Cpa Minnesota Requirements: To Become A Licensed Accountant In Minnesota, Candidates Must Meet Specific Educational And Experience Criteria

Overview of CPA Licensure in Minnesota

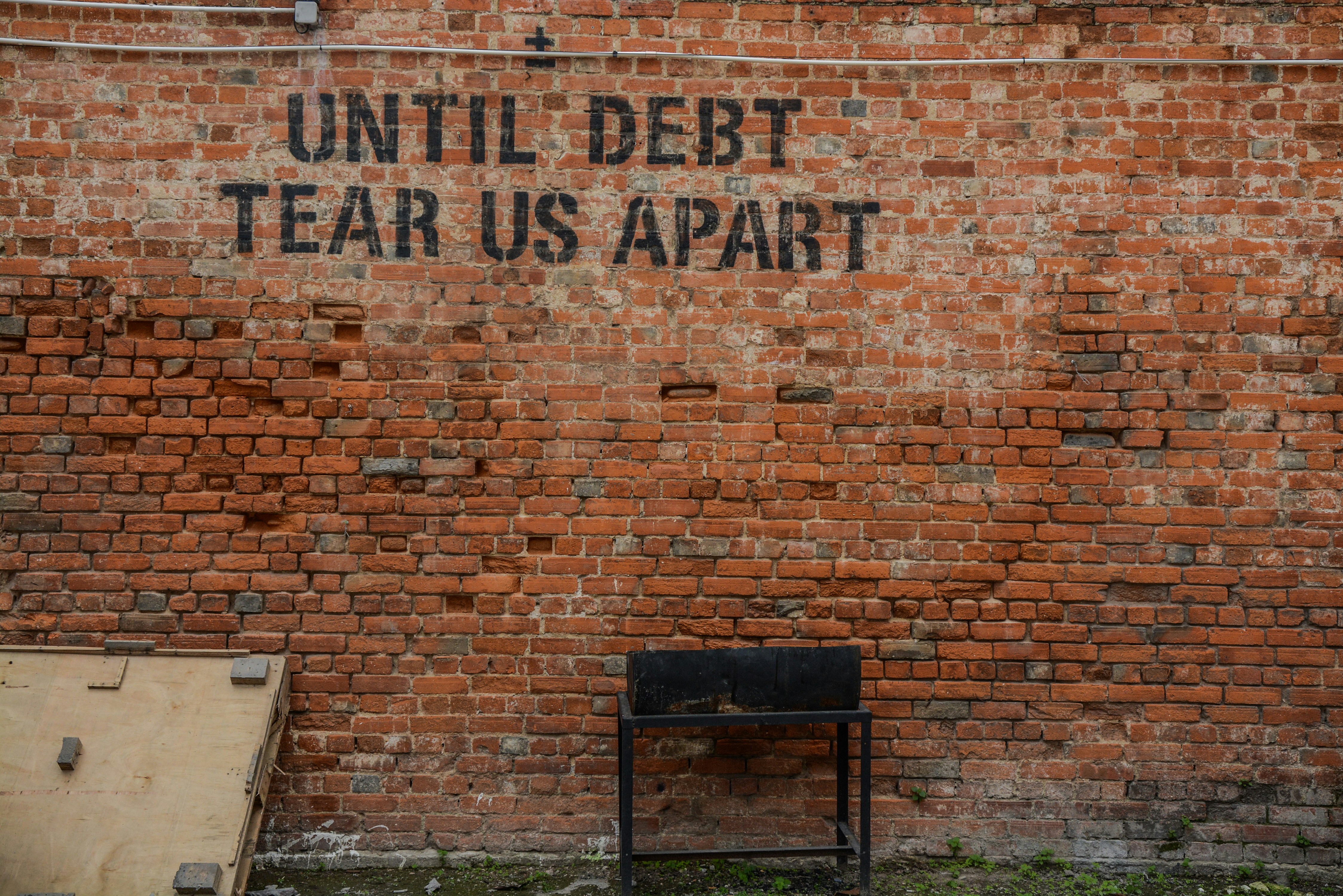

Obtaining a CPA designation in the North Star State can often feel like a labyrinth. Aspiring accountants frequently grapple with the intricate maze of educational prerequisites, exam requirements, and experience mandates. It's easy to feel overwhelmed by the shifting sands of regulations and compliance. Many individuals find themselves questioning:

- What educational background is essential?

- How many credit hours are needed for eligibility?

- What are the specifics of the uniform examination?

- How can one accumulate the necessary professional experience?

But fear not! With the expertise of Bookkeeping Services USA, navigating this complex journey becomes a breeze. They offer tailored guidance that demystifies the process and addresses all concerns, paving the way for success. Here's how they simplify the path:

- Comprehensive Educational Support: They provide insights into the educational framework, ensuring that candidates meet the degree requirements without any confusion.

