Audit Adjustments

Adjustments are most often processed when a tax audit has been conducted and ZIMRA determine that there have been over and/or under deductions of tax then adjustments need to be processed.

Adjusting for payments received outside the payroll

If an employee incurs a tax liability outside the payroll it cannot be adjusted within the payroll. The tax amount processed would affect the FDS tax computation. The system would include the adjustment in the amount of tax payable on payroll transactions and would in the end return the adjustment amount to the employee. It is suggested that the payment be made outside the payroll and a separate receipt received.

Prior Year Adjustments

In the prior year process the amounts of the adjustment to each individual using 'PAYE Adjustment (Previous)' and 'Levy Adjustment (Previous)' Transaction Codes so that the ITF16 and P6 information agree to the correct PAYE amounts determined by ZIMRA.

Current Year Adjustments

In the current year process the impact of the adjustment of the prior year in the current payroll using 'PAYE Adjustment (Current)' and 'Levy Adjustment (Current)'.

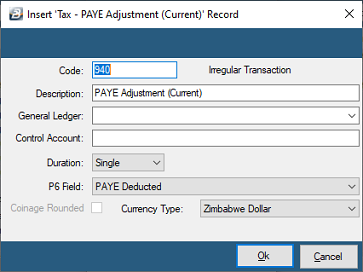

![]() Tax - PAYE Adjustment (Current)

Tax - PAYE Adjustment (Current)

There may be instances where it may be necessary to adjust the PAYE amount accumulated for the current year. Circumstances where this is necessary are very rare. We have had instances where clients have taken on history data from another system and not separated PAYE and Aids levy. This distinction is necessary for FDS calculations, thus the facility to process this type of adjustment.

To create an 'Tax - PAYE Adjustment (Current)' Transaction Code: - Go to the 'Edit' , 'Transaction Codes' menu options. - Click 'Insert' and select the Transaction Category 'Tax - PAYE Adjustment (Current)' . - Accept/ Change the default 'Code'. - Enter an appropriate 'Description'. - Select the 'General Ledger' Code to be entered onto journal reports and exports. - Set the 'Duration' - whether the transaction is to come through for a 'Single', 'Multiple' or 'Indefinite' number of periods. - Set the 'P6 Field' for year end ITF16 export. - Select whether the Transaction Code should be inserted automatically onto every payslip on the payroll. - Click Ok to save the new Transaction Code.

More: |

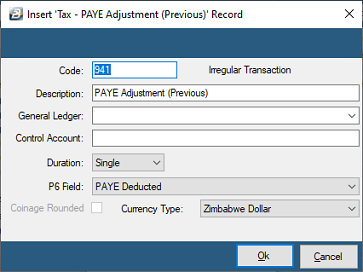

![]() Tax - PAYE Adjustment (Previous)

Tax - PAYE Adjustment (Previous)

When disks have been submitted to ZIMRA for audit for a prior year, a schedule is produced of over or under deduction of PAYE. In the case of an under payment of tax process a deduction from the employee in the current payroll period and then adjust the the PAYE in the previous year. This will ensure that the ITF16 and P6 reflects the adjusted amount that ZIMRA require.

To create an 'Tax - PAYE Adjustment (Previous)' Transaction Code: - Go to the 'Edit' , 'Transaction Codes' menu options. - Click 'Insert' and select the Transaction Category 'Tax - PAYE Adjustment (Previous)' . - Accept/ Change the default 'Code'. - Enter an appropriate 'Description'. - Select the 'General Ledger' Code to be entered onto journal reports and exports. - Set the 'Duration' - whether the transaction is to come through for a 'Single', 'Multiple' or 'Indefinite' number of periods. - Set the 'P6 Field' for year end ITF16 export. - Select whether the Transaction Code should be inserted automatically onto every payslip on the payroll. - Click Ok to save the new Transaction Code.

