To process a second, or subsequent, pay run in a period process a Net Pay Adjustment. This is often necessary where a bonus is being paid after the main payroll has been run, or it is discovered that there are additional earnings and deductions that need to be paid to employees.

Explanation

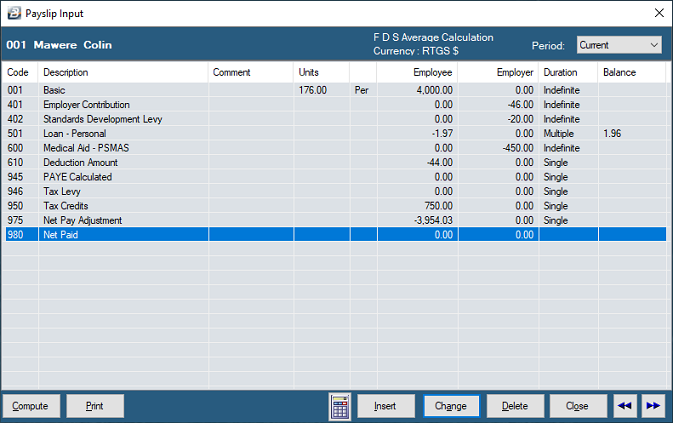

When a payroll run is done for the first time in a period employees are paid the Net Paid amount calculated by the system. When it is decided to process further transactions into the payroll after this payment is done then it is necessary to run a the Net Pay Adjustment transaction, process the new transactions and make a second payment to staff.

To process a second, or subsequent, pay run backup the payroll first and then:

•Create the Net Pay Adjustment Transaction Code (Code 975), if it does not already exist, then

•Go to the Utilities menu to process the Net Pay Adjustment.

•When this is done the existing Net Paid amounts are transferred to the Net Pay Adjustment Transaction Code, leaving a zero Net Paid amount.

•Process the additional transactions (example overtime or bonus)

•Run the Calculation Routine

•The new Net Paid amounts will now only include the new earnings and deductions and the revised PAYE amounts.

•Check the results

•Print Reports

•Backup

•Do the Period end procedure.