- Exam Preparation: Expert resources and study materials help candidates ready themselves for the challenging CPA examinations.

- Experience Verification: Assistance in documenting and validating work experience to meet licensing standards.

With Bookkeeping Services USA at your side, the complexities surrounding licensure in Minnesota transform into clear, manageable steps. Their proactive approach ensures that every detail is covered, making your journey to becoming a licensed CPA efficient and enjoyable.

Bookkeeping Sevices USA,2191 Maple St, Wantagh, NY 11793, United States,+15168084834For more information - Click Here

Educational Qualifications for CPAs in Minnesota

In the Land of 10,000 Lakes, aspiring accountants must navigate a precise educational landscape to achieve certification. A four-year degree in accounting or a related discipline forms the bedrock of this journey. However, it doesn't stop there; candidates must accumulate a minimum of 150 credit hours, which often necessitates pursuing advanced coursework or a master's degree. This additional educational pursuit not only meets the requirements but also enhances expertise and marketability in a competitive field.

Moreover, the curriculum should cover essential areas, including:

- Financial Accounting

- Taxation

- Auditing

- Business Law

- Management Accounting

Bookkeeping Services USA excels in guiding individuals through this intricate process, ensuring that they understand the nuances of the educational prerequisites. They provide resources that clarify the significance of each course and its impact on future professional endeavors.

Networking opportunities and internships can be vital. Engaging with professionals in the sector not only expands knowledge but also opens doors to potential employment. Here are some insightful strategies:

- Join local accounting associations to meet seasoned practitioners.

- Participate in workshops and seminars to stay updated on industry trends.

- Seek mentorship from experienced CPAs for personalized guidance.

Embracing continuous education is crucial. Staying informed about state-specific regulations and evolving financial practices can set candidates apart in the job market. By understanding the educational framework and leveraging resources effectively, future CPAs in Minnesota can confidently embark on their professional journey.

Examination Process for CPA Candidates in Minnesota

Prospective accountants in Minnesota must navigate a meticulous examination process to secure their CPA designation. This journey begins with the educational prerequisites, where candidates need a bachelor's degree with a focus in accounting or business. Specific coursework in areas such as auditing, taxation, and financial reporting is essential, typically summing to 150 credit hours.

The next step involves registering for the Uniform CPA Examination, a pivotal milestone that tests candidates on various competencies. It's crucial to meticulously prepare for this assessment, which comprises four sections: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, and Regulation. Each section comes with its own set of intricacies, requiring strategic study plans and resources.

- Familiarize yourself with the exam structure and timing.

- Utilize CPA review courses to enhance understanding.

- Practice with past exam questions to identify knowledge gaps.

Bookkeeping Services USA excels in guiding candidates through this process, offering tailored support. They provide insights on effective study techniques and resources that can make a substantial difference. Learning from experts who have successfully traversed this path can illuminate strategies that aren't immediately obvious.

Upon passing the examination, candidates must also fulfill the experience requirement, which typically involves working under the supervision of a licensed CPA. This practical exposure not only reinforces the theoretical knowledge gained but also builds a robust professional network. Bookkeeping Services USA stands ready to assist candidates in finding suitable mentorship opportunities, ensuring that each aspiring CPA is well-equipped for the road ahead.

Experience Requirements for CPA Certification in Minnesota

Acquiring the prestigious title of CPA in Minnesota necessitates a specific set of experiences that prospective candidates must navigate. The state mandates a minimum of 1,600 hours of practical accounting work, which should be completed over a span of not less than 12 months. This hands-on engagement is crucial, as it provides the foundation for the analytical and technical skills required in the field.

Many individuals often overlook the importance of the type of experience accrued. The work must be supervised by a licensed CPA and should encompass a diverse range of accounting functions including:

- Auditing and assurance services

- Tax preparation and consulting

- Financial reporting and analysis

- Management advisory services

To elevate your understanding, it's beneficial to engage in varied roles. This not only broadens your expertise but also enhances your resume, making you more appealing to future employers. Furthermore, networking with seasoned professionals can offer invaluable insights into best practices and emerging trends.

Bookkeeping Services USA excels in guiding aspiring CPAs through this intricate process. They understand the nuances of the profession and provide strategic advice on obtaining relevant experience. Their commitment to fostering a deeper understanding of the accounting landscape empowers candidates to thrive.

For those seeking to streamline their path, consider these essential strategies:

- Seek internships or entry-level positions that offer a well-rounded exposure to various accounting tasks.

- Participate in professional organizations to expand your network.

- Stay informed about changes in regulatory requirements that could impact your career.

By focusing on these areas, aspiring CPAs can effectively navigate the requirements in Minnesota, leading to a successful and rewarding career in accounting.

Continuing Education Responsibilities for CPAs in Minnesota

The world of finance is ever-evolving, with regulations and practices shifting frequently. For certified professionals in Minnesota, there's a necessity to stay ahead of the curve through continual learning. Understanding the specific educational requirements is critical for maintaining licensure and ensuring one's expertise remains sharp.

