After processing the final period of the year we do a period end procedure to go into the first period of the next tax year. This process we call a 'Year End Procedure'.

To simplify this process we have created a Wizard that automatically:

Creates the next year's periods

Sets up the common public holidays for the next tax year

Important: Before starting the year end procedure ensure that all necessary reports have been printed and exports prepared. A final

Year End Backup should be taken and stored carefully.

Year End Procedure Steps

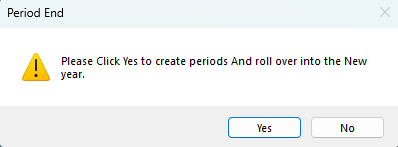

Go to the 'Utilities', then 'Period End' menu options

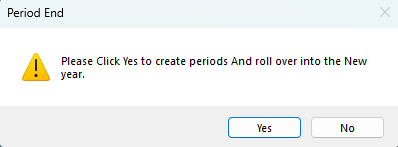

Year-End procedure dialog

On the pop-up screen select 'Yes' to proceed with the Year-End procedure

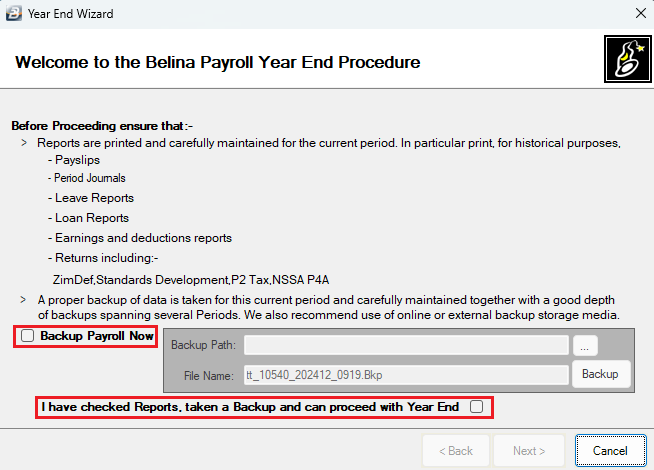

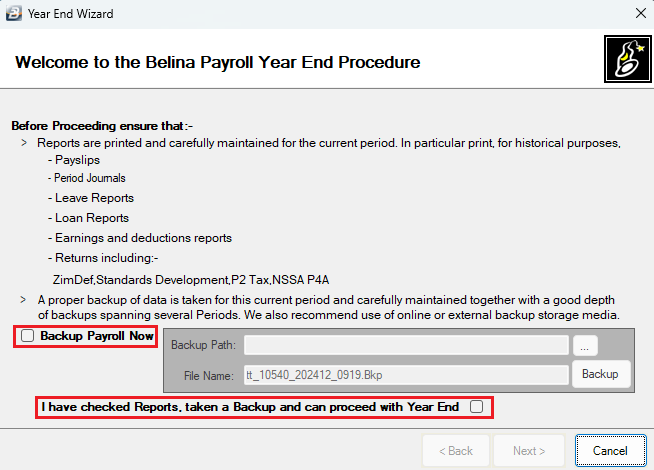

Backup confirmation screen

It is necessary that you take a Backup if you have not done so already. If you need to do a backup place a tick in the 'Backup Payroll Now' checkbox.

Insert a tick on the check-box with text 'I have checked reports, taken a Backup and can proceed with Year End'

