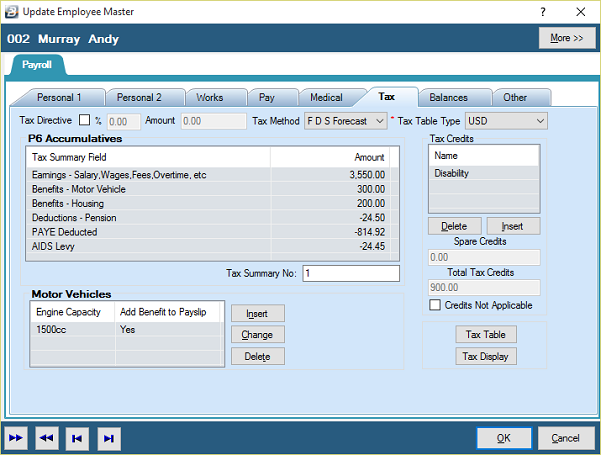

Tax Directive There may good reason why tax should not be deducted from an employee e.g. a student working on attachment where the total income for the tax year will not reach the annual threshold or where there are significant medical expenses that rank for credit. In these instances it is possible to apply to ZIMRA for a 'Tax Directive'. A directive from ZIMRA gives the necessary authority to waive, or alter, the amount of tax to deduct from an individual. To process a Tax Directive, for one employee, place a tick against 'Tax Directive' under the 'Tax' tab of the individual's employee masterfile record. The Tax Directive can either be put in as a percentage or as an amount.

When capturing data from another system into Belina PayrollHR it may be appropriate to put the payroll onto 'Directive' so that the actual PAYE and Aids Levy amounts, previously calculated, can be entered manually. Putting the payroll onto Directive is covered under History Capture.

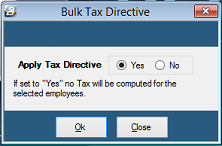

Tax Directive Convert This is used to apply a tax directive to turn off the calculation of tax and then to turn it back on.

To stop the calculation of tax: •Go to the 'Data', 'Bulk Routines', and then 'Tax Directive Convert' menu options.

•Select 'Yes' to apply a Tax Directive (range selection comes after pressing 'Ok') •Click 'OK' •Tag or select the ranges that the directive applies to.

To turn the calculation back on go through the above steps by set 'Apply Tax Directive' to 'No'. |