouse and minor children but not dependents.

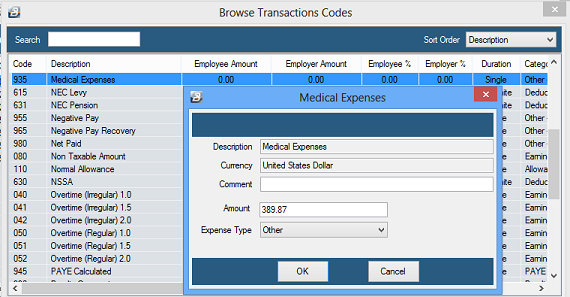

Medical Expense Transaction Code Setup Medical Expense Transaction Code Setup

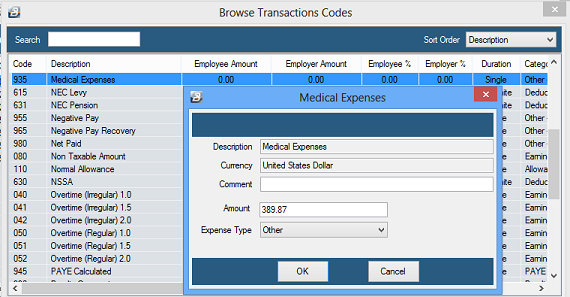

Check whether a Medical Expense Transaction Code exists (Code 935).

- If not, create one by going to the 'Edit', then 'Transaction Codes' menu options

- Click 'Insert'

- Select 'Other - Medical Expenses'

- Enter/ change the default details

- Click 'Ok'

To process a medical credit:

- Go to the 'Process, then 'Payslip Input' menu options

- Select the employee

- Click 'Insert'

- Browse for your 'Medical Expenses' Transaction Type (Code - 935)

- Enter a 'Comment', if appropriate.

- Enter the amount (the whole expense amount)

- Use the dropdown menu to select the 'Expense Type'

- Click 'Ok'

The medical expense will come through on the employee's 'Employee Input' screen and will also be reflected on the FDS Tax Display .

|

Medical Credit Setup Medical Credit Setup

To do this:

•Go to the 'Setup', then 'Tax' menu options •Under the 'Tax Table' tab enter 50% against 'Medical Credits'.

When this is done medical expenses processed on the payroll will receive a 50% tax credit. Shortfalls or medical aid contributions (employee contribution for the member, spouse and minor children) are to be processed for an employee the employee will get 50% of the processed amounts as a tax credit.

|

Processing Medical Expenses Processing Medical Expenses

To process Medical Expenses :

•Go to the 'Process', then 'Payslip Input' menu options •Select the employee •Click 'Insert' •Browse for your medical expenses code, usually Code 935 •Enter the amount (the whole expense amount)

•Select 'Expense Type' •Click 'Ok'

The credit will offset immediately for the employee, and spread over the tax year. The Tax Payable in the current period will be reduced. Any balance will be carried forward into subsequent period/s until fully utilized.

To check that the medical expense credits are coming through properly check the Tax Display for the individual.

FILING - MEDICAL EXPENSES

Medical Expenses should only be processed if there is a valid, official, invoice/ receipt as proof of payment. File these vouchers for possible future audit purposes.

|

|

![]() Blind, Disabled and Elderly Tax Credit

Blind, Disabled and Elderly Tax Credit