Then select 'Next' to proceed

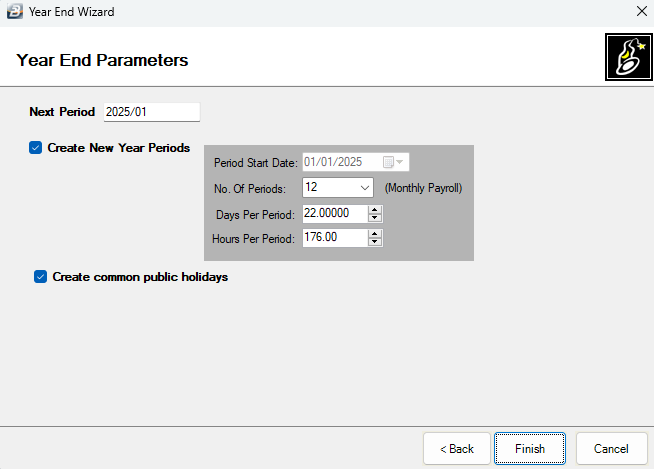

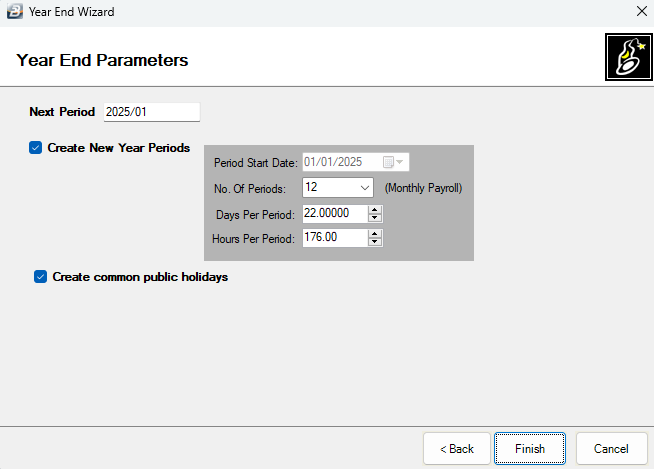

Public holidays setup screen

The check boxes for 'Create New Year Periods' and 'Create common public holidays' come already ticked, keep these.

By default the year end wizard adopts the period settings from the previous tax year. You can change the period settings if necessary.

Click 'Finish' to complete the Year-End procedure and to proceed to enter the Tax tables for 2026.

