The interest calculation can be made using either the Reducing Compound or Simple interest methods. The interest is calculated on Period balances, not daily balances.

Reducing Compound

Under the 'Reducing Compound' method interest is calculated as follows:

- In the first period, period interest is calculated on the full principal amount.

- Then the repayment is taken into account to compute the closing balance for the period.

- In the second and subsequent periods, period interest is calculated on the previous period's closing balance,

Simple Interest

Under the 'Simple Interest' method interest is calculated as follows:

- The interested for the principal amount using the interest rate to be applied , for the number of payroll periods that make up the life of the loan is calculated.

- The total interest amount calculated, above, is then divided equally over the number of payroll periods required to repay the loan.

- More interest will be calculated using this method than the Reducing Compound method since it does not take into account the reducing balance over the life of the loan.

Assumptions:

- Initial Principal amount is given to the employee at the beginning of each period

- Repayments are deducted at the end of each period

- Periods are equal

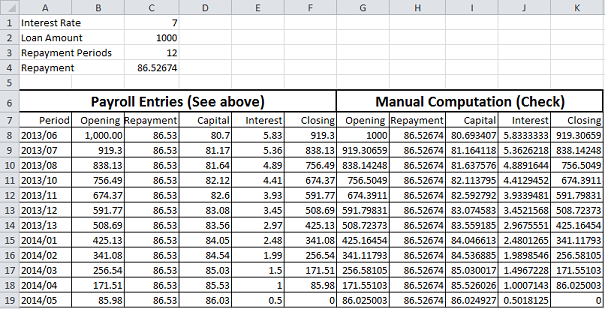

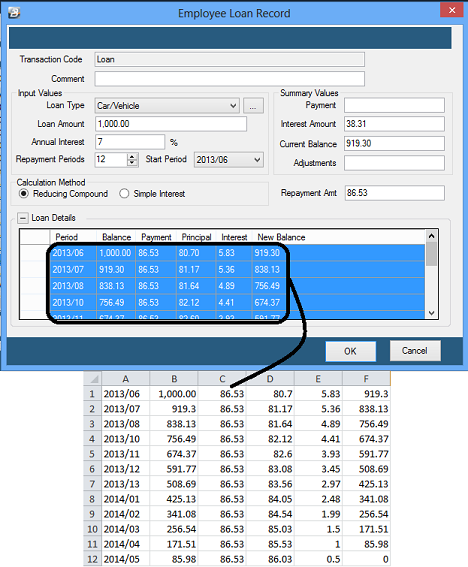

The 'Loan Details' with repayment schedule can be copied and pasted into spreadsheet for evaluation and analysis.

Comparison of exported 'Loan Details' to amounts manually computed on spreadsheet, assumes, or entails:

•the balance outstanding on the loan at the beginning of a period is outstanding for the full period

•interest calculated for a period is based on the opening balance of the loan at the beginning of the period

•there are equal period installments over the life of the loan.

•there is rounding of amounts to 2 decimal places.