Code

|

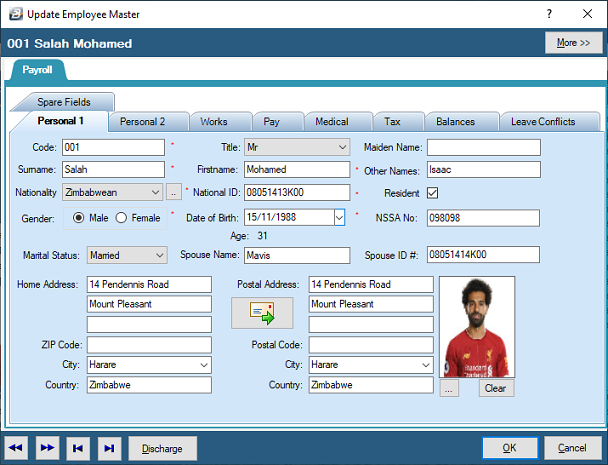

A unique employee number should be allocated to each individual on the payroll. Normally the number would be automatically generated if the 'Automatic Employee Code' feature has been activated under Global Defaults.

|

Title

|

Use the drop-down menu to select the title of the individual

|

Maiden Name

|

Enter the maiden name of the employee, if applicable

|

Surname

|

Enter the surname of the employee

|

First Name

|

Enter the first name of the employee

|

Other Names

|

Enter the other name/s of the employee

|

Nationality

|

Use the drop-down menu to select the nationality of the employee

|

National ID

|

Enter the employee's National Identification Number. Belina PayrollHR has a built in security check of National ID numbers to ensure that there are no duplications. This feature can be turned off under the Global Defaults menu.

|

Resident

|

Use the check-box ot indicate whether the employee is a Resident.

|

Gender

|

Use the Radio Button to select the gender of the employee

|

Date of Birth

|

Enter the employee's date of birth. This field is used to calculate the the age of the employee. This has an impact on awarding the elderly credit in the tax calculation and whether to deduct NSSA contributions from older employees.

|

NSSA No.

|

Enter the NSSA number for the employee. This comes through on NSSA reports.

|

Marital Status

|

Use the drop-down menu to select the marital status of the employee

|

Home Address

|

Enter the home address of the employee

|

Postal Address

|

Enter the Postal address of the employee. If this is the same as the Home Address simply press the button with the icon showing the envelope and arrow to have the details copied from Home Address to Postal Address.

|

Photo Ellipsis

|

Press the Ellipsis button to browse files and folders on the computer for the employee photograph.

|