The FDS Tax calculation takes into account tax paid to date.

If there has been an over-deduction of tax during the year to date the system will automatically reduce the tax deduction to zero, if necessary, in subsequent periods. If the refund is greater than the amount of PAYE in the current period then allowing Calculated Tax Refunds will enable the system to make a payment to the employee of the total amount of the over-deduction of PAYE.

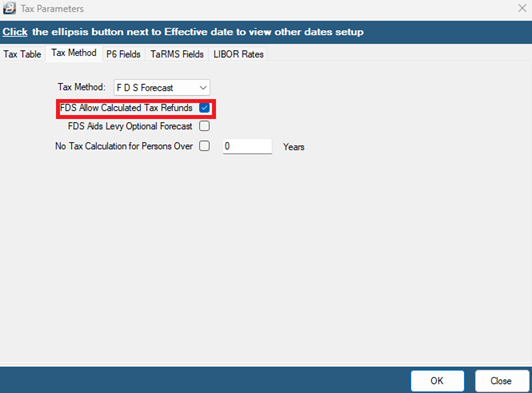

If a full refund is to be made immediately of the over-deducted amount tick 'FDS Allow Calculated Tax Refunds'.

To do this:

- Go to the 'Setup' then 'Tax' menu options

- Select the 'Tax Method' tab

- Place a tick against 'FDS Allow Calculated Tax Refunds'

The approval of allowing such a transaction to be be processed would depend on the circumstances of the original over-deduction. We suggest that this only be done if there is a tax directive issued by ZIMRA or with in consultation with a reputable tax consultant.