General Ledger Accounts - Example Layout

General Ledger accounts need to be set up in Belina PayrollHR for accounting data exports and for journal printouts if account codes are to be included. The general ledger layout is normally already established before implementation of the payroll and will be specific to each organization. The following is an example list of accounts for illustrative purposes only:

G/L Code

|

Account Type

|

Transaction Code Description

|

G/L Description

|

450000

|

Header

|

|

Salaries and Wages

|

450001

|

Sub

|

Basic

|

Salaries and Wages - Basic

|

450001

|

Sub

|

Shorttime

|

Salaries and Wages - Basic

|

450002

|

Sub

|

Overtime - 1.5

|

Salaries and Wages - Overtime

|

450002

|

Sub

|

Overtime - 2

|

Salaries and Wages - Overtime

|

450003

|

Sub

|

Leave - Days Taken

|

Salaries and Wages - Leave Days Taken

|

450003

|

Sub

|

Leave - Paid in Advance

|

Salaries and Wages - Leave Paid in Advance

|

450004

|

Sub

|

Leave - CILL

|

Salaries and Wages - Leave - CILL

|

450005

|

Sub

|

Leave - Sick

|

Salaries and Wages - Leave - Sick

|

450006

|

Sub

|

Leave - Compassionate

|

Salaries and Wages - Leave - Compassionate

|

450007

|

Sub

|

Leave - Maternity

|

Salaries and Wages - Leave - Maternity

|

450008

|

Sub

|

Leave - Study

|

Salaries and Wages - Leave - Study

|

451000

|

Header

|

|

Allowances and Benefits

|

451001

|

Sub

|

Allowance - Transport

|

Allowances and Benefits - Transport

|

451002

|

Sub

|

Allowance - Acting

|

Allowances and Benefits - Acting Allowance

|

451003

|

Sub

|

Allowance - Shift

|

Allowances and Benefits - Shift Allowance

|

451004

|

Sub

|

Allowance - Vehicle

|

Allowances and Benefits - Vehicle Allowance

|

451005

|

Sub

|

Benefit - Housing

|

Allowances and Benefits - Housing Benefit

|

451006

|

Sub

|

Benefit - Vehicle

|

Allowances and Benefits - Vehicle Benefit

|

452000

|

Header

|

|

Company Contributions

|

452001

|

Sub

|

Deduction - Pension

|

Company Contributions - Pension

|

452002

|

Sub

|

Deduction - NSSA

|

Company Contributions - NSSA

|

452003

|

Sub

|

Deduction - Medical

|

Company Contributions - Medical

|

452004

|

Sub

|

Deduction - NEC

|

Company Contributions - NEC

|

600000

|

Header

|

|

Loans

|

600001

|

Sub

|

Loan - Staff

|

Loans - Staff

|

600002

|

Sub

|

Loan - Vehicle

|

Loans - Vehicle

|

600003

|

Sub

|

Loan - Housing

|

Loans - Housing

|

750000

|

Header

|

|

Control Account

|

750001

|

Sub

|

Pension

|

Control Account - Pension

|

750002

|

Sub

|

NSSA

|

Control Account - NSSA

|

750003

|

Sub

|

Medical

|

Control Account - Medical

|

750004

|

Sub

|

Trade Union

|

Control Account - Trade

|

750005

|

Sub

|

NEC

|

Control Account - NEC

|

750006

|

Sub

|

Deduction - WCIF

|

Control Account - WCIF

|

750007

|

Sub

|

Deduction - ZIMDEV

|

Control Account - ZIMDEV

|

750008

|

Sub

|

Deduction - Standards

|

Control Account - Standards Development

|

750009

|

Sub

|

PAYE

|

Control Account - PAYE

|

750010

|

Sub

|

Net Paid

|

Control Account - Net Paid

|

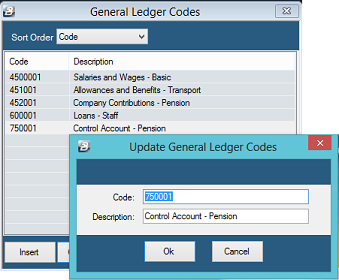

To Create General Ledger Accounts

To create these accounts in Belina PayrollHR:

Step 1

|

Go to the 'Edit' then 'General Ledger' menu options

|

Step 2

|

Press 'Insert' and enter the 'Code' and 'Description' for the first General Ledger code

|

Step 3

|

Continue inserting all the other required General Ledger Accounts

|

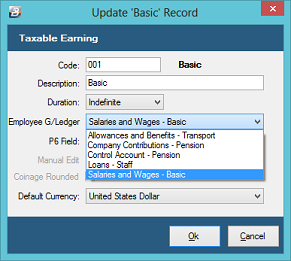

Allocating General Ledger Accounts to Transaction Codes

If the transaction journal is to be exported from Belina PayrollHR then the each transaction code should be setup with the General Ledger to which the value would be ascribed.

To do this:

Step 1 Go to the 'Edit' and 'Transaction Codes' menus

Step 2 Select each Transaction Code in turn

Step 3 Enter the general ledger code for that Transaction Code using the drop down menu against 'Employee G/ Ledger'

Expense and Control Accounts

On those transactions where there are payments to third parties there are two fields for the entry of general ledger codes, enter the:

•

|

expense in the left hand field. The expense code will be debited with the employer portion, if any, of any deduction

|

•

|

control account will be credited with both the employee and the employer portion of any deduction.

|

|