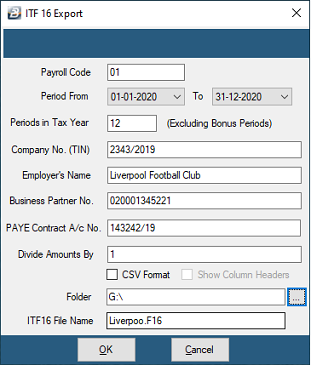

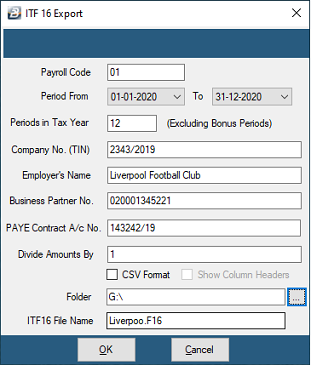

Every year, or on the request of ZIMRA, an ITF16 export needs to be submitted for tax audit purposes. To extract the export:

•Go to the 'Utilities', 'Exports', then 'ITF16' menu options

•Select the date range to be included in the ITF16

•Complete the other details (see 'Field Explanations' below), then

•Press OK to export the file.

The file will be located in the folder that was entered in the setup.

Field Explanations

Field Explanations

Payroll Code

|

Accept the default of '01'. If there is more than one payroll for the organization then number the ITF16's accordingly.

|

Period From and To

|

Use the dropdown menus to select the beginning and the end of the tax year being submitted.

|

Periods in Tax Year

|

Accept, or change, the default number of payroll periods in the tax period.

|

Company No. (TIN)

|

Enter the Tax Identification Number (TIN) for the organization. This is a number allocated by ZIMRA for the organization

|

Employer's Name

|

Enter the name of the organization as registered with ZIMRA.

|

Business Partner No.

|

Enter the Business Partner number allocated to the organization by ZIMRA.

|

PAYE Contract A/c No.

|

Enter the PAYE Contract A/c No. allocated to the organization by ZIMRA.

|

Divide Amounts by

|

Accept the default '1' entry. This field was previously used in the hyper-inflationary period where currency denominations needed to be reduced.

|

CSV Format

|

ZIMRA has a special file format for the ITF exports with an file extension .F16. Use the checkbox if there are circumstances where you would want to export the file in CSV format. There is an additional functionality that highlights if the first line of the data includes column headers.

|

Folder

|

Use the elipsis button to select where the file will be written to.

|

ITF16 File Name

|

Accept the default file name, or change it if necessary.

|

|