TaRMS is the new Tax and Revenue Management System that ZIMRA has introduced to control the receipt and audit of PAYE amounts deducted from employees.

Every month employers upload the TaRMS report, produced by the Belina system, onto the ZIMRA TaRMS Self Service Portal. The TaRMS report details the PAYE amounts deducted, and keeps a cumulative total, for each of the employee. The system also reconciles the amounts deducted by the employer and compares it with the amount paid across to ZIMRA.

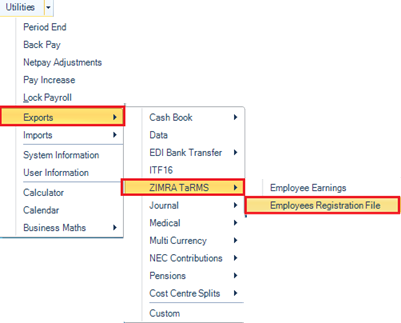

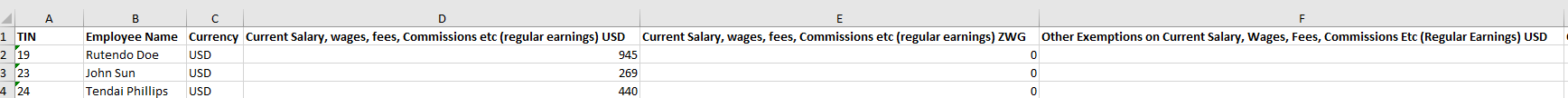

According to the Public Notice of 05 2025, Issued on 03 February 2025 by Zimra all employees need to be registered on the Employee Management Module so that they are allocated TIN numbers. The provided format from ZIMRA comprises of the columns in the picture below. The information required can be exported from our Belina System to do this : - go to the 'Utilities', 'Exports' then 'ZiMRA TaRMS' menu options - select 'Employees Registration File'

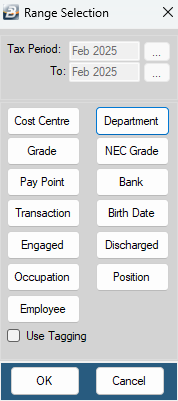

- on the range selection window click 'OK to proceed and click 'Use Tagging' if there is need to filter and select a specific range of employees

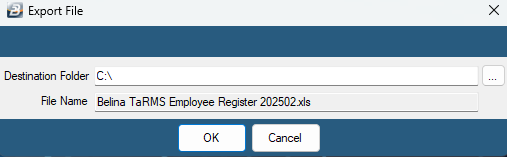

- After confirming the destination folder and the file name click 'OK' to save the report.

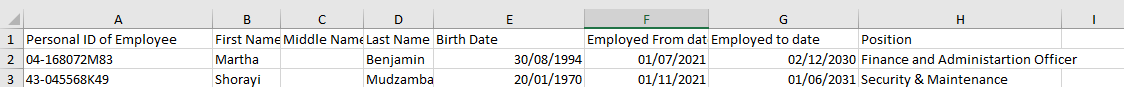

- Below is a sample export report for the 'Employees Registration File'

-NB: The system only exports the fields that can be important on the ZIMRA TaRMS portal in bulk. Hence, some required information you will have to enter manually and for information on how to do the upload on the TaRMS platform or any errors you may encounter in the registration process please contact the ZIMRA contact center or your Liaison officer for assistance. |

When you are done registering your employees on the TARMS portal you will get TIN numbers that you will need to import into out Belina system so that you upload you employee details. There are 2 ways you can do this:

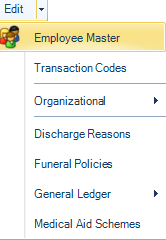

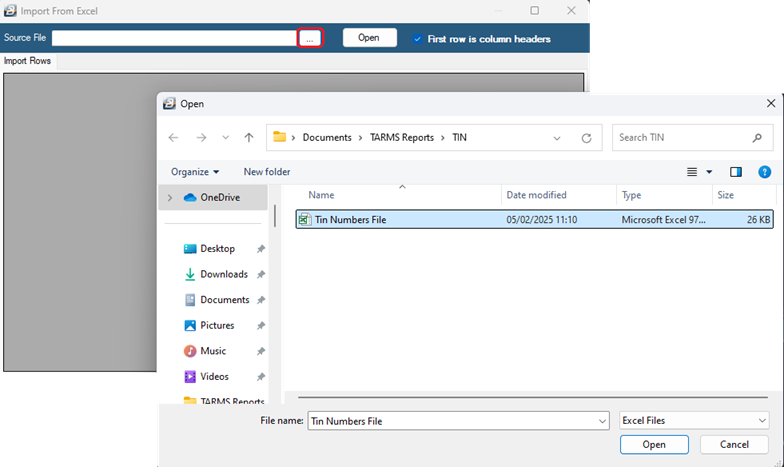

Option 1 : Updating the Employee record in the Employee Master: - Click 'Edit', then 'Employee master' - Select the 'Employee in question'

- Open the 'Tax tab' - On the 'Tax Identification No. field' enter the TIN number for the employee - Click 'Ok' to save

Option 2: Importing Tin numbers into Belina from an Excel file: - Create an excel file with two columns one with employees ID numbers and the other column with the employees TIN numbers from ZiMRA

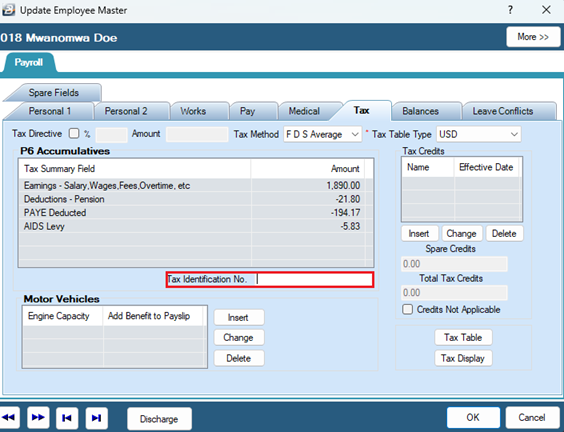

To import the information on the excel sheet into Belina: - Click 'Utilities', 'Imports' ,'Excel Spreadsheet' - A warning displays. Press Yes to continue if a backup has been done or is not required. Otherwise stop and do a backup and proceed after it has been done.

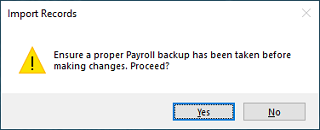

- Use the ellipsis button in the red box to select the file to import - Navigate to the folder where the file is saved and select the file and click on open

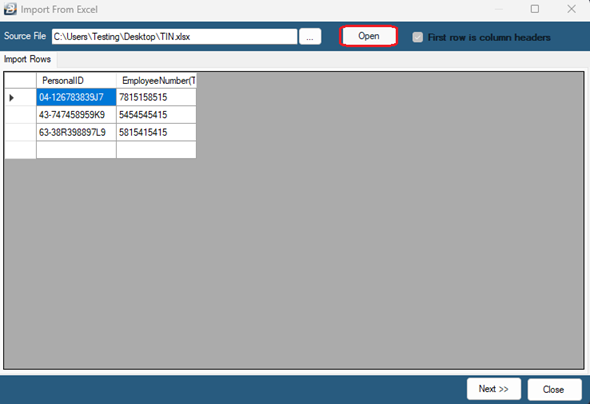

- Click on 'Open' as displayed by the picture below and the information on the Excel will be displayed, check that the spreadsheet data is being displayed as expected.

- Click on Next.

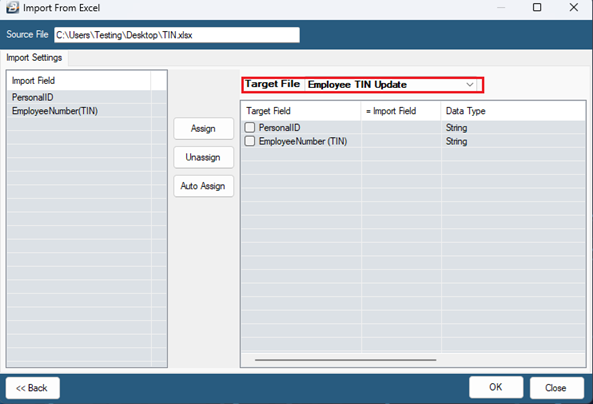

The screen that comes after has the fields to be imported to, - Use the dropdown menu to select the Target File type Employee TIN update as highlighted in the picture below

- Notice the listed Import Field entries in the left hand panel and the Target File Listings in the right hand panel - Link the fields in the left hand panel to those in the right hand panel - The Import Field description will be displayed next to the Target File description in the right hand panel.

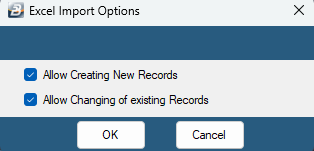

- To import the TIN numbers: - Click 'PersonalID' on the 'Import Field' on the left panel then select 'Assign' and match it with 'PersonalID' on the right panel which is the Target File - Click 'EmployeeNumber(TIN)' on the 'Import Field' on the left panel then select 'Assign' and match it with 'EmployeeNumber(TIN)' on the right panel which is the Target File - Click 'OK' to proceed - On the screen like the one below select both options 'Allow Creating of New Records' and 'Allow Changing of existing Records'

You will get a progress report you would have been done with your import for TIN numbers |

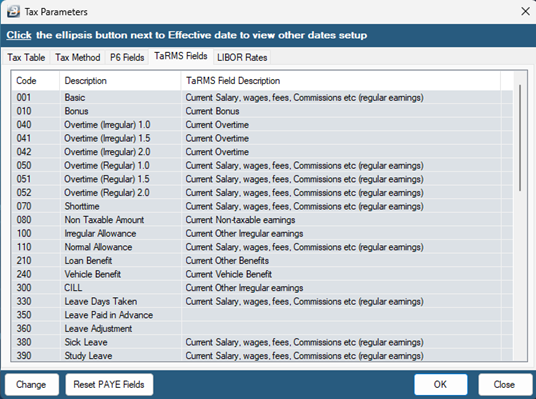

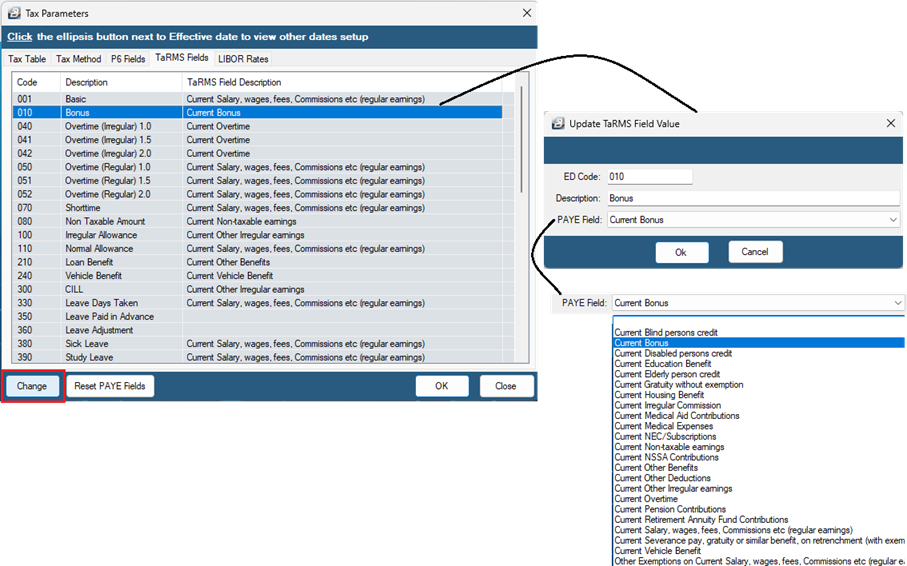

Verify that all the transaction codes in your payroll are allocated their respective TaRMS fields that they correspond to.

Go to Setup >> Tax >>Existing >> TaRMS Fields you will get a window like the one below.

It is important for you to confirm if your transaction codes have been assigned the correct TaRMS Field Description which are the headings in the ZIMRA provided PAYE template. Use the following Key as a reference.

If you need to change the TaRMS Field Description Highlight the Transaction Code and Click Change.

Use the Dropdown under PAYE Field to change the TaRMS Field Description to the correct one and click OK. Repeat the same process for any TaRMS Fields that need to be updated. |

TaRMS is the new Tax and Revenue Management System that ZIMRA has introduced to control the receipt and audit of PAYE amounts deducted from employees.

Every month employers upload the TaRMS report, produced by the Belina system, onto the ZIMRA TaRMS Self Service Portal. The TaRMS report details the PAYE amounts deducted, and keeps a cumulative total, for each of the employee. The system also reconciles the amounts deducted by the employer and compares it with the amount paid across to ZIMRA.

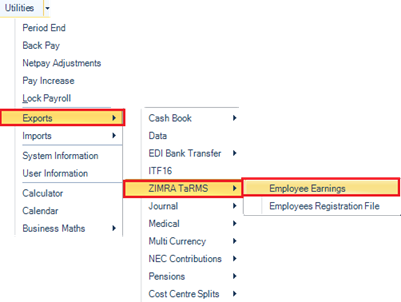

To produce the TaRMS report:

- Go to the 'Utilities', 'Exports' then 'ZIMRA TaRMS' menu options

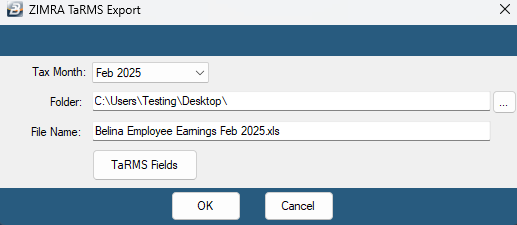

- select 'Employee Earnings' - use the dropdown menu to select the 'Tax Month' being reported on - use the ellipsis button to select the folder into which the report will be stored - accept or change the default File Name that has been automatically allocated to the report.

- press 'OK' to continue - on the range selection window click 'OK to proceed and click 'Use Tagging' if there is need to filter and select a specific range of employees

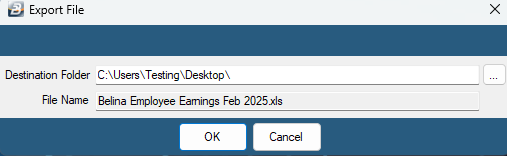

- click 'OK' to save the export file

- Your file should have headers as displayed below

Exporting in Consolidation

If you have more than one payroll and would like to export the TaRMS report as one for all your payrolls, you can use our payroll consolidation feature. |