All non-cash benefits received, as a result of employment, are taxable. They value being the amount that the employee benefits.

The benefits should be included on the employee's payslip. The value of the benefit is included in the tax calculation but although a value is put on the payslip this is not included, itself, in the Net Paid.

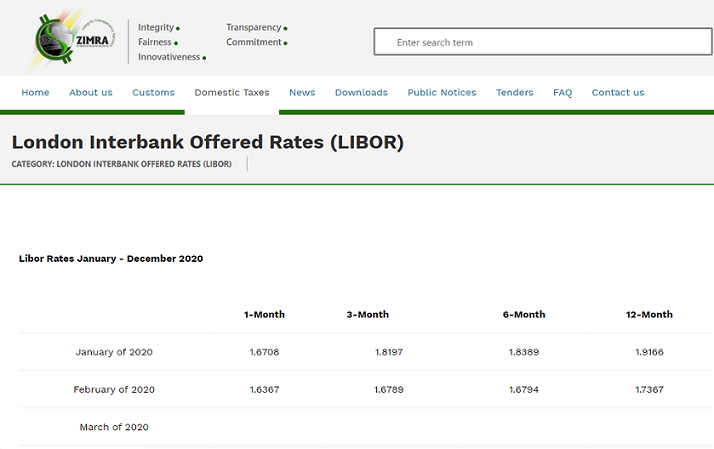

A loan benefit arises on the provision of a loan to an employee where the interest rate charged on the loan is less than the LIBOR rate plus 5% and the loan amount exceeds USD100 or ZWL8000. No benefit would arise if the charge is above the LIBOR rate plus 5%.

The above rates are for loans of 1, 3, 6 and 12 month duration.

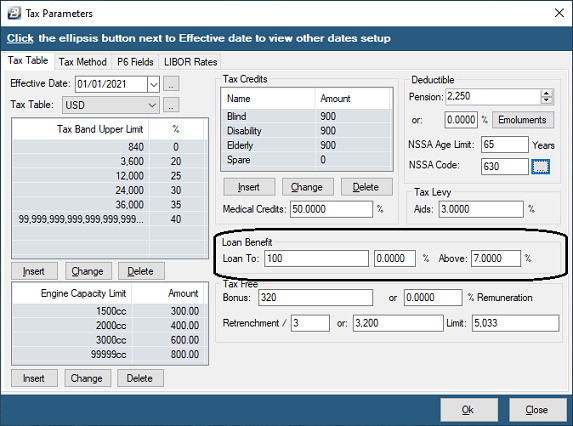

To setup the LIBOR rate: •Go to the 'Setup', then 'Tax' menu options •Go to the section 'Loan Benefit' on the right hand side of the screen •Enter the LIBOR rate plus the 5% ZIMRA loading of the amount

|

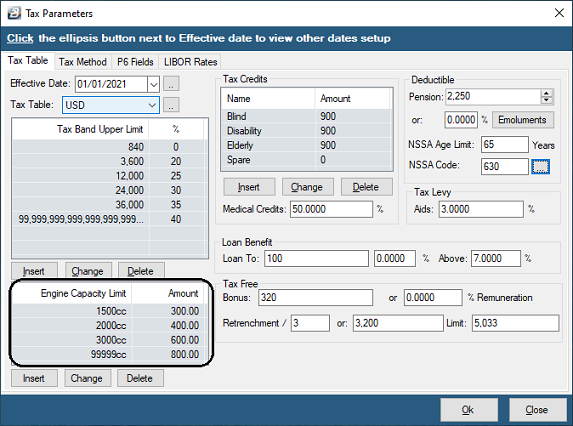

Vehicle benefit rates can be setup manually, but are updated, together, with other tax parameters, when the annual budget is announced and an updated software version is made available for update at the end of each tax year.

To setup the Vehicle benefit rates •Go to the 'Setup', then 'Tax' menu options •Go to the section 'Engine Capacity Limit' on the bottom left-hand-side of the screen •Press 'Insert' to add a new Engine Capacity, 'Change' to alter an existing Engine Capacity and 'Delete' to remove an existing Engine Capacity.

The vehicle benefit rates applicable from 1 January 2021 are:

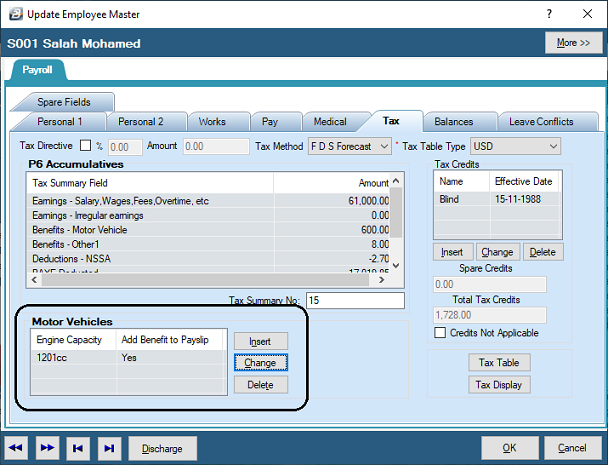

When setting up the vehicle/s that an employee has been allocated within the organization enter the actual Engine Capacities of the vehicle/s. Belina PayrollHR will automatically lookup the relevant benefit amount for that sized Engine Capacity.

When processing, the Vehicle benefit amount can be set to come through automatically with the total Motor Vehicle benefit amount. |

The general tax rule is that all remuneration received by an employee is taxable in the same manner as any other earning or allowance. To process the value of a benefit create a Transaction Code using the 'Benefit' category. |

As mentioned, earlier, all benefits received, as a result of employment, are taxable at the value of the benefit to the employee. To process the value of an other benefit create a Transaction Code using the 'Benefit - Other (Regular)' or Benefit - Other (Irregular) 'categories. |