HISTORY Historically P6 forms were certificates issued to employees certifying the earnings and deductions that had been made whilst employed with that organization for the current tax year. Employees then submitted the P6 when they submitted their annual tax. CURRENT With the introduction of the FDS tax system, P6's effectively have become tax receipts for funds that employees have paid in PAYE and Aids Levy. The employee retains the P6 unless a tax return is being submitted to account for third-party income. P6's should only be printed once ZIMRA have: •Audited the ITF16 file, •Come through with any adjustments necessary •Checked the revised ITF16 file taking into account the adjustments that have been processed •Given the go-ahead to print P6's by ZIMRA

Before printing P6's, ensure that all Transaction Codes have the correct P6 fields assigned to them.

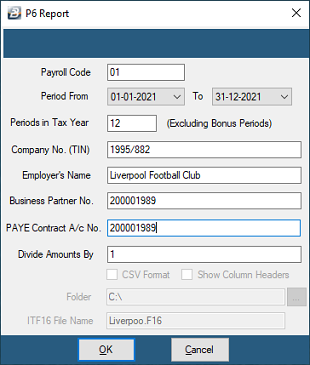

To print P6's: •Go to 'View', 'Tax', then to 'P6' menu options •Fill in your organizational details

•Click 'OK' •Select the Range of employees to be included in the print •Press Preview, or print, as required.

Print 3 copies (One for the company, one for the employee and one for ZIMRA). |