It is essential to check a sample of Tax Calculations

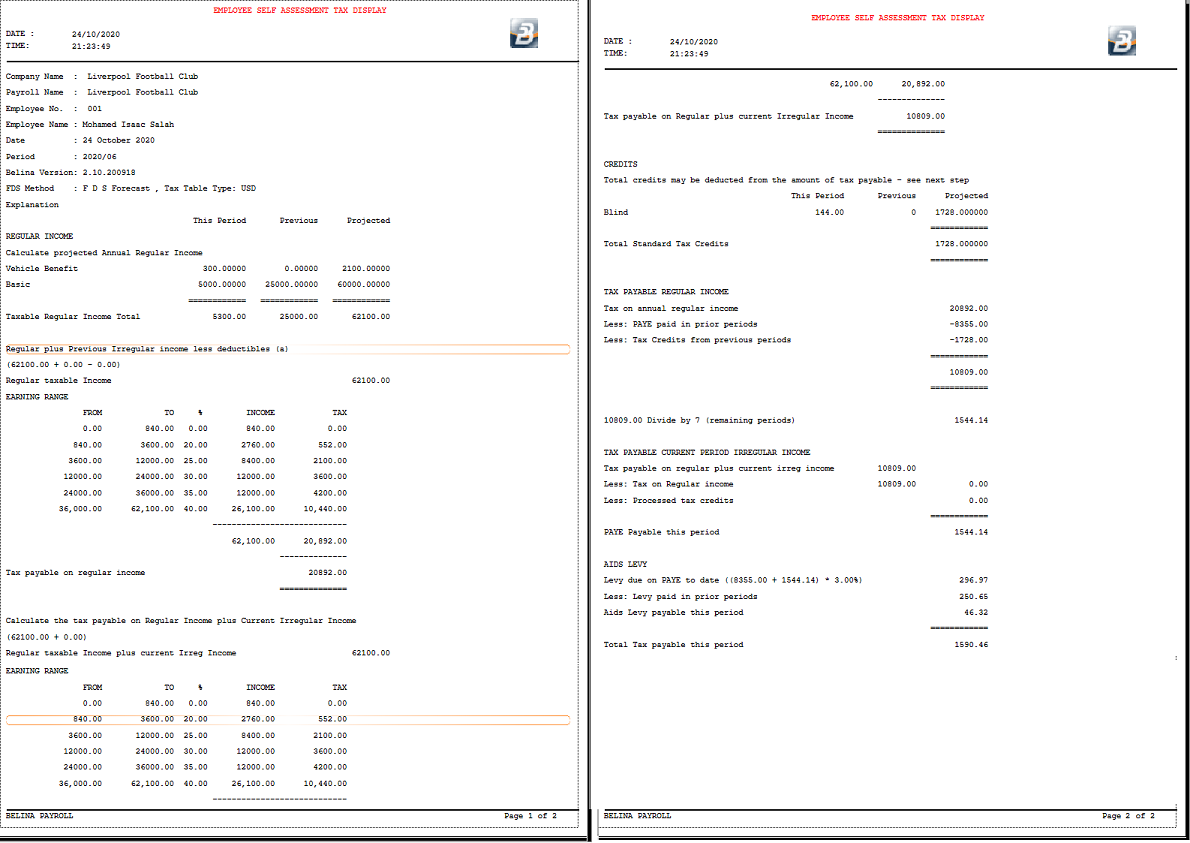

One of the major strengths of Belina PayrollHR is the transparency of its tax calculations.

Belina PayrollHR has a 'Tax Display' - a detailed explanation of how the tax was calculated for an employee. This is a valuable tool in understanding how a particular result was achieved, for the employer, employee and for resolving any support related issue.

It is particularly important to check the tax computations when a new payroll has been setup or where there have been changes to the tax parameters when the budget is announced.

Always look at the reasonableness of the PAYE amount. Often errors can be found by applying this simple principal. If an employee is on the top tax band take the tax percentage for that band and compute the tax on the amount earned as a guide.

To view the Tax Display - Payslip Input Press the 'Print' button in the bottom left hand corner of the Payslip Input screen for the individual.

Select the period required:

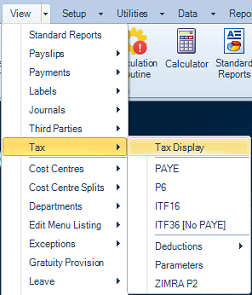

To view the Tax Display - Reports menu

NOTE: Understanding the complexity of the tax calculation may require assistance. We have made every effort to reduce this complexity by presenting a well laid out and detailed explanation. Understanding the tax display improves over time. Each time the report is printed and followed through the clearer it will become. Belina support staff can assist in explaining any points that may present difficulty.

|