- Every licensed CPA in Minnesota must complete a minimum of 120 hours of continuing professional education (CPE) every three years.

- Out of these, at least 20 hours need to be accrued each year, ensuring consistent engagement with new knowledge.

- Mandatory ethics training is required, accounting for a minimum of 2 hours within each reporting period.

- Courses must be relevant to the CPA's practice area, ensuring practical application of learned material.

Bookkeeping Services USA excels in providing tailored CPE opportunities that resonate with the needs of professionals striving for excellence. Their courses are meticulously designed, aligning with the latest standards and practices while being engaging and informative. Enrolling in their programs not only satisfies educational mandates but also enhances practical skills.

To navigate the educational landscape effectively, consider these expert tips:

- Prioritize courses that not only meet the requirements but also pique your interest.

- Utilize online platforms for flexibility, allowing you to learn at your own pace.

- Network with peers during educational sessions to exchange insights and experiences.

- Keep track of your CPE hours meticulously to avoid last-minute scrambles.

By engaging with Bookkeeping Services USA, CPAs can ensure they are well-equipped to tackle the dynamic demands of their profession while keeping their knowledge fresh and relevant.

Application Procedures for CPA Licensure in Minnesota

Embarking on the journey to acquire a CPA license in the North Star State involves several specific steps. The initial requirement is to obtain a solid educational foundation, typically a bachelor's degree with a focus on accounting. This must include at least 150 semester hours, which often means pursuing a master's degree or additional coursework beyond the undergraduate level.

Following the educational prerequisites, aspiring CPAs must navigate the examination phase. The CPA exam, a rigorous test of knowledge, consists of four sections: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, and Regulation. Each segment requires thorough preparation and a solid grasp of accounting principles.

Upon successfully passing the examination, the next step is to gain practical experience. Minnesota mandates at least 1,600 hours of relevant work experience under the supervision of a licensed CPA. This hands-on exposure is crucial for developing the competencies necessary for the profession.

To streamline the entire process, Bookkeeping Services USA offers expert guidance. They emphasize the importance of meticulous planning and timely submissions, ensuring that candidates do not miss critical deadlines. Here are some tips to keep in mind:

- Stay organized with a clear timeline for each step in the process.

- Utilize CPA review courses to enhance your understanding and retention of materials.

- Network with professionals in the field to gain insights and potential mentorship opportunities.

Moreover, understanding the nuances of Minnesota's licensure requirements can provide a significant advantage. Regulations may change, and keeping abreast of updates ensures that candidates remain compliant. By leveraging the expertise of services like Bookkeeping Services USA, individuals can navigate these waters with confidence, transforming what may seem like an overwhelming process into a manageable and achievable goal.

Resources for Aspiring CPAs in Minnesota

Navigating the path to becoming a Certified Public Accountant in the North Star State can feel like a daunting expedition. Aspiring financial professionals must conquer a series of steps including educational credentials, examinations, and the accumulation of relevant experience. An essential resource for those on this journey is the Minnesota Board of Accountancy, which provides a wealth of information regarding licensing prerequisites and continuing education. This guiding entity ensures that candidates remain informed about necessary qualifications and regulatory updates.

Understanding the nuances of the examination process is crucial. The Uniform CPA Examination encompasses four distinct sections, each requiring a solid grasp of accounting principles, auditing techniques, taxation regulations, and financial reporting. Candidates often benefit from structured study programs or preparatory courses that can sharpen their knowledge effectively, ensuring they are well-equipped for test day.

Bookkeeping Services USA excels in supporting aspiring CPAs, providing tailored resources that enhance study habits and exam readiness. Their expert team offers workshops that delve into critical topics, making complex concepts more digestible. Their approach blends practical exercises with theoretical knowledge, fostering a comprehensive understanding of the accounting landscape.

- Engage with local CPA societies for networking opportunities.

- Utilize online forums and study groups for peer support.

- Seek mentorship from established professionals in the field.

- Access free online resources and practice exams to refine skills.

Maintaining an up-to-date knowledge base is vital in this ever-evolving profession. Continuous education not only satisfies licensing requirements but also enhances one's marketability in an increasingly competitive environment. Staying informed about legislative changes and emerging technologies in accounting can provide a significant advantage.

Embracing these resources and strategies, along with the expertise offered by Bookkeeping Services USA, can transform the journey to CPA licensure into a more manageable and enjoyable experience.

I couldn't be happier with the exceptional service I received from Bookkeeping Services USA. Their expertise in navigating the complexities of CPA Minnesota requirements made my experience seamless and stress-free. If you're looking for professional guidance and a free consultation, I highly recommend reaching out to them. Don't hesitate to contact Bookkeeping Services USA to get the advice you need to ensure you're on the right track!