Often the payroll is used to collect monies from employees on behalf of credit stores and other third parties. To do this a Transaction Code is setup for the third party and the deduction processed. The organization then pays over the total amount deducted from all the employees. When this is done a breakdown of the total deduction amount can be supplied together with the names and the third party's account number for each person for whom a deduction has been made.

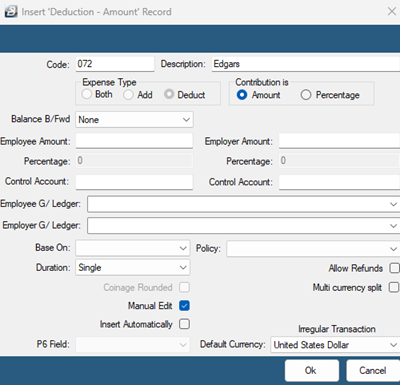

Step 1: To set up the Transaction Code that will be used to collect third party deductions:

- Go to the 'Edit', then 'Transaction Codes' menu options

- If the code does not already exist press the 'Insert' button

- Select the Transaction Category 'Deduction - Amount'

- Enter the name of the Third Party, example 'Edgars Credit Stores'

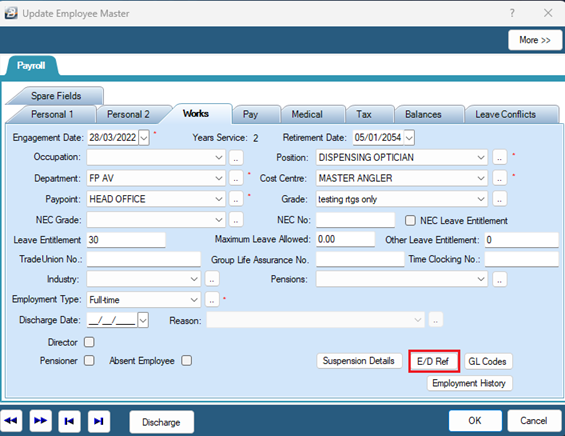

Step 2: To enter the third party account number for each employee:

- Go to the 'Edit', then 'Employee Master' menu options

- Select the employee

- Go to the 'Works Info' Tab

- Click on the 'E/D Ref' button at the bottom of the screen

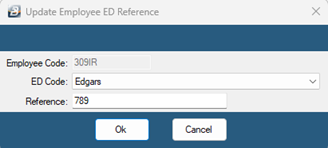

- Press 'Insert'

- Use the dropdown menu to select the Transaction Code used in making the transfer to the third party

- Enter the 'Reference' (Account Number)

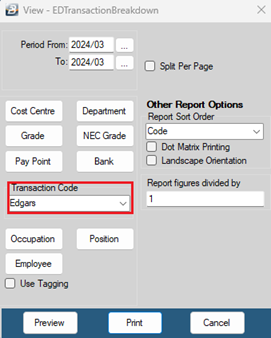

Step 3: To print the report:

- Go to the 'View', 'Transactions', 'Breakdown', 'By Transaction' menu options

- Use the dropdown menu to select the Transaction Code

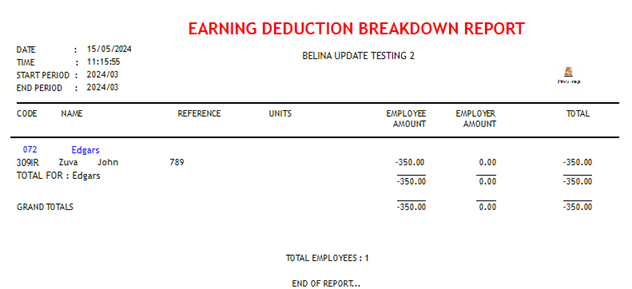

- Press 'Ok' and see an example report below:

Note the column 'REFERENCE' which details the account number for each of the employees that had a transaction processed for the third party.