More: |

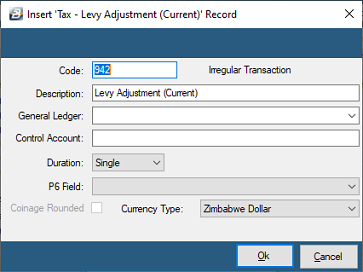

![]() Tax - Levy Adjustment (Current)

Tax - Levy Adjustment (Current)

There may be instances where it may be necessary to adjust the Aids Levy amount accumulated for the current year. Circumstances where this is necessary are very rare. We have had instances where clients have taken on history data from another system and not separated PAYE and Aids levy. This distinction is necessary for FDS calculations, thus the facility to process this type of adjustment.

To create an 'Tax - Levy Adjustment (Current)' Transaction Code: - Go to the 'Edit' , 'Transaction Codes' menu options. - Click 'Insert' and select the Transaction Category 'Tax - Levy Adjustment (Current)'. - Accept/ Change the default 'Code'. - Enter an appropriate 'Description'. - Select the 'General Ledger' Code to be entered onto journal reports and exports. - Set the 'Duration' - whether the transaction is to come through for a 'Single', 'Multiple' or 'Indefinite' number of periods. - Set the 'P6 Field' for year end ITF16 export. - Click Ok to save the new Transaction Code.

More: |

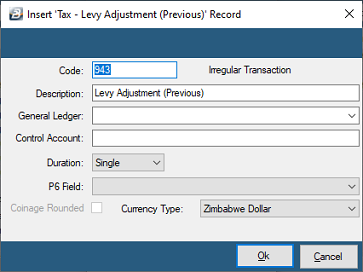

![]() Tax - Levy Adjustment (Previous)

Tax - Levy Adjustment (Previous)

When ITF16 information has been submitted to ZIMRA for audit for a prior year, a schedule is produced of over or under deduction of taxation deductions, including Aids levy. In the case of an under payment of tax process a deduction from the employee in the current payroll period and then adjust the the Aids Levy in the previous year. This will ensure that the ITF16 and P6 reflects the adjusted amount that ZIMRA require.

To create an 'Tax - Levy Adjustment (Previous)' Transaction Code: - Go to the 'Edit' , 'Transaction Codes' menu options. - Click 'Insert' and select the Transaction Category 'Tax - Levy Adjustment (Previous)'. - Accept/ Change the default 'Code'. - Enter an appropriate 'Description'. - Select the 'General Ledger' Code to be entered onto journal reports and exports. - Set the 'Duration' - whether the transaction is to come through for a 'Single', 'Multiple' or 'Indefinite' number of periods. - Set the 'P6 Field' for year end ITF16 export. - Select whether the Transaction Code should be inserted automatically onto every payslip on the payroll. - Click Ok to save the new Transaction Code.

More: |

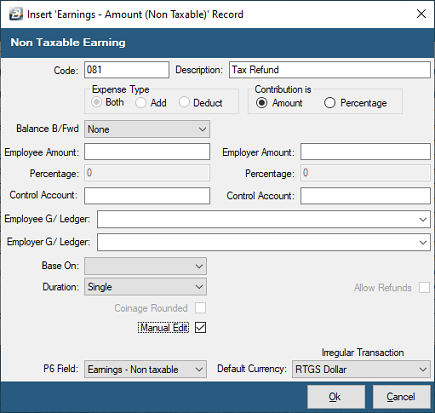

The FDS Tax calculation takes into account tax paid to date. If there has been an over-deduction of tax during the year to date the system will automatically reduce the tax deduction to zero, if it is necessary however, to make a refund for an amount larger than that which would occur automatically in the current period then use this Transaction Code to process the refund.

To create an 'Tax - Refund' Transaction Code: - Go to the 'Edit' , 'Transaction Codes' menu options. - Click 'Insert' and select the Transaction Category 'Earnings - Amount (Non Taxable)'. - Accept/ Change the default 'Code'. - Enter an appropriate 'Description'. - Select the 'General Ledger' Code to be entered onto journal reports and exports. - Set the 'P6 Field' for year end ITF16 export. - Click Ok to save the new Transaction Code.

More: |