There are a number of error messages that display when

Medical Aid

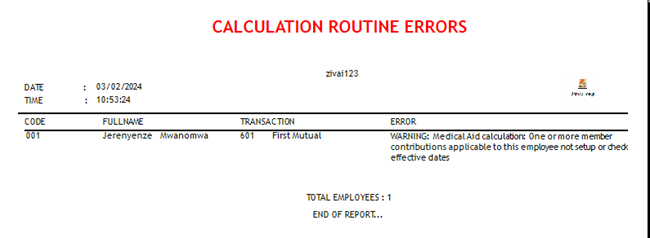

Error messages display when running the Calculation Routine if medical aids have not been set up correctly, in the following instances:

- Where the type of member is not setup for the given 'Medical Aid Scheme'

- Where the 'Commencement Date' in the Employee Master is set before the 'Effective Date' of the medical aid scheme.

To correct this:

- Go to the 'Edit' then 'Medical Aid Schemes'

- Select the scheme and click 'Change'

- If there is a member not setup click 'Insert' and enter the details for the type of member eg. 'Dependent <18'

- If the commencement date has been incorrectly set as a future date then change the effective date to the date when the medical cover commenced.

- Once this has been done re-run the Calculation Routine to ensure that the error message does not re-appear.

NSSA

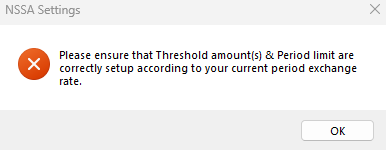

Error messages display when running the Calculation Routine if the NSSA limit and threshold amounts have not been set up correctly, in the following instances:

- Where the Payroll rate and the interbank rate used for calculating the NSSA on a USD/Multicurrency payroll are different

- Where the default NSSA limit of 99999999999 has not been changed and replaced with the correct current NSSA limit amount

To correct this:

- Go to the 'Process menu option' then 'Calculation Routine'

- Once it opens a dialog box will pop-up and populate it with the correct amounts for NSSA limit and the threshold amounts '

Tax Tables

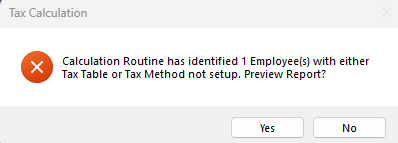

An error message will display when running the Calculation Routine if employees are on different tax table types

To correct this:

-Take a Backup

- Go to the 'Data menu option' then 'Bulk Routines'

-Select 'Employee Master File Changes'

-select and tick 'Tax table type'

- on the tax table line use the drop down under New value and choose the tax table type you are using in your payroll