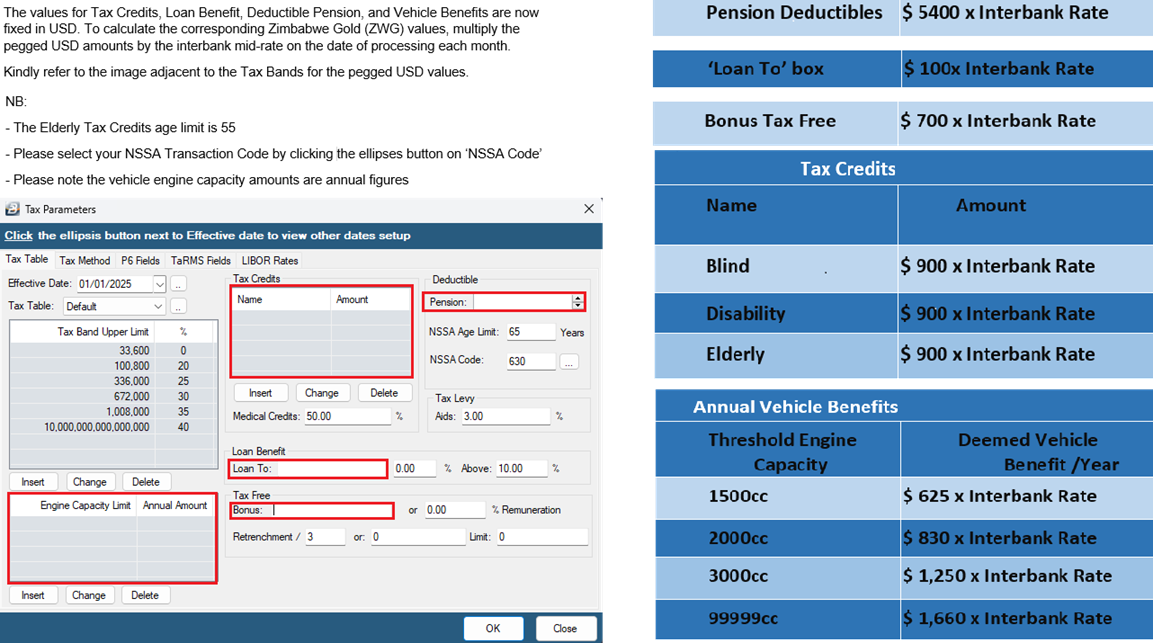

Setting Up Tax Tables for 2026

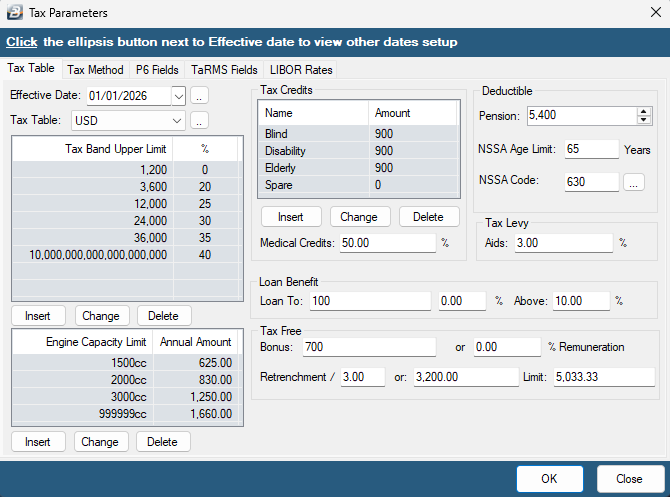

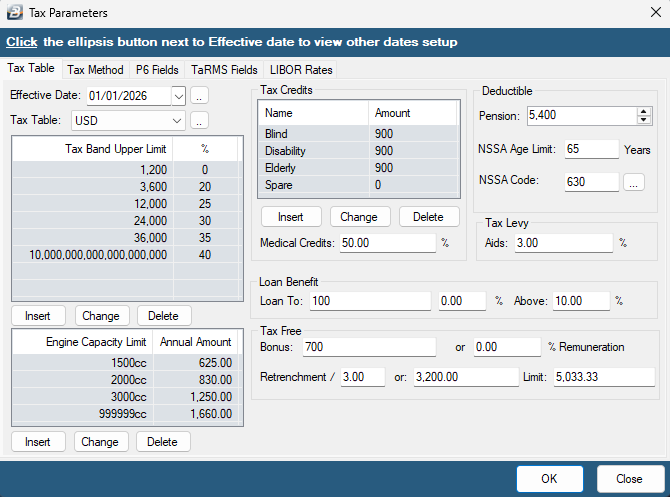

USD Tax Tables 2026

If your payroll is USD/Multicurrency proceed to enter the tax bands as shown below:

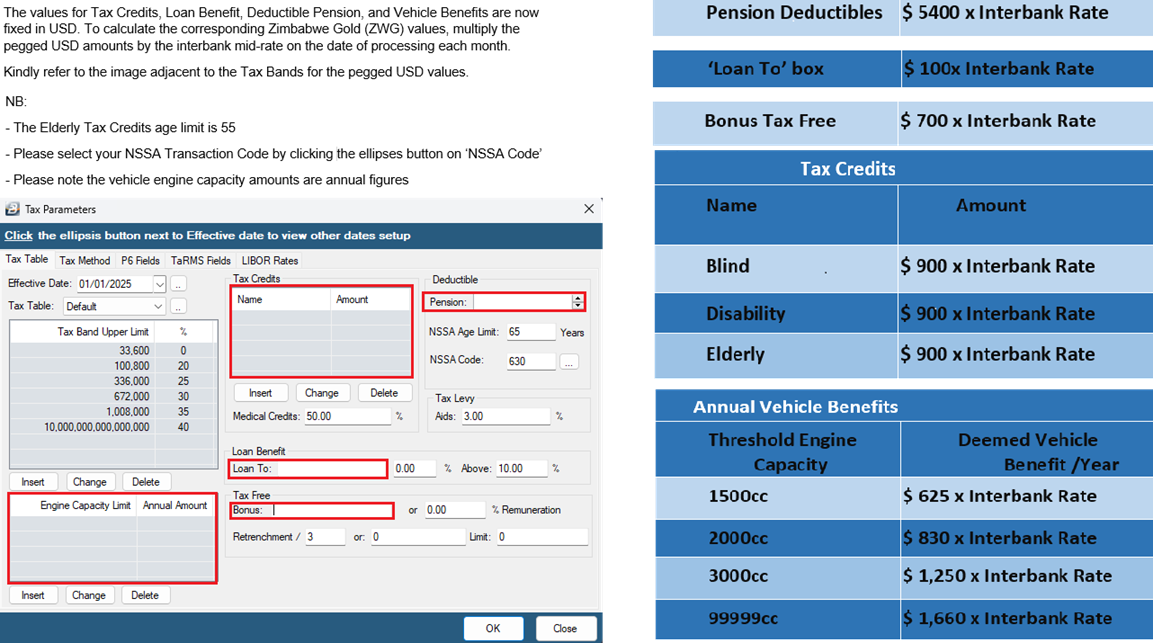

Key Values for USD Tax Tables:

The Elderly tax credit age lower limit is 55 years

Deductible Pension is 5400

Medical Credits are 50%

Tax Levy Aids is 3%

USD Tax Tables configuration for 2026

After you have finished entering the tax bands (USD tax tables) click on 'OK' to view the payroll in the new year.

