Pay advances would normally be made outside of the payroll during the course of a period and be recovered at payday. In some cases the recovery may be made in a subsequent period. Loans have a tax implication. Advances made during the period could be argued do not require the processing of a tax benefit, but if the advance is recovered in a subsequent period this is more difficult.

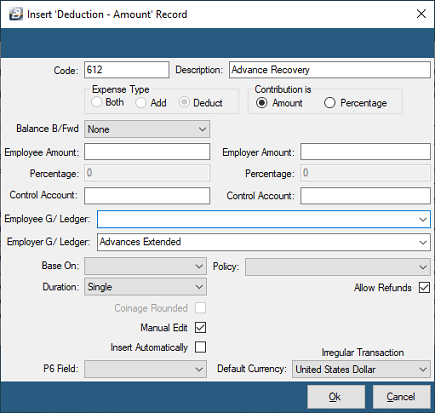

To process an advance recovery ensure that an Advance Recovery Transaction Code has been created. To do this:

•Go to the 'Edit', 'Transaction Codes' menu options

•Check to see if there is an advance recovery transaction setup, if not then

•Press 'Insert', browse the transaction code categories

•Select 'Deduction - Amount'

•Enter the details for the Advance recovery

In particular you would need to enter details of:

Description |

Enter the Desccription of the Advance Recovery that is clear to your employees |

Employee G/ Ledger Code |

Enter the General Ledger Control, or other, account that was debited when the advance was extended outside the payroll |

Manual Edit |

Tick 'Manual Edit' to enable the entry of the Advance amount during processing. |

Allow Refunds |

Tick this checkbox to enable the one Transaction Code to be be able to process the extension of the Advance amount to the employee as well as the Recovery of the amount. |

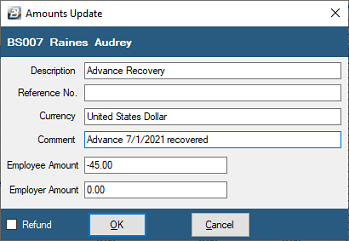

Most often you would process the Transaction through Payslip Input. To do this:

•Go to the 'Process', then 'Payslip Input' menu options

•Select the employee that is having the Advance Recovery transaction processed

•Press 'Insert'

•Select the 'Advance Recovery' Transaction Code

•Enter the amount of the advance being recovered

•Press 'OK' to accept the transaction

Using the 'Refund' checkbox would add the Advance amount to the employee's payslip.