The Retrenchment Calculator is a utility program that can be used outside of Belina Payroll to calculate the PAYE to be deducted from retrenchment amounts being paid to employees. The Retrenchment Calculator then produces a report which can be submitted to ZIMRA for verification and approval. Once this is done and the tax directive has been received then the retrenchment can then be processed into the payroll as a transaction. Please note that, on Year To Date Amounts use amounts of the current tax Year in-cases where there is a tax split in-between the year.

A careful check needs to be done to ensure that the retrenchment has been correctly processed into the payroll. To do this:

•Process the full payroll and run the Calculation Routine, note the total PAYE amount (X)

•Process the retrenchment amounts

•Run the Calculation Routine and note the new PAYE amount (Y)

•Calculate the difference in the PAYE amounts (Y) - (X). This amount should agree to the PAYE amount reported by the Retrenchment Calculator.

Enter topic text here.After having installed the Belina PayrollHR software to get the system running the following steps need to be followed:

![]() Step 1 - Download the Retrenchment Calculator Calculator

Step 1 - Download the Retrenchment Calculator Calculator

Download the Retrenchment Calculator from the Belina website.

|

![]() Step 2 - Process the Retrenchment Amounts Calculator

Step 2 - Process the Retrenchment Amounts Calculator

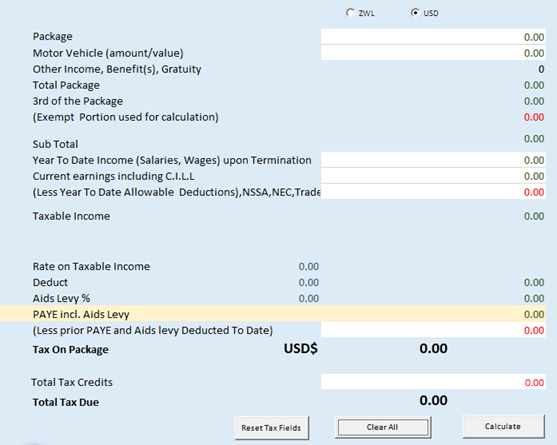

The Retrenchment calculator is a Microsoft Excel document with macros embedded. By default Excel disables macros so click on Enable Content to have permissions to use the Calculator

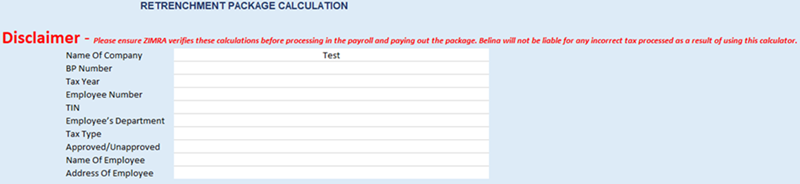

Populate the Company and Employee details on the first paragraph of the calculator. The details required are labeled on the calculator.

|

![]() Step 3 - Extract and submit report to ZIMRA

Step 3 - Extract and submit report to ZIMRA

After doing the calculations, please contact your ZIMRA Liason officer and get a confirmation of the figures. |