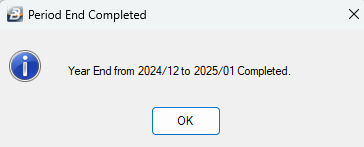

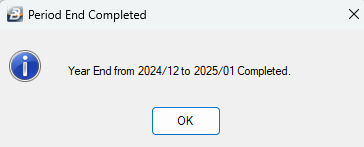

Year-end completion confirmation

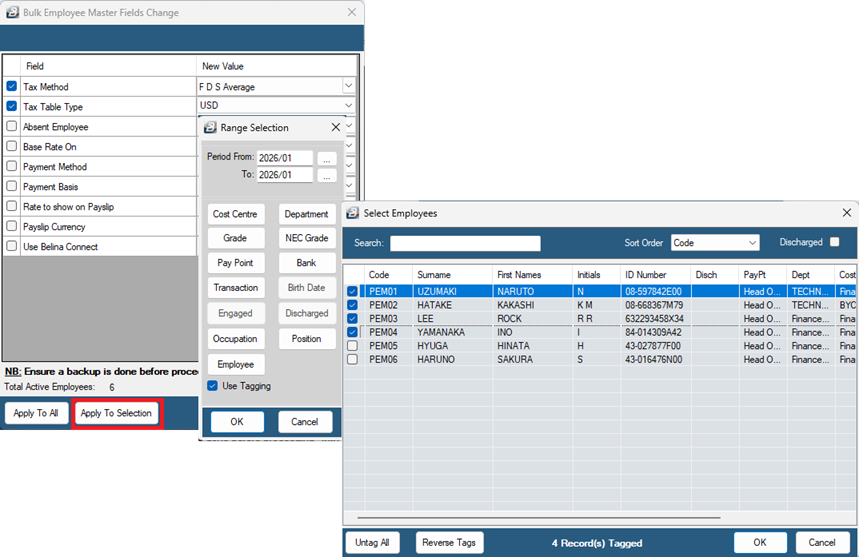

Converting Employees to the Applicable Tax Method

Before commencing your 2026 payroll processing: Please ensure the correct tax method is set for each employee.

FDS Average is the recommended tax method for full-time employees.

PAYE/Non-FDS is applicable for employees who are seasonal, casual, contract or join during the year.

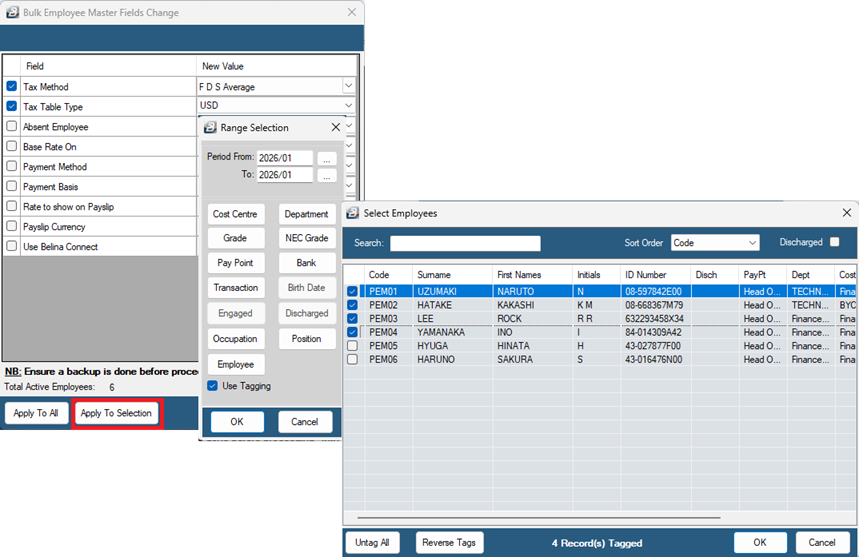

To ensure this setup: Go to Data - Bulk Routines - Employee master file changes

Bulk employee tax method conversion

Tick 'Tax Method' and select 'FDS Average'

Tick 'Tax Table Type' and select 'USD'

Select 'Apply To Selection' - tick 'Use Tagging' - proceed to select the tagging criteria

Tag the employees who fall under FDS Average tax method

Click OK to save the selection of employees

Click OK to proceed

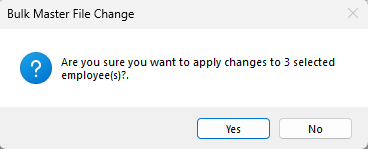

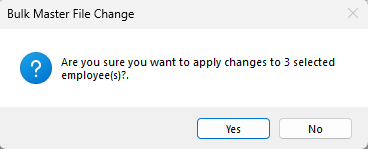

Confirmation dialog

A pop-up will appear confirming if you want to proceed with the bulk master file change. Click Yes to proceed.

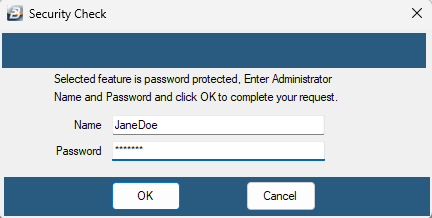

Administrator authentication

Enter Administrator Name and Password then click OK to complete the Bulk Master File Change.

Repeat this process to change the tax method and tax table type for PAYE/Non-FDS Employees.

ZWG Tax Tables 2026

If your payroll is solely in ZWG then enter the tax bands as shown below:

Note: Please note the communication from the Ministry Of Finance as provided for in Section 57 of the Finance Act, on the figures to be used for vehicles benefits, loan benefits, bonus tax free, deductible pension and tax credits.

ZWG Tax Tables configuration for 2026

✅ Year-End Process Complete!

The Year-End process is complete, and you can commence your January payroll processing.