Processing a Retrenchment Package:

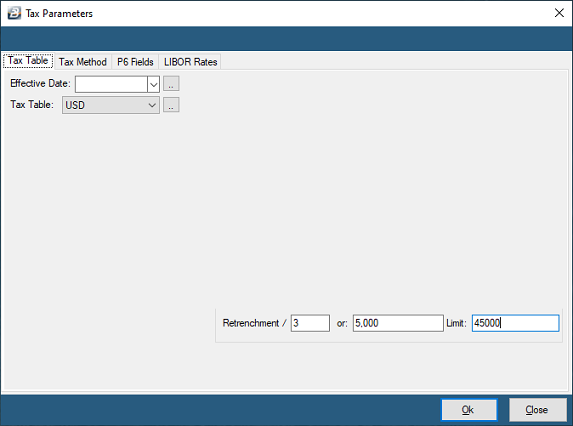

The Finance Act 13 of 2023 provides a partial tax exemption on retrenchment packages.

•The exempt amount is the greater of one-third (1/3) of the total retrenchment package or US3,200 (or its ZWG equivalent), with a maximum exemption of one-third of US15,100.

•Taxable amount: Any balance above the exempt portion is subject to taxation.

•For example, if a package is US12,000, one−third of the package is US4,000. Since US4,000 is greater than US3,200 and below the cap of US5,033.33, it is tax−exempt. The remaining US8,000 becomes the taxable portion.

![]() Labour Law, Grounds for Retrenchment and Inclusions in the Retrenchment

Labour Law, Grounds for Retrenchment and Inclusions in the Retrenchment

It is advisable to seek professional assistance with any retrenchment.

Retrenchments are covered in the Labour Act (Chapter 28.01) Section 12C. Procedures to follow are: 1. The employer should first identify the grounds for retrenchment, the employees to be retrenched, and the proposed terms and conditions of the retrenchment. 2. Written notice of the retrenchment should then be given to the organization’s Works Council, NEC, or Retrenchment Board (Section 12C (1) (a)) 3. The written notice should state the details of every employee whom the employer wishes to retrench and the reasons for the proposed retrenchment (3. Section 12C (1) (b)) 4. The Works Council or NEC should attempt to reach an agreement between the employer and employees as to whether or not the employees should be retrenched and, if they are to be retrenched, the terms and conditions on which they may be retrenched taking into account the continuance of operations of the organization and the mitigation of consequences of retrenchment on the employees. 5. Negotiations must be concluded within one month. If no agreement has been reached the matter should be referred, in writing together with supporting documentation, to the Retrenchment Board. 6. The Retrenchment Board shall consider the matter and make a recommendation to the Minister on whether to permit the retrenchment and the terms and conditions that should apply within two weeks. 7. If the Retrenchment Board fails to decide the documentation regarding the case will be forwarded, within two weeks, to the Minister for a decision on whether to allow or disallow the retrenchment. 8. If the Minister fails to decide within the time frames provided then the scheme of retrenchment will be deemed to have been approved. 9. When an agreement is reached LRR2 form is submitted 10. Final approval granted by Ministry

Acceptable grounds for retrenchment - Liquidation, - Restructuring, - Mergers, and - Overstaffing.

A retrenchment package could include: - 3 Months’ Notice Pay - Severance Package - Service Allowance - Relocation Allowance - Medical Aid for 3 - 6 Months - Purchase of assets at book value |

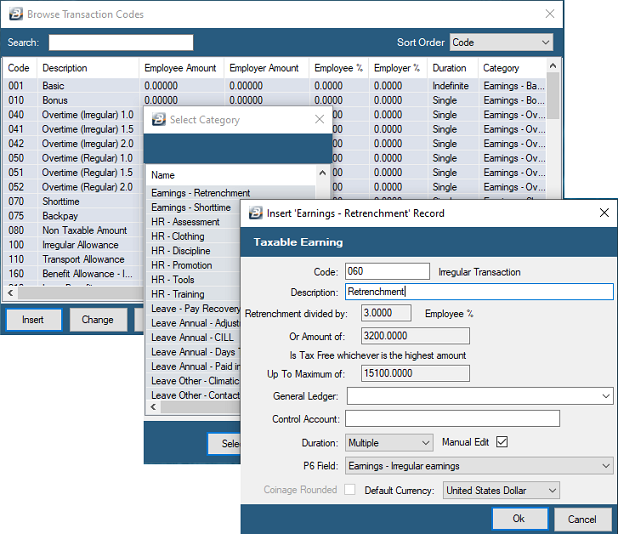

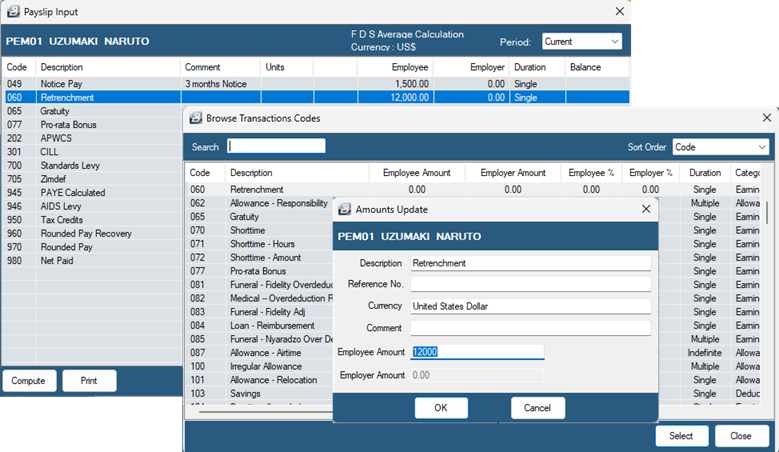

![]() Steps for Processing Retrenchment

Steps for Processing